Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Finance Lecturer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

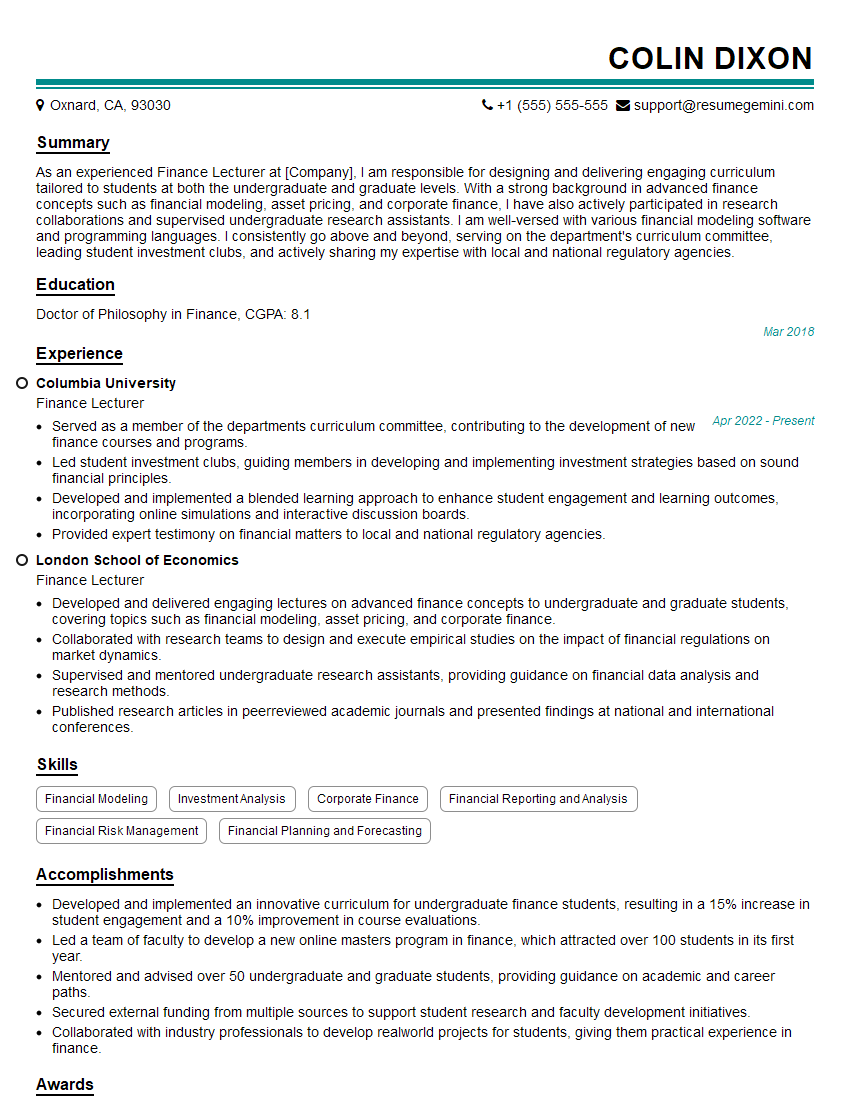

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Finance Lecturer

1. What are the essential elements of financial planning?

- Gathering financial data

- Analyzing financial data

- Developing financial goals

- Creating a financial plan

- Implementing and monitoring the financial plan

2. What are the different types of financial planning?

Personal financial planning

- Retirement planning

- Investment planning

- Tax planning

- Estate planning

Business financial planning

- Capital budgeting

- Financial forecasting

- Mergers and acquisitions

- Risk management

3. What are the ethical considerations in financial planning?

- Fiduciary duty

- Conflict of interest

- Misrepresentation

- Fraud

4. What are the challenges facing financial planners today?

- The increasing complexity of financial products

- The changing regulatory environment

- The need to meet the needs of a diverse client base

- The impact of technology on the financial planning process

5. What are your strengths as a financial planner?

- Strong analytical skills

- Excellent communication skills

- Deep understanding of financial products and markets

- Ability to develop and implement financial plans

- Commitment to providing objective and unbiased advice

6. What are your weaknesses as a financial planner?

- Limited experience in certain areas of financial planning

- May not be able to meet the needs of all clients

- May be biased towards certain financial products or strategies

- May not be able to keep up with the latest changes in the financial planning industry

