Are you gearing up for a career in Financial Compliance Officer? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Financial Compliance Officer and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

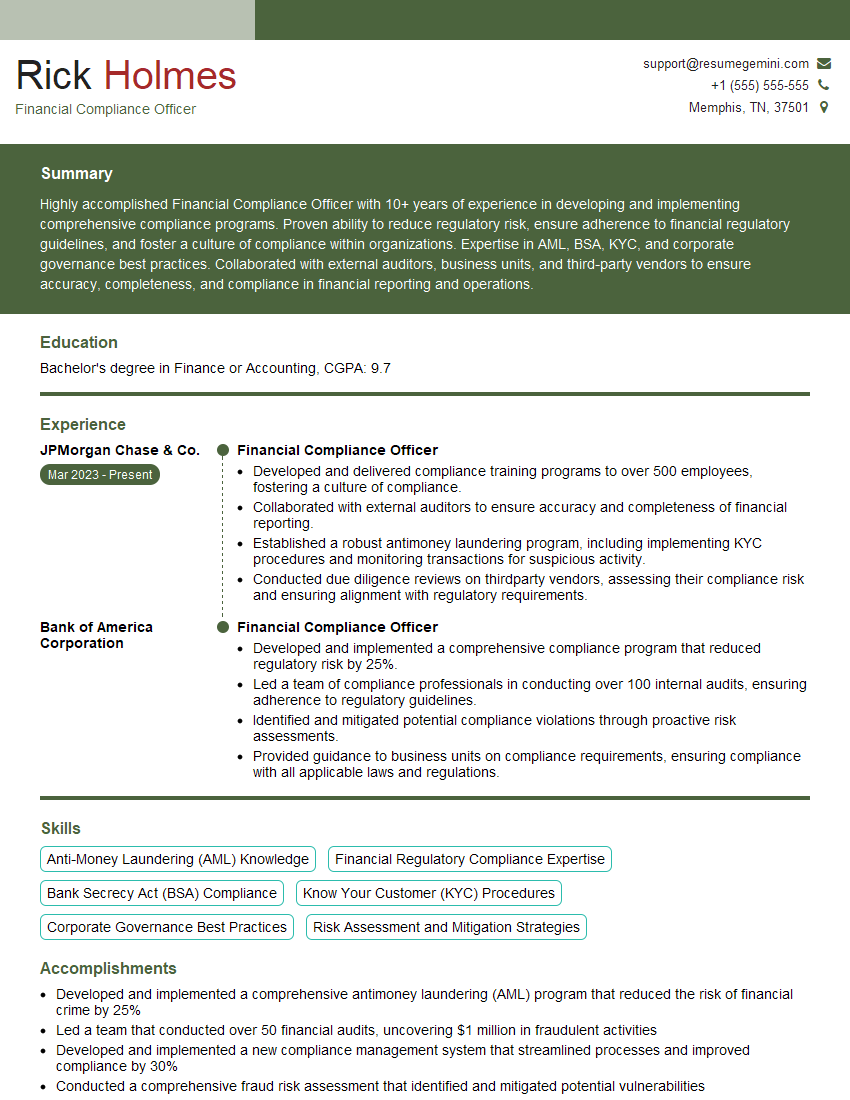

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Compliance Officer

1. Describe the key responsibilities of a Financial Compliance Officer.

- Develop and implement compliance policies and procedures.

- Monitor and audit compliance with financial regulations and industry standards.

- Investigate potential violations and take appropriate disciplinary action.

- Train employees on compliance obligations.

2. What are the most important qualities of a successful Financial Compliance Officer?

- Strong understanding of financial regulations and industry standards.

- Detail-oriented and analytical mindset.

- Excellent communication and interpersonal skills.

- Ability to work independently and as part of a team.

3. How do you stay up-to-date on the latest financial regulations and industry best practices?

- Attend industry conferences and workshops.

- Read industry publications and news articles.

- Network with other compliance professionals.

4. Describe a time when you had to investigate a potential violation of financial regulations.

- Explain the steps you took to investigate the violation.

- Describe how you determined the severity of the violation.

- Discuss the disciplinary action you took, if any.

5. How do you handle situations where employees are resistant to compliance requirements?

- Explain the importance of compliance to the employees.

- Discuss the consequences of non-compliance.

- Provide training and resources to help employees comply.

- Take disciplinary action, if necessary.

6. What are the most common financial crimes that you have encountered?

- Money laundering

- Insider trading

- Fraud

- Embezzlement

7. What are the challenges of working as a Financial Compliance Officer?

- Keeping up with the ever-changing regulatory environment.

- Balancing the need for compliance with the need for business efficiency.

- Dealing with employees who are resistant to compliance requirements.

8. What are the rewards of working as a Financial Compliance Officer?

- The opportunity to make a positive impact on the financial industry.

- The satisfaction of knowing that you are helping to protect the integrity of the financial system.

- The opportunity to learn about a variety of financial topics.

9. What is your understanding of the Bank Secrecy Act (BSA)?

- The BSA is a federal law that requires financial institutions to help the government fight money laundering and terrorist financing.

- The BSA requires financial institutions to:

- Identify and verify the identity of their customers.

- Report suspicious transactions to the government.

- Maintain records of their transactions.

10. What is the Patriot Act and how does it impact financial compliance?

- The Patriot Act is a federal law that was passed in the wake of the 9/11 terrorist attacks.

- The Patriot Act expands the government’s authority to investigate and prosecute terrorist financing.

- The Patriot Act also imposes new requirements on financial institutions, including:

- Enhanced customer due diligence.

- Increased reporting of suspicious transactions.

- Cooperation with law enforcement.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Compliance Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Compliance Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Compliance Officers are responsible for ensuring that their organizations adhere to all applicable laws, regulations, and ethical standards. Their key job responsibilities include:

1. Compliance Monitoring

Monitoring and assessing the organization’s compliance with all relevant laws, regulations, and industry standards.

- Developing and implementing compliance policies and procedures.

- Conducting regular audits and reviews to identify any potential compliance risks.

2. Risk Management

Identifying, assessing, and mitigating compliance risks.

- Developing and implementing risk management strategies.

- Working with other departments to identify and address potential compliance issues.

3. Training and Education

Providing training and education to employees on compliance-related matters.

- Developing and delivering training programs on compliance topics.

- Answering employee questions and providing guidance on compliance issues.

4. Reporting and Disclosure

Reporting on compliance-related matters to senior management and external stakeholders.

- Preparing and submitting compliance reports to regulatory agencies.

- Responding to inquiries from regulators and other stakeholders.

Interview Tips

To ace an interview for a Financial Compliance Officer position, it is important to be well-prepared. Here are a few tips:

1. Research the Company and the Position

Before the interview, take the time to research the company and the specific position you are applying for. This will help you understand the company’s culture, values, and compliance requirements.

- Visit the company’s website and read their annual report.

- Review the job description and identify the key qualifications and responsibilities.

2. Practice Your Answers

Take some time to practice your answers to common interview questions. This will help you feel more confident and prepared during the interview.

- Write out your answers to questions such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”

- Practice your answers with a friend or family member.

3. Dress Professionally

First impressions matter, so it is important to dress professionally for your interview. This means wearing a suit or business casual attire.

- Make sure your clothes are clean and pressed.

- Choose neutral colors such as black, navy, or gray.

4. Be Enthusiastic and Positive

Hiring managers are more likely to hire candidates who are enthusiastic and positive about the position. Show your excitement for the job and the company during the interview.

- Smile and make eye contact with the interviewers.

- Express your enthusiasm for the position and the company.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Compliance Officer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!