Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Agent position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

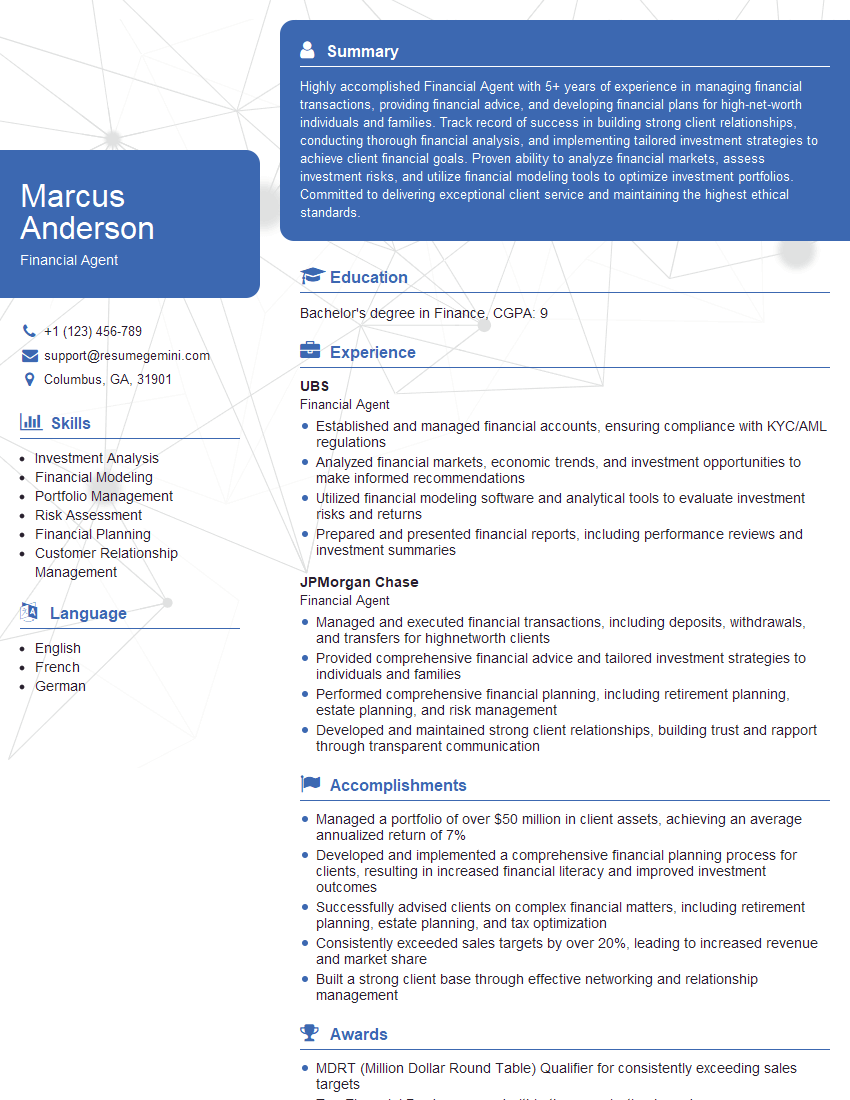

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Agent

1. Describe the process of underwriting a loan application for a residential mortgage?

The process of underwriting a loan application for a residential mortgage involves several key steps:

- Loan Origination: The process begins with the loan officer collecting the applicant’s financial information and submitting it to the lender.

- Credit Analysis: The lender reviews the applicant’s credit history, including credit scores, credit utilization, and payment history.

- Income Verification: The lender verifies the applicant’s income and employment status through pay stubs, W-2 forms, and tax returns.

- Asset Verification: The lender verifies the applicant’s assets, such as bank accounts, investments, and real estate holdings.

- Property Appraisal: The lender orders an appraisal of the property to determine its value and ensure that it is sufficient collateral for the loan.

- Debt-to-Income ratio (DTI) Calculation: The lender calculates the applicant’s DTI ratio to assess their ability to repay the loan.

- Underwriting Decision: Based on the analysis of the applicant’s financial information and the property appraisal, the lender makes a decision on whether to approve or deny the loan application.

2. What are the key factors that determine the interest rate on a mortgage loan?

Factors internal to the borrower:

- Credit score

- Debt-to-income ratio

- Loan-to-value ratio

- Loan term

Factors external to the borrower:

- Economic conditions

- Federal Reserve interest rates

- Mortgage market conditions

- Lender’s policies and risk appetite

3. Explain the difference between a fixed-rate mortgage and an adjustable-rate mortgage (ARM)?

- Fixed-Rate Mortgage: The interest rate remains constant throughout the loan term, providing stability and predictability in monthly payments.

- Adjustable-Rate Mortgage: The interest rate fluctuates periodically based on an index, such as the Secured Overnight Financing Rate (SOFR), leading to potential changes in monthly payments.

- Pros of Fixed-Rate Mortgage: Predictability, stability, peace of mind

- Cons of Fixed-Rate Mortgage: Higher initial interest rates

- Pros of ARM: Potentially lower initial interest rates, flexibility

- Cons of ARM: Interest rate risk, potential for higher monthly payments

4. What are the different types of mortgage products available and how do they differ?

- Conventional Loans: Conforms to Fannie Mae or Freddie Mac guidelines, typically require a higher credit score and lower DTI, offer lower interest rates.

- Government-Insured Loans: Backed by the Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), and the United States Department of Agriculture (USDA), these loans may have more flexible credit and DTI requirements but may come with additional fees and mortgage insurance.

