Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Finance Associate position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

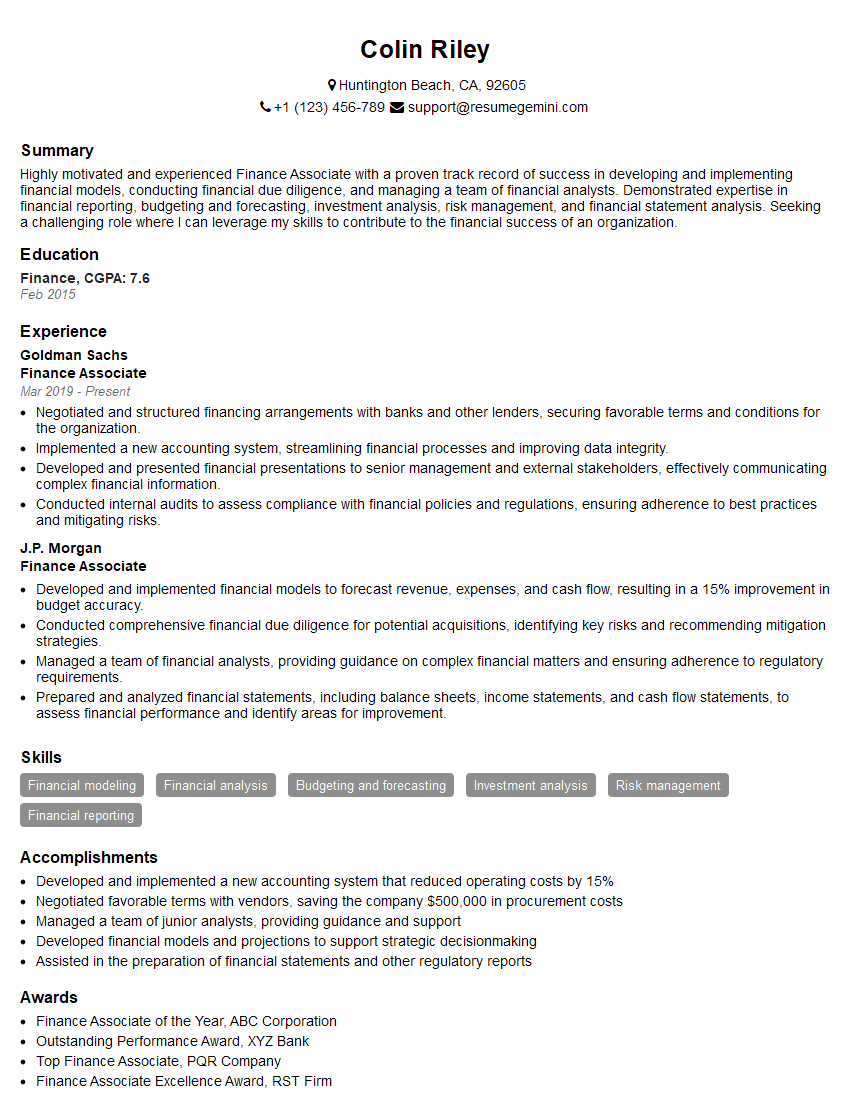

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Finance Associate

1. Walk me through the process of preparing a balance sheet?

To prepare a balance sheet, I follow these steps:

- Gather financial data: I collect data from various sources such as trial balances, general ledgers, and bank statements.

- Classify accounts: I categorize each account into assets, liabilities, or equity.

- Calculate account balances: I determine the ending balance for each account based on the financial data.

- Create a balance sheet template: I use a standard template that includes asset, liability, and equity sections.

- Populate the balance sheet: I enter the account balances into the appropriate sections of the balance sheet.

- Ensure balance: I verify that the total assets equal the total liabilities plus equity, ensuring that the balance sheet balances.

- Review and adjust: I review the balance sheet for accuracy and make any necessary adjustments.

2. How do you analyze financial statements to assess a company’s financial health?

Profitability Analysis

- Gross Profit Margin: Net Sales / Cost of Goods Sold

- Operating Profit Margin: Operating Income / Net Sales

- Net Profit Margin: Net Income / Net Sales

Efficiency Analysis

- Inventory Turnover: Cost of Goods Sold / Average Inventory

- Days Sales Outstanding (DSO): Average Accounts Receivable / (Net Sales / 365)

- Asset Turnover: Net Sales / Average Total Assets

Liquidity Analysis

- Current Ratio: Current Assets / Current Liabilities

- Quick Ratio (Acid-test Ratio): (Current Assets – Inventory) / Current Liabilities

Solvency Analysis

- Debt-to-Asset Ratio: Total Debt / Total Assets

- Debt-to-Equity Ratio: Total Debt / Shareholder Equity

3. Describe the key components of a cash flow statement and explain how it differs from an income statement.

A cash flow statement reports the cash inflows and outflows of a company over a period of time, while an income statement reports the revenues and expenses over the same period.

Key Components of a Cash Flow Statement:

- Operating Activities: Cash generated from core business operations.

- Investing Activities: Cash used for capital expenditures and investments.

- Financing Activities: Cash used for debt and equity financing.

4. Explain the concept of time value of money and how it is used in financial analysis.

The time value of money (TVM) is the concept that money has different values at different points in time. This is because money can earn interest over time, so a dollar today is worth more than a dollar in the future.

TVM is used in financial analysis to determine the future value of investments and the present value of future cash flows. This helps investors make informed decisions about how to allocate their resources.

5. What are the different methods of capital budgeting and how do you evaluate their strengths and weaknesses?

Payback Period

- Strength: Simple and easy to understand.

