Are you gearing up for a career in Financial Aid Counselor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Financial Aid Counselor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

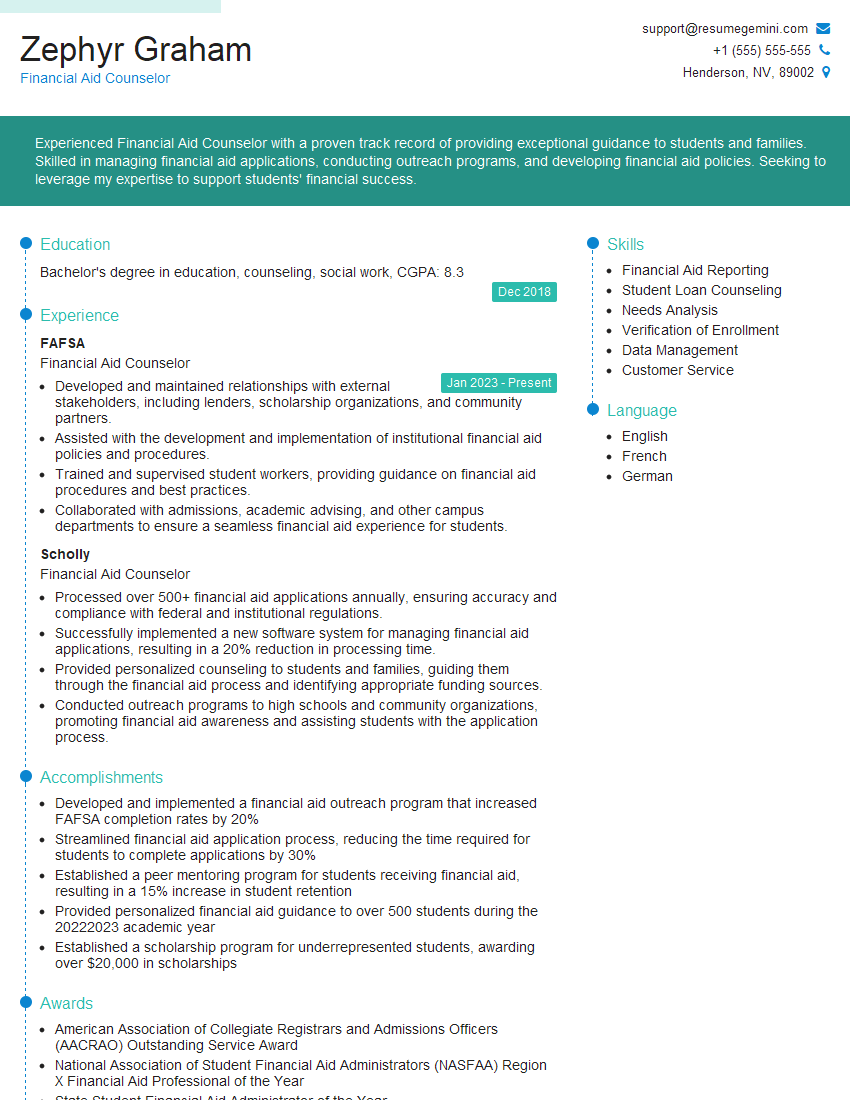

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Aid Counselor

1. Explain the process of calculating a student’s financial need?

To calculate a student’s financial need, I first determine their cost of attendance, which includes tuition and fees, room and board, books and supplies, and transportation. Then, I subtract the student’s expected family contribution (EFC) from their cost of attendance. The EFC is a measure of how much the student’s family is expected to contribute to their education. The difference between the cost of attendance and the EFC is the student’s financial need.

2. What are the different types of financial aid available to students?

Grants

- Pell Grants: These are federal grants that are awarded to low-income students.

- SEOG Grants: These are federal grants that are awarded to low-income students who demonstrate exceptional financial need.

- State Grants: These are grants that are awarded by individual states to students who meet certain criteria.

Scholarships

- Academic Scholarships: These are scholarships that are awarded to students who have a strong academic record.

- Athletic Scholarships: These are scholarships that are awarded to students who participate in varsity sports.

- Private Scholarships: These are scholarships that are awarded by private organizations to students who meet certain criteria.

Loans

- Federal Direct Loans: These are loans that are made by the federal government to students.

- Private Loans: These are loans that are made by private lenders to students.

Work-Study

- Federal Work-Study: This is a program that provides part-time employment to students who demonstrate financial need.

3. What are the different factors that can affect a student’s financial aid eligibility?

- Cost of attendance: The cost of attendance at the student’s school can affect their financial aid eligibility.

