Are you gearing up for an interview for a Farm Appraiser position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Farm Appraiser and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

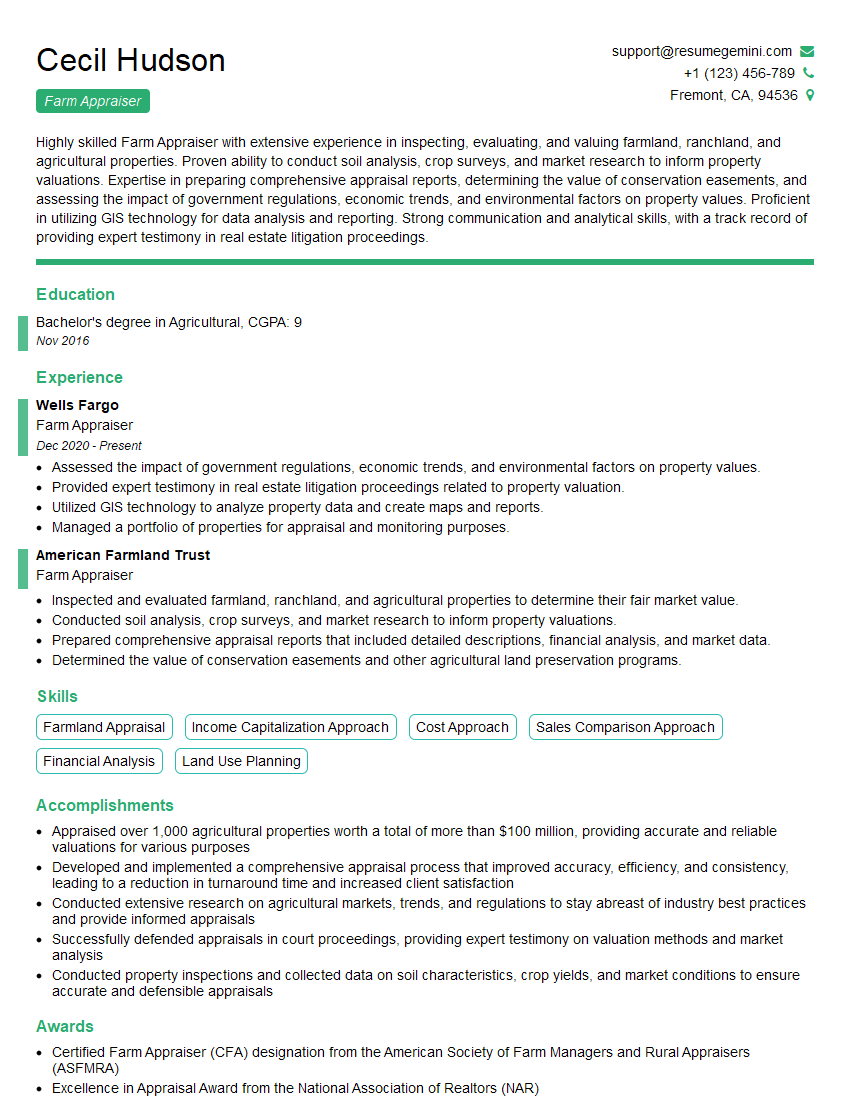

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Farm Appraiser

1. What are the key factors you consider when appraising a farm property?

- Physical characteristics of the land: This includes factors such as soil quality, topography, water availability, and accessibility.

- Improvements on the property: These include structures such as buildings, fences, and irrigation systems, as well as improvements such as drainage and land leveling.

- Market conditions: This includes factors such as supply and demand, interest rates, and economic conditions.

- Legal factors: These include factors such as zoning, easements, and property rights.

- Environmental factors: These include factors such as water quality, air quality, and soil contamination.

2. How do you determine the value of a farm property using the income approach?

- Estimate the net income that the property can generate.

- Capitalize the net income using an appropriate capitalization rate.

- The resulting value is the estimated value of the property using the income approach.

3. What are the different types of farm property appraisals?

- Market value appraisal: This type of appraisal estimates the most probable price that a property would sell for in the current market.

- Loan or mortgage appraisal: This type of appraisal is used to determine the value of a property for the purpose of obtaining a loan or mortgage.

- Tax appraisal: This type of appraisal is used to determine the value of a property for the purpose of taxation.

- Insurance appraisal: This type of appraisal is used to determine the value of a property for the purpose of insurance.

- Estate appraisal: This type of appraisal is used to determine the value of a property for the purpose of estate planning or settlement.

4. What are the ethical responsibilities of a farm appraiser?

- To maintain independence and objectivity.

- To disclose any conflicts of interest.

