Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Assistance Specialist position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

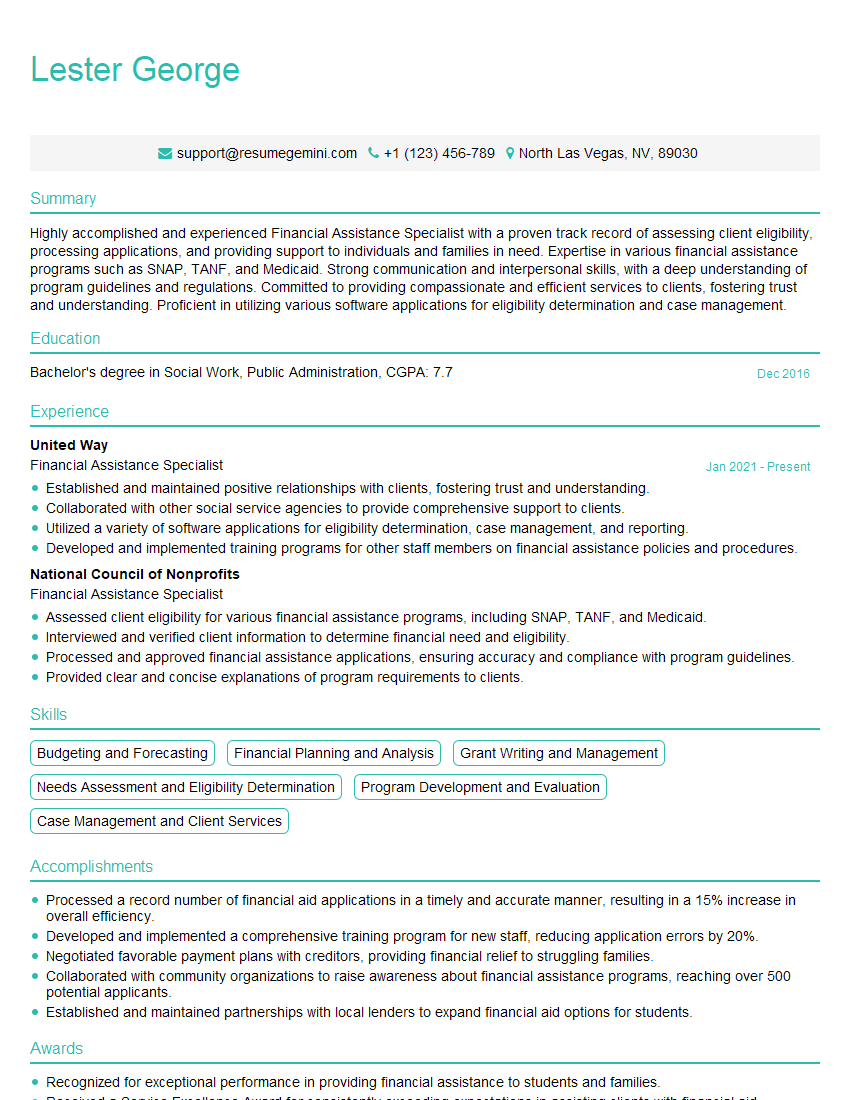

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Assistance Specialist

1. What are the different types of financial assistance programs available?

- Needs-based grants, such as the Pell Grant and the Federal Supplemental Educational Opportunity Grant (FSEOG)

- Merit-based scholarships, such as the National Merit Scholarship and the Gates Millennium Scholarship

- Loans, such as the Federal Direct Student Loan and the Federal Parent PLUS Loan

- Work-study programs, such as the Federal Work-Study Program

2. What are the eligibility requirements for each type of financial assistance program?

Needs-based grants

- Must be a U.S. citizen or eligible non-citizen

- Must be enrolled in an eligible degree or certificate program

- Must have financial need, as determined by the FAFSA

Merit-based scholarships

- Must meet the scholarship’s specific eligibility criteria, such as academic achievement, extracurricular activities, or financial need

Loans

- Must be a U.S. citizen or eligible non-citizen

- Must be enrolled in an eligible degree or certificate program

- Must have a good credit history

Work-study programs

- Must be a U.S. citizen or eligible non-citizen

- Must be enrolled in an eligible degree or certificate program

- Must have financial need, as determined by the FAFSA

3. What is the FAFSA and how does it work?

The Free Application for Federal Student Aid (FAFSA) is a form that students must complete in order to apply for federal financial aid. The FAFSA collects information about the student’s family income and assets, as well as their academic history. This information is used to determine the student’s eligibility for various types of financial assistance.

4. What are the different types of student loans and what are the interest rates?

- Federal Direct Student Loans

- Subsidized loans: These loans are available to students with financial need. The government pays the interest on these loans while the student is in school and during grace periods.

- Unsubsidized loans: These loans are available to all students. The student is responsible for paying the interest on these loans, even while in school and during grace periods.

- Federal Parent PLUS Loans: These loans are available to parents of dependent students. The parents are responsible for repaying these loans.

- Private student loans: These loans are available from banks and other private lenders. The interest rates on these loans are typically higher than the interest rates on federal student loans.

5. What are the repayment options for student loans?

- Standard repayment plan: This is the most common repayment plan. Payments are fixed and are made monthly over a period of 10 years.

- Graduated repayment plan: Payments start out low and gradually increase over time. This plan is good for borrowers who expect their income to increase in the future.

