Are you gearing up for an interview for a Financial Administrator position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Financial Administrator and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

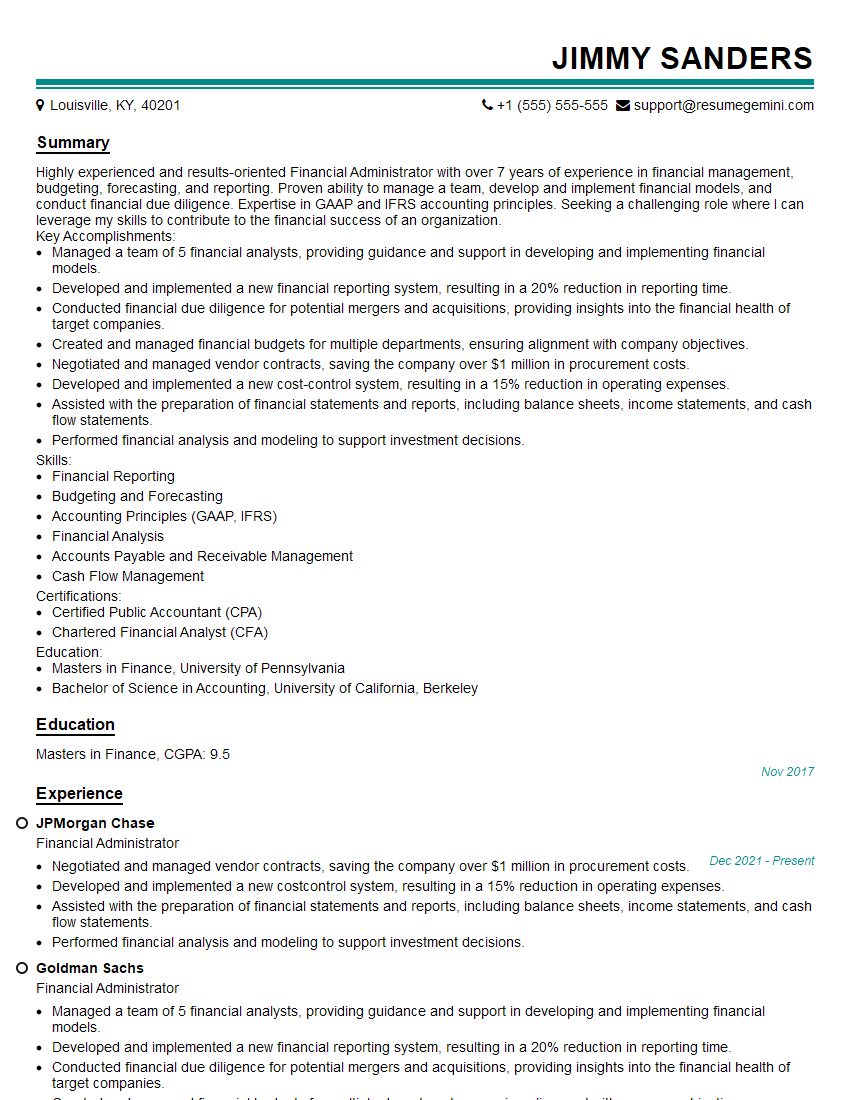

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Administrator

1. What accounting software are you proficient in?

- I am proficient in a variety of accounting software, including QuickBooks, NetSuite, SAP, and Oracle NetSuite.

- I have experience using these software programs to perform a variety of accounting tasks, including financial reporting, budgeting, and forecasting.

2. What are your strengths and weaknesses as a Financial Administrator?

Strengths

- I am a highly organized and detail-oriented individual with a strong understanding of accounting principles.

- I am also a team player with excellent communication and interpersonal skills.

Weaknesses

- I do not have any experience with the specific accounting software that you use.

- I am also new to the financial industry and do not have extensive experience in all areas of financial administration.

- However, I am a quick learner and I am confident that I can quickly gain the knowledge and skills necessary to be successful in this role.

3. What are your experiences in preparing financial statements?

- In my previous role, I was responsible for preparing a variety of financial statements, including balance sheets, income statements, and cash flow statements.

- I also have experience preparing financial reports for external auditors and regulatory agencies.

