Are you gearing up for an interview for a Financial Counselor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Financial Counselor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

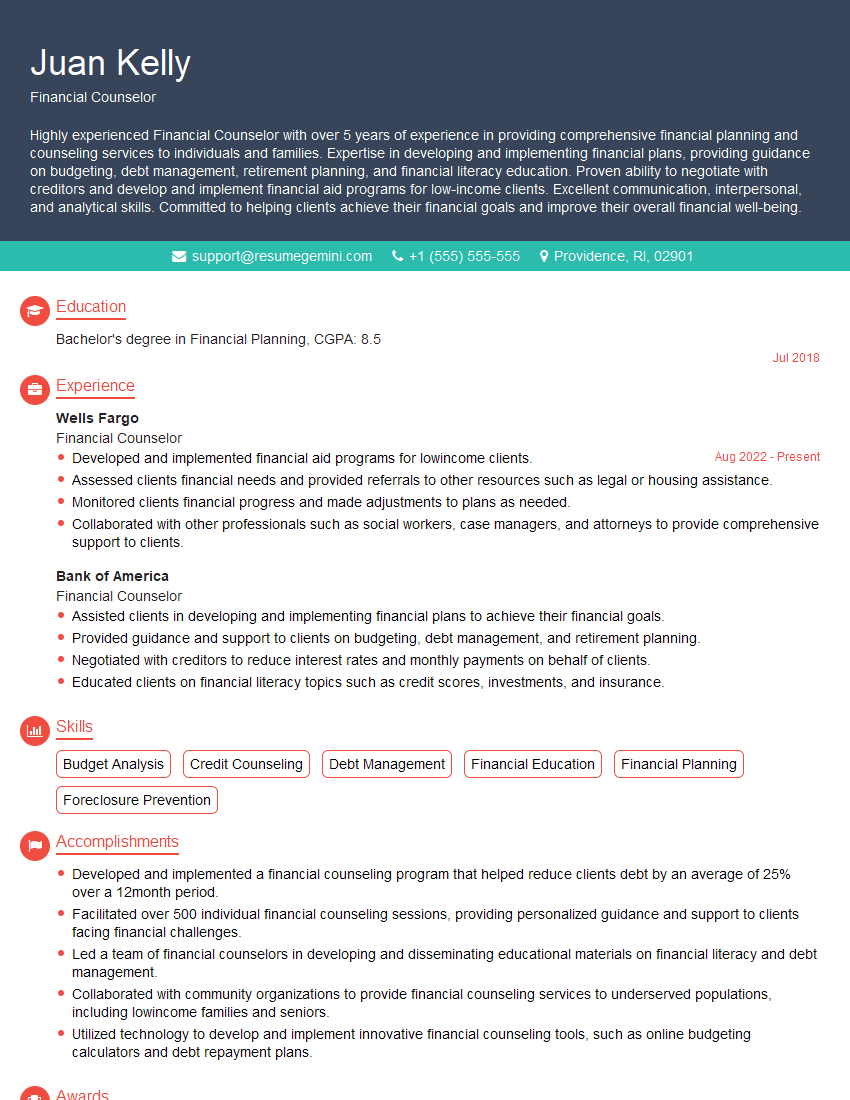

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Counselor

1. How would you assess a client’s financial situation?

To assess a client’s financial situation, I would:

- Gather information about their income, expenses, assets, and debts.

- Review their financial statements and tax returns.

- Discuss their financial goals and objectives.

- Analyze their risk tolerance and investment horizon.

- Identify any financial challenges or opportunities.

2. What are some of the most common financial challenges that clients face?

Debt management

- High credit card balances

- Student loan debt

- Medical debt

Retirement planning

- Saving enough money

- Choosing the right investments

- Planning for healthcare expenses

Investment management

- Building a diversified portfolio

- Managing risk

- Maximizing returns

3. What are some of the most important qualities of a successful financial counselor?

The most important qualities of a successful financial counselor include:

- Technical expertise: A deep understanding of financial planning principles, investment strategies, and tax laws.

- Communication skills: The ability to clearly explain complex financial concepts to clients in a way that they can understand.

- Empathy: The ability to understand and relate to clients’ financial concerns and goals.

- Ethics: A commitment to providing objective, unbiased advice that is in the best interests of clients.

4. What are some of the ethical considerations that financial counselors must be aware of?

Financial counselors must be aware of the following ethical considerations:

- Conflicts of interest: Financial counselors must avoid any situations where their personal interests could conflict with the interests of their clients.

