Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Accountant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

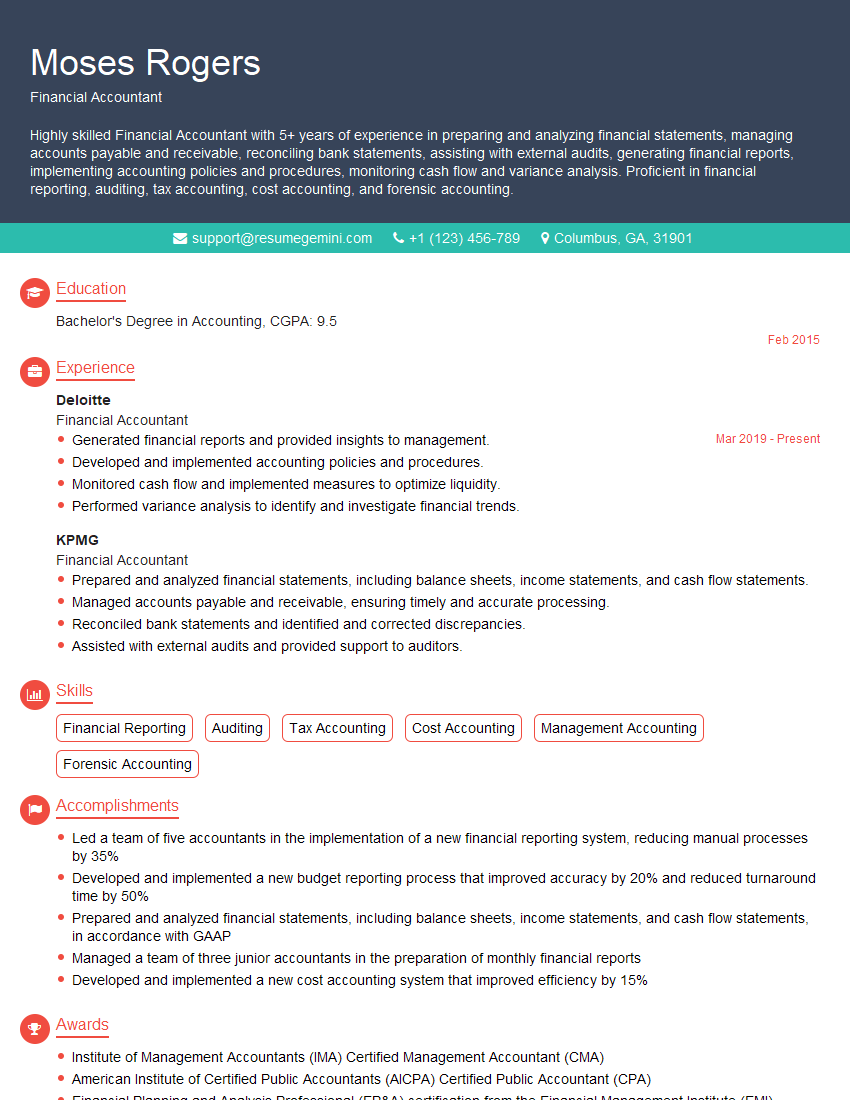

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Accountant

1. Explain the concept of accrual accounting and how it differs from cash accounting.

- Accrual accounting follows the matching principle, recognizing revenue when earned and expenses when incurred, regardless of cash flow.

- Cash accounting only recognizes transactions when cash is received or paid.

- Accrual accounting provides a more accurate picture of a company’s financial performance, while cash accounting focuses on cash flow.

2. Describe the process of preparing a balance sheet.

- Gather trial balance and adjust entries to update account balances.

- Classify accounts into assets, liabilities, equity, revenue, and expenses.

- Group accounts under appropriate headings and subtotals.

- Ensure that the balance sheet balances, meaning total assets equal total liabilities and equity.

3. Explain the concept of depreciation and how it is calculated.

- Depreciation allocates the cost of a long-term asset over its useful life.

- It reduces the asset’s book value and creates a depreciation expense.

- Common depreciation methods include straight-line, double-declining balance, and sum-of-the-years’ digits.

4. Describe the process of preparing a cash flow statement.

- Reconcile net income to cash flow from operating activities using the indirect method.

- Classify cash flows into operating, investing, and financing activities.

- Summarize cash inflows and outflows for each category.

- Report ending cash and cash equivalents.

5. Explain the concept of internal controls.

- Internal controls protect an organization’s assets, ensure reliable financial reporting, and promote operational efficiency.

- Key elements include segregation of duties, authorization of transactions, documentation, physical safeguards, and independent verification.

