Are you gearing up for a career in Examiner of Currency? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Examiner of Currency and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

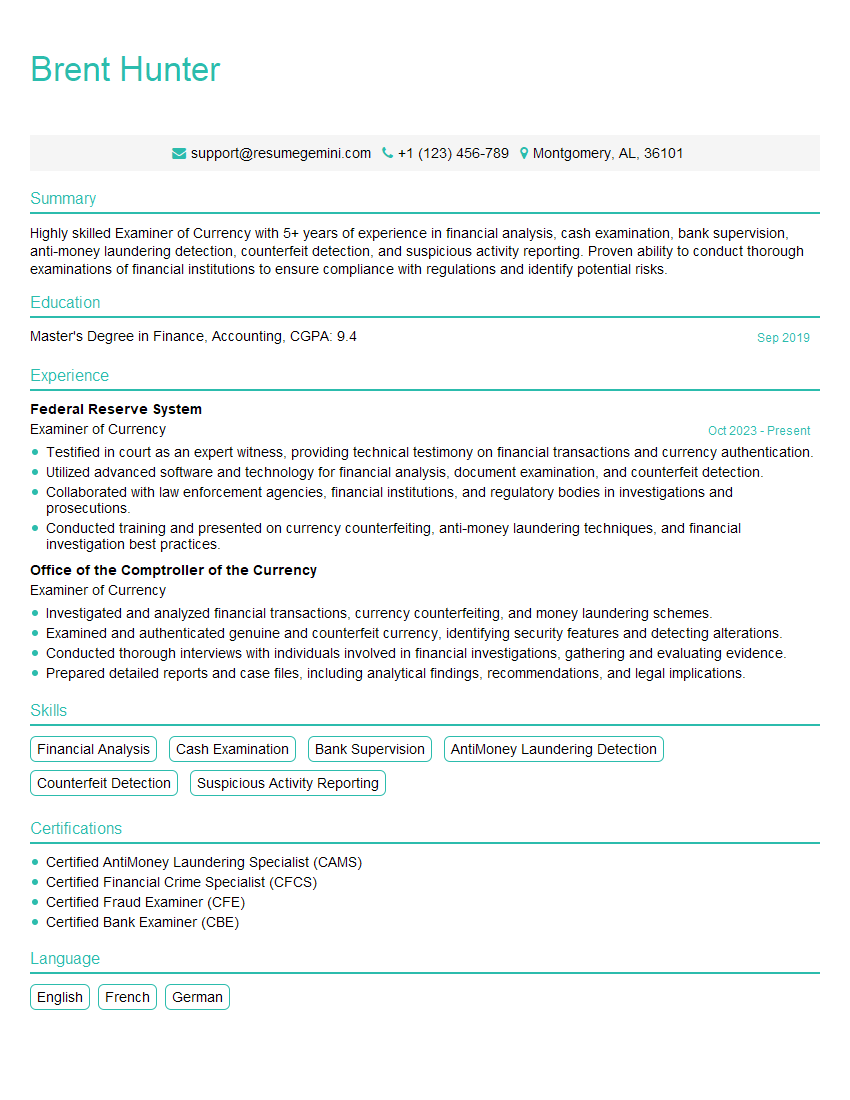

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Examiner of Currency

1. Explain the role of an Examiner of Currency in detail.

An Examiner of Currency is responsible for detecting and deterring counterfeiting and other illicit activities involving U.S. currency. This includes:

- Examining currency for authenticity and detecting counterfeits

- Investigating reports of counterfeiting

- Educating the public about counterfeiting and how to identify it

- Working with law enforcement agencies to apprehend counterfeiters

2. What are the essential skills required for an Examiner of Currency?

Technical Skills:

- Expertise in identifying counterfeit currency using a variety of techniques

- Knowledge of currency design and production techniques

- Proficient in using advanced technology and equipment for examining currency

Soft Skills:

- Excellent attention to detail and analytical skills

- Strong communication and interpersonal skills

- Ability to work independently and as part of a team

- Commitment to integrity and ethical behavior

3. Describe your experience examining counterfeit currency.

In my previous role as an Examiner of Currency, I was responsible for examining large quantities of currency for authenticity. I used a variety of techniques, including visual inspection, ultraviolet light, and infrared scanning, to identify counterfeit bills. I also conducted investigations into reports of counterfeiting and provided training to law enforcement agencies on how to detect counterfeit currency.

4. What is the most challenging aspect of being an Examiner of Currency?

The most challenging aspect of being an Examiner of Currency is staying ahead of the counterfeiters. Counterfeiters are constantly developing new and sophisticated techniques to produce counterfeit currency, and it is critical that Examiners stay up-to-date on these techniques in order to effectively detect counterfeits.

