Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Finance Specialist interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Finance Specialist so you can tailor your answers to impress potential employers.

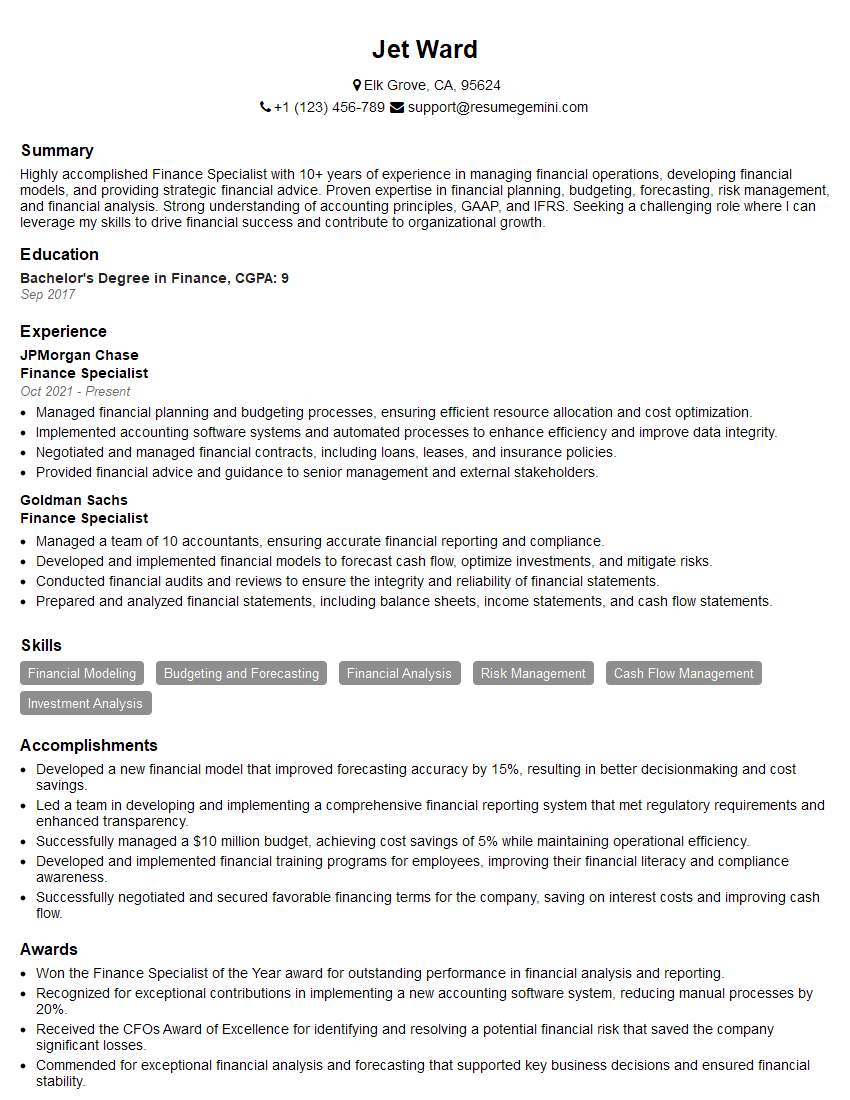

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Finance Specialist

1. Tell us about your experience in financial modeling and analysis?

In my previous role as a Financial Analyst at [Company Name], I was responsible for developing and maintaining complex financial models used for various purposes, including:

- Forecasting financial performance and projecting future cash flows

- Evaluating investment opportunities and recommending capital allocation strategies

- Performing sensitivity analysis and scenario planning to assess risk

I have a strong understanding of financial accounting principles, valuation techniques, and statistical methods. I am also proficient in using financial modeling software such as Excel, Python, and R.

2. Describe your experience in budgeting and forecasting?

Budgeting Process

- In my previous role, I worked closely with the finance team to develop and execute the annual operating budget

- I was responsible for collecting data, analyzing trends, and formulating budget assumptions

Forecasting

- I also played a key role in developing financial forecasts to support strategic planning and performance evaluation

- I used financial modeling techniques to project future revenue, expenses, and cash flows

3. Talk us through your experience with financial reporting and analysis?

In my previous role, I was responsible for preparing and analyzing financial statements, including the balance sheet, income statement, and cash flow statement.

