Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Financial Assistance Advisor interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Financial Assistance Advisor so you can tailor your answers to impress potential employers.

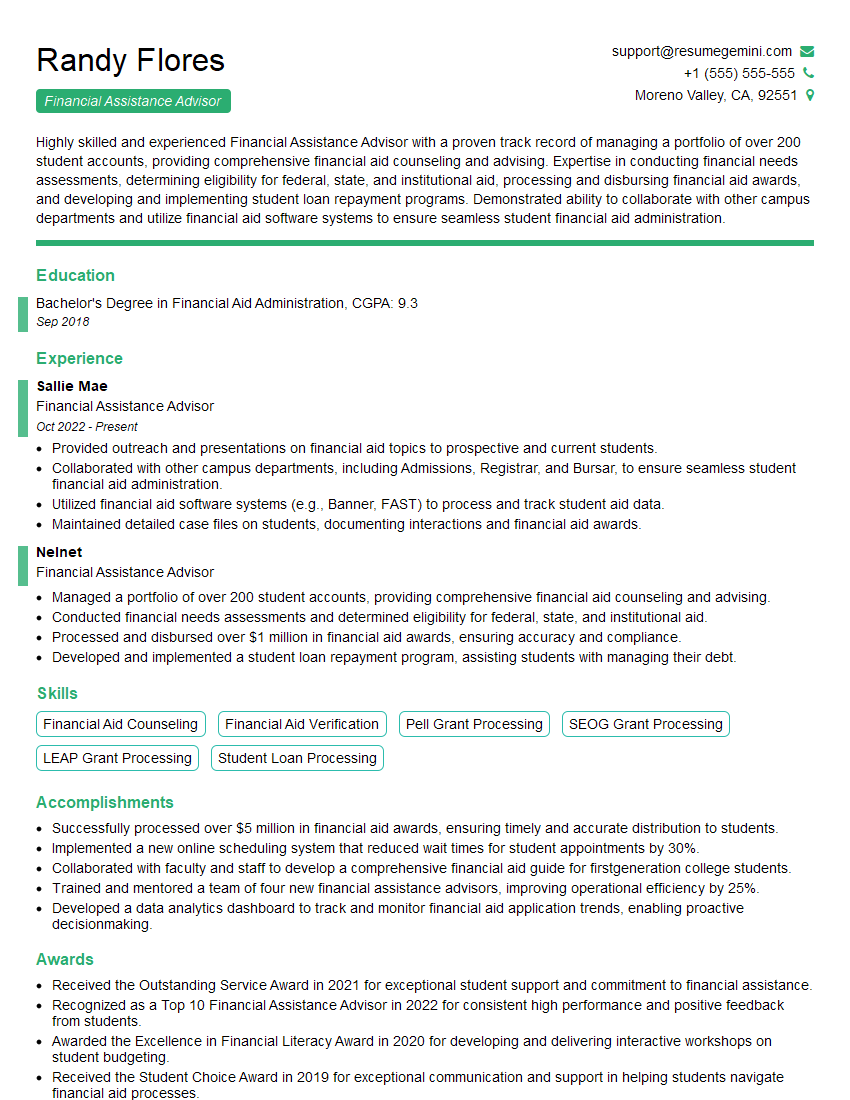

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Assistance Advisor

1. Explain the process of determining a student’s financial aid eligibility?

The process of determining a student’s financial aid eligibility typically involves the following steps:

- Completing the Free Application for Federal Student Aid (FAFSA) or the California Dream Act Application (CADAA)

- The FAFSA or CADAA collects information about the student’s and their family’s income, assets, and expenses

- The U.S. Department of Education uses this information to calculate the student’s Expected Family Contribution (EFC)

- The EFC is the amount of money that the student and their family are expected to contribute towards the cost of college

- The cost of attendance (COA) minus the EFC equals the student’s financial need

- The financial need is used to determine the student’s eligibility for federal, state, and institutional financial aid programs

2. What are the major types of financial aid available to students?

Federal Grants

- Pell Grants

- Federal Supplemental Educational Opportunity Grants (FSEOG)

- Teacher Education Assistance for College and Higher Education (TEACH) Grants

Federal Loans

- Subsidized Stafford Loans

- Unsubsidized Stafford Loans

- PLUS Loans

Federal Work-Study (FWS)

State Grants

- Cal Grant A

- Cal Grant B

- Chafee Grant for Foster Youth

Institutional Scholarships and Grants

Private Scholarships and Grants

3. What are the differences between grants, loans, and work-study?

Grants are free money that does not have to be repaid. Loans are borrowed money that must be repaid with interest. Work-study is a program that allows students to work part-time to earn money to help pay for college.

