Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Finance Consultant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

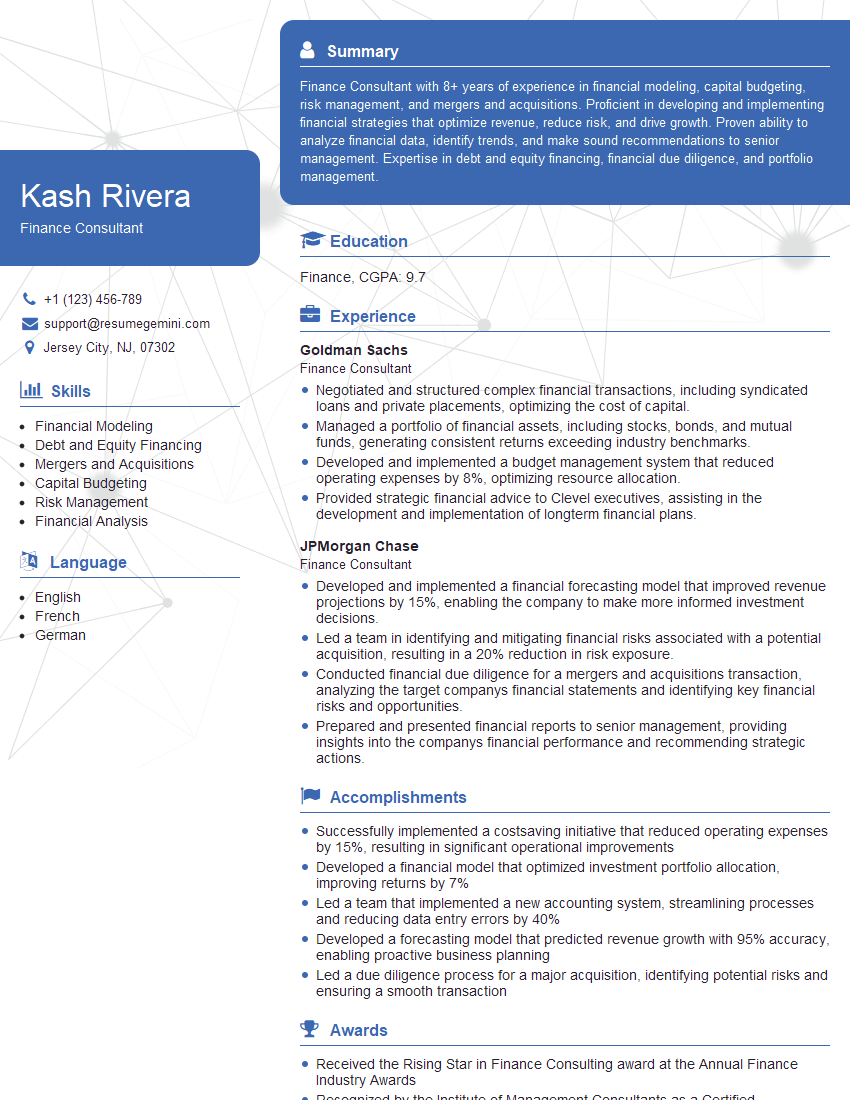

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Finance Consultant

1. Describe the key financial ratios used to assess a company’s profitability, liquidity, and solvency?

Profitability:

- Gross Profit Margin

- Operating Profit Margin

- Net Profit Margin

Liquidity:

- Current Ratio

- Quick Ratio

- Cash Conversion Cycle

Solvency:

- Debt-to-Equity Ratio

- Debt-to-Asset Ratio

- Interest Coverage Ratio

2. Discuss the different methods used for financial forecasting and their pros and cons?

Time Series Analysis

- Pros: Simple and easy to use

- Cons: Limited accuracy for non-seasonal data

Causal Modeling

- Pros: Captures relationships and dependencies

- Cons: Data-intensive and complex to build

Judgmental Forecasting

- Pros: Incorporates qualitative insights

- Cons: Subjective and prone to biases

3. Explain the concept of weighted average cost of capital (WACC) and how it is used in capital budgeting decisions?

Definition: WACC represents the average cost of a company’s capital, weighted by the proportions of debt and equity used.

Calculation: WACC = (Weight of Debt * Cost of Debt) + (Weight of Equity * Cost of Equity)

Use in Capital Budgeting: WACC is used as the discount rate to evaluate future cash flows in capital budgeting projects. A project is considered profitable if its net present value (NPV) is positive when discounted at WACC.

4. Describe the process of financial due diligence for a potential investment or acquisition?

Assessment of Financial Health:

- Review of financial statements

- Key financial ratio analysis

Management and Operations:

- Interviews with management

- Assessment of operational efficiency

Legal and Regulatory Compliance:

- Review of contracts and legal documents

- Verification of regulatory compliance

5. Discuss the ethical considerations involved in financial consulting and how potential conflicts of interest can be managed?

