Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Finance Teacher interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Finance Teacher so you can tailor your answers to impress potential employers.

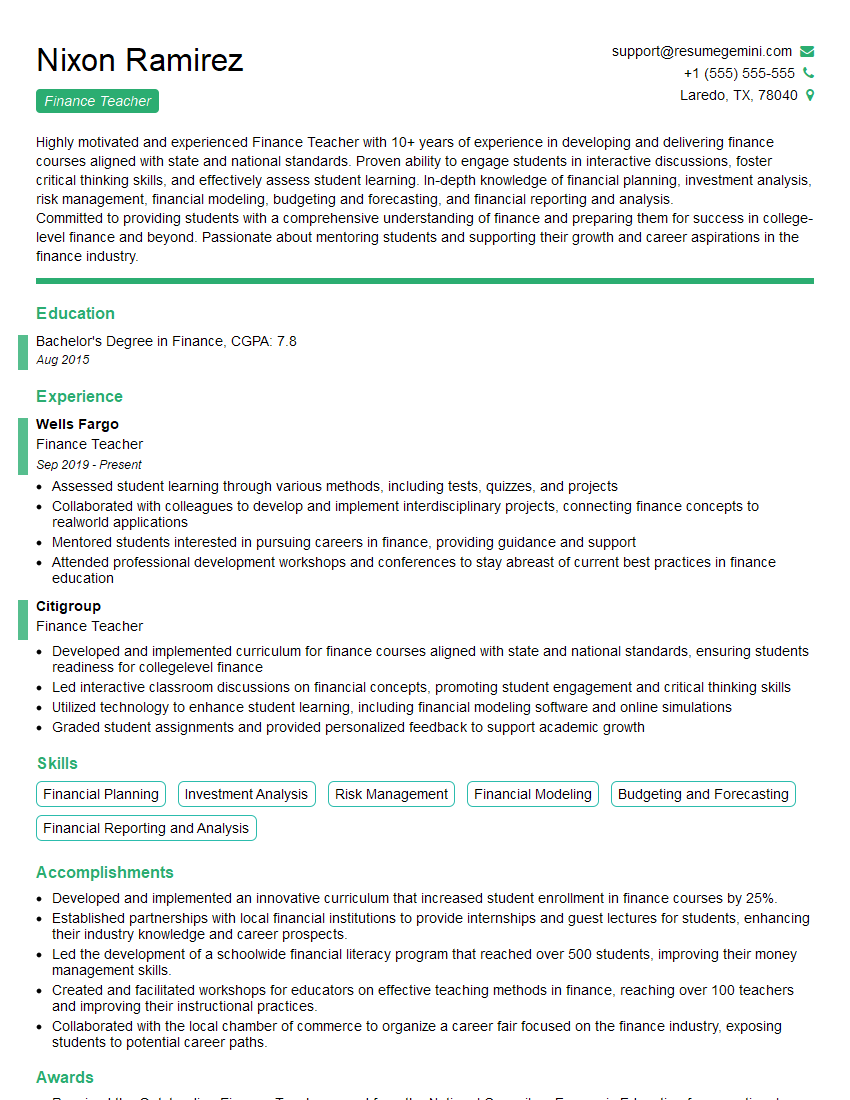

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Finance Teacher

1. How would you teach the concept of financial ratios to high school students?

- Start by explaining the purpose of financial ratios: to provide insights into a company’s financial health and performance.

- Use real-world examples to make the concept relatable and engaging.

- Divide ratios into different categories (liquidity, profitability, efficiency, solvency) and explain their significance.

- Incorporate hands-on activities, such as analyzing company financial statements, to reinforce understanding.

- Relate the concepts to practical applications in personal finance and investing.

2. Describe your approach to teaching investment strategies to students with varying levels of prior knowledge.

Differentiated Instruction:

- Assess students’ prior knowledge and tailor instruction accordingly.

- Provide differentiated materials and resources catering to different learning styles.

- Offer optional enrichment activities for students seeking a deeper understanding.

Project-Based Learning:

- Assign group projects where students work together to research and create investment portfolios.

- Provide guidance and support throughout the project, encouraging students to develop critical thinking and problem-solving skills.

- Facilitate peer presentations to share learning outcomes and insights.

3. How do you incorporate real-world applications into your finance lessons?

- Use case studies of real-world companies to illustrate financial principles and decision-making.

- Invite guest speakers from the financial industry to share their experiences and insights.

- Organize field trips to financial institutions, such as banks or investment firms.

- Incorporate online simulations and virtual experiences to give students hands-on practice.

- Encourage students to follow financial news and analyze current events related to the economy and financial markets.

4. How do you assess students’ understanding of complex financial concepts?

- Written assignments: Essays, reports, and problem-solving exercises.

- Projects: Presentations, simulations, and portfolio creation.

- Class discussions: Encourage participation and critical analysis.