- Jumbo Loans: Exceed the conforming loan limits set by Fannie Mae and Freddie Mac, typically require higher credit scores, lower DTIs, and may have higher interest rates.

- Interest-Only Loans: Borrowers pay only the interest portion of the loan for a specified period, which can lead to lower initial monthly payments but higher overall interest costs.

- Balloon Loans: Offer lower payments for a specific period, after which a large lump sum payment (balloon payment) is due.

5. Describe the role of a financial agent in the mortgage process?

- Loan Origination: Assist clients with pre-approval, loan application, and document collection.

- Client Education: Provide clear and comprehensive information about different mortgage options and the loan process.

- Negotiation and Advocacy: Negotiate with lenders on behalf of clients to secure the best possible loan terms and conditions.

- Loan Closing Coordination: Ensure a smooth closing process, reviewing loan documents, coordinating with the lender, title company, and other parties involved.

- Post-Closing Support: Provide ongoing support and guidance to clients after loan closing on matters related to mortgage payments, refinancing, or other financial planning needs.

6. How do you stay up-to-date with the latest changes in the mortgage industry?

- Industry Publications and Webinars: Regularly read industry news, magazines, and attend webinars to stay informed about market trends and regulatory updates.

- Continuing Education: Participate in continuing education courses, seminars, and workshops to enhance knowledge and stay abreast of industry best practices.

- Networking and Conferences: Attend industry conferences and networking events to connect with other professionals, share knowledge, and gain insights into the latest developments.

- Lender and Industry Updates: Stay informed through communication with lenders, loan originators, and other industry professionals to learn about new products, programs, and market conditions.

7. Discuss the ethical responsibilities of a financial agent?

- Confidentiality: Maintain the privacy of client information and protect sensitive financial data.

- Transparency and Disclosure: Provide clear and honest information about mortgage products and processes, avoiding misrepresentation or omission of material facts.

- Conflict of Interest Avoidance: Act in the best interests of clients and avoid situations where personal or financial gain could compromise professional judgment.

- Fiduciary Duty: Act with utmost care, diligence, and loyalty in fulfilling responsibilities to clients.

- Compliance with Laws and Regulations: Adhere to all applicable laws and industry regulations governing mortgage lending and financial advising.

8. Describe a challenging mortgage case that you handled and how you resolved it?

- Provide a brief overview of the case, including the client’s situation and the challenges faced

- Explain the steps you took to research and analyze the case

- Describe the creative solutions or strategies you implemented to overcome the challenges

- Discuss the outcome of the case and the impact it had on the client

9. How do you build and maintain strong relationships with clients?

- Effective Communication: Communicate clearly, promptly, and proactively to keep clients informed and address their concerns.

- Personalization: Tailor financial advice and recommendations to meet individual client needs and goals.

- Empathy and Understanding: Be empathetic to clients’ financial situations and show genuine care for their well-being.

- Trust and Transparency: Build trust by being honest and transparent in all interactions, avoiding conflicts of interest.

- Value-Added Services: Provide value beyond mortgage financing, such as financial planning, investment advice, and ongoing support.

10. How do you manage multiple clients and prioritize their needs?

- Strong Organizational Skills: Maintain organized records and utilize technology to track client information and appointments.

- Time Management: Prioritize tasks effectively to ensure timely responses to all clients and meet deadlines.

- Communication Management: Use communication tools to stay connected with clients and manage expectations, setting clear boundaries for availability.

- Delegation and Collaboration: When necessary, delegate tasks or collaborate with colleagues to ensure efficient service delivery.

- Client Segmentation: Categorize clients based on their needs and priorities to tailor communication and support accordingly.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Agents are responsible for a variety of tasks that help companies raise capital and manage their finances. These tasks can vary depending on the industry and the size of the company, but some of the most common responsibilities include:

1. Raising Capital

Financial Agents help companies raise capital by selling securities such as stocks and bonds. They work with companies to determine the best way to raise capital, and they then help to market and sell the securities to investors.

- Develop and implement capital raising strategies.

- Manage relationships with investors.

2. Managing Investments

Financial Agents help companies manage their investments by providing advice and guidance. They help companies to develop investment strategies, and they monitor the performance of investments.

- Develop and implement investment strategies.

- Monitor the performance of investments.

3. Providing Financial Advice

Financial Agents provide financial advice to companies on a variety of topics, such as mergers and acquisitions, capital structure, and risk management.

- Provide financial advice on mergers and acquisitions.

- Advise on capital structure and risk management.

4. Other Responsibilities

In addition to the above responsibilities, Financial Agents may also perform a variety of other tasks, such as:

- Conducting financial due diligence.

- Preparing financial reports.

Interview Tips

To ace the interview for a Financial Agent position, it is important to be prepared to answer questions about your experience and qualifications. Here are a few tips to help you prepare:

1. Research the Company

Before the interview, take some time to research the company. This will help you to understand the company’s business, its financial situation, and its culture. You can find information about the company on its website, in news articles, and in financial reports.

2. Practice Answering Common Interview Questions

There are a number of common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. It is helpful to practice answering these questions in advance so that you can deliver your answers confidently and concisely.

3. Be Prepared to Discuss Your Experience

The interviewer will likely ask you about your experience in the financial industry. Be prepared to discuss your experience in detail, including the specific tasks that you have performed and the results that you have achieved.

4. Be Professional and Enthusiastic

It is important to be professional and enthusiastic throughout the interview. This will help you to make a good impression on the interviewer and to show that you are serious about the position.

5. Follow Up

After the interview, send a thank-you note to the interviewer. This is a good way to reiterate your interest in the position and to thank the interviewer for their time.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Financial Agent, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Financial Agent positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.