Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Financial Center Manager interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Financial Center Manager so you can tailor your answers to impress potential employers.

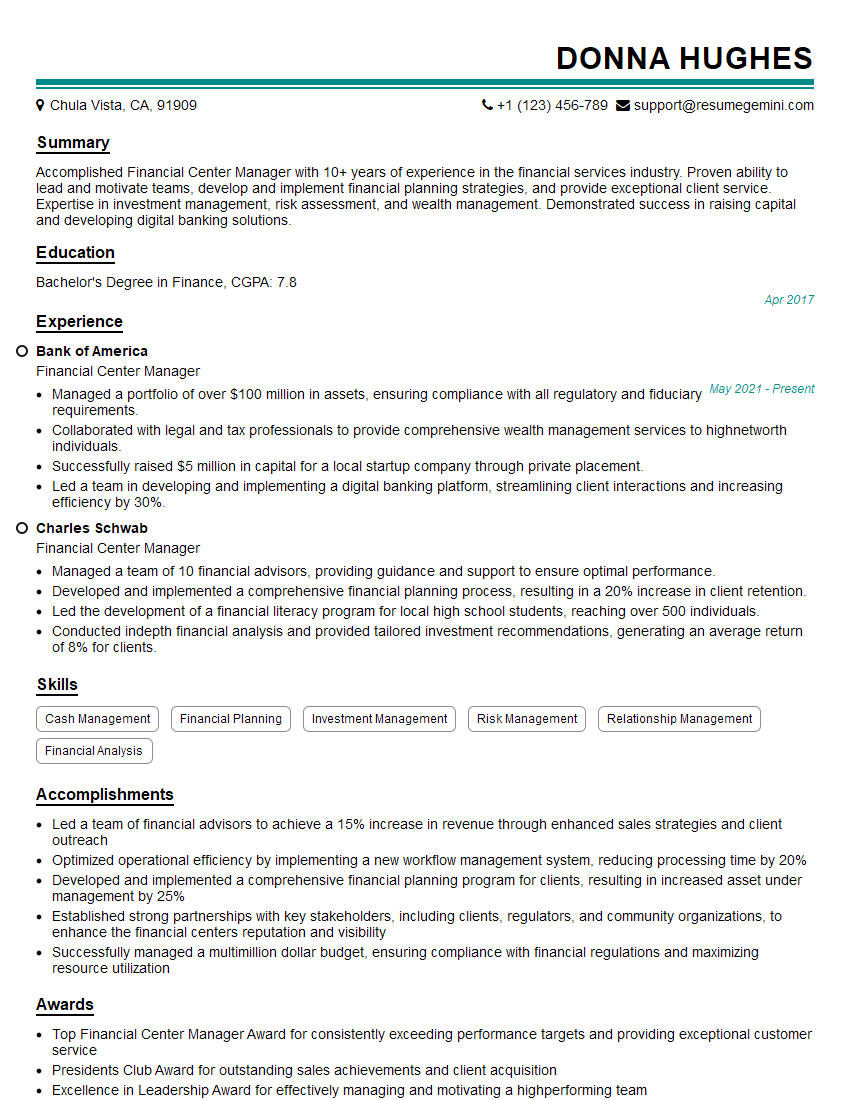

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Center Manager

1. How would you go about improving customer satisfaction levels at our financial center?

- Conduct customer surveys to identify areas for improvement.

- Implement a customer feedback system to gather real-time feedback.

- Provide personalized and tailored financial advice to meet individual customer needs.

- Train staff on excellent customer service techniques.

- Empower employees to resolve customer issues quickly and effectively.

- Utilize technology and automation to streamline processes and reduce wait times.

2. What strategies would you use to increase revenue and profitability at our financial center?

Cross-selling and Up-selling:

- Identify opportunities to recommend complementary financial products and services to existing customers.

- Provide incentives and rewards to employees for successful cross-selling.

Targeted Marketing:

- Conduct thorough market research to identify potential customers and their financial needs.

- Develop targeted marketing campaigns to reach these customers with tailored messages and offers.

Investment Advisory Services:

- Offer personalized investment advice to high-net-worth individuals and families.

- Partner with financial advisors to provide comprehensive wealth management services.

Fee-Based Services:

- Introduce fees for premium services such as financial planning and retirement planning.

- Provide value-added services that justify the additional charges.

3. How would you manage a team of financial advisors and ensure that they are meeting performance goals?

- Establish clear performance goals and expectations.

- Conduct regular performance reviews to track progress and provide feedback.

- Provide ongoing training and development opportunities to enhance skills and knowledge.

- Foster a collaborative and supportive work environment.

- Recognize and reward exceptional performance.

- Address underperformance promptly and provide constructive guidance.

4. What experience do you have in managing a financial center’s operations and ensuring compliance with regulatory requirements?

- Managing daily operations, including cash handling, account reconciliation, and customer transactions.

