Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Auditor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

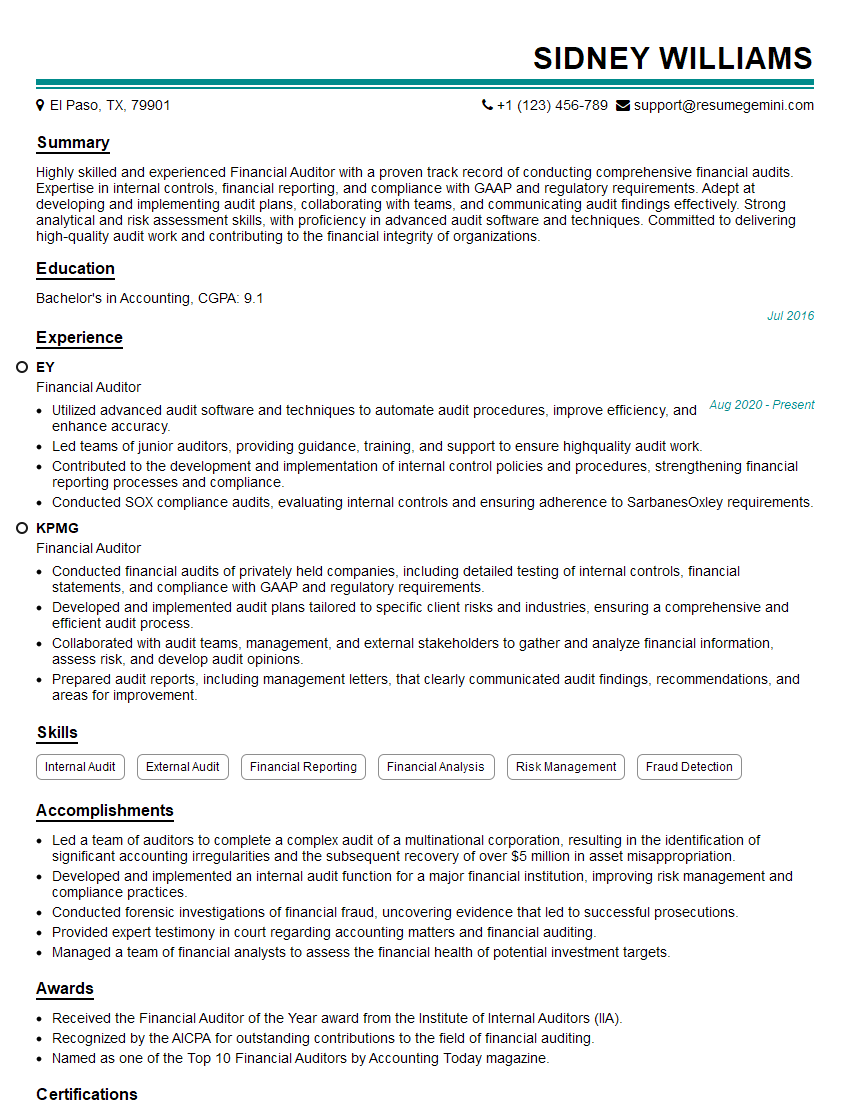

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Auditor

1. Explain the process of performing an audit on a company’s financial statements?

The process of performing an audit on a company’s financial statements involves the following steps:

- Planning: The auditor plans the audit by understanding the company’s business, industry, and financial reporting framework. The auditor also assesses the risks of material misstatement and develops an audit strategy.

- Risk assessment: The auditor assesses the risks of material misstatement by considering factors such as the company’s internal control system, the nature of the company’s business, and the results of previous audits. The auditor uses this information to identify areas where there is a higher risk of misstatement.

- Testing: The auditor tests the company’s internal control system and performs substantive procedures to obtain evidence about the accuracy and completeness of the financial statements. Substantive procedures may include analytical procedures, tests of details, and vouching.

- Evaluation: The auditor evaluates the results of the testing and forms an opinion on the fairness of the financial statements. The auditor also considers the effects of any misstatements on the financial statements.

- Reporting: The auditor issues an audit report that expresses the auditor’s opinion on the financial statements. The auditor may also make recommendations for improving the company’s internal control system or financial reporting practices.

2. Describe the different audit procedures used to verify the accuracy of a company’s cash balance?

- Bank reconciliation: The auditor reconciles the company’s bank statements to the cash balance in the financial statements. This helps to identify any discrepancies between the two.

- Confirmation: The auditor sends confirmation requests to the company’s banks to verify the cash balance.

- Inspection: The auditor inspects the company’s cash on hand to verify its existence.

- Cut-off testing: The auditor performs cut-off testing at the end of the accounting period to ensure that all transactions have been recorded in the correct period.

3. What are the key risks associated with auditing a company’s inventory?

- Inventory misstatement: The auditor is responsible for ensuring that the inventory is accurately valued and recorded in the financial statements. There are several risks that can lead to inventory misstatement, including theft, damage, and obsolescence.

- Internal control weaknesses: The auditor must assess the strength of the company’s internal control system to identify any weaknesses that could increase the risk of inventory misstatement. Weaknesses in internal control can make it easier for employees to steal inventory or manipulate the inventory records.

- Fraud: Fraud can also be a risk in auditing inventory. For example, employees may collude with vendors to inflate the value of inventory.

4. How do you assess the effectiveness of a company’s internal control system?

- Control environment: The auditor assesses the control environment by considering factors such as the company’s management philosophy and operating style, the company’s board of directors, and the company’s internal audit function.

- Risk assessment: The auditor assesses the company’s risk assessment process to identify how the company identifies, assesses, and responds to risks.

