Feeling lost in a sea of interview questions? Landed that dream interview for Financial Consultant but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Financial Consultant interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

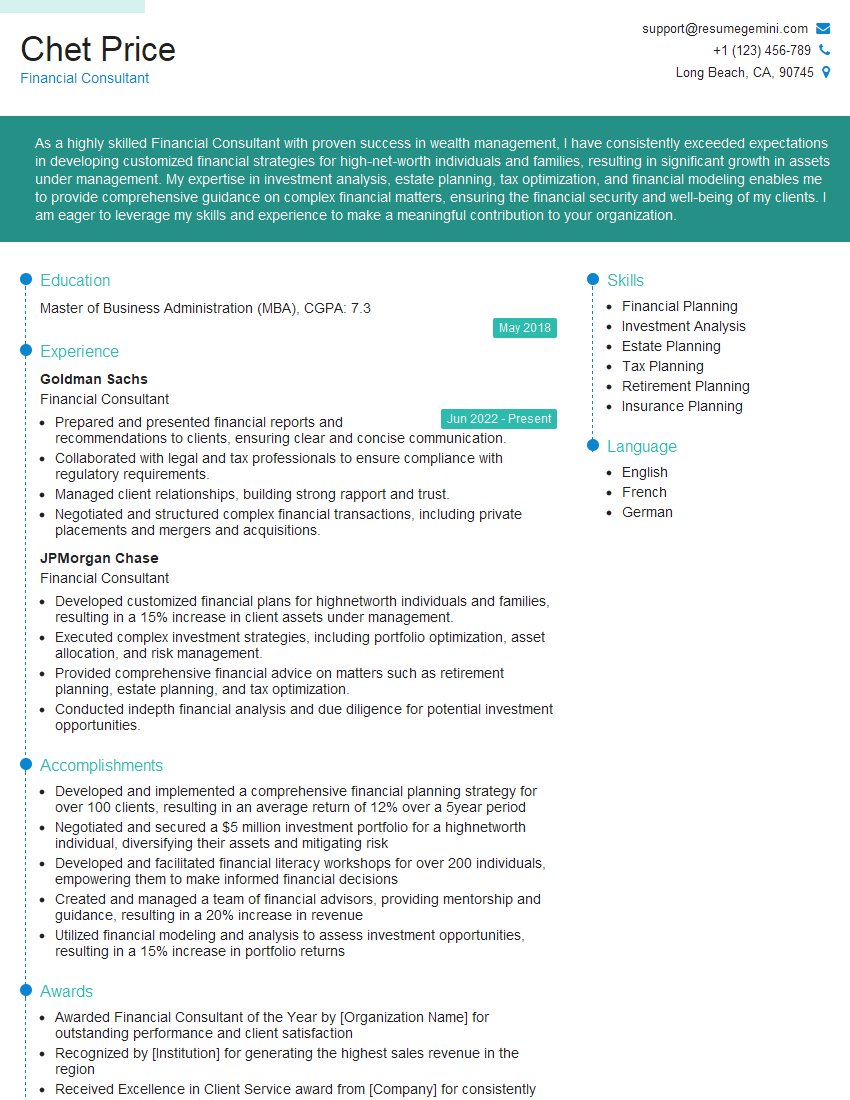

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Consultant

1. What are the key steps involved in developing a comprehensive financial plan for a client?

The key steps involved in developing a comprehensive financial plan for a client are as follows:

- Gather client data and information.

- Analyze the client’s financial situation.

- Identify the client’s financial goals.

- Develop financial recommendations.

- Implement the financial plan.

- Monitor the financial plan and make adjustments as needed.

2. Describe the different types of investment strategies and how they can be tailored to meet the unique needs of clients?

There are a variety of investment strategies that can be tailored to meet the unique needs of clients. Some common investment strategies include:

Conservative Strategies

- Investing in low-risk assets such as bonds and money market accounts.

- Diversifying investments across different asset classes.

- Rebalancing investments regularly.

Moderate Strategies

- Investing in a mix of risk assets such as stocks and bonds.

- Adjusting the asset allocation based on market conditions.

- Using investment strategies such as dollar-cost averaging.

Aggressive Strategies

- Investing in high-risk assets such as stocks and real estate.

- Using leverage to increase potential returns.

- Making frequent trades.

3. How do you stay up-to-date on the latest financial news and trends?

I stay up-to-date on the latest financial news and trends by reading industry publications, attending conferences, and networking with other professionals. I also use online resources such as financial news websites and social media to stay informed about the latest developments in the financial markets.