7. What are your goals as a financial planner?

- To help clients achieve their financial goals

- To build a successful financial planning practice

- To make a positive impact on the financial lives of others

- To stay abreast of the latest changes in the financial planning industry

- To be recognized as a leader in the financial planning profession

8. Why do you want to work as a financial planner for our company?

- I am passionate about helping people achieve their financial goals

- I am impressed with your company’s commitment to providing objective and unbiased advice

- I believe that I can make a valuable contribution to your team

- I am eager to learn and grow as a financial planner

- I am confident that I can be a successful financial planner for your company

9. What is your experience with using financial planning software?

- I have experience using a variety of financial planning software

- I am proficient in using software to perform financial analysis, develop financial plans, and track client progress

- I am familiar with the latest features and functionality of financial planning software

- I am able to use software to efficiently and effectively manage my clients’ financial planning needs

10. What is your approach to financial planning?

- My approach to financial planning is comprehensive and holistic

- I take into account all aspects of a client’s financial situation

- I work with clients to develop a customized financial plan that meets their unique needs and goals

- I am committed to providing ongoing support and guidance to my clients

- I believe that financial planning is an essential part of achieving financial success

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Finance Lecturer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Finance Lecturer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Finance Lecturers are responsible for teaching and researching in the field of finance. They develop and deliver lectures, lead seminars and tutorials, and assess student work. They also conduct research in their specialist areas and publish their findings in academic journals.

1. Teaching

Finance Lecturers are responsible for developing and delivering lectures, leading seminars and tutorials, and assessing student work. They must be able to communicate complex financial concepts in a clear and engaging manner, and they must be able to create a positive and supportive learning environment for their students.

- Develop and deliver lectures on a variety of financial topics

- Lead seminars and tutorials to help students understand lecture material

- Assess student work, including essays, exams, and presentations

2. Research

Finance Lecturers are expected to conduct research in their specialist areas and publish their findings in academic journals. They must be able to identify and investigate research questions, and they must be able to write and present their findings in a clear and concise manner.

- Conduct research on a variety of financial topics

- Publish their findings in academic journals

- Present their research at conferences and seminars

3. Administration

Finance Lecturers are also responsible for carrying out a variety of administrative tasks, such as curriculum development, course coordination, and student advising. They must be able to work independently and as part of a team, and they must be able to meet deadlines and manage their time effectively.

- Participate in curriculum development and course coordination

- Advise students on academic and career matters

- Attend department and faculty meetings

4. Outreach

Finance Lecturers are often involved in outreach activities, such as giving guest lectures, writing articles for popular publications, and participating in public debates. They must be able to communicate complex financial concepts to a non-academic audience, and they must be able to represent their university in a positive and professional manner.

- Give guest lectures to industry groups and community organizations

- Write articles for popular publications

- Participate in public debates on financial issues

Interview Tips

Interviewing for a Finance Lecturer position can be a challenging experience, but there are a few things you can do to prepare and increase your chances of success.

1. Research the position and the university

Before you go to the interview, take some time to research the position and the university. This will help you to understand the specific requirements of the job and to tailor your answers to the interviewer’s questions.

- Read the job description carefully and identify the key requirements

- Visit the university’s website and learn about its mission, values, and academic programs

- Talk to people who know about the position or the university, such as former students, colleagues, or friends

2. Prepare your answers to common interview questions

There are a few common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. It is important to prepare your answers to these questions in advance so that you can deliver them confidently and concisely.

- Brainstorm a list of potential interview questions

- Write out your answers to the questions and practice delivering them aloud

- Be prepared to discuss your research, teaching experience, and administrative skills

3. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally and arrive on time for your interview. This will show the interviewer that you are serious about the position and that you respect their time.

- Wear a suit or business casual attire

- Arrive on time for your interview

- Be polite and respectful to the interviewer and other staff members

4. Be yourself and be enthusiastic

It is important to be yourself and be enthusiastic during your interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not.

- Be yourself and be authentic

- Show your passion for teaching and research

- Be enthusiastic about the position and the university

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Finance Lecturer role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.