Are you gearing up for a career in Financial Coordinator? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Financial Coordinator and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

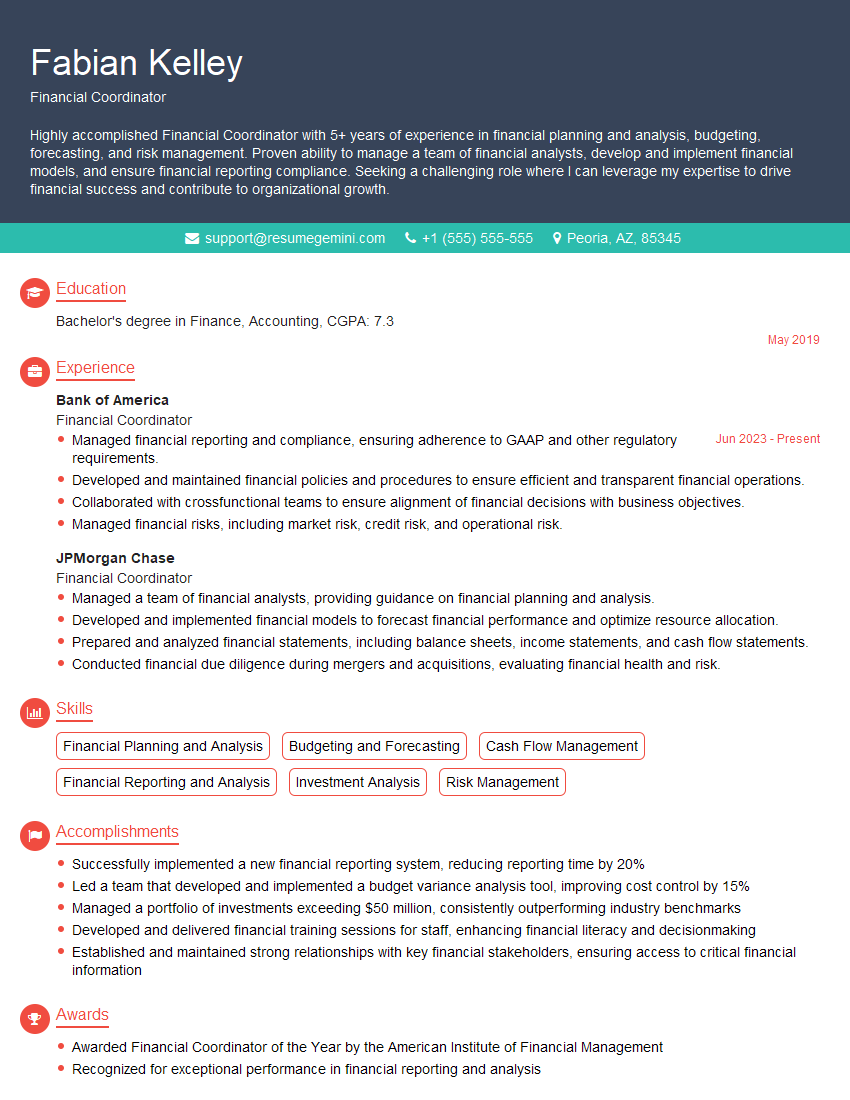

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Coordinator

1. Explain the process for reconciling financial statements?

The process of reconciling financial statements involves comparing the balances in the general ledger to the balances in the financial statements. The purpose of this process is to ensure that the balances in the financial statements are accurate and that there are no errors. The following steps are involved in the reconciliation process:

- Identify the accounts that need to be reconciled.

- Gather the necessary documentation, such as bank statements, credit card statements, and invoices.

- Compare the balances in the general ledger to the balances in the financial statements.

- Investigate any differences between the balances.

- Make any necessary adjustments to the general ledger or financial statements.

2. How do you prepare a cash flow statement?

Steps involved in the preparation of cash flow statement:

- Start with the net income from the income statement.

- Add back depreciation and amortization, as these are non-cash expenses.

- Adjust for changes in working capital, such as accounts receivable, accounts payable, and inventory.

- Add or subtract any other cash flows, such as interest payments or proceeds from the sale of assets.

- The resulting amount is the net cash flow from operating activities.

Following are the three main categories of cash flow statement:

- Operating Activities

- Investing Activities

- Financing Activities

3. What are the key financial ratios that you use to assess a company’s financial health?

There are a number of financial ratios that can be used to assess a company’s financial health. Some of the most common ratios include:

- Liquidity ratios, such as the current ratio and the quick ratio, measure a company’s ability to meet its short-term obligations.

- Solvency ratios, such as the debt-to-equity ratio and the times interest earned ratio, measure a company’s ability to meet its long-term obligations.

- Profitability ratios, such as the gross profit margin and the net profit margin, measure a company’s profitability.

- Efficiency ratios, such as the inventory turnover ratio and the days sales outstanding ratio, measure a company’s efficiency in using its assets.