- I ensured that financial statements were accurate, compliant with GAAP, and presented in a clear and concise manner

- I also analyzed financial data to identify trends, risks, and opportunities

4. What are your skills in risk management and internal controls?

I have a strong understanding of risk management principles and practices.

- In my previous role, I was responsible for developing and implementing risk management policies and procedures

- I also conducted risk assessments to identify, evaluate, and mitigate potential risks

- I am also well-versed in internal controls and have experience in implementing and monitoring control systems

5. How would you approach improving the efficiency of a finance department?

I would approach improving the efficiency of a finance department by:

- Automating tasks and processes to reduce manual labor

- Implementing technology solutions to streamline data collection and analysis

- Improving communication and collaboration between finance and other departments

- Training and developing finance staff to enhance their skills and knowledge

6. What are your strengths and weaknesses as a Finance Specialist?

Strengths

- Strong analytical and problem-solving skills

- Excellent communication and presentation skills

- Proficient in financial modeling and analysis

- Experience in budgeting, forecasting, and financial reporting

Weaknesses

- Limited experience in certain areas, such as investment banking

- Can sometimes be overly detail-oriented

7. What are your salary expectations?

My salary expectations are in line with the market average for a Finance Specialist with my experience and qualifications. I am open to discussing a salary range that is commensurate with the responsibilities of the position and the value I can bring to your company.

8. Why are you interested in this role?

I am interested in this role because it aligns with my skills and experience in finance. I am particularly interested in the opportunity to contribute to your company’s financial success and growth.

9. What are your career goals?

My career goals are to become a CFO and to lead a finance team that supports the strategic objectives of a company.

10. Do you have any questions for me?

Yes, I do have a few questions:

- What are the biggest challenges that the finance department is currently facing?

- What are the company’s financial goals for the next fiscal year?

- What opportunities for professional growth and development are available within the finance department?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Finance Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Finance Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Finance Specialists play a vital role in any organization’s financial management. Their key responsibilities include:1. Financial Planning and Forecasting

Developing and implementing financial plans and forecasts based on historical data analysis and market trends.

- Estimating revenue, expenses, and cash flows.

- Identifying potential risks and opportunities.

2. Financial Reporting and Analysis

Preparing and presenting financial statements, such as balance sheets, income statements, and cash flow statements.

- Analyzing financial performance and identifying areas for improvement.

- Providing insights and recommendations to management.

3. Budget Management

Developing and managing budgets for various departments and projects.

- Monitoring expenses and identifying areas of overspending.

- Ensuring compliance with budget guidelines.

4. Cash Flow Management

Forecasting and managing cash flows to ensure optimal utilization of funds.

- Investing excess cash to maximize returns.

- Negotiating payment terms with vendors.

5. Risk Management

Identifying and assessing financial risks, such as credit risk, market risk, and operational risk.

- Developing and implementing risk mitigation strategies.

- Monitoring and reporting on risk exposure.

6. External Reporting

Preparing and submitting financial reports to external stakeholders, such as investors, creditors, and regulatory agencies.

- Ensuring compliance with accounting standards and regulations.

- Representing the organization in financial matters.

Interview Tips

To ace the interview for a Finance Specialist position, it’s essential to prepare thoroughly. Here are some tips:1. Research the Company and Role

Familiarize yourself with the company’s financial performance, industry trends, and the specific responsibilities of the Finance Specialist role.

- Visit the company’s website and social media pages.

- Read industry publications and news articles.

2. Practice Common Interview Questions

Prepare for common interview questions related to financial planning, forecasting, budgeting, risk management, and financial reporting.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Provide specific examples of your work experience.

3. Showcase Your Skills

Highlight your financial modeling, analytical, and problem-solving skills during the interview.

- Discuss your experience with financial software and tools.

- Share examples of how you have solved financial challenges.

4. Ask Thoughtful Questions

Ask thoughtful questions to demonstrate your interest in the position and the company.

- Inquire about the company’s financial goals and objectives.

- Ask about the team you will be working with.

5. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally and arrive for the interview on time.

- Choose attire that is appropriate for a business environment.

- Be punctual and allow extra time for traffic or unexpected delays.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Finance Specialist interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!