Feeling lost in a sea of interview questions? Landed that dream interview for Financial Controller but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Financial Controller interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

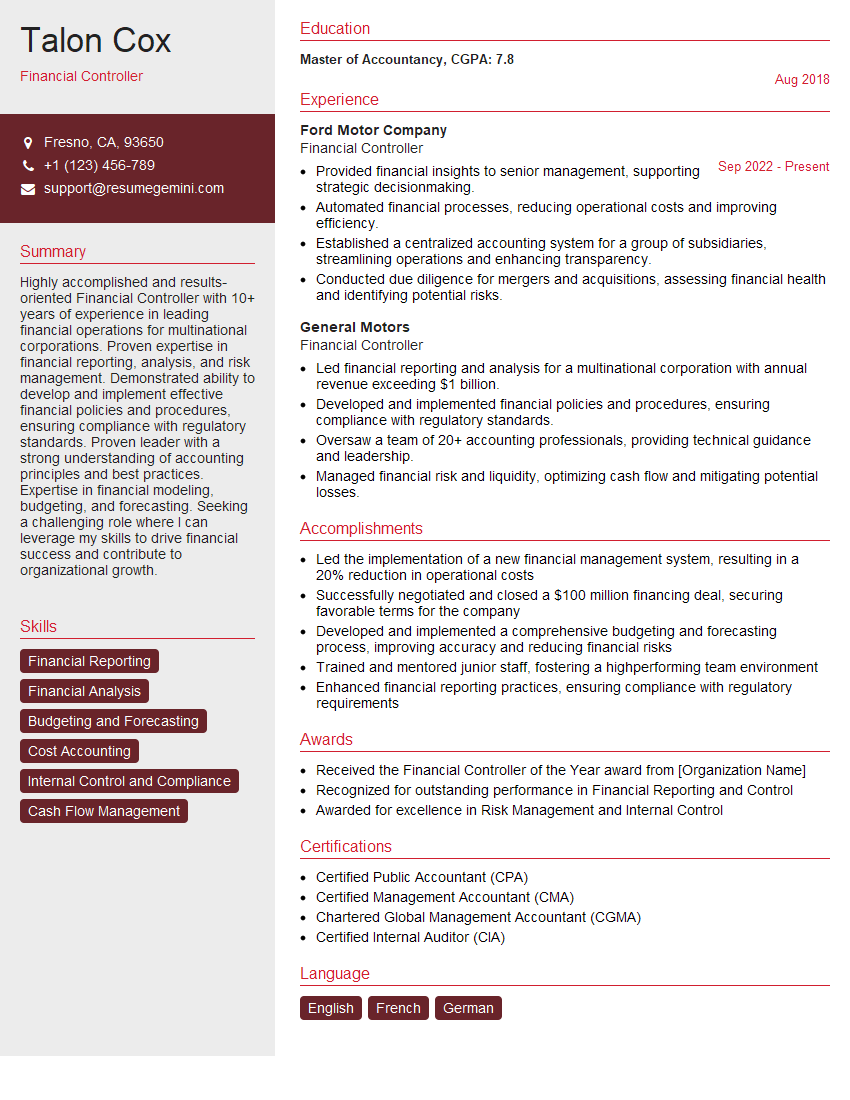

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Controller

1. How would you handle a situation where actual financial performance significantly deviates from budgeted or forecasted performance?

- Analyze the reasons for the deviation, identifying any underlying issues or trends.

- Communicate the findings to management and stakeholders, providing clear and concise explanations.

- Develop and implement corrective action plans to address the deviations and improve future performance.

- Review and update budgeting and forecasting processes as necessary to ensure accuracy and reliability.

2. Describe your experience in developing and implementing financial policies and procedures.

: Policy Development

- Conduct thorough research and analysis to identify areas for policy improvement.

- Collaborate with stakeholders to gather input and ensure alignment with organizational goals.

- Draft and review policies, ensuring compliance with regulatory requirements and best practices.

Subheading: Policy Implementation

- Communicate policies effectively to all relevant parties, including employees, vendors, and customers.

- Establish mechanisms for monitoring and enforcing policy compliance.

- Provide training and support to ensure understanding and adherence.

3. How do you stay up-to-date on changes in accounting standards and regulations?

- Attend industry conferences and workshops to gain insights from experts and peers.

- Subscribe to professional journals and publications to stay informed about emerging trends and regulatory updates.

- Participate in continuing professional education programs to enhance knowledge and skills.

- Network with professionals in the field to exchange ideas and share best practices.

