Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Coach position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

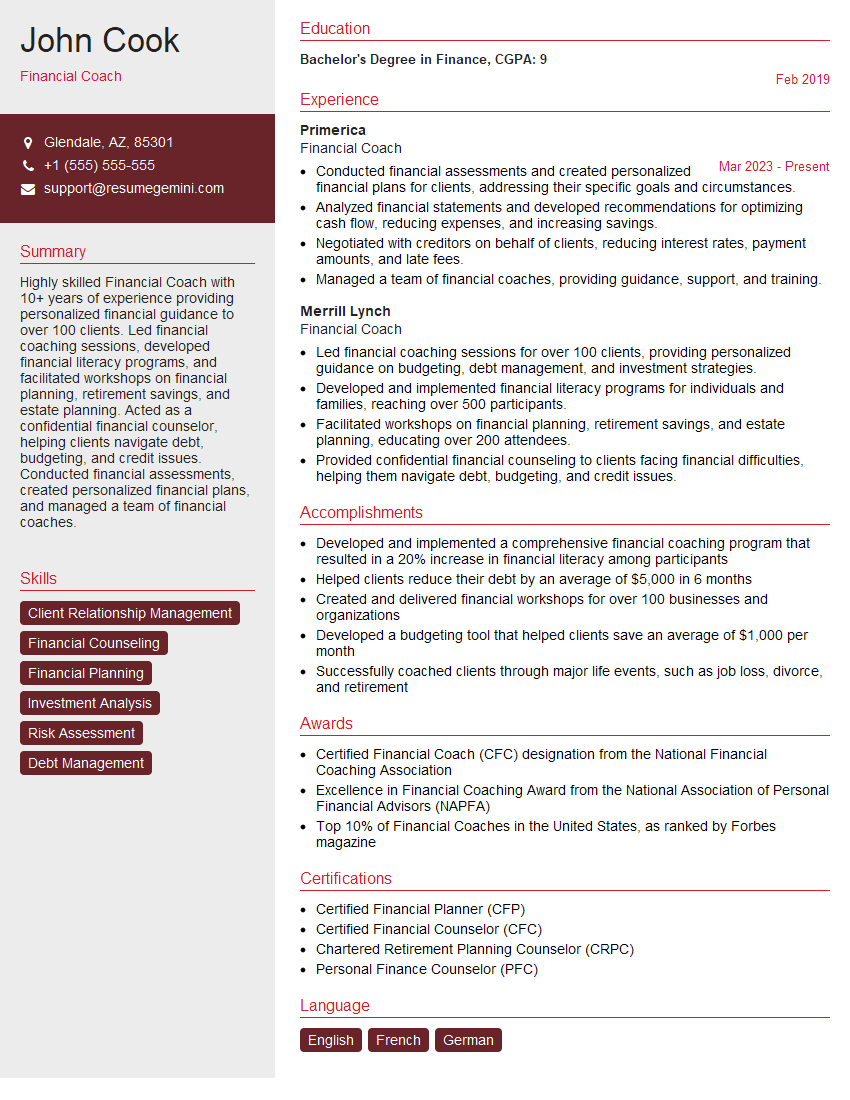

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Coach

1. How do you determine a client’s financial goals and risk tolerance?

- Employ active listening skills to comprehend their aspirations, concerns, and priorities.

- Utilize discovery questionnaires to gather detailed financial information and risk preferences.

2. Describe your approach to developing financial plans.

- Collaborate with clients to establish clear, achievable financial targets.

- Craft diversified portfolios tailored to clients’ risk tolerance and investment objectives.

- Regularly review and adjust plans as market conditions or client circumstances evolve.

Goal Setting

Portfolio Construction

Monitoring and Rebalancing

3. How do you manage client expectations and ensure they are satisfied with your services?

- Proactively communicate with clients, providing timely updates and addressing concerns.

- Set realistic expectations and manage risk to avoid disappointments.

- Regularly gather feedback and make adjustments to improve client satisfaction.

4. Describe a challenging financial situation you successfully navigated for a client.

- Summarize the client’s situation, highlighting the specific challenges encountered.

- Explain your analysis and the recommended solutions implemented.