- Implementing and maintaining compliance programs for anti-money laundering, know-your-customer, and privacy regulations.

- Conducting regular audits and inspections to ensure adherence to policies and procedures.

- Working closely with regulatory authorities and reporting any suspicious activities.

- Staying updated on changes to financial regulations and implementing necessary adjustments.

5. How would you evaluate the performance of the financial center and identify areas for improvement?

- Regularly review financial metrics such as revenue, profitability, and customer satisfaction.

- Conduct customer surveys to gather feedback on products, services, and overall experience.

- Compare performance against industry benchmarks and peer institutions.

- Identify areas where processes can be streamlined or improved to enhance efficiency.

- Seek input from employees and customers to identify potential areas for improvement.

6. What technology trends are you aware of that could impact the future of financial center management?

- Artificial intelligence (AI) for automated customer service and financial planning.

- Blockchain technology for secure and transparent transactions.

- Mobile banking and digital wallets for convenient and accessible banking.

- Cloud computing for data storage, processing, and enhanced scalability.

- Robotic process automation (RPA) for streamlining routine tasks and improving efficiency.

7. How would you motivate and engage your team to achieve high levels of performance?

- Set clear and achievable goals and provide regular feedback.

- Foster a culture of recognition and appreciation for accomplishments.

- Provide opportunities for professional development and growth.

- Encourage collaboration and teamwork among team members.

- Create a positive and supportive work environment.

8. How would you handle a situation where a customer is dissatisfied with the service provided by a financial advisor?

- Listen attentively to the customer’s concerns and acknowledge their perspective.

- Investigate the issue thoroughly and gather all relevant facts.

- Discuss the situation with the financial advisor involved to understand their perspective.

- Work with the customer and the financial advisor to find a mutually acceptable resolution.

- Follow up with the customer regularly to ensure their satisfaction and restore their trust.

9. How would you lead the financial center in adapting to changing market conditions and customer needs?

- Monitor industry trends and customer feedback to identify emerging needs.

- Collaborate with other departments within the organization to develop innovative products and services.

- Foster a culture of continuous learning and adaptation among the team.

- Explore new technologies and partnerships to enhance customer experience.

- Stay informed about regulatory changes and implement necessary adjustments to ensure compliance.

10. How would you build strong relationships with the local community and support financial literacy initiatives?

- Partner with local schools and organizations to provide financial education workshops.

- Participate in community events and sponsor financial literacy programs.

- Offer free financial counseling to low-income individuals and families.

- Collaborate with local businesses to provide employee financial wellness programs.

- Establish a financial center advisory board to engage community members and gather feedback.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Center Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Center Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Financial Center Manager is responsible for the overall financial operations of a financial center. This includes managing the budget, developing and implementing financial plans, and overseeing the day-to-day operations of the center.

1. Budget Management

The Financial Center Manager is responsible for the financial planning, budgeting and management of funds for the center, projects, and events.

- Develop and manage operating and capital budgets

- Monitor expenses and revenues, and ensure compliance with policies and regulations

2. Financial Reporting

The Financial Center Manager is responsible for the preparation of financial reports, such as balance sheets and income statements.

- Prepare and present financial statements and reports to stakeholders, including management, board members, and investors

- Participate in audits and financial reviews

3. Investment Management

The Financial Center Manager may be responsible for the management of the center’s investments.

- Develop and implement investment strategies

- Monitor investment performance, and make adjustments as necessary

4. Risk Management

The Financial Center Manager is responsible for identifying and managing the financial risks faced by the center.

- Identify and assess financial risks

- Develop and implement risk management strategies

Interview Tips

Preparing for an interview for a Financial Center Manager position requires a combination of technical knowledge, financial acumen, and interpersonal skills.

1. Research the company and the position

Before the interview, take the time to research the company and the specific position you are applying for. This will help you understand the company’s culture, business model, and the key responsibilities of the role.

- Visit the company’s website and read about their mission, values, and recent financial performance

- Look up the job description for the position you are applying for and make note of the key requirements and qualifications

2. Highlight your relevant experience and skills

In your interview, be sure to highlight your relevant experience and skills. This includes your experience in managing budgets, developing financial plans, and overseeing financial operations.

- Use specific examples to demonstrate your skills and abilities

- Quantify your accomplishments whenever possible, using numbers and metrics to show the impact of your work

3. Be prepared to answer questions about your financial acumen

The interviewer will likely ask you questions about your financial acumen. Be prepared to answer questions about your understanding of financial concepts, such as budgeting, accounting, and risk management.

- Review your knowledge of financial terminology and concepts

- Practice answering questions about your financial experience and expertise

4. Be confident and enthusiastic

Confidence and enthusiasm are key ingredients for success in any interview. Be confident in your abilities and enthusiastic about the opportunity to work for the company.

- Make eye contact with the interviewer and speak clearly and confidently

- Convey your enthusiasm for the position and the company

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Financial Center Manager role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.