Feeling lost in a sea of interview questions? Landed that dream interview for Finance Analyst but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Finance Analyst interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

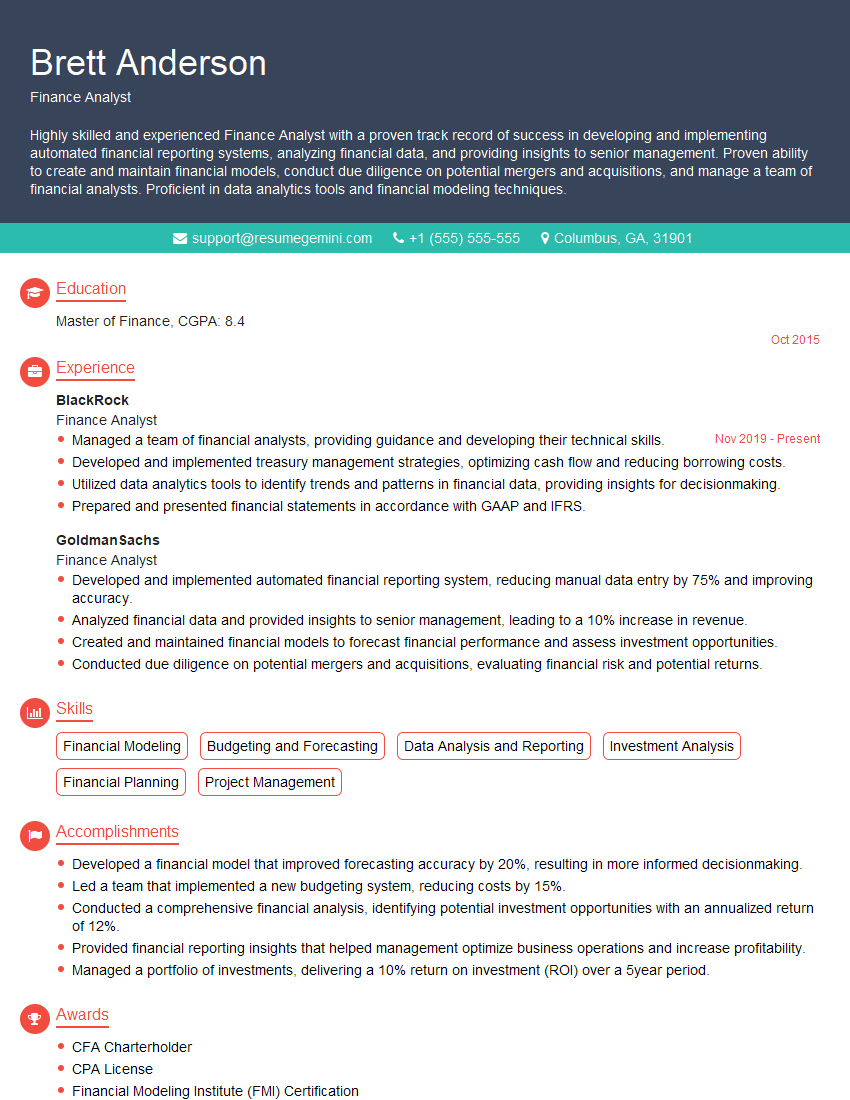

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Finance Analyst

1. Explain the key financial ratios used to evaluate a company’s performance and how you interpret them?

- Liquidity ratios: Measure a company’s ability to meet its short-term obligations, such as current ratio and quick ratio.

- Solvency ratios: Assess a company’s ability to pay its long-term debts, such as debt-to-equity ratio and times interest earned ratio.

- Profitability ratios: Indicate the company’s ability to generate profit, such as gross profit margin, operating profit margin, and net profit margin.

- Efficiency ratios: Measure how effectively a company uses its assets and resources, such as inventory turnover ratio and asset turnover ratio.

- Market value ratios: Evaluate a company’s market value relative to its financial performance, such as price-to-earnings ratio and price-to-book ratio.

- I interpret these ratios by comparing them to industry benchmarks and historical trends. Deviations or significant changes can indicate areas of concern or potential opportunities.

2. Walk me through the process of building a financial model for a company.

Assumptions and Data Collection

- Start by gathering relevant financial data, such as historical revenue, expenses, and balance sheets.

- Make assumptions about future economic conditions, market trends, and company-specific factors.

Income Statement, Balance Sheet, and Cash Flow Statement

- Project income and expenses to forecast revenue and operating expenses.

- Estimate the balance sheet by adjusting assets, liabilities, and equity based on projected income and expenses.

- Create a cash flow statement to track cash inflows and outflows.

Scenario Analysis and Sensitivity

- Run different scenarios to assess the impact of changes in assumptions and key drivers.

- Perform sensitivity analysis to determine the effects of variations in critical variables.

Validation and Presentation

- Validate the model by comparing it to historical data and industry benchmarks.

- Present the model results in a clear and understandable way, highlighting key insights and potential risks.

3. How do you stay up-to-date with the latest financial trends and regulations?

- Attend industry conferences and seminars.

- Subscribe to financial publications and newsletters.

- Network with professionals in the field.

- Participate in continuing education courses.

- Regularly review regulatory updates from relevant governing bodies.

- Utilize online resources, such as industry databases and research portals.

4. Describe your experience in using financial software and tools.

- Excel: Advanced proficiency in financial modeling, data analysis, and data visualization.

- Bloomberg Terminal: Expertise in accessing real-time market data, news, and analytics.

- Python: Experience in automating financial tasks, data cleaning, and analysis.