- Quantify the positive outcomes achieved for the client, such as debt reduction or wealth growth.

5. How do you stay updated on the latest financial trends and regulations?

- Attend industry conferences and webinars.

- Read financial publications and research reports.

- Maintain professional certifications, such as the Certified Financial Planner (CFP) designation.

6. How do you handle conflicts of interest that may arise during your work?

- Adhere to ethical guidelines and disclose any potential conflicts to clients.

- Maintain objectivity and act in the best interests of clients, even if it conflicts with personal or firm interests.

- Seek guidance from supervisors or external experts if necessary.

7. What is your understanding of the fiduciary responsibility of a financial coach?

- Act in the best interests of clients, prioritizing their financial well-being.

- Provide objective advice and avoid conflicts of interest.

- Maintain confidentiality and protect client information.

8. How do you assess a client’s retirement readiness?

- Review their financial situation, including income, expenses, savings, and investments.

- Estimate future income and expenses using projections and retirement calculators.

- Identify potential gaps and develop strategies to address them.

9. What are some common financial mistakes that you help clients avoid?

- Overspending and accumulating excessive debt.

- Investing without a clear strategy or understanding risk.

- Not saving enough for retirement or emergencies.

10. How do you measure the effectiveness of your financial coaching services?

- Track client satisfaction through surveys and testimonials.

- Monitor financial outcomes, such as debt reduction, investment growth, or retirement savings progress.

- Seek feedback from clients and make adjustments to improve services.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Coach.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Coach‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Financial Coach is responsible for guiding and assisting individuals and families in managing their personal finances effectively. They help clients develop personalized financial plans, improve their financial literacy, and achieve their financial goals.

1. Financial Planning and Guidance

Create and implement customized financial plans that address clients’ unique financial objectives, such as budgeting, debt management, saving, and investment.

- Conduct thorough financial assessments to understand clients’ current financial situation, goals, and risk tolerance.

- Develop strategies for optimizing cash flow, reducing expenses, and maximizing income.

2. Financial Literacy Education

Provide education and guidance to clients on a wide range of financial topics, including budgeting, credit management, saving, and investing.

- Create and deliver engaging financial education materials, such as workshops, presentations, and online resources.

- Empower clients to make informed financial decisions and develop long-term financial habits.

3. Goal Setting and Progress Tracking

Collaborate with clients to establish clear financial goals and develop strategies for achieving them.

- Regularly review progress with clients and make adjustments to the financial plan as needed.

- Provide encouragement and motivation to help clients stay on track and overcome challenges.

4. Specialized Financial Services

Provide specialized financial services tailored to clients’ specific needs, such as:

- Debt consolidation and management

- Retirement and estate planning

- Investment analysis and recommendations

Interview Tips

Preparing thoroughly for a Financial Coach interview is essential to showcasing your qualifications and impressing the hiring manager. Here are some key tips and strategies to help you ace the interview:

1. Research the Company and Position

Familiarize yourself with the company’s mission, values, and financial services offerings. Research the specific role and its responsibilities to demonstrate your understanding of the position.

2. Highlight Your Financial Coaching Skills

Emphasize your ability to assess clients’ financial situations, develop personalized plans, and provide effective financial guidance. Showcase your knowledge of financial planning principles, budgeting, and investment strategies.

- Example: Quantify your accomplishments by providing specific examples of how you helped clients achieve their financial goals.

3. Demonstrate Your Communication and Interpersonal Skills

Financial Coaches should possess strong communication and interpersonal skills to build rapport with clients and effectively convey complex financial concepts.

- Example: Share examples of how you actively listened to clients, understood their financial challenges, and developed tailored solutions to meet their needs.

4. Showcase Your Passion for Financial Literacy

Convey your passion for educating clients on financial matters and empowering them to make informed decisions. Discuss your experience in developing financial education materials and delivering financial literacy workshops.

- Example: Describe how you successfully implemented a financial literacy program that significantly improved clients’ financial well-being.

5. Prepare Thoughtful Questions

Asking thoughtful questions during the interview shows your engagement and interest in the company and position. Prepare questions about the company’s financial planning approach, client-focused initiatives, and opportunities for professional development.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Coach interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.