- Control activities: The auditor evaluates the company’s control activities to determine whether they are designed and implemented effectively. Control activities include policies and procedures that are designed to prevent, detect, and correct misstatements.

- Information and communication: The auditor assesses the company’s information and communication systems to determine whether they are effective in providing relevant and timely information to those who need it.

- Monitoring: The auditor assesses the company’s monitoring activities to determine whether they are effective in evaluating the effectiveness of the internal control system.

5. What are the most common accounting errors that you have encountered during your audits?

- Errors in recording transactions: These errors can include posting errors, errors in totaling, and errors in calculating balances.

- Errors in applying accounting principles: These errors can include errors in applying the accrual basis of accounting, errors in applying the matching principle, and errors in applying the going concern assumption.

- Misstatements in financial statements: These errors can include errors in the presentation of financial information, errors in the disclosure of financial information, and errors in the opinion expressed by the auditor.

6. What is your experience with using audit software?

I have experience using a variety of audit software, including ACL, IDEA, and CaseWare. I am proficient in using these software programs to perform audit procedures such as data analysis, sampling, and testing.

7. What are the ethical responsibilities of an auditor?

- Integrity: Auditors must be honest and ethical in all their dealings.

- Objectivity: Auditors must be independent and objective in their work.

- Professional competence and due care: Auditors must have the necessary knowledge, skills, and experience to perform their work competently.

- Confidentiality: Auditors must keep confidential all information they obtain during their work.

- Professionalism: Auditors must act in a professional manner at all times.

8. What is your understanding of the International Auditing Standards (IASs)?

The IASs are a set of standards that govern the audit of financial statements. The IASs are issued by the International Auditing and Assurance Standards Board (IAASB). The IASs are designed to promote high-quality audits and to ensure that audits are performed in a consistent manner.

9. What are the key differences between an audit and a review?

- Scope of work: An audit is more comprehensive than a review. An audit includes the examination of evidence to support the financial statements, while a review only includes limited procedures.

- Level of assurance: An audit provides a higher level of assurance than a review. An auditor expresses an opinion on the fairness of the financial statements, while a reviewer only provides limited assurance.

- Report: An audit report is more detailed than a review report. An audit report includes the auditor’s opinion on the financial statements, while a review report only includes a statement that the reviewer has performed limited procedures.

10. What are your career goals?

My career goal is to become a partner in a public accounting firm. I am confident that I have the skills and experience necessary to be successful in this role. I am also committed to continuing my professional development and to providing my clients with the highest quality of service.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Auditor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Auditor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Auditors are responsible for ensuring that an organization’s financial records are accurate and compliant with all applicable laws and regulations. They play a vital role in maintaining the integrity of a company’s financial reporting and safeguarding its assets. The key job responsibilities of a Financial Auditor include:

1. Planning and Execution of Audits

Planning and executing audits is a crucial aspect of a Financial Auditor’s role. They are responsible for developing and implementing audit plans, which outline the scope and objectives of the audit and the procedures that will be used to gather and evaluate evidence.

- Establishing the scope and objectives of the audit

- Developing an audit plan to guide the audit process

- Executing the audit procedures, such as reviewing financial records, interviewing management and staff, and observing operations

2. Financial Statement Analysis

Financial statement analysis is a key component of the audit process. Financial Auditors are responsible for evaluating the accuracy and completeness of financial statements, including the balance sheet, income statement, and statement of cash flows.

- Analyzing financial statements for accuracy, completeness, and compliance with applicable laws and regulations

- Identifying and assessing potential risks and areas of concern

- Preparing audit reports and management letters that communicate the results of the audit

3. Internal Control Assessment

Internal control assessment is another important aspect of an audit. Financial Auditors are responsible for evaluating the effectiveness of a company’s internal control system, which is designed to prevent and detect errors and fraud.

- Evaluating the design and effectiveness of internal controls

- Making recommendations to improve internal controls

- Testing the operating effectiveness of internal controls

4. Fraud Detection and Prevention

Fraud detection and prevention is a critical responsibility of Financial Auditors. They are responsible for identifying and assessing the risk of fraud and taking steps to prevent and detect fraudulent activities.

- Identifying and assessing the risk of fraud

- Developing and implementing fraud prevention measures

- Investigating suspected fraudulent activities

Interview Tips

Preparing for a Financial Auditor interview requires a thorough understanding of the role and the industry. Here are some interview tips and tricks to help you ace the interview:

1. Research the Company and Industry

Before the interview, take the time to research the company and the industry in which they operate. This will give you a good understanding of the company’s financial reporting requirements and the specific challenges they may be facing.

- Visit the company’s website

- Read recent news articles about the company

- Review the company’s financial statements

2. Practice your Auditing Skills

Financial Auditors are expected to have strong auditing skills. You should be comfortable with the audit process and the different audit techniques. Practice answering questions about your auditing experience and how you would approach different auditing situations.

- Review your audit experience

- Practice answering common interview questions about auditing

- Consider taking a practice audit exam

3. Highlight Your Communication Skills

Financial Auditors need strong communication skills to be able to effectively communicate the results of their audits to management and other stakeholders. In the interview, highlight your communication skills and provide examples of how you have effectively communicated complex financial information.

- Provide examples of how you have communicated complex financial information

- Discuss your experience in writing audit reports and management letters

- Emphasize your ability to effectively communicate with people from all levels of the organization

4. Be Prepared to Discuss Your Ethics

Financial Auditors are expected to maintain high ethical standards. In the interview, you should be prepared to discuss your ethical values and how you would handle ethical dilemmas.

- Explain your understanding of the AICPA Code of Professional Conduct

- Discuss your experience in handling ethical dilemmas

- Provide examples of how you have upheld ethical standards in your work

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Auditor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.