4. How do you use financial modeling to make business decisions?

Financial modeling is a powerful tool that can be used to make informed business decisions. Financial models can be used to forecast future financial performance, evaluate the impact of different decisions, and optimize financial strategies. Some of the most common uses of financial modeling include:

- Forecasting future financial performance, such as revenue, expenses, and profits.

- Evaluating the impact of different decisions, such as pricing changes, product launches, and marketing campaigns.

- Optimizing financial strategies, such as capital budgeting, debt financing, and investment decisions.

5. What are the key challenges that you face in your role as a Financial Coordinator?

Some of the key challenges that I face in my role as a Financial Coordinator include:

- Keeping up with the constant changes in financial reporting regulations.

- Managing the day-to-day financial operations of the company.

- Ensuring that the company’s financial statements are accurate and reliable.

- Working with a variety of stakeholders, including senior management, auditors, and investors.

- Staying abreast of new developments in financial technology.

6. What are your strengths and weaknesses as a Financial Coordinator?

Strengths:

- Strong analytical and problem-solving skills.

- Excellent communication and interpersonal skills.

- Deep understanding of financial reporting regulations.

- Proven track record of success in managing financial operations.

- Ability to work independently and as part of a team.

Weaknesses:

- Can be a bit detail-oriented at times.

- Not always comfortable with public speaking.

7. What are your career goals?

My career goal is to become a CFO. I believe that my skills and experience as a Financial Coordinator have prepared me for this role. I am confident that I have the necessary knowledge and skills to lead a finance team and contribute to the success of a company.

8. Why are you interested in this role?

I am interested in this role because it is a great opportunity to use my skills and experience to make a positive impact on a company. I am particularly interested in the company’s commitment to innovation and growth. I believe that my skills and experience can help the company achieve its goals.

9. What is your salary expectation?

My salary expectation is in line with the market rate for similar roles. I am confident that I can bring value to the company and am willing to negotiate a salary that is fair and commensurate with my experience and skills.

10. Do you have any questions for me?

I do have a few questions:

- What are the biggest challenges facing the company right now?

- What are the company’s goals for the next year?

- How do you see the role of the Financial Coordinator evolving in the future?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Coordinator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Coordinator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Coordinators play a critical role in the financial operations of an organization. Their responsibilities encompass a wide range of tasks, including:

1. Financial Planning and Budgeting

Develop and implement financial plans and budgets that align with organizational goals.

- Analyze financial data to identify trends, forecast financial performance, and develop strategies to achieve financial objectives.

- Prepare and present financial reports to senior management and stakeholders, including income statements, balance sheets, and cash flow statements.

2. Financial Analysis and Reporting

Monitor and analyze financial performance, identify areas for improvement, and make recommendations for corrective actions.

- Conduct financial audits and reviews to ensure compliance with accounting principles and regulations.

- Manage relationships with banks and other financial institutions to secure funding and negotiate favorable terms.

3. Investment Management

Manage investment portfolios to maximize returns and minimize risk.

- Research and evaluate investment opportunities, including stocks, bonds, and real estate.

- Recommend investment strategies and make investment decisions based on market analysis and risk tolerance.

4. Risk Management

Identify, assess, and mitigate financial risks to protect the organization.

- Develop and implement risk management policies and procedures.

- Monitor financial risks, such as currency fluctuations, interest rate changes, and credit defaults, and take appropriate actions to mitigate potential losses.

Interview Tips

Preparing thoroughly for an interview can significantly increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Company and Position

Familiarize yourself with the company’s history, financial performance, industry, and culture. Research the specific job responsibilities and qualifications required for the Financial Coordinator position.

- Visit the company’s website, LinkedIn page, and Glassdoor reviews for insights into the company’s values and work environment.

- Read industry publications and financial news to stay up-to-date on the latest trends and best practices.

2. Practice Common Interview Questions

Anticipate common interview questions and prepare thoughtful responses that highlight your skills and experience.

- Tell me about your experience in financial planning and budgeting.

- How do you conduct financial analysis and interpret financial data?

- What investment strategies have you used in the past?

- How do you identify and mitigate financial risks?

3. Showcase Your Technical Skills

Demonstrate your proficiency in financial modeling, accounting, and data analysis. Discuss specific projects or assignments where you utilized these skills to achieve positive outcomes.

- Highlight your experience with financial software such as SAP, Oracle, or QuickBooks.

- Provide examples of financial models you have developed to analyze financial performance and support decision-making.

4. Emphasize Communication and Interpersonal Skills

Financial Coordinators often work with various stakeholders, including senior management, finance teams, and external financial institutions. Showcase your ability to communicate effectively, build rapport, and influence decision-making.

- Discuss your experience presenting financial data and insights to stakeholders in a clear and engaging manner.

- Highlight your ability to work effectively in a team environment and collaborate with colleagues to achieve shared goals.

5. Ask Thoughtful Questions

Asking thoughtful questions at the end of the interview demonstrates your interest in the position and the company. Prepare questions that show you have done your research and are genuinely interested in the organization’s goals and future plans.

- Inquire about the company’s current financial initiatives and priorities.

- Ask about the organization’s culture and its approach to employee development.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Coordinator interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!