- To use ethical methods and practices in the appraisal process.

- To provide accurate and unbiased appraisals.

- To maintain confidentiality of client information.

5. What are the continuing education requirements for farm appraisers?

- Continuing education is required to maintain certification as a farm appraiser.

- The specific requirements vary by state, but typically include a certain number of hours of coursework in appraisal theory and practice.

- Continuing education can be obtained through a variety of sources, including online courses, seminars, and conferences.

6. What are the challenges of appraising farm property?

- Farm properties are often unique, which can make it difficult to find comparable sales.

- Farm incomes can be volatile, which can make it difficult to estimate the value of a property.

- Farm properties are often subject to a variety of environmental factors, which can affect their value.

- Farm properties are often owned by families, which can make it difficult to obtain information about the property.

7. What are the trends in the farm real estate market?

- The farm real estate market has been strong in recent years, with prices rising in most parts of the country.

- The demand for farm land is being driven by a number of factors, including the increasing demand for food, the growth of the biofuel industry, and the low interest rates.

- The supply of farm land is limited, which is also contributing to the rising prices.

8. What are the different types of farm loans?

- Operating loans: These loans are used to finance the day-to-day operations of a farm, such as the purchase of seed, fertilizer, and fuel.

- Capital loans: These loans are used to finance the purchase of major assets, such as land, buildings, and equipment.

- Real estate loans: These loans are used to finance the purchase of farm land.

9. What are the factors that affect the interest rate on a farm loan?

- The creditworthiness of the borrower.

- The term of the loan.

- The size of the loan.

- The type of loan.

- The current interest rate environment.

10. What are the different types of farm insurance?

- Property insurance: This type of insurance protects the farm’s buildings, equipment, and crops from damage or loss.

- Liability insurance: This type of insurance protects the farm owner from lawsuits arising from injuries or damage to others.

- Crop insurance: This type of insurance protects the farm’s crops from damage or loss due to weather, pests, or other factors.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Farm Appraiser.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Farm Appraiser‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Farm Appraisers are professionals who specialize in valuing agricultural land and farm property. They play a crucial role in the real estate industry, providing expert opinions on the worth of agricultural assets for various purposes, including loans, estate planning, and property acquisition.

1. Property Valuation

Conduct thorough inspections and analysis of farm properties

- Assess land size, soil quality, and topography

- Evaluate infrastructure, including buildings, fences, and water sources

- Consider market trends, comparable sales, and the property’s earning potential

2. Market Research

Stay updated on agricultural markets and real estate trends

- Study crop yields, commodity prices, and government regulations

- Monitor recent farm sales and land development

- Attend industry events and conferences to gather insights

3. Report Writing

Prepare detailed appraisal reports

- Document property characteristics, valuation methodology, and conclusions

- Provide clear and concise explanations of the property’s value

- Meet industry standards and comply with legal and regulatory requirements

4. Client Management

Build relationships with clients and meet their needs

- Understand clients’ goals and objectives

- Provide timely and responsive communication

- Maintain confidentiality and ethical standards

Interview Tips

Preparing for a farm appraiser interview requires a solid understanding of the industry and your qualifications. Here are some essential tips to help you ace the interview.

1. Research the Company and Role

Thoroughly review the company’s website, social media profiles, and recent news to gain insights into their culture, values, and business practices. Study the specific job description and identify the key responsibilities and qualifications required for the role.

2. Highlight Your Expertise

During the interview, confidently present your knowledge of the agricultural real estate industry and your technical skills in farm appraisal. Provide specific examples of your experience in property valuation, market research, and report writing. Quantify your accomplishments whenever possible using metrics such as the number of appraisals completed, value of properties appraised, or satisfied clients.

3. Showcase Your Industry Knowledge

Demonstrate your up-to-date understanding of agricultural markets and real estate trends. Discuss your insights on current issues affecting the industry, such as sustainability practices, technological advancements, or government regulations. Show that you are actively engaged with the industry through membership in professional organizations, attendance at conferences, or participation in research projects.

4. Emphasize Your Client-Focused Approach

Highlight your ability to build strong relationships with clients and deliver exceptional service. Explain how you actively listen to clients’ needs, provide clear and timely communication, and maintain confidentiality. Share examples of situations where you went above and beyond to meet or exceed client expectations.

5. Prepare for Common Interview Questions

Anticipate common interview questions and prepare thoughtful responses. Practice describing your farm appraisal experience, explaining your valuation methodology, and discussing your understanding of the agricultural industry. Also, be prepared to talk about your strengths, weaknesses, and why you are the ideal candidate for the role.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Farm Appraiser, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Farm Appraiser positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.