Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Field Tax Auditor interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Field Tax Auditor so you can tailor your answers to impress potential employers.

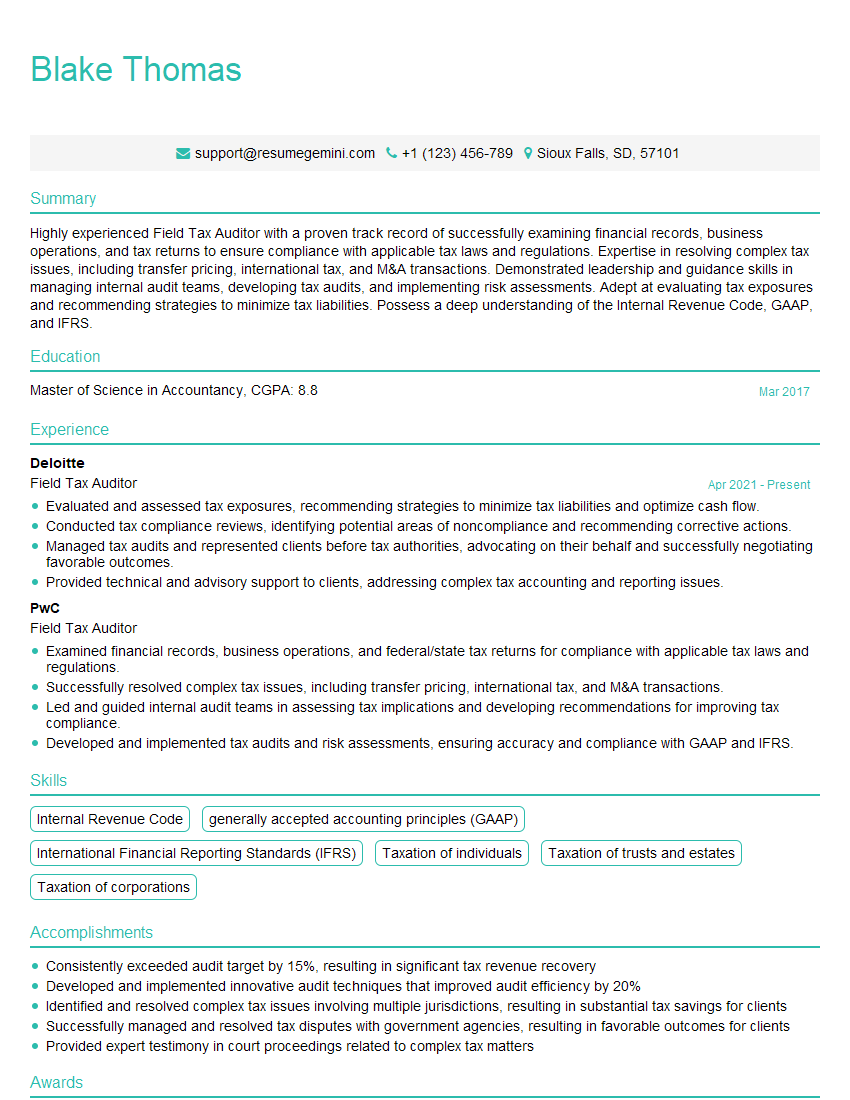

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Field Tax Auditor

1. What are the key differences between a tax audit and a financial audit?

A tax audit focuses on a taxpayer’s compliance with tax laws, while a financial audit examines a company’s financial statements to express an opinion on their fairness.

- Tax audits are conducted by tax authorities, while financial audits can be conducted by internal or external auditors.

- Tax audits are primarily concerned with ensuring that the taxpayer has paid the correct amount of tax, while financial audits are concerned with the accuracy and reliability of the financial statements.

- Tax audits are typically more limited in scope than financial audits, as they focus on specific areas of the taxpayer’s tax return.

2. What are the different types of tax audits?

Desk Audit

- Conducted through correspondence

- Auditor reviews the taxpayer’s return and supporting documents without visiting taxpayer’s premises

Field Audit

- Auditor visits taxpayer’s premises

- Examines a wider range of documents and interviews management and employees

Office Audit

- Taxpayer visits auditor’s office

- Similar to a field audit but less intrusive (e.g., no need to provide a work space for auditors)

3. What are the key steps involved in a field tax audit?

The key steps involved in a field tax audit typically include:

- Planning: The auditor will review the taxpayer’s tax return and other relevant documents to develop an audit plan.

- Fieldwork: The auditor will visit the taxpayer’s premises to conduct the audit. This will involve examining the taxpayer’s accounting records, interviewing management and employees, and observing the taxpayer’s operations.

- Reporting: The auditor will prepare an audit report that summarizes the findings of the audit and any recommended adjustments to the taxpayer’s tax return.

4. What are some of the common issues that field tax auditors encounter?

Some of the common issues that field tax auditors encounter include:

- Unreported income: The taxpayer may have failed to report all of their income, either intentionally or unintentionally.

- Overstated deductions: The taxpayer may have claimed deductions that they are not entitled to, or may have overstated the amount of their deductions.

- Incorrect tax calculations: The taxpayer may have made errors in calculating their tax liability.

- Untimely filing: The taxpayer may have failed to file their tax return on time.

5. What are the challenges of being a field tax auditor?

Some of the challenges of being a field tax auditor include:

- Dealing with uncooperative taxpayers: Some taxpayers may be resistant to cooperating with the audit process.

- Working under tight deadlines: Auditors are often under pressure to complete audits within a certain timeframe.

- Staying up-to-date on tax laws: Tax laws are constantly changing, so auditors need to stay up-to-date on the latest changes.