- Expected family contribution: The student’s EFC can affect their financial aid eligibility.

- Income and assets: The income and assets of the student and their family can affect their financial aid eligibility.

- Enrollment status: The student’s enrollment status (full-time, part-time, etc.) can affect their financial aid eligibility.

- Citizenship status: The student’s citizenship status can affect their financial aid eligibility.

4. What are the consequences of not meeting the financial aid deadlines?

If a student does not meet the financial aid deadlines, they may not be eligible for certain types of financial aid. For example, if a student does not meet the FAFSA deadline, they may not be eligible for federal Pell Grants. Additionally, students who do not meet the financial aid deadlines may have to pay a late fee or may have to submit additional documentation.

5. How can you help a student who is struggling to afford college?

- Explore financial aid options: I can help the student explore all of the financial aid options that are available to them, including grants, scholarships, loans, and work-study.

- Create a budget: I can help the student create a budget that will help them to track their income and expenses and to make informed decisions about how to spend their money.

- Connect with resources: I can connect the student with resources on campus and in the community that can help them to afford college.

6. What is your favorite part of working as a financial aid counselor?

My favorite part of working as a financial aid counselor is helping students to achieve their educational goals. I enjoy working with students to find the financial aid that they need to pay for college. I also enjoy helping students to understand their financial aid options and to make informed decisions about how to pay for college.

7. What is your least favorite part of working as a financial aid counselor?

My least favorite part of working as a financial aid counselor is seeing students who are struggling to afford college. I wish that there were more financial aid available to help students to pay for college. I also wish that there were more resources available to help students to understand their financial aid options.

8. What are your strengths as a financial aid counselor?

- I am a strong communicator. I am able to explain complex financial aid information to students in a way that is easy to understand.

- I am a good listener. I am able to build rapport with students and to understand their financial aid needs.

- I am a problem solver. I am able to help students to find solutions to their financial aid challenges.

9. What are your weaknesses as a financial aid counselor?

- I am sometimes too detail-oriented. I can get bogged down in the details of a student’s financial aid application and miss the big picture.

- I am sometimes too trusting. I can be hesitant to question a student’s financial aid information, even if I have reason to believe that it is inaccurate.

10. What are your career goals as a financial aid counselor?

My career goal is to become a financial aid director. I would like to continue to help students to achieve their educational goals by providing them with the financial assistance that they need. I would also like to work to improve the financial aid system so that it is more accessible and affordable for all students.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Aid Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Aid Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Aid Counselors play a vital role in assisting students and their families in navigating the financial aid process. Key responsibilities include:

1. Providing Financial Aid Advice and Guidance

Counselors offer guidance and information on financial aid options, including scholarships, grants, loans, and work-study programs. They explain eligibility criteria, application procedures, and deadlines, helping students understand and choose the most suitable options.

2. Evaluating Financial Aid Applications

They review and evaluate financial aid applications, ensuring accuracy and completeness. Counselors assess students’ financial need, eligibility for various aid programs, and determine appropriate award amounts.

3. Processing and Disbursing Financial Aid

Counselors process and disburse financial aid awards to students according to established deadlines and procedures. They work with students to resolve any issues or discrepancies in the disbursement process.

4. Educating Students and Families

Counselors provide education and outreach to students and families about financial aid policies, procedures, and resources. They conduct workshops, presentations, and individual counseling sessions to ensure students understand their financial aid options and obligations.

5. Maintaining Confidentiality and Compliance

Counselors maintain the confidentiality of student financial information and adhere to all applicable laws, regulations, and ethical guidelines.

Interview Tips

To prepare for a Financial Aid Counselor interview, consider the following tips:

1. Research the Institution and Position

Familiarize yourself with the institution’s mission, values, and financial aid policies. Understand the specific responsibilities of the Financial Aid Counselor role within the institution’s context.

2. Highlight Your Skills and Experience

Emphasize your knowledge of financial aid regulations, your ability to interpret complex financial data, and your skills in advising and counseling students.

3. Demonstrate Your Passion for Helping Students

Show the interviewer your commitment to helping students achieve their educational goals through financial aid. Provide examples of your experience working with students from diverse backgrounds and financial situations.

4. Prepare for Common Interview Questions

- Tell me about your experience advising students on financial aid.

- How do you handle complex financial aid situations?

- What are your strategies for educating students and families about financial aid?

- How do you stay updated on changes in financial aid regulations?

- Why are you interested in working as a Financial Aid Counselor at this institution?

5. Prepare Questions for the Interviewer

Ask thoughtful questions that demonstrate your interest in the position and the institution. This shows the interviewer that you are engaged and genuinely interested in the opportunity.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Aid Counselor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!