- Internal controls help prevent fraud and errors, maintaining the integrity of financial records.

6. Describe the process of preparing a trial balance.

- Extract account balances from the general ledger.

- Group balances by account type: assets, liabilities, equity, revenue, and expenses.

- List accounts in a standard order.

- Debit balances should equal credit balances, ensuring the trial balance is balanced.

7. Explain the difference between a debit and a credit.

- Debits increase asset, expense, and loss accounts; they decrease liability, equity, and revenue accounts.

- Credits increase liability, equity, and revenue accounts; they decrease asset, expense, and loss accounts.

- The accounting equation (Assets = Liabilities + Equity) must always be in balance.

8. Describe the process of recording a journal entry.

- Identify accounts affected and specify their debit/credit amounts.

- Prepare a journal entry with the date, description, account names, debit amounts, and credit amounts.

- Post the journal entries to the general ledger, updating account balances.

- Ensure that the journal entry is accurate and complete.

9. Explain the concept of Generally Accepted Accounting Principles (GAAP).

- GAAP are accounting standards and guidelines used to ensure consistency in financial reporting.

- They provide a framework for recording, summarizing, and reporting financial information.

- Adhering to GAAP enhances the reliability and comparability of financial statements.

10. Discuss the importance of financial ratios in financial analysis.

- Financial ratios provide insights into a company’s financial performance and health.

- They can measure liquidity, profitability, solvency, and efficiency.

- Analyzing financial ratios can help identify strengths, weaknesses, and areas for improvement.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Accountants play a critical role in the financial well-being of an organization. Their responsibilities encompass a wide range of tasks related to accounting, reporting, and analysis.

1. Preparing Financial Statements

Financial Accountants are responsible for compiling, analyzing, and presenting financial statements, such as balance sheets, income statements, and cash flow statements. These statements provide a comprehensive overview of a company’s financial position and performance.

2. Maintaining Accounting Records

Accurate accounting records are the foundation of financial reporting. Financial Accountants maintain detailed records of all financial transactions, ensuring that they are properly classified, recorded, and reconciled.

3. Analyzing Financial Data

Financial Accountants analyze financial data to identify trends, patterns, and areas for improvement. They use their analytical skills to assess the company’s financial health, make recommendations, and support decision-making.

4. Complying with Regulations

Financial Accountants are responsible for ensuring that the company’s financial practices comply with all applicable laws and regulations. This includes adhering to accounting standards, filing taxes accurately, and maintaining accurate financial records.

5. Internal Controls and Audits

Financial Accountants participate in the development and implementation of internal controls to prevent fraud and ensure the accuracy of financial data. They may also assist with internal audits to assess the effectiveness of internal controls and identify areas for improvement.

6. Budgeting and Forecasting

Financial Accountants assist in preparing budgets and forecasts to guide financial planning and decision-making. They analyze past financial data and industry trends to make informed projections about future financial performance.

7. Tax Preparation and Reporting

Financial Accountants may be responsible for preparing and filing tax returns for the company. They ensure that taxes are calculated correctly and filed timely.

Interview Tips

Interviewing for a Financial Accountant position requires thorough preparation and effective communication skills. Here are some tips to help you ace the interview:

1. Research the Company and Position

Before the interview, take the time to research the company and the specific Financial Accountant position you are applying for. This will help you understand the company’s industry, business model, and financial reporting requirements.

2. Practice Your Answers

Anticipate common interview questions related to financial accounting, such as your understanding of GAAP, experience with accounting software, and your analytical skills. Practice your answers to these questions to ensure you can convey your knowledge and experience clearly and concisely.

3. Quantify Your Achievements

When describing your past experiences, be specific and quantify your achievements whenever possible. For example, instead of saying “I was responsible for financial reporting,” say “I prepared monthly financial statements that improved financial visibility by 25%.”

4. Highlight Your Analytical Skills

Financial Accountants are expected to have strong analytical skills. Showcase your ability to analyze financial data, identify trends, and make sound judgments by providing concrete examples from your previous experience.

5. Demonstrate Your Attention to Detail

Attention to detail is crucial in financial accounting. Highlight your ability to perform accurate and meticulous work. Share examples where you caught errors or discrepancies in financial data and took corrective action.

6. Be Prepared to Discuss Technical Skills

You will likely be asked about your proficiency in accounting software and specific accounting methodologies. Review the job description carefully to identify the required technical skills and be prepared to discuss your experience and expertise.

7. Ask Thoughtful Questions

At the end of the interview, take the opportunity to ask thoughtful questions to demonstrate your interest and engagement. This shows the interviewer that you are genuinely interested in the position and the company.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Accountant interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!