4. What is your understanding of GAAP and IFRS?

- GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) are two sets of accounting standards that are used to prepare financial statements.

- GAAP is the set of accounting standards that are used in the United States, while IFRS is the set of accounting standards that are used in most other countries.

5. What are your experiences in budgeting and forecasting?

- In my previous role, I was responsible for developing and maintaining the company’s budget.

- I also have experience in forecasting financial performance and preparing financial projections.

6. What are your experiences in managing accounts payable and accounts receivable?

- In my previous role, I was responsible for managing the company’s accounts payable and accounts receivable.

- This involved processing invoices, making payments, and collecting payments from customers.

7. What are your experiences in internal controls?

- In my previous role, I was responsible for developing and implementing internal controls to ensure the accuracy and reliability of financial reporting.

- This involved establishing policies and procedures, and monitoring compliance with those policies and procedures.

8. What are your experiences in financial analysis?

- In my previous role, I was responsible for conducting financial analysis to support decision-making.

- This involved analyzing financial data, identifying trends, and making recommendations.

9. What are your experiences in treasury management?

- In my previous role, I was responsible for managing the company’s treasury function.

- This involved investing surplus cash, managing debt, and managing foreign exchange risk.

10. What are your experiences in risk management?

- In my previous role, I was responsible for developing and implementing risk management policies and procedures.

- This involved identifying risks, assessing risks, and mitigating risks.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Administrator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Administrator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Administrators are responsible for managing the day-to-day financial operations of an organization. They ensure the accuracy and reliability of financial records, and they prepare and analyze financial statements and reports. They also work with other departments to develop and implement financial policies and procedures.

1. Managing Accounts Payable and Accounts Receivable

Financial Administrators manage accounts payable and accounts receivable, including processing invoices, payments, and receipts. They also reconcile bank statements and maintain general ledger accounts.

- Process invoices for payment.

- Maintain accounts payable and accounts receivable ledgers.

- Reconcile bank statements.

2. Preparing and Analyzing Financial Statements

Financial Administrators prepare and analyze financial statements, including balance sheets, income statements, and cash flow statements. They also prepare financial reports and present them to management.

- Prepare balance sheets, income statements, and cash flow statements.

- Analyze financial statements to identify trends and patterns.

- Prepare financial reports and present them to management.

3. Developing and Implementing Financial Policies and Procedures

Financial Administrators work with other departments to develop and implement financial policies and procedures. They also ensure that the organization is in compliance with all applicable financial regulations.

- Develop and implement financial policies and procedures.

- Ensure that the organization is in compliance with all applicable financial regulations.

4. Budgeting and Forecasting

Financial Administrators develop and manage budgets and forecasts. They also track actual results against budgets and forecasts and make adjustments as needed.

- Develop and manage budgets.

- Track actual results against budgets and forecasts.

- Make adjustments to budgets and forecasts as needed.

Interview Tips

Preparing for a Financial Administrator interview can be daunting, but there are a few key tips that can help you ace the interview and land the job.

1. Research the Company

Before you go on an interview, take some time to research the company. This will help you understand the company’s culture, values, and financial situation. You can also use this information to tailor your answers to the interviewer’s questions.

- Visit the company’s website.

- Read recent news articles about the company.

- Talk to people who work at the company.

2. Practice Answering Common Interview Questions

There are a few common interview questions that you are likely to be asked in a Financial Administrator interview. Practice answering these questions in advance so that you can deliver your answers confidently and concisely.

- Tell me about your experience in financial management.

- What are your strengths and weaknesses as a Financial Administrator?

- Why are you interested in working for this company?

3. Be Prepared to Talk About Your Skills and Experience

The interviewer will want to know about your skills and experience in financial management. Be prepared to talk about your experience in:

- Managing accounts payable and accounts receivable.

- Preparing and analyzing financial statements.

- Developing and implementing financial policies and procedures.

- Budgeting and forecasting.

4. Ask Questions

At the end of the interview, the interviewer will likely ask if you have any questions. This is your opportunity to learn more about the company and the position. Ask questions about the company’s culture, the financial team, and the position’s responsibilities.

- What is the company’s culture like?

- Who would I be reporting to?

- What are the key challenges facing the financial team?

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Administrator interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!