5. What is the most rewarding aspect of being an Examiner of Currency?

The most rewarding aspect of being an Examiner of Currency is knowing that I am making a difference in the fight against counterfeiting. Counterfeiting is a serious crime that can have a devastating impact on our economy, and I am proud to be part of the team that is working to protect our currency from being counterfeited.

6. How do you stay current on the latest counterfeiting trends?

I stay current on the latest counterfeiting trends by attending conferences, reading industry publications, and participating in training programs. I also work closely with law enforcement agencies to share information about new counterfeiting techniques.

7. What are the different types of counterfeiting techniques?

The most common counterfeiting techniques include:

- Copying: Copying genuine currency using a printer or copier

- Alteration: Altering genuine currency by changing its denomination or design

- Fake: Creating counterfeit currency from scratch using materials that resemble genuine currency

- Counterfeiting: Creating counterfeit currency using advanced technology and materials that are nearly indistinguishable from genuine currency

8. What are the key security features of U.S. currency?

The key security features of U.S. currency include:

- Watermark: A faint image of the President or Treasurer of the United States appears in the paper when held up to light

- Security thread: A thin, embedded strip of plastic that glows under ultraviolet light

- Color-shifting ink: The color of the ink on the denomination changes from one color to another when the bill is tilted

- Raised printing: The numerals and lettering on the bill are raised, creating a tactile effect

- Microprinting: Tiny letters or numbers that are printed in the margins or on the back of the bill and are only visible under magnification

9. What should the public do if they suspect they have received counterfeit currency?

If you suspect you have received counterfeit currency, you should do the following:

- Do not spend the bill

- Contact your local law enforcement agency

- Write down the serial number of the bill

- Note the location where you received the bill

10. What is the future of currency?

The future of currency is uncertain. Some experts believe that physical currency will eventually be replaced by digital currency, while others believe that physical currency will continue to be used for the foreseeable future. However, one thing is for certain: the need for Examiners of Currency will continue to grow as counterfeiters develop new and more sophisticated techniques.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Examiner of Currency.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Examiner of Currency‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Examiners of Currency are highly trained and experienced professionals responsible for safeguarding the integrity of the U.S. currency by examining financial institutions and detecting counterfeit or fraudulent currency.

1. Examining Financial Institutions

Conduct thorough examinations of banks, credit unions, and other financial institutions to ensure compliance with federal banking regulations.

- Review financial records, including balance sheets, income statements, and loan portfolios.

- Assess the institution’s risk management practices, including anti-money laundering and terrorist financing controls.

2. Detecting Counterfeit Currency

Use specialized equipment and techniques to identify and seize counterfeit currency.

- Analyze the physical characteristics of currency, including paper quality, ink composition, and security features.

- Consult with law enforcement agencies to track counterfeit currency distribution networks.

3. Investigating Financial Crimes

Investigate suspected financial crimes, including counterfeiting, fraud, and money laundering.

- Interview witnesses, collect evidence, and prepare reports on suspected criminal activity.

- Collaborate with law enforcement and prosecution teams to build cases against suspected criminals.

4. Training and Education

Conduct training and educational programs to financial institutions on anti-counterfeiting best practices and compliance with banking regulations.

- Develop and deliver training materials on counterfeit detection, risk management, and regulatory compliance.

- Provide guidance and technical assistance to financial institutions to help them prevent and mitigate financial crimes.

Interview Tips

Preparing for an interview for an Examiner of Currency position requires a comprehensive approach that encompasses technical expertise, communication skills, and a deep understanding of the industry.

1. Research the Institution

Thoroughly research the Federal Reserve System, the Office of the Comptroller of the Currency (OCC), and the financial institution you are applying to.

- Familiarize yourself with their mission, goals, and recent initiatives.

- Demonstrate knowledge of the latest developments in financial regulation and anti-counterfeiting measures.

2. Highlight Relevant Skills and Experience

Emphasize your technical expertise in financial examination, counterfeit detection, and financial crimes investigation.

- Quantify your accomplishments and provide specific examples of how you have successfully identified and mitigated financial risks.

- Showcase your understanding of banking regulations and supervisory best practices.

3. Demonstrate Strong Communication Abilities

Interviewers will assess your ability to communicate effectively both verbally and in writing.

- Articulate your thoughts clearly and concisely, using specific examples to support your points.

- Demonstrate your ability to write concise and impactful reports that accurately convey complex concepts.

4. Prepare for Technical Questions

Review common interview questions related to financial examination techniques, counterfeit detection, and banking regulations.

- Practice scenarios that require you to apply your technical knowledge to real-world situations.

- Be prepared to discuss case studies that demonstrate your problem-solving abilities.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Examiner of Currency interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!