4. What are the qualifications for receiving financial aid?

The qualifications for receiving financial aid vary depending on the type of aid. However, most financial aid programs require students to:

- Be a U.S. citizen or eligible non-citizen

- Have a valid Social Security number

- Be enrolled in an eligible degree or certificate program

- Maintain satisfactory academic progress

- Meet the income and asset requirements

5. What are the deadlines for applying for financial aid?

The deadlines for applying for financial aid vary depending on the type of aid. However, most financial aid programs require students to apply by March 2nd. It is important to apply for financial aid as early as possible to ensure that you receive the maximum amount of aid for which you are eligible.

6. What are the consequences of not completing the FAFSA or CADAA?

Students who do not complete the FAFSA or CADAA may not be eligible for any federal or state financial aid. In addition, some colleges and universities may require students to complete the FAFSA or CADAA in order to be eligible for institutional financial aid.

7. What are the different types of scholarships available to students?

There are many different types of scholarships available to students, including:

- Academic scholarships

- Athletic scholarships

- Need-based scholarships

- Minority scholarships

- First-generation scholarships

- Transfer scholarships

8. What are the benefits of receiving financial aid?

Receiving financial aid can make it possible for students to attend college who otherwise would not be able to afford it. Financial aid can also help students to reduce their student loan debt and to graduate on time.

9. What are the challenges of working as a financial aid advisor?

Working as a financial aid advisor can be challenging because you often have to deal with students who are facing difficult financial situations. You also have to be able to keep up with the ever-changing financial aid regulations.

10. What are the rewards of working as a financial aid advisor?

Working as a financial aid advisor can be rewarding because you can make a real difference in the lives of students. You can help them to achieve their educational goals and to succeed in college.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Assistance Advisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Assistance Advisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Assistance Advisors are responsible for providing guidance and assistance to individuals and families in need of financial aid. They assess financial situations, determine eligibility for various programs, and provide information on available resources. Key job responsibilities include:

1. Eligibility Determination

Assess financial situations and determine eligibility for assistance programs based on income, expenses, and other factors.

- Review financial documents, such as pay stubs, bank statements, and tax returns.

- Interview clients to gather information on their financial status and household circumstances.

2. Program Selection

Identify and recommend appropriate assistance programs that meet the needs of clients.

- Research and stay informed about various assistance programs, including government benefits, non-profit organizations, and community resources.

- Provide information on program requirements, eligibility criteria, and application procedures.

3. Application Assistance

Assist clients with completing and submitting applications for financial assistance.

- Provide guidance on required documentation and help clients gather necessary information.

- Review applications for completeness and accuracy before submission.

4. Case Management

Monitor and track client cases, providing ongoing assistance and support.

- Stay in contact with clients to track their progress and address any issues that may arise.

- Educate clients on financial management and budgeting techniques.

5. Community Outreach

Participate in community outreach programs to increase awareness of financial assistance resources.

- Attend community events and presentations to provide information on available programs.

- Collaborate with other organizations and agencies to promote financial assistance services.

Interview Tips

Preparing thoroughly for a Financial Assistance Advisor interview is crucial to making a positive impression. Here are some tips to help candidates ace the interview:

1. Research the Organization

Familiarize yourself with the organization’s mission, values, and the specific financial assistance programs they offer. This will demonstrate your understanding of their work and your interest in the role.

2. Highlight Relevant Skills and Experience

Emphasize your experience in assessing financial situations, determining eligibility for assistance programs, and providing guidance to clients. Share examples that showcase your ability to analyze financial data, communicate complex information effectively, and build rapport with people from diverse backgrounds.

3. Prepare for Common Interview Questions

Research common interview questions for financial assistance advisors. Practice answering questions related to your experience, qualifications, and understanding of the industry. Consider using the STAR method (Situation, Task, Action, Result) to structure your responses.

4. Be Prepared to Discuss Your Knowledge of Financial Assistance Programs

Demonstrate your knowledge of different financial assistance programs, eligibility requirements, and application procedures. This will show the interviewer that you are well-informed and up-to-date on the field.

5. Emphasize Your Compassion and Empathy

Financial assistance advisors play a vital role in helping individuals and families in need. Highlight your compassion, empathy, and understanding of the challenges faced by low-income populations. Share examples of how you have provided support and guidance to clients in a sensitive and respectful manner.

6. Ask Thoughtful Questions

Asking thoughtful questions at the end of the interview shows your engagement and interest in the role. Prepare questions related to the organization’s approach to providing financial assistance, their plans for future program development, or any specific challenges they are facing.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Financial Assistance Advisor role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.