Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Director position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