- SQL: Familiarity with database management and data retrieval for financial applications.

- Tableau: Proficiency in creating interactive data visualizations and dashboards for financial reporting.

5. How do you prioritize and manage multiple projects simultaneously?

- Task Management: Use tools like task lists, project management software, and time blocking to organize and prioritize tasks.

- Establish Clear Deadlines: Set realistic deadlines for each task and project to ensure timely completion.

- Delegate and Collaborate: Identify opportunities to delegate tasks to team members or seek collaboration for specific aspects of projects.

- Prioritize High-Impact Tasks: Focus on completing tasks that have a significant impact on project outcomes and business objectives.

- Regularly Monitor and Adjust: Regularly review progress and make adjustments to timelines or resource allocation as needed.

6. Explain how you approach analyzing financial data to identify trends and patterns.

- Exploratory Data Analysis: Use statistical techniques and visualizations to explore and summarize financial data.

- Time Series Analysis: Identify trends and seasonality in financial data over time.

- Correlation Analysis: Determine relationships between different financial variables.

- Regression Analysis: Build statistical models to predict financial outcomes based on historical data.

- Hypothesis Testing: Test hypotheses about financial relationships using statistical methods.

7. How do you communicate financial information to non-financial stakeholders?

- Simplify and Clarify: Use clear and concise language, avoiding technical jargon.

- Use Visuals: Employ charts, graphs, and dashboards to make data easily understandable.

- Provide Context: Explain the significance of financial data within the broader business context.

- Be Patient and Answer Questions: Allow ample time for questions and actively listen to stakeholder concerns.

- Customize the Presentation: Tailor the communication to the specific audience and their level of financial literacy.

8. Describe your understanding of the capital asset pricing model (CAPM).

- Formula: E(Ri) = Rf + βi * (Rm – Rf)

- Assumptions: Market is efficient, investors are risk-averse, no arbitrage opportunities exist.

- Key Inputs: Risk-free rate (Rf), market risk premium (Rm – Rf), beta (βi).

- Interpretation: CAPM determines the expected return of an asset based on its riskiness relative to the market.

- Limitations: Sensitivity to beta estimation, assumes constant market risk premium, may not be accurate for all asset classes.

9. What are the key considerations when evaluating a company’s investment potential?

- Financial Performance: Revenue growth, profitability, cash flow generation.

- Industry Analysis: Industry size, growth potential, competitive landscape.

- Management Team: Experience, track record, strategic vision.

- Valuation Metrics: Price-to-earnings ratio, price-to-sales ratio, discounted cash flow analysis.

- Risk Assessment: Business risk, financial risk, market risk.

10. How do you stay motivated and manage stress in a demanding work environment?

- Set Realistic Goals: Break down large projects into smaller, achievable tasks to maintain motivation.

- Prioritize Self-Care: Engage in regular exercise, maintain a healthy diet, and get enough sleep.

- Seek Support: Build relationships with colleagues and supervisors for encouragement and assistance.

- Use Stress Management Techniques: Practice mindfulness, meditation, or other relaxation techniques to manage stress levels.

- Maintain Perspective: Remember that challenges are temporary and focus on the long-term goals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Finance Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Finance Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Finance Analyst is responsible for conducting financial analysis, providing recommendations, and creating financial models to support decision-making within an organization. Their key job responsibilities include:

1. Financial Modeling

Developing and maintaining financial models to forecast financial performance, evaluate investment opportunities, and assess risk.

- Creating financial projections and scenarios using historical data, industry trends, and economic forecasts.

- Conducting sensitivity analysis to assess the impact of different variables on financial outcomes.

2. Financial Analysis

Analyzing financial data to identify trends, patterns, and potential areas for improvement.

- Performing financial ratio analysis, profitability analysis, and cash flow analysis.

- Identifying key financial indicators and developing recommendations for operational and strategic decision-making.

3. Investment Analysis

Evaluating investment opportunities, conducting due diligence, and making recommendations on investment decisions.

- Analyzing financial statements, industry reports, and economic data to assess investment risks and returns.

- Developing investment proposals and presenting them to management for approval.

4. Risk Management

Identifying, assessing, and mitigating financial risks faced by the organization.

- Conducting risk assessments, developing risk management plans, and implementing risk mitigation strategies.

- Monitoring financial markets and economic conditions to identify potential risks and opportunities.

Interview Tips

Preparing for a Finance Analyst interview requires a combination of technical knowledge and soft skills. Here are some tips to help you ace the interview:

1. Technical Skills

Make sure you have a strong foundation in financial modeling, financial analysis, and investment analysis. Review your coursework, practice using financial software, and brush up on industry-specific terminology.

- Familiarize yourself with the company’s financial statements and industry trends.

- Prepare examples of your financial modeling and analysis work.

2. Soft Skills

Finance Analysts need excellent communication and presentation skills. Practice your presentation skills and prepare for questions about your analytical, problem-solving, and decision-making abilities.

- Be prepared to discuss your experience working in a team environment.

- Demonstrate your ability to think critically and solve problems.

3. Research the Company

Thoroughly research the company you’re interviewing with. Understand their business model, financial performance, and industry position. This will help you tailor your answers to the specific requirements of the role.

- Review the company’s website, financial reports, and news articles.

- Prepare questions to ask the interviewer about the company and the role.

4. Mock Interviews

Practice your answers to common interview questions with a friend or mentor. This will give you confidence and help you identify areas for improvement.

- Prepare for questions about your financial modeling skills, analytical abilities, and experience.

- Ask for feedback on your answers and presentation skills.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Finance Analyst role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.