Ethical Principles:

- Objectivity and independence

- Confidentiality

- Integrity

Conflicts of Interest:

- Identify and disclose any potential conflicts

- Establish clear boundaries and avoid biased recommendations

- Seek external advice or expertise if necessary

6. Explain the role of financial technology (fintech) in transforming the financial services industry?

Automation and Efficiency:

- Streamlining financial processes

- Reducing manual errors and costs

Access to Capital and Financial Services:

- Expanding access to financial products and services

- Lowering barriers to entry for small businesses and individuals

Investment and Wealth Management:

- Robo-advisors and digital investment platforms

- Personalized financial planning and tailored investment strategies

7. Describe the challenges and opportunities in the field of financial consulting?

Challenges:- Keeping up with the evolving regulatory landscape

- Managing client expectations and meeting deadlines

- Growing demand for financial advisory services

- Advancements in technology and data analytics

8. Explain how you approach a financial modeling exercise for a new business venture?

Define Assumptions and Parameters:

- Market size and growth potential

- Operating costs and expenses

Build Financial Statements:

- Income statement

- Balance sheet

- Cash flow statement

Scenario Analysis and Sensitivity Testing:

- Identify key variables and assumptions

- Analyze how changes in these variables affect financial outcomes

9. Discuss the importance of communication skills in financial consulting and how you convey complex financial information to non-financial stakeholders?

Clarity and Simplicity:

- Using jargon-free language

- Breaking down complex concepts into manageable chunks

Customization and Relevance:

- Tailoring communication to the audience’s knowledge level

- Emphasizing the business impact of financial analysis

Visual and Interactive Tools:

- Using charts, graphs, and dashboards

- Interactive simulations and case studies

10. Describe a challenging financial consulting project you worked on and how you overcame the obstacles?

Challenge:

Obstacles:

Solutions:

- Collaborated with multiple stakeholders to gather necessary data

- Leveraged data analytics tools to expedite modeling

- Communicated progress and challenges transparently to ensure stakeholder alignment

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Finance Consultant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Finance Consultant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Finance Consultants are highly sought-after professionals in the financial industry, providing expert advice and guidance to organizations seeking to improve their financial performance and make informed decisions.

1. Financial Analysis

Conduct in-depth financial analysis to assess the financial health of organizations, identify areas for improvement, and develop strategies to enhance profitability.

- Evaluate financial statements, including balance sheets, income statements, and cash flow statements.

- Perform ratio analysis, trend analysis, and regression analysis to identify key financial indicators and patterns.

2. Financial Modeling

Develop and utilize financial models to forecast financial performance, evaluate investment opportunities, and support decision-making.

- Build financial models using Excel, SQL, and other tools to simulate different scenarios and provide projections.

- Estimate financial metrics such as revenue, expenses, profits, and cash flows.

3. Strategic Planning

Collaborate with management teams to develop and implement financial strategies that align with the organization’s overall business objectives.

- Participate in strategic planning sessions and provide financial insights to inform decision-making.

- Develop financial projections and budgets to support strategic initiatives.

4. Business Development

Identify and pursue new business opportunities, maintain client relationships, and grow the firm’s consulting practice.

- Network with industry professionals and potential clients to generate leads.

- Develop proposals and pitch the firm’s services to prospective clients.

Interview Tips

To ace your Finance Consultant interview, preparation is key. Here are some tips to help you stand out:

1. Research the Company and Role

Thoroughly research the company, its financial performance, and the specific role you are applying for. Understanding the company’s business model and industry will demonstrate your genuine interest and knowledge.

- Visit the company’s website and read about their financials, services, and recent news.

- Review the job description carefully and identify the key skills and qualifications required.

2. Prepare Case Studies and Examples

Finance Consultants often need to analyze financial data and provide recommendations. Prepare case studies or examples from previous projects that showcase your abilities in financial modeling, analysis, and problem-solving.

- Use specific metrics and data to demonstrate your findings and recommendations.

- Emphasize the impact of your work and the value you brought to the organization.

3. Practice Technical Skills

Finance Consultants rely on strong analytical and technical skills. Practice solving financial problems using Excel, SQL, or other relevant tools. Be prepared to demonstrate your proficiency in financial modeling and data analysis.

- Take online courses or practice problems to improve your technical abilities.

- Consider obtaining industry certifications, such as the Chartered Financial Analyst (CFA) or Certified Public Accountant (CPA), to enhance your credibility.

4. Highlight Communication and Interpersonal Skills

Finance Consultants need to be able to communicate complex financial concepts clearly and effectively. Practice presenting your findings and recommendations in a concise and engaging manner.

- Prepare examples of how you have successfully presented financial information to non-financial audiences.

- Demonstrate your ability to build rapport and collaborate with individuals from diverse backgrounds.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Finance Consultant role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.