- Confidentiality: Financial counselors must keep client information confidential.

- Suitability: Financial counselors must recommend investments that are suitable for their clients’ risk tolerance and investment objectives.

- Fiduciary duty: Financial counselors must act in the best interests of their clients.

5. What are some of the latest trends in financial counseling?

Some of the latest trends in financial counseling include:

- The use of technology: Financial counselors are increasingly using technology to provide remote counseling services and to manage client information.

- The focus on behavioral finance: Financial counselors are increasingly recognizing the importance of behavioral finance, which studies the psychological factors that influence financial decision-making.

- The rise of robo-advisors: Robo-advisors are automated investment platforms that provide personalized investment advice and portfolio management services.

6. What are the different types of financial counseling services that you offer?

I offer a variety of financial counseling services, including:

- Budgeting and debt management

- Retirement planning

- Investment management

- Education planning

- Estate planning

7. What is your fee structure?

My fee structure is based on the following factors:

- The type of service provided

- The complexity of the client’s financial situation

- The amount of time required to provide the service

8. What are your qualifications?

I have a bachelor’s degree in finance from a reputable university and I am a Certified Financial Planner (CFP). I have also worked as a financial counselor for the past 5 years.

9. What is your experience in working with clients from diverse backgrounds?

I have worked with clients from a variety of backgrounds, including:

- Different income levels

- Different ages

- Different ethnicities

- Different cultures

10. What is your approach to working with clients?

My approach to working with clients is based on the following principles:

- I believe that every client is unique and has their own individual financial goals and objectives.

- I take a holistic approach to financial planning, which means that I consider all aspects of a client’s financial situation.

- I believe that it is important to educate clients about their finances so that they can make informed decisions.

- I am committed to providing objective, unbiased advice that is in the best interests of my clients.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Counselors are financial professionals who provide guidance and support to individuals and families on various financial matters. They analyze financial situations, identify challenges and opportunities, and develop and implement financial plans to help clients achieve their financial goals.

1. Financial Assessment and Planning

Assess clients’ financial situation, including income, expenses, assets, and liabilities.

- Develop personalized financial plans tailored to clients’ unique needs and goals.

2. Debt Management

Provide guidance on debt repayment strategies, including consolidation, negotiation, and budgeting.

- Help clients create and stick to debt repayment plans.

3. Budgeting and Cash Flow Management

Create and maintain income and expense budgets for clients.

- Analyze spending patterns and identify areas for improvement.

- Develop strategies to optimize cash flow and reduce expenses.

4. Credit Counseling

Provide advice on credit management, including credit repair and improvement.

- Review credit reports and assist clients in disputing errors.

- Develop plans to improve credit scores.

5. Retirement Planning

Help clients plan for retirement, including retirement savings and investment strategies.

- Analyze retirement goals and risk tolerance.

6. Education and Advocacy

Provide financial education and support to clients.

- Explain complex financial concepts in a clear and understandable way.

- Advocates for clients’ financial interests.

Interview Tips

Preparing thoroughly for a financial counselor interview is crucial to showcase your qualifications and impress the hiring manager. Here are some tips to help you ace the interview:

1. Research the Company and Position

Familiarize yourself with the company’s mission, values, and services. Research the specific role and understand its responsibilities and expectations.

- Review the job description carefully and identify the key skills and experience they are seeking.

- Visit the company’s website, read industry articles, and connect with employees on LinkedIn to gain insights into the company culture and work environment.

2. Practice Your Answers

Anticipate common interview questions related to financial counseling and prepare your answers ahead of time.

- Use the STAR method (Situation, Task, Action, Result) to structure your responses and provide specific examples of your skills.

- Practice answering questions out loud to build confidence and ensure your responses are clear and concise.

3. Showcase Your Skills and Experience

Highlight your relevant skills and experience in financial counseling, including your ability to:

- Analyze financial statements

- Develop financial plans

- Provide guidance on debt management

- Educate clients on financial matters

- Maintain confidentiality

4. Demonstrate Your Passion

Express your passion for financial counseling and helping others achieve their financial goals.

- Share examples of how you have helped clients improve their financial situation.

- Emphasize your commitment to providing ethical and compassionate guidance.

5. Ask Thoughtful Questions

Asking thoughtful questions shows that you are engaged in the interview and interested in the position.

- Prepare questions about the company’s approach to financial counseling, their target clientele, and opportunities for professional development.

- Avoid asking questions that can be easily answered by referring to the job description or company website.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Counselor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!