6. What are the qualities of a successful field tax auditor?

Some of the qualities of a successful field tax auditor include:

- Strong technical skills: Auditors need to have a strong understanding of tax laws and accounting principles.

- Excellent communication skills: Auditors need to be able to communicate effectively with taxpayers, management, and other stakeholders.

- Strong analytical skills: Auditors need to be able to analyze financial data and identify potential issues.

- Attention to detail: Auditors need to be able to pay attention to detail and identify any errors or inconsistencies in the taxpayer’s records.

7. How do you handle situations where taxpayers are uncooperative?

When dealing with uncooperative taxpayers, it is important to remain professional and respectful.

- Try to establish a rapport with the taxpayer: This can help to break down any barriers and make the taxpayer more willing to cooperate.

- Explain the purpose of the audit and how it will benefit the taxpayer: This can help to dispel any misconceptions that the taxpayer may have about the audit process.

- Be patient and understanding: It is important to remember that taxpayers may be feeling stressed or anxious about the audit.

- If necessary, seek assistance from your supervisor or other colleagues: They may be able to provide support or advice.

8. How do you stay up-to-date on tax laws?

There are a number of ways to stay up-to-date on tax laws, including:

- Reading tax publications: There are a number of tax publications available, both online and in print, that provide information on the latest tax laws and regulations.

- Attending tax seminars and conferences: Tax seminars and conferences are a great way to learn about the latest tax laws and trends.

- Taking tax courses: Tax courses can provide a more in-depth understanding of tax laws and regulations.

9. What are the ethical responsibilities of a field tax auditor?

Field tax auditors have a number of ethical responsibilities, including:

- Maintaining confidentiality: Auditors must keep all taxpayer information confidential.

- Being impartial: Auditors must be impartial and avoid any conflicts of interest.

- Exercising due care: Auditors must exercise due care in conducting their audits and reporting their findings.

10. Why are you interested in working as a field tax auditor for our company?

I am interested in working as a field tax auditor for your company because I am passionate about tax law and I am eager to use my skills to help taxpayers comply with the law.

- Your company has a strong reputation for providing high-quality tax services, and I am confident that I can make a valuable contribution to your team.

- I am a highly motivated and results-oriented individual, and I am confident that I can quickly learn and master the skills necessary to be a successful field tax auditor.

- I am also a team player and I am always willing to go the extra mile to help my colleagues.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Field Tax Auditor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Field Tax Auditor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Field Tax Auditors are responsible for examining financial records and documents to ensure compliance with tax laws and regulations. Their key responsibilities include:

1. Conducting Tax Audits

Field Tax Auditors conduct audits on behalf of tax agencies or companies to verify the accuracy of financial reporting and ensure compliance with tax laws.

- Review financial statements, tax returns, and other supporting documents

- Interview management and staff to gather information about the company’s operations

- Analyze financial data and identify potential areas of concern

- Write audit reports that summarize the findings and make recommendations for corrective action

2. Identifying Tax Fraud

Field Tax Auditors are trained to identify and investigate tax fraud. They may uncover fraudulent activities by examining financial records, conducting interviews, and following leads.

- Review financial statements for unusual transactions or inconsistencies

- Interview employees and management to identify suspicious activities

- Follow leads to gather additional evidence of fraud

- Prepare reports that document the findings and recommend appropriate action

3. Advising on Tax Matters

Field Tax Auditors may provide advice to taxpayers on tax laws and regulations. They may help taxpayers understand their tax obligations, prepare tax returns, and respond to tax audits.

- Provide written and verbal advice on tax matters

- Assist taxpayers with preparing tax returns

- Represent taxpayers during tax audits

- Negotiate settlements with tax authorities

4. Enforcing Tax Laws

Field Tax Auditors may enforce tax laws by imposing penalties and taking legal action against non-compliant taxpayers. They may also work with law enforcement agencies to investigate and prosecute tax crimes.

- Impose penalties on taxpayers who fail to comply with tax laws

- Take legal action against taxpayers who commit tax crimes

- Work with law enforcement agencies to investigate and prosecute tax crimes

- Refer cases to the appropriate authorities for further action

Interview Tips

To ace the interview for a Field Tax Auditor position, candidates should prepare thoroughly and demonstrate their knowledge and skills. Here are some tips:

1. Research the Company and Position

Before the interview, research the company and the specific position you are applying for. This will help you understand the company’s culture, values, and mission, as well as the specific responsibilities of the role.

- Visit the company’s website and social media pages

- Read news articles and industry publications about the company

- Talk to people who work or have worked for the company

2. Prepare for Common Interview Questions

There are several common interview questions that you are likely to be asked. Prepare for these questions by practicing your answers and providing specific examples from your experience.

- Tell me about yourself

- Why are you interested in this position?

- What are your strengths and weaknesses?

- Why should we hire you?

- What are your salary expectations?

3. Highlight Your Skills and Experience

During the interview, be sure to highlight your skills and experience that are relevant to the position. Use specific examples to demonstrate your abilities and show how you have successfully completed similar tasks in the past.

- Discuss your experience in conducting tax audits

- Provide examples of how you have identified tax fraud

- Highlight your knowledge of tax laws and regulations

- Describe your experience in providing advice on tax matters

4. Ask Questions

At the end of the interview, be sure to ask questions of your own. This shows that you are engaged in the conversation and interested in the position. It also gives you a chance to learn more about the company and the role.

- What are the most important responsibilities of this position?

- What are the biggest challenges facing the company right now?

- What are the opportunities for advancement within the company?

- When can I expect to hear back from you?

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Field Tax Auditor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!