- Quizzes and exams: Test both conceptual understanding and application skills.

- Peer assessments: Provide opportunities for students to evaluate and provide feedback on each other’s work.

5. Describe your strategies for engaging students in finance lessons.

- Use interactive games, simulations, and online tools.

- Incorporate hands-on activities, such as role-playing, mock interviews, and trading exercises.

- Relate financial concepts to real-life situations and student experiences.

- Encourage group discussions and student-led presentations.

- Connect finance to other subjects, such as economics, math, and business.

6. How do you stay up-to-date on the latest developments in the financial industry?

- Attend industry conferences and workshops.

- Read financial news and research reports.

- Network with professionals in the financial sector.

- Participate in professional development courses and webinars.

- Utilize online resources and platforms for financial education.

7. Describe your experience in developing and implementing financial literacy programs for students.

Program Design:

- Researched and identified the needs of the target audience.

- Developed curricula and lesson plans aligned with relevant standards.

- Incorporated interactive activities and real-world simulations.

Program Implementation:

- Collaborated with teachers and administrators to integrate the program into the school curriculum.

- Facilitated workshops and training sessions for educators.

- Monitored student progress and made data-driven modifications to the program.

8. How do you handle students who are struggling with financial concepts?

- Identify the root of their difficulties.

- Provide individualized support and differentiated instruction.

- Encourage students to ask questions and seek help.

- Break down complex concepts into smaller, manageable steps.

- Offer extra practice opportunities and review sessions.

9. Describe your approach to fostering financial responsibility and critical thinking skills in students.

- Integrate real-life scenarios and case studies.

- Encourage students to analyze financial data and make informed decisions.

- Emphasize the consequences of financial choices.

- Provide opportunities for students to manage simulated investment portfolios.

- Collaborate with experts from the financial industry to share insights and best practices.

10. How do you promote collaboration and peer learning in your finance classes?

- Assign group projects that require students to work together on financial analysis and decision-making.

- Facilitate peer review sessions where students provide feedback on each other’s work.

- Encourage students to form study groups for support and discussion.

- Utilize online platforms and forums for students to connect and share ideas.

- Create a positive and inclusive classroom environment that fosters collaboration.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Finance Teacher.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Finance Teacher‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Finance Teachers are responsible for providing instruction in financial literacy and related subjects. They may also be responsible for developing and implementing curriculum, grading students, and advising students on financial matters.

1. Teach financial literacy concepts

Finance Teachers must be able to effectively teach financial literacy concepts to students of all ages and backgrounds. This includes teaching students about budgeting, saving, investing, and managing debt.

- Develop and implement lesson plans that align with state and national standards.

- Use a variety of teaching methods to engage students, such as lectures, discussions, and group projects.

- Assess student learning through tests, quizzes, and other assignments.

2. Develop and implement curriculum

Finance Teachers may be responsible for developing and implementing curriculum for their courses. This includes selecting textbooks and other materials, and developing lesson plans and activities.

- Research and identify appropriate textbooks and other materials.

- Develop lesson plans that are aligned with state and national standards.

- Incorporate hands-on activities and projects into the curriculum.

3. Grade students

Finance Teachers are responsible for grading students’ work. This includes assessing students’ knowledge and skills through tests, quizzes, and other assignments.

- Develop grading rubrics that are aligned with state and national standards.

- Provide timely and constructive feedback to students on their work.

- Maintain accurate and up-to-date grade records.

4. Advise students on financial matters

Finance Teachers may also be responsible for advising students on financial matters. This includes helping students develop financial plans, manage their debt, and save for the future.

- Meet with students individually to discuss their financial goals.

- Develop and implement financial literacy workshops and programs.

- Provide resources and referrals to students who need additional financial assistance.

Interview Tips

Preparing for an interview can be a daunting task, but with the right tips and tricks, you can ace your interview and land your dream job.

1. Research the company and the position

Before you go on an interview, it is important to do your research on the company and the position you are applying for. This will help you understand the company’s culture and values, and it will also help you prepare for the questions that you may be asked.

- Visit the company’s website and social media pages.

- Read articles and news stories about the company.

- Talk to people who work at the company.

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is important to practice your answers to these questions so that you can deliver them confidently and clearly.

- Make a list of common interview questions.

- Practice answering the questions out loud.

- Get feedback from a friend or family member.

3. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally and arrive on time for your interview. This shows the interviewer that you are serious about the position and that you respect their time.

- Choose clothing that is appropriate for the company culture.

- Make sure your clothes are clean and pressed.

- Arrive for your interview on time, or even a few minutes early.

4. Be yourself and be confident

The most important thing is to be yourself and be confident in your abilities. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. And remember, confidence is key! If you believe in yourself, the interviewer will too.

- Be honest and authentic in your answers.

- Maintain eye contact with the interviewer.

- Speak clearly and confidently.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Finance Teacher interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.