4. How do you evaluate the performance of a financial plan?

I evaluate the performance of a financial plan by comparing the actual results to the expected results. I also consider the client’s financial goals and objectives, as well as the current market conditions. I use a variety of metrics to evaluate performance, such as:

- Rate of return

- Risk

- Client satisfaction

5. What are some of the ethical challenges that financial consultants face?

Some of the ethical challenges that financial consultants face include:

- Conflicts of interest

- Misrepresentation of information

- Breach of confidentiality

- Unfair treatment of clients

6. How do you handle clients who are resistant to change?

When working with clients who are resistant to change, I try to understand their concerns and objections. I then provide them with clear and concise information about the benefits of the proposed changes. I also listen to their feedback and try to address their concerns in a way that is both empathetic and professional.

7. What are some of the most important qualities of a successful financial consultant?

Some of the most important qualities of a successful financial consultant include:

- Strong communication and interpersonal skills

- In-depth knowledge of financial products and services

- Ability to build and maintain client relationships

- Ethical and professional conduct

- Commitment to continuing education

8. What are your strengths and weaknesses as a financial consultant?

My strengths as a financial consultant include my strong communication and interpersonal skills, my in-depth knowledge of financial products and services, and my ability to build and maintain client relationships. I am also ethical and professional in my conduct and committed to continuing education.

One of my weaknesses is that I am relatively new to the financial industry. However, I am eager to learn and grow, and I am confident that I can quickly develop the necessary skills and experience to be a successful financial consultant.

9. What are your career goals as a financial consultant?

My career goals as a financial consultant are to build a successful practice and help my clients achieve their financial goals. I want to be known as a trusted advisor who provides sound financial advice and helps my clients make informed decisions about their finances.

10. What questions do you have for me about the position?

I am interested in learning more about the position and the firm. I would like to know more about the firm’s culture, the types of clients you serve, and the opportunities for professional development.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Consultant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Consultant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Consultants play a crucial role in the financial planning and management of their clients. Their responsibilities encompass a wide range of tasks:

1. Financial Planning and Analysis

Develop comprehensive financial plans tailored to clients’ specific goals, considering factors such as income, expenses, savings, investments, and risk tolerance.

- Analyze clients’ financial status, identify areas for improvement, and recommend strategies for optimizing financial well-being.

- Prepare financial projections, conduct risk assessments, and evaluate investment options to inform decision-making.

2. Investment Management

Provide investment advice and manage clients’ portfolios, aligning with their risk tolerance and financial objectives.

- Research and recommend investment strategies, asset allocation, and specific investment products.

- Monitor market trends, evaluate portfolio performance, and make adjustments as needed.

3. Retirement Planning

Help clients plan for a secure financial future in retirement, considering factors such as income sources, expenses, and investment strategies.

- Develop retirement income plans, explore retirement savings options, and advise on tax-efficient strategies.

- Estimate future retirement expenses and project potential income streams.

4. Tax Planning and Optimization

Provide guidance on tax planning strategies to minimize tax liability and maximize financial returns.

- Analyze tax implications of financial transactions, investments, and retirement plans.

- Recommend tax-saving strategies, such as tax deductions, credits, and deferrals.

5. Risk Management and Insurance Planning

Assess clients’ risk tolerance and develop strategies to mitigate potential financial losses or setbacks.

- Review insurance coverage, recommend appropriate policies, and advise on risk management strategies.

- Educate clients on the importance of financial protection and insurance planning.

Interview Tips

An effective way to prepare for a Financial Consultant interview is to:

1. Research the Company and the Role

Familiarize yourself with the company’s history, mission, services, and industry trends. Study the job description thoroughly to understand the specific requirements of the role.

- Visit the company’s website, read industry news, and connect with employees on LinkedIn.

- Identify the key skills and experiences the interviewer is seeking.

2. Practice Common Interview Questions

Prepare for typical interview questions by researching and practising your responses. Practice with a friend, family member, or career coach.

- Prepare answers to questions about your financial planning and investment knowledge, experience with clients, and ethical considerations.

- Be ready to share examples of successful financial plans you have developed or investments you have managed.

3. Showcase Your Skills and Experience

Highlight your relevant skills, experience, and qualifications in your resume, cover letter, and interview. Use specific examples to demonstrate your abilities.

- Emphasize your analytical skills, financial modelling proficiency, and knowledge of financial markets.

- Describe your experience in providing financial advice, managing portfolios, and developing tailored plans.

4. Be Professional and Confident

Dress appropriately, maintain eye contact, and speak clearly and confidently. Demonstrate good communication and interpersonal skills throughout the interview.

- Arrive on time and prepare thoughtful questions to ask the interviewer.

- Be enthusiastic and show genuine interest in the role and the company.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Financial Consultant role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.