- Weakness: Ignores time value of money and cash flows beyond the payback period.

Net Present Value (NPV)

- Strength: Considers time value of money and all cash flows.

- Weakness: Relies on accurate estimates of future cash flows and discount rate.

Internal Rate of Return (IRR)

- Strength: Considers time value of money and finds the discount rate that makes NPV equal to zero.

- Weakness: Can be difficult to calculate and multiple IRRs are possible.

6. How do you use financial ratios to analyze a company’s performance and identify potential risks?

Financial ratios provide valuable insights into a company’s financial performance and health. By comparing ratios over time or with industry benchmarks, potential risks can be identified:

- Liquidity ratios (e.g., current ratio, quick ratio): Assess a company’s ability to meet short-term obligations.

- Solvency ratios (e.g., debt-to-asset ratio, debt-to-equity ratio): Evaluate a company’s long-term financial stability.

- Profitability ratios (e.g., gross profit margin, operating profit margin, net profit margin): Measure a company’s profitability and efficiency.

- Efficiency ratios (e.g., inventory turnover, days sales outstanding, asset turnover): Assess how effectively a company uses its resources.

7. Describe how you would use Excel to perform financial modeling and forecasting.

Excel is a powerful tool for financial modeling and forecasting. I use it to:

- Build financial models: Create spreadsheets that represent financial statements, cash flows, and other relevant data.

- Analyze scenarios: Change input variables to see how they affect financial outcomes.

- Forecast future performance: Use historical data and assumptions to predict future financial results.

- Generate reports and visualizations: Create charts, graphs, and tables to present financial information clearly.

8. What are your experiences in managing a team of finance professionals?

As a Finance Manager at [Previous Company], I led a team of 5 finance professionals. My responsibilities included:

- Providing strategic guidance and direction to the team.

- Assigning tasks and monitoring progress.

- Coaching and developing team members.

- Ensuring team collaboration and communication.

- Representing the finance department in meetings and presentations.

9. How do you stay up-to-date with the latest developments in finance and accounting?

To stay current in finance and accounting, I:

- Attend industry conferences and webinars: Engage with experts and learn about emerging trends.

- Read financial publications and journals: Stay informed about industry news and best practices.

- Take continuing education courses: Enhance my knowledge and skills in specialized areas.

- Network with finance professionals: Connect with peers and exchange ideas.

10. What are your career goals and how do you see this role contributing to your professional development?

My career goal is to grow into a senior financial leadership role. I believe this Finance Associate position will contribute to my professional development by:

- Providing hands-on experience in key financial functions.

- Expanding my knowledge of financial modeling and analysis.

- Developing my leadership and communication skills.

- Allowing me to make a significant contribution to the company’s financial success.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Finance Associate.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Finance Associate‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Finance Associates are responsible for a variety of financial tasks within an organization. Their duties may include:

1. Financial Analysis and Reporting

Finance Associates may be responsible for analyzing financial data, preparing financial statements, and reporting on the financial performance of the organization.

- Analyze financial data to identify trends and patterns.

- Prepare financial statements, such as balance sheets and income statements.

- Report on the financial performance of the organization to management and other stakeholders.

2. Budgeting and Forecasting

Finance Associates may be involved in budgeting and forecasting activities.

- Develop and manage budgets.

- Forecast financial performance.

- Monitor actual performance against budget and forecast.

3. Cash Management

Finance Associates may be responsible for managing the organization’s cash flow.

- Forecast cash flows.

- Manage bank relationships.

- Invest excess cash.

4. Risk Management

Finance Associates may be involved in risk management activities.

- Identify and assess financial risks.

- Develop and implement risk management strategies.

- Monitor risk exposure and report on risk management activities.

Interview Tips

Preparing for a finance associate interview can be a daunting task, but with the right preparation, you can increase your chances of success.

1. Know the Job Description

Before you start preparing for your interview, it’s important to carefully review the job description. This will give you a good understanding of the specific responsibilities of the role and the qualifications that the employer is looking for.

- Highlight your skills and experience that are most relevant to the job requirements.

- Be prepared to discuss how your skills and experience can benefit the organization.

2. Research the Company

It’s also important to research the company that you’re interviewing with. This will help you understand the company’s culture, values, and business goals.

- Visit the company’s website and social media pages.

- Read news articles and press releases about the company.

- Talk to people who work at the company, if possible.

3. Practice Your Answers

Once you’ve done your research, it’s time to start practicing your answers to common interview questions.

- Use the STAR method to answer behavioral questions.

- Prepare thoughtful answers to questions about your skills, experience, and qualifications.

- Practice answering questions in front of a mirror or with a friend or family member.

4. Dress Professionally

First impressions matter, so it’s important to dress professionally for your interview.

- Choose clothing that is clean, pressed, and fits well.

- Avoid wearing too much jewelry or makeup.

- Make sure your shoes are clean and polished.

5. Be On Time

Punctuality is important, so make sure to arrive for your interview on time.

- Plan your route in advance and leave yourself plenty of time to get there.

- If you’re running late, call or email the interviewer to let them know.

- Don’t be afraid to ask for directions if you get lost.

6. Be Yourself

Most importantly, be yourself during your interview. The interviewer wants to get to know you and see if you’re a good fit for the role. So be honest, enthusiastic, and confident.

- Smile and make eye contact with the interviewer.

- Be polite and respectful.

- Answer questions truthfully and concisely.

Next Step:

Now that you’re armed with the knowledge of Finance Associate interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Finance Associate positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini