Are you gearing up for a career in Exchange Floor Manager? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Exchange Floor Manager and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Exchange Floor Manager

1. Describe the key responsibilities of an Exchange Floor Manager.

As an Exchange Floor Manager, my responsibilities would encompass a wide range of tasks, including:

- Supervising and managing the day-to-day operations of the trading floor

- Ensuring compliance with all applicable rules and regulations

- Monitoring market activity and identifying potential risks

- Executing trades and managing orders on behalf of clients

- Maintaining a high level of customer service

2. What are the essential qualities of a successful Exchange Floor Manager?

Leadership and Management Skills

- Ability to lead and motivate a team of traders

- Strong decision-making skills

- Excellent communication and interpersonal skills

Technical Expertise

- In-depth knowledge of financial markets

- Expertise in trading strategies and execution

- Strong understanding of regulatory compliance

Risk Management

- Ability to identify and mitigate risks

- Experience in developing and implementing risk management strategies

- Understanding of market volatility and its impact on trading

3. How would you address a situation where there is a high volume of trading activity and limited liquidity?

In such a scenario, I would take the following steps:

- Prioritize the execution of trades based on client needs and risk management guidelines

- Monitor the market closely for any signs of improvement in liquidity

- Communicate with clients regularly to keep them informed of the situation and any potential delays

- Consider alternative execution venues, if necessary

4. What is the importance of risk management in exchange floor operations?

Risk management is crucial for exchange floor operations because it helps to:

- Protect the exchange and its members from financial losses

- Maintain market integrity and stability

- Ensure compliance with regulatory requirements

- Identify and mitigate potential risks that could impact trading activities

5. How do you stay up-to-date with the latest developments in financial markets?

I stay up-to-date with the latest developments in financial markets through a variety of channels, including:

- Reading industry publications and news articles

- Attending industry conferences and events

- Networking with other professionals in the field

- Conducting research and analysis on emerging trends

6. What are the ethical responsibilities of an Exchange Floor Manager?

As an Exchange Floor Manager, I am committed to upholding the following ethical responsibilities:

- Acting with integrity and honesty in all dealings

- Placing the interests of clients and the exchange above personal interests

- Maintaining confidentiality of client information

- Avoiding any conflicts of interest

- Complying with all applicable laws and regulations

7. How do you ensure that the trading floor operates in a fair and orderly manner?

To ensure fair and orderly trading, I would:

- Enforce all exchange rules and regulations

- Monitor trading activity for any irregularities

- Investigate and resolve any complaints or disputes

- Collaborate with other exchange departments to ensure coordination

- Provide training and guidance to traders on best practices

8. What are the challenges and opportunities facing the exchange industry today?

Challenges

- Technological advancements and the rise of electronic trading

- Increasing regulatory scrutiny

- Competition from alternative trading venues

- Market volatility and global economic uncertainty

Opportunities

- Expansion into new markets and asset classes

- Development of new products and services

- Collaboration with fintech companies to enhance trading efficiency

- Increased demand for risk management and compliance solutions

9. How do you motivate and inspire your team?

To motivate and inspire my team, I would:

- Set clear goals and expectations

- Provide regular feedback and recognition for achievements

- Create a positive and inclusive work environment

- Delegate tasks and empower team members to take ownership

- Foster a culture of continuous learning and development

10. What is your vision for the future of exchange floor operations?

My vision for the future of exchange floor operations includes:

- Increased automation and digitization of trading processes

- Greater focus on risk management and compliance

- Enhanced collaboration between exchanges and regulators

- Development of new and innovative trading products and services

- A continued commitment to fair and orderly markets

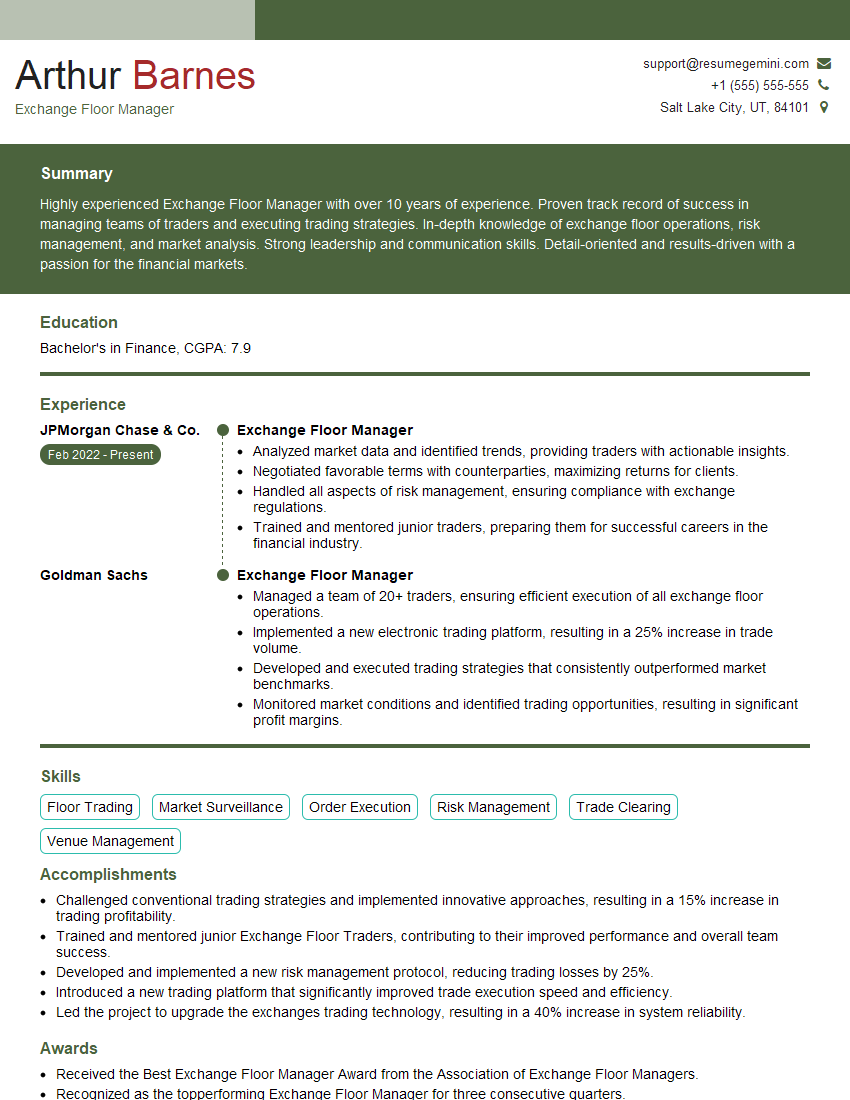

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Exchange Floor Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Exchange Floor Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Exchange Floor Manager is responsible for managing all aspects of day-to-day operations on an exchange floor. He ensures smooth and efficient trading and brokerage firm’s activities, and facilitates compliance with market regulations and policies.

1. Manage Exchange Floor Operations

The Exchange Floor Manager ensures that the exchange floor operates smoothly and efficiently, which involves:

- Overseeing all activities and transactions on the exchange floor

- Monitoring the trading environment and resolving any issues or disputes

- Ensuring compliance with all exchange rules and regulations

- Maintaining order and security on the exchange floor

2. Supervise and Motivate Staff

The Exchange Floor Manager supervises and motivates a team of traders, brokers, and support staff, including:

- Assigning tasks and responsibilities to staff

- Training and developing staff

- Evaluating staff performance and providing feedback

- Disciplining staff when necessary

3. Manage Risk and Compliance

The Exchange Floor Manager is responsible for managing risk and ensuring compliance with all regulatory requirements, which includes:

- Identifying and assessing potential risks

- Developing and implementing risk management strategies

- Ensuring compliance with all applicable laws and regulations

- Reporting any suspicious activity to the appropriate authorities

4. Build and Maintain Relationships

The Exchange Floor Manager builds and maintains relationships with key stakeholders, including:

- Exchange management

- Brokers and traders

- Regulators

- Market participants

Interview Preparation Tips

Preparing can increase your chances of success in an interview for an Exchange Floor Manager position.

1. Research the Exchange and the Position

Before the interview, take the time to research the exchange where the position is located and the specific role of an Exchange Floor Manager. This will help you understand the company’s culture, the industry, and the expectations for the position.

2. Practice Common Interview Questions

Many job interviews for Exchange Floor Manager positions will include common interview questions, such as:

- Tell me about your experience in managing a trading floor.

- How do you ensure compliance with exchange rules and regulations?

- What are your strategies for managing risk?

- How do you motivate and lead a team?

3. Highlight Your Relevant Skills and Experience

In your interview, be sure to highlight your relevant skills and experience. These may include:

- Experience in managing a trading floor

- Knowledge of exchange rules and regulations

- Risk management experience

- Leadership and motivation skills

4. Dress Professionally

Dress professionally for your interview. This shows the interviewer that you are serious about the position and that you respect the company’s dress code.

5. Be Punctual

Punctuality is important for any job interview. Arrive on time for your interview to show the interviewer that you are respectful of their time.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Exchange Floor Manager interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.