- Extended repayment plan: This plan is available to borrowers who cannot afford to make the monthly payments required under the standard or graduated repayment plans. Payments are lower and are made over a period of up to 25 years.

- Income-driven repayment plans: These plans base the monthly payments on the borrower’s income and family size. Payments can be as low as $0 per month.

6. What are the consequences of defaulting on a student loan?

- Damage to credit score

- Loss of eligibility for federal student aid

- Wage garnishment

- Tax refund offset

- Legal action

7. What are the different types of scholarships available and how do I apply for them?

- Academic scholarships: These scholarships are awarded to students with strong academic records.

- Athletic scholarships: These scholarships are awarded to students who excel in athletics.

- Arts scholarships: These scholarships are awarded to students who excel in the arts, such as music, dance, or theater.

- Diversity scholarships: These scholarships are awarded to students from underrepresented backgrounds.

- Need-based scholarships: These scholarships are awarded to students with financial need.

To apply for scholarships, students should start by searching for scholarships that they are eligible for. Once they have found a few scholarships, they should carefully read the application instructions and submit a complete application.

8. What are the different types of grants available and how do I apply for them?

- Federal Pell Grant: This grant is available to low-income undergraduate students.

- Federal Supplemental Educational Opportunity Grant (FSEOG): This grant is available to low-income undergraduate students who are enrolled in an eligible degree or certificate program.

- State grants: Many states offer grants to students who attend college in their state.

- Institutional grants: Many colleges and universities offer grants to their students.

To apply for grants, students should start by completing the FAFSA. The FAFSA will automatically consider students for federal and state grants. Students may also need to complete a separate application for institutional grants.

9. What are the different types of work-study programs available and how do I apply for them?

- Federal Work-Study Program: This program provides part-time jobs to undergraduate and graduate students who have financial need.

- Institutional work-study programs: Many colleges and universities offer work-study programs to their students.

To apply for work-study programs, students should start by completing the FAFSA. The FAFSA will automatically consider students for the Federal Work-Study Program. Students may also need to complete a separate application for institutional work-study programs.

10. What are the different types of student loan forgiveness programs available?

- Public Service Loan Forgiveness Program: This program forgives the remaining balance of federal student loans for borrowers who work in public service jobs for 10 years.

- Teacher Loan Forgiveness Program: This program forgives the remaining balance of federal student loans for teachers who work in low-income schools for 5 years.

- Perkins Loan Cancellation Program: This program cancels the remaining balance of Perkins Loans for borrowers who work in certain public service jobs.

To apply for student loan forgiveness programs, borrowers should contact their loan servicer. The loan servicer will provide borrowers with information about the eligibility requirements and application process.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Assistance Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Assistance Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Financial Assistance Specialist is responsible for providing financial assistance to individuals and families in need. They work with clients to determine their eligibility for assistance programs, complete applications, and provide guidance on managing their finances.

1. Determine Client Eligibility

Review applications and supporting documentation to determine client eligibility for various assistance programs, such as food stamps, Medicaid, and housing assistance.

- Conduct interviews with clients to gather information and assess their financial situation.

- Verify client information through contact with employers, banks, and other sources.

2. Complete Applications

Assist clients in completing complex application forms for assistance programs, ensuring accuracy and completeness.

- Provide guidance to clients on eligibility requirements and documentation needed.

- Review applications before submission to identify potential errors or omissions.

3. Provide Financial Education

Educate clients on financial management, budgeting, and debt reduction strategies.

- Develop and deliver workshops or individual counseling sessions on financial literacy.

- Provide resources and referrals to clients for additional financial assistance.

4. Maintain Case Records

Maintain accurate and up-to-date case records for each client, including application status, eligibility determinations, and financial assistance provided.

- Document all client interactions, including phone calls, meetings, and case notes.

- Keep records organized and easily accessible for review.

Interview Tips

Preparing thoroughly for your interview will significantly increase your chances of success. Here are some tips to help you ace your Financial Assistance Specialist interview:

1. Research the Organization and Position

Take the time to learn about the organization’s mission, values, and the specific role you are applying for. This will help you understand the organization’s culture and the qualities they are looking for in a candidate.

- Visit the organization’s website and read any available materials about their work.

- Research the industry and any relevant trends or issues.

2. Practice Answering Common Interview Questions

Anticipate potential interview questions and prepare your answers in advance. Common questions include:

- Tell me about your experience in financial assistance.

- How do you determine client eligibility for assistance programs?

- What is your approach to providing financial education to clients?

- How do you handle challenging or difficult clients?

3. Highlight Your Skills and Experience

Emphasize your relevant skills and experience during the interview. Quantify your accomplishments whenever possible to demonstrate the impact of your work.

- Provide specific examples of successful case management.

- Share your knowledge of financial assistance programs and eligibility requirements.

4. Be Enthusiastic and Personable

Financial Assistance Specialists work directly with clients who are often facing financial hardship. It is important to be empathetic, compassionate, and positive in your interactions. Show the interviewer that you are passionate about helping others and that you have a genuine desire to make a difference in their lives.

- Smile, make eye contact, and be friendly.

- Share stories or examples that demonstrate your compassion and understanding of client needs.

5. Follow Up After the Interview

Within 24 hours of the interview, send a thank-you note to the interviewer. This is an opportunity to reiterate your interest in the position and highlight any additional qualifications or experience that you may have forgotten to mention during the interview.

- Thank the interviewer for their time and consideration.

- Reiterate your key skills and experience.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Financial Assistance Specialist role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.