4. Explain your approach to financial risk management.

- Identify and assess potential financial risks, including credit risk, liquidity risk, and operational risk.

- Develop and implement risk mitigation strategies, such as hedging, diversification, and insurance.

- Monitor and evaluate risks on an ongoing basis, making adjustments as needed.

- Communicate risk management strategies and outcomes to management and stakeholders.

5. How do you collaborate with other departments, such as operations, sales, and marketing, to ensure financial alignment with business objectives?

- Establish clear communication channels and regular reporting mechanisms.

- Participate in cross-functional meetings and projects to provide financial insights and analysis.

- Develop financial models and projections to support decision-making and resource allocation.

- Provide tailored financial reporting and analysis to meet the specific needs of different departments.

6. Describe your experience in financial planning and analysis.

- Develop and maintain detailed financial plans, including budgets, cash flow projections, and capital expenditure plans.

- Perform financial analysis to identify trends, evaluate performance, and support strategic decision-making.

- Use financial modeling and forecasting tools to predict future cash flows and profitability.

- Present financial information and analysis to management and stakeholders in a clear and concise manner.

7. How do you approach the management of working capital?

- Analyze the components of working capital, including inventory, accounts receivable, and accounts payable.

- Develop strategies to optimize working capital levels, such as inventory management techniques and supplier payment terms.

- Monitor and track key working capital metrics, such as inventory turnover and days sales outstanding.

- Implement process improvements to enhance efficiency and reduce working capital requirements.

8. Explain your experience in managing financial audits.

- Collaborate with external auditors to plan and execute financial audits.

- Provide necessary documentation and information to auditors in a timely and accurate manner.

- Review and respond to audit findings, including corrective action plans.

- Implement recommendations from auditors to improve financial processes and controls.

9. How do you ensure the accuracy and integrity of financial reporting?

- Establish and maintain a robust system of internal controls.

- Perform regular reconciliations and reviews of financial data.

- Comply with applicable accounting standards and regulatory requirements.

- Provide training and guidance to staff responsible for financial reporting.

10. Describe your experience in mergers and acquisitions.

- Participate in due diligence processes, including financial analysis and valuation.

- Develop and execute financial integration plans to combine operations post-merger.

- Manage financial aspects of post-acquisition integration, such as cost optimization and revenue synergy realization.

- Advise management on the financial implications of potential mergers and acquisitions.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Controller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Controller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Financial Controller, you are essentially the business’ financial strategist. You will lead the planning, execution, and reporting of financial activities. Your responsibilities will include:

1. Financial Planning and Analysis

You will develop and implement financial plans and budgets, and conduct financial analyses to support decision-making. This will involve:

- Preparing financial statements and reports

- Forecasting financial performance

- Identifying and mitigating financial risks

2. Accounting and Compliance

You will ensure that accounting policies and procedures are followed and that the company complies with relevant laws and regulations. This will involve:

- Managing the accounting team

- Maintaining accounting records

- Preparing tax returns

3. Treasury and Risk Management

You will develop and implement strategies for managing the company’s financial resources and mitigating financial risks. This will involve:

- Managing cash flow

- Investing excess funds

- Purchasing insurance

4. Budgeting and Forecasting

You will develop and implement budgets and forecasts to support the company’s financial planning. This will involve:

- Preparing financial projections

- Monitoring actual performance against budgets

- Making adjustments to budgets as needed

Interview Tips

Preparing for an interview for a Financial Controller position can be daunting, but by following these tips you can increase your chances of success:

1. Research the Company and the Position

Take the time to research the company and the specific position you are applying for. This will help you understand the company’s culture, values, and financial goals. It will also help you tailor your answers to the specific requirements of the position.

- Visit the company’s website

- Read the company’s annual report

- Talk to people who work at the company

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about your experience in financial planning and analysis?” and “What are your strengths and weaknesses?” Practice your answers to these questions in advance so that you can deliver them confidently and concisely.

- Use the STAR method to answer questions

- Be specific and provide examples

- Highlight your skills and experience

3. Dress Professionally and Arrive on Time

First impressions matter, so make sure you dress professionally and arrive on time for your interview. This will show the interviewer that you are serious about the position and that you respect their time.

- Wear a suit or business casual attire

- Be well-groomed

- Arrive at the interview location 10-15 minutes early

4. Be Positive and Enthusiastic

Interviewers are looking for candidates who are positive and enthusiastic about the position and the company. Make sure you convey your excitement for the opportunity and your belief that you have the skills and experience to be successful in the role.

- Smile and make eye contact

- Be articulate and confident

- Ask questions about the position and the company

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Financial Controller role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.