Are you gearing up for a career in Finance Clerk? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Finance Clerk and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

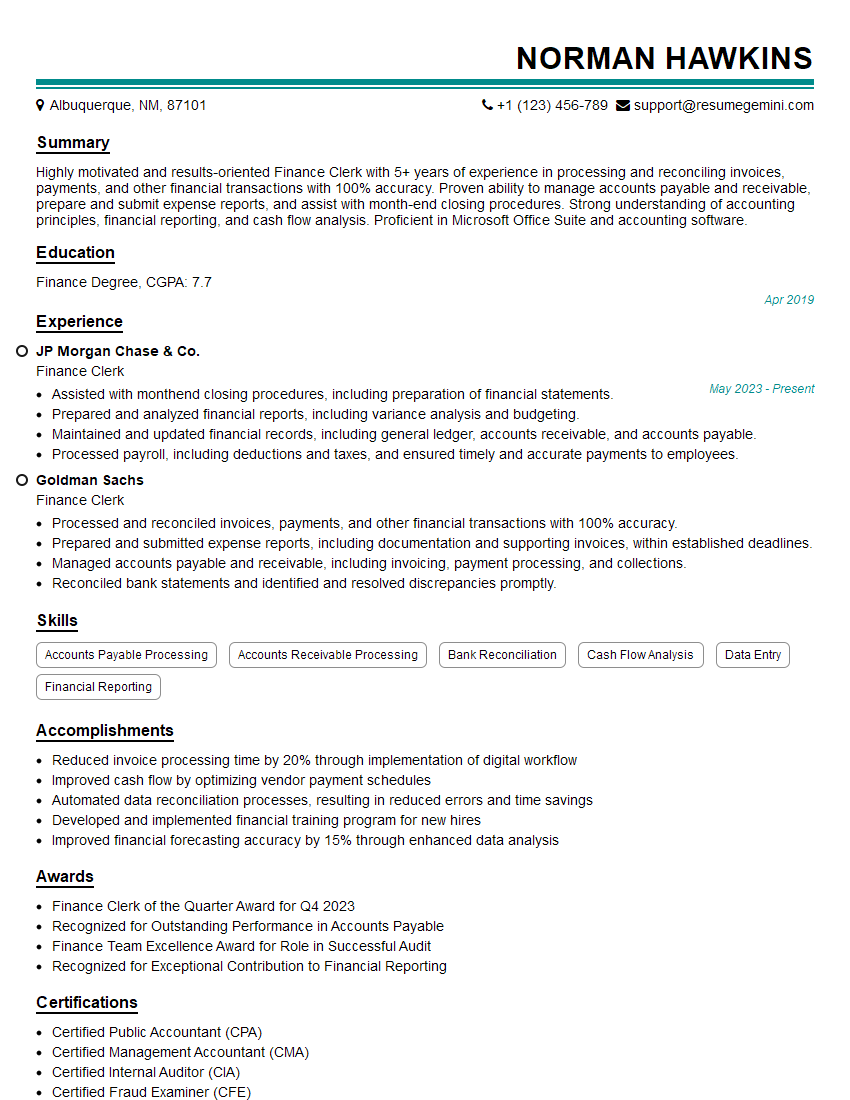

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Finance Clerk

1. What is Accounts Receivable?

Accounts Receivable is a ledger account that represents the money owed to a company by its customers for goods or services sold on credit. It is an essential part of any business’s financial accounting system. AR represents the amount of money that customers owe the company for the goods and services they purchased but have not yet paid for.

2. What are the key responsibilities of a Finance Clerk?

- Processing invoices and payments

- Recording transactions in the accounting system

- Reconciling bank statements

- Preparing financial reports

3. What are the different types of financial transactions that you have experience with?

- Accounts payable

- Accounts receivable

- Payroll

- Cash management

4. What is your experience with using accounting software?

- Proficient in Microsoft Excel

- Experience with QuickBooks and Sage 50

5. What are your strengths as a Finance Clerk?

- Strong attention to detail

- Excellent communication skills

- Ability to work independently and as part of a team

6. What are your weaknesses as a Finance Clerk?

- I am sometimes too detail-oriented, which can slow me down.

- I am not always the best at communicating with people who do not have a financial background.

7. What is your salary expectation?

My salary expectation is $50,000 per year.

8. Why do you want to work for this company?

I am interested in working for this company because I am impressed with your commitment to customer service and your focus on financial stability.

9. What are your career goals?

My career goal is to become a Certified Public Accountant (CPA).

10. Do you have any questions for me?

I do not have any questions at this time.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Finance Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Finance Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Finance Clerks play a vital role in the financial operations of an organization. They perform a diverse range of tasks related to accounting, bookkeeping, and financial reporting.

1. Data Entry and Processing

Finance Clerks are responsible for accurately entering and processing financial data. This includes recording transactions, reconciling accounts, and preparing financial statements.

- Maintain accurate financial records, including general ledgers, accounts payable and receivable, and cash flow statements.

- Reconcile bank statements and other financial documents to ensure accuracy and completeness.

2. Accounts Payable and Receivable

Finance Clerks manage accounts payable and receivable, ensuring timely payment of invoices and collection of outstanding receivables.

- Process vendor invoices for payment and maintain vendor records.

- Follow up on overdue payments and resolve any payment discrepancies.

3. Financial Reporting

Finance Clerks assist in the preparation of financial reports, including income statements, balance sheets, and cash flow statements.

- Gather and analyze financial data to prepare reports for management and external stakeholders.

- Ensure that financial reports are accurate, timely, and compliant with accounting standards.

4. Customer Service

Finance Clerks often interact with customers to resolve billing inquiries, answer questions, and provide account information.

- Respond to customer inquiries promptly and professionally.

- Resolve billing disputes and provide account updates.

Interview Tips

Preparing thoroughly for an interview is crucial for success. Here are some tips to help you ace your Finance Clerk interview:

1. Research the Company and Position

Before the interview, take some time to research the company and the specific Finance Clerk position. This will help you understand the company’s culture, values, and the specific duties and responsibilities of the role.

- Visit the company’s website and read about their history, mission, and financial performance.

- Review the job description thoroughly and identify the key skills and qualifications required.

2. Practice Common Interview Questions

Many job interviews follow a similar format, so it’s helpful to practice answering common interview questions. This will help you feel more confident and prepared.

- Prepare for questions about your experience, skills, and qualifications.

- Consider behavioral questions that ask you to describe specific situations and how you responded.

3. Highlight Your Relevant Skills and Experience

During the interview, focus on highlighting your relevant skills and experience that match the requirements of the Finance Clerk role.

- Emphasize your experience in data entry, accounting, and financial reporting.

- Share examples of how you have successfully managed accounts payable or receivable.

4. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview shows that you are engaged and interested in the position. Prepare a few questions to ask the interviewer about the company, the role, or the team.

- Inquire about the company’s financial goals and objectives.

- Ask about the opportunities for professional development and growth within the organization.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Finance Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!