Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Exchange Teller position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

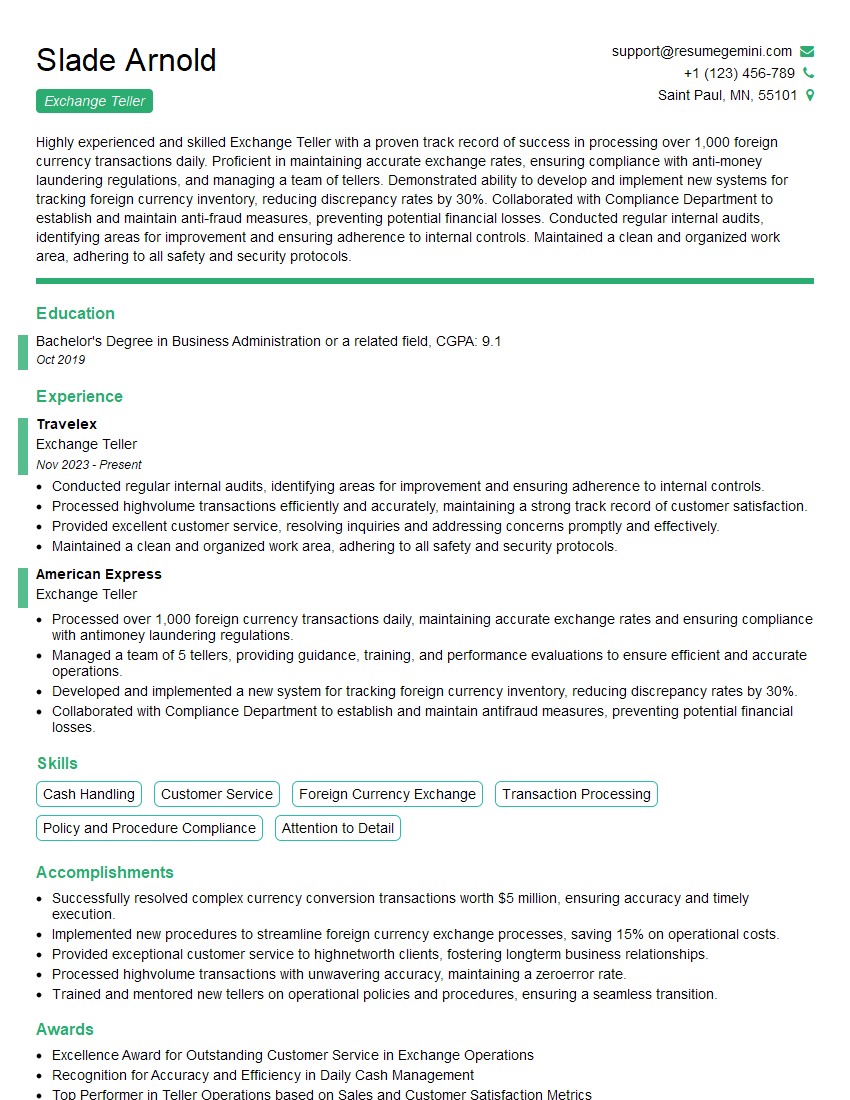

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Exchange Teller

1. What are the key responsibilities of an Exchange Teller?

- Providing excellent customer service

- Processing foreign currency exchange transactions

- Verifying and counting currency

- Maintaining accurate records of transactions

- Following bank policies and procedures

2. How do you handle a situation where a customer is trying to exchange a large sum of money?

- I would first verify the customer’s identity and check for any suspicious activity.

- I would then count the money carefully and check for any counterfeit bills.

- Once the money is verified, I would complete the transaction and provide the customer with a receipt.

3. What is your experience with using foreign currency exchange software?

- I have extensive experience using foreign currency exchange software, including [software name].

- I am proficient in using this software to process transactions, track currency rates, and generate reports.

4. How do you stay up-to-date on the latest foreign currency exchange rates?

- I regularly monitor financial news and websites to stay up-to-date on the latest foreign currency exchange rates.

- I also subscribe to industry publications and attend conferences to learn about the latest trends in the foreign exchange market.

5. What are some of the challenges you have faced as an Exchange Teller?

- One of the challenges I have faced is dealing with customers who are unfamiliar with foreign currency exchange.

- I have also had to deal with customers who are trying to exchange counterfeit bills.

6. How do you handle customers who are upset or angry?

- When dealing with upset or angry customers, I remain calm and professional.

- I listen to their concerns and try to understand their point of view.

- I then work to resolve the issue in a way that is fair to both the customer and the bank.

7. What are your strengths as an Exchange Teller?

- My strengths include my excellent customer service skills, my attention to detail, and my strong knowledge of foreign currency exchange.

- I am also a team player and I am always willing to help out my colleagues.

8. What are your weaknesses as an Exchange Teller?

- One of my weaknesses is that I can sometimes be too trusting.

- I am also not always as good at multitasking as I would like to be.

9. Why are you interested in working as an Exchange Teller at our bank?

- I am interested in working as an Exchange Teller at your bank because I am passionate about foreign currency exchange.

- I am also impressed by your bank’s reputation for customer service and innovation.

10. What are your salary expectations?

- My salary expectations are in line with the market rate for Exchange Tellers with my experience and qualifications.

- I am also willing to negotiate my salary based on the benefits package and the overall compensation package.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Exchange Teller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Exchange Teller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Exchange Tellers are responsible for a range of financial transactions, including exchanging foreign currency, issuing travelers checks, and processing wire transfers. They must be able to work independently and as part of a team, and have a strong understanding of banking regulations.

1. Cash Handling

Exchange Tellers are responsible for handling large amounts of cash on a daily basis. They must be able to count and verify cash accurately, and make sure that all transactions are properly recorded.

- Count and verify cash

- Make sure that all transactions are properly recorded

- Identify and report counterfeit money

2. Customer Service

Exchange Tellers must be able to provide excellent customer service. They must be able to answer questions clearly and concisely, and help customers with their financial needs.

- Answer questions about foreign currency exchange rates

- Help customers with travelers checks and wire transfers

- Provide general banking information

3. Compliance

Exchange Tellers must be familiar with all banking regulations. They must be able to identify and report suspicious activity, and follow all procedures to prevent money laundering and other financial crimes.

- Identify and report suspicious activity

- Follow all procedures to prevent money laundering and other financial crimes

- Stay up-to-date on all banking regulations

4. Teamwork

Exchange Tellers often work as part of a team. They must be able to cooperate with other tellers and bank staff to provide excellent customer service.

- Cooperate with other tellers and bank staff

- Provide excellent customer service

- Work as part of a team

Interview Tips

Preparing for an Exchange Teller interview can be daunting, but with the right preparation, you can increase your chances of success. Here are a few tips to help you ace your interview:

1. Research the Company

Before your interview, take some time to research the company you’re applying to. This will show the interviewer that you’re interested in the position and that you’ve taken the time to learn about the company’s culture and values.

- Visit the company’s website

- Read about the company’s history and mission

- Check out the company’s social media pages

2. Practice Your Answers

Once you’ve researched the company, take some time to practice your answers to common interview questions. This will help you feel more confident and prepared during your interview.

- Think about the skills and experience you have that make you a good fit for the position

- Prepare answers to questions about your customer service experience, your knowledge of banking regulations, and your teamwork skills

- Practice your answers out loud so that you can deliver them clearly and concisely

3. Dress Professionally

First impressions matter, so make sure to dress professionally for your interview. This means wearing a suit or business casual attire. You should also make sure that your clothes are clean and pressed.

- Wear a suit or business casual attire

- Make sure that your clothes are clean and pressed

- Avoid wearing casual clothes, such as jeans and t-shirts

4. Be Punctual

Punctuality is important for any interview, but it’s especially important for an Exchange Teller interview. This is because Exchange Tellers are often responsible for handling large amounts of cash, and being punctual shows that you’re reliable and trustworthy.

- Arrive at your interview on time

- If you’re running late, call or email the interviewer to let them know

- Don’t be late for your interview

5. Be Yourself

The most important thing is to be yourself during your interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Be honest and genuine, and let your personality shine through.

- Be yourself

- Don’t try to be someone you’re not

- Be honest and genuine

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Exchange Teller interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.