Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Financial Compliance Examiner interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Financial Compliance Examiner so you can tailor your answers to impress potential employers.

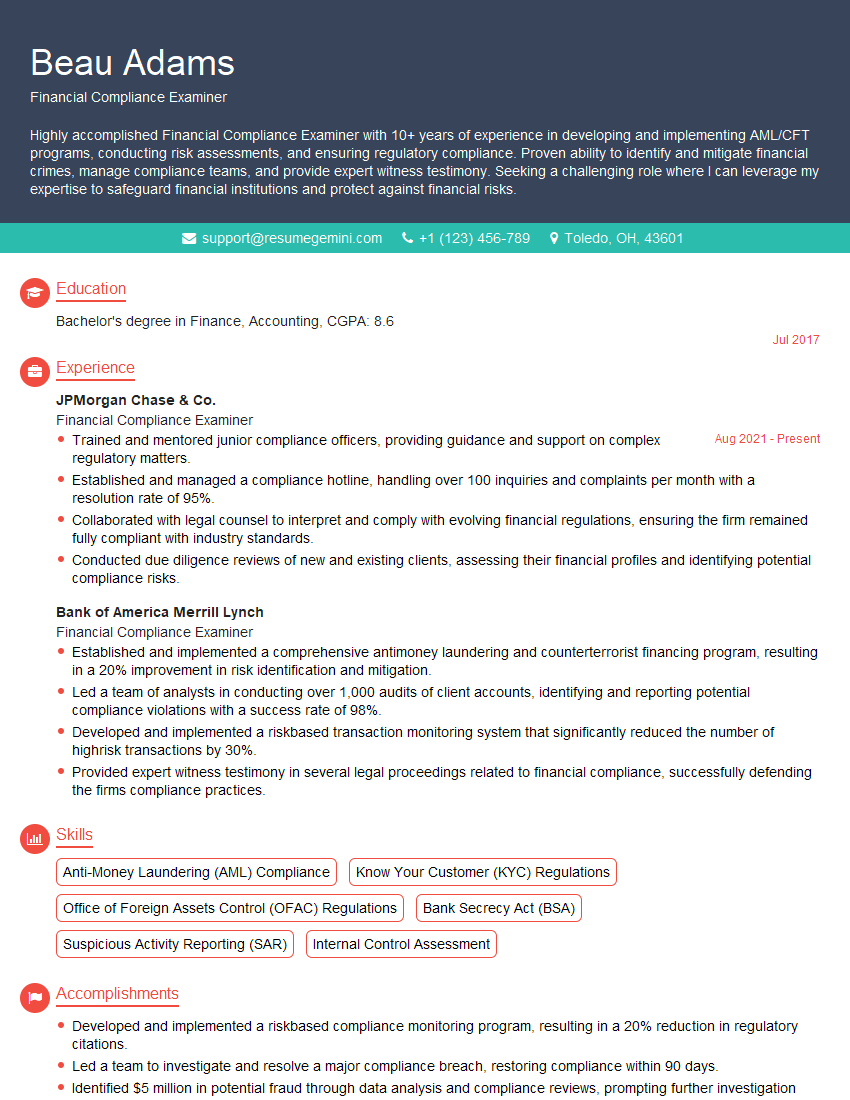

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Compliance Examiner

1. Describe the key elements of an effective compliance program?

An effective compliance program typically includes the following key elements:

- Clear and comprehensive policies and procedures.

- A strong and independent compliance function.

- Effective risk management processes.

- Regular training and education for employees.

- A system for monitoring and auditing compliance.

- A process for responding to and investigating compliance violations.

2. What are some common challenges faced by financial compliance examiners?

Regulatory complexity

- Keeping up with the ever-changing regulatory landscape.

- Interpreting and applying regulations to complex financial transactions.

Data management

- Collecting and organizing large volumes of data from multiple sources.

- Analyzing data to identify potential compliance issues.

Communication and reporting

- Communicating complex compliance issues to management and other stakeholders.

- Reporting on compliance activities and findings.

3. Describe the role of technology in financial compliance?

Technology plays a vital role in financial compliance by:

- Automating compliance processes and reducing manual errors.

- Providing real-time monitoring and alerts for potential compliance violations.

- Helping to identify and mitigate compliance risks.

- Improving communication and collaboration among compliance professionals.

4. What are the key differences between internal and external financial audits?

Internal financial audits are conducted by employees of the company being audited. External financial audits are conducted by independent auditors who are not employed by the company being audited.

Key differences between internal and external financial audits include:

- Scope of the audit.

- Purpose of the audit.

- Reporting requirements.

5. What are some of the most common types of financial fraud?

Some of the most common types of financial fraud include:

- Misappropriation of assets.

- Financial statement fraud.

- Bribery and corruption.

- Cybercrime.

- Insider trading.

6. What are the key elements of an effective anti-money laundering program?

An effective anti-money laundering program typically includes the following key elements:

- Customer due diligence procedures.

- Transaction monitoring systems.

- Risk management processes.

- Training and education for employees.

- A system for reporting suspicious activity.

7. What are the key differences between risk assessment and risk management?

Risk assessment is the process of identifying and analyzing potential risks. Risk management is the process of developing and implementing strategies to mitigate or manage risks.

Key differences between risk assessment and risk management include:

- Purpose.

- Scope.

- Output.

8. What are the key steps in conducting a financial compliance review?

The key steps in conducting a financial compliance review typically include the following:

- Planning the review.

- Gathering data and documentation.

- Assessing compliance with relevant laws and regulations.

- Identifying and evaluating risks.

- Making recommendations for improvements.

- Reporting on the findings of the review.

9. What are the key qualities and skills of a successful financial compliance examiner?

Some of the key qualities and skills of a successful financial compliance examiner include:

- Strong understanding of financial regulations and compliance requirements.

- Excellent analytical and problem-solving skills.

- Attention to detail and accuracy.

- Strong communication and interpersonal skills.

- Ability to work independently and as part of a team.

10. What are your career goals and how does this position align with them?

My career goal is to become a leading expert in financial compliance. I believe that this position would be a great opportunity for me to develop my skills and knowledge in this area and to contribute to the success of your organization.

I am particularly interested in the opportunity to work on a variety of compliance projects and to learn from experienced professionals in the field. I am also excited about the opportunity to contribute to the development and implementation of your compliance program.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Compliance Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Compliance Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Compliance Examiners play a crucial role in ensuring that financial institutions adhere to regulations and internal policies. Their primary responsibilities include:

1. Regulatory Compliance

Reviewing and interpreting financial regulations, including those issued by the SEC, FINRA, and other regulatory bodies. Ensuring that the organization’s policies and procedures align with these regulations.

2. Internal Controls Assessment

Evaluating the effectiveness of internal controls designed to prevent, detect, and mitigate financial risks. Identifying weaknesses and recommending improvements to strengthen the control environment.

3. Transaction Monitoring

Monitoring financial transactions for suspicious activity or patterns that may indicate fraud or other compliance violations. Investigating anomalies and reporting any concerns to appropriate authorities.

4. Risk Management

Identifying, assessing, and mitigating financial risks faced by the organization. Developing and implementing risk-management strategies to minimize potential losses.

Interview Tips

To ace the interview for a Financial Compliance Examiner position, candidates should thoroughly prepare and consider the following tips:

1. Research the Organization

Familiarize yourself with the company’s business, industry, and recent news. Research their compliance history and any relevant regulatory actions taken against them.

2. Practice Common Interview Questions

Prepare answers to common interview questions related to compliance, risk management, and financial regulations. Use the STAR method (Situation, Task, Action, Result) to structure your responses.

3. Highlight Industry Knowledge and Certifications

Emphasize your understanding of industry best practices and relevant certifications, such as Certified Anti-Money Laundering Specialist (CAMS) or Certified Regulatory Compliance Manager (CRCM).

4. Demonstrate Analytical and Communication Skills

Financial Compliance Examiners require strong analytical skills to review financial data, identify trends, and make informed recommendations. Additionally, they must possess excellent communication skills to convey complex compliance matters to various stakeholders.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Financial Compliance Examiner, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Financial Compliance Examiner positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.