Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Finance Risk Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

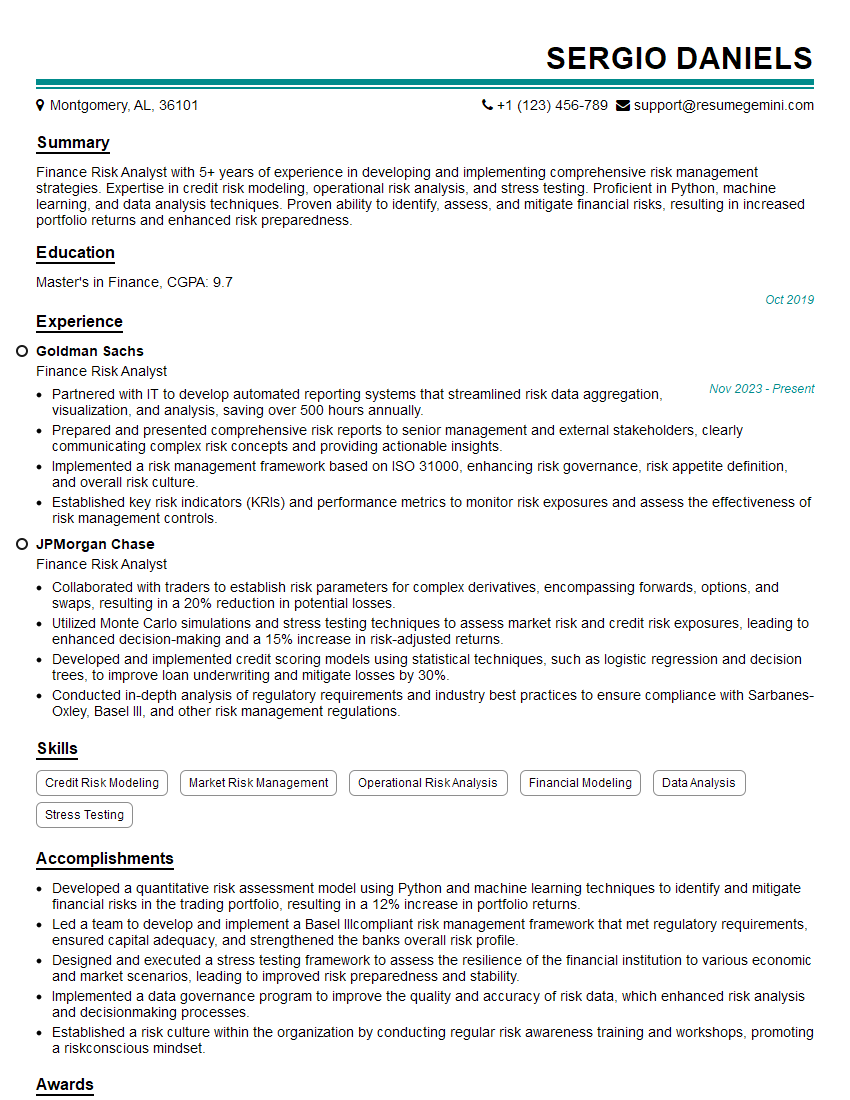

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Finance Risk Analyst

1. Describe the steps involved in conducting a risk assessment.

The steps involved in conducting a risk assessment typically include:

- Identify hazards: This involves identifying potential sources of harm or loss within the organization.

- Assess risks: Involves evaluating the likelihood and severity of each identified hazard.

- Develop risk controls: Involves identifying and implementing measures to mitigate or eliminate risks.

- Monitor and review risks: This involves continuously monitoring risks and making adjustments to controls as needed.

2. What are the different types of financial risks that a company may face?

Market risk

- Price risk: The risk of losses due to changes in market prices, such as interest rates, exchange rates, or commodity prices.

- Liquidity risk: The risk of not being able to meet financial obligations when they become due.

Credit risk

- Default risk: The risk of a borrower failing to repay a loan or meet other financial obligations.

- Concentration risk: The risk of having a significant exposure to a single borrower or group of borrowers.

Operational risk

- Fraud risk: The risk of losses due to fraudulent activities, such as embezzlement or forgery.

- Compliance risk: The risk of losses due to non-compliance with laws and regulations.

3. What are the key elements of a risk management framework?

The key elements of a risk management framework typically include:

- Risk appetite: This defines the level of risk that the organization is willing to tolerate.

- Risk assessment: This involves identifying and assessing risks.

- Risk mitigation: This involves developing and implementing measures to mitigate or eliminate risks.

- Risk monitoring: This involves continuously monitoring risks and making adjustments to controls as needed.

4. How do you measure and quantify financial risks?

Financial risks can be measured and quantified using a variety of methods, including:

- Value at Risk (VaR): This measures the potential loss in value of a portfolio over a given time horizon with a specified confidence level.

- Expected Shortfall (ES): This measures the expected loss in value of a portfolio that exceeds VaR.

- Stress testing: This involves simulating extreme market conditions to assess the potential impact on a portfolio.

5. What are the challenges of implementing a risk management framework?

Common challenges in implementing a risk management framework include:

- Lack of data: Risk assessments require accurate and timely data, which can be a challenge to obtain.

- Complexity: Risk management frameworks can be complex and difficult to implement across large organizations.

- Lack of buy-in: It can be difficult to get buy-in from all stakeholders, which can hinder the effectiveness of the framework.

6. How do you communicate risk management findings to senior management?

Effectively communicating risk management findings to senior management requires:

- Clarity: Presenting the findings in a clear and concise manner, using non-technical language.

- Conciseness: Focusing on the most important findings and avoiding overwhelming senior management with details.

- Actionable insights: Providing recommendations and insights that can help senior management make informed decisions.

7. Describe the Basel Accords and their implications for financial risk management.

The Basel Accords are a series of international banking regulations that set minimum capital requirements for banks based on their risk profile.

- Basel I: Introduced in 1988, it established the risk-weighting approach for determining capital requirements.

- Basel II: Introduced in 2004, it refined the risk-weighting approach and introduced additional capital requirements for operational risk.

- Basel III: Introduced in 2010, it further strengthened capital requirements and introduced new liquidity and leverage ratios.

- Basel Accords require banks to have adequate capital to absorb potential losses.

- Banks need to develop robust risk management frameworks to meet the requirements of Basel Accords.

8. What is the role of technology in financial risk management?

Technology plays a crucial role in financial risk management by:

- Data aggregation and analysis: Collecting and analyzing large amounts of data to identify and assess risks.

- Risk modeling: Developing and using models to simulate and quantify risks.

- Risk monitoring: Continuously monitoring risks and tracking changes in risk profiles.

9. What are the emerging trends in financial risk management?

Emerging trends in financial risk management include:

- Increased use of artificial intelligence (AI) and machine learning (ML): For risk assessment, modeling, and monitoring.

- Adoption of cloud computing: For faster data processing and access to advanced risk management tools.

- Focus on climate risk: Identifying and mitigating risks related to climate change.

- Integrated risk management: Considering the interconnectedness of different types of risks.

10. How do you stay updated with the latest developments in financial risk management?

To stay updated with the latest developments in financial risk management, I:

- Attend industry conferences and webinars: To learn about new trends and best practices.

- Read industry publications and research papers: To stay abreast of the latest research and developments.

- Participate in professional development programs: To enhance my skills and knowledge.

- Network with other risk professionals: To exchange ideas and insights.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Finance Risk Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Finance Risk Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Finance Risk Analyst is responsible for identifying, assessing, and mitigating financial risks within the organization. This role plays a critical part in safeguarding the company’s financial health and stability.

1. Risk Identification and Assessment

Identify potential financial risks across various business units and operations

- Conduct thorough analysis of financial data, market trends, and industry dynamics to pinpoint risk factors

- Develop and implement risk assessment methodologies to evaluate the likelihood and impact of identified risks

2. Risk Mitigation and Management

Develop and recommend strategies to mitigate and manage identified risks

- Propose risk controls and policies to reduce the probability or impact of potential financial losses

- Monitor and evaluate the effectiveness of implemented risk mitigation measures

3. Financial Modeling and Analysis

Use financial models and analytical techniques to assess financial risks

- Develop and validate financial models to quantify and analyze risks

- Conduct sensitivity analysis and stress testing to assess the impact of various scenarios on financial performance

4. Reporting and Communication

Effectively communicate risk findings and recommendations to management and stakeholders

- Prepare clear and concise risk reports, presentations, and analysis summaries

- Engage with senior management and business units to discuss risk exposures and mitigation plans

Interview Tips

Preparing thoroughly for a Finance Risk Analyst interview can significantly enhance your chances of success. Here are some tips to help you ace the interview:

1. Research the Organization and Role

Take time to thoroughly research the company, its industry, and the specific role you’re applying for. This will demonstrate your interest and preparation.

2. Showcase Your Technical Skills

Highlight your proficiency in financial modeling, risk assessment techniques, and data analysis. Quantify your accomplishments and provide specific examples of how you’ve used these skills to mitigate risks.

3. Emphasize Your Understanding of Risk Concepts

Demonstrate a deep understanding of various financial risks, such as credit risk, market risk, operational risk, and regulatory risk. Explain how you stay up-to-date with emerging risk trends.

4. Highlight Your Communication and Interpersonal Skills

Effective communication is crucial in this role. Practice presenting complex financial concepts clearly and concisely. Showcasing your ability to build rapport and influence stakeholders is also essential.

5. Prepare for Common Interview Questions

Prepare for common interview questions related to risk management, financial analysis, and your experience. Anticipating these questions will help you answer confidently and articulately.

6. Ask Thoughtful Questions

Prepare a few thoughtful questions to ask the interviewer. This shows your engagement and interest in the role and the organization.

7. Dress Professionally and Arrive on Time

Make a positive first impression by dressing professionally and arriving on time for your interview. Maintain a positive and enthusiastic attitude throughout the process.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Finance Risk Analyst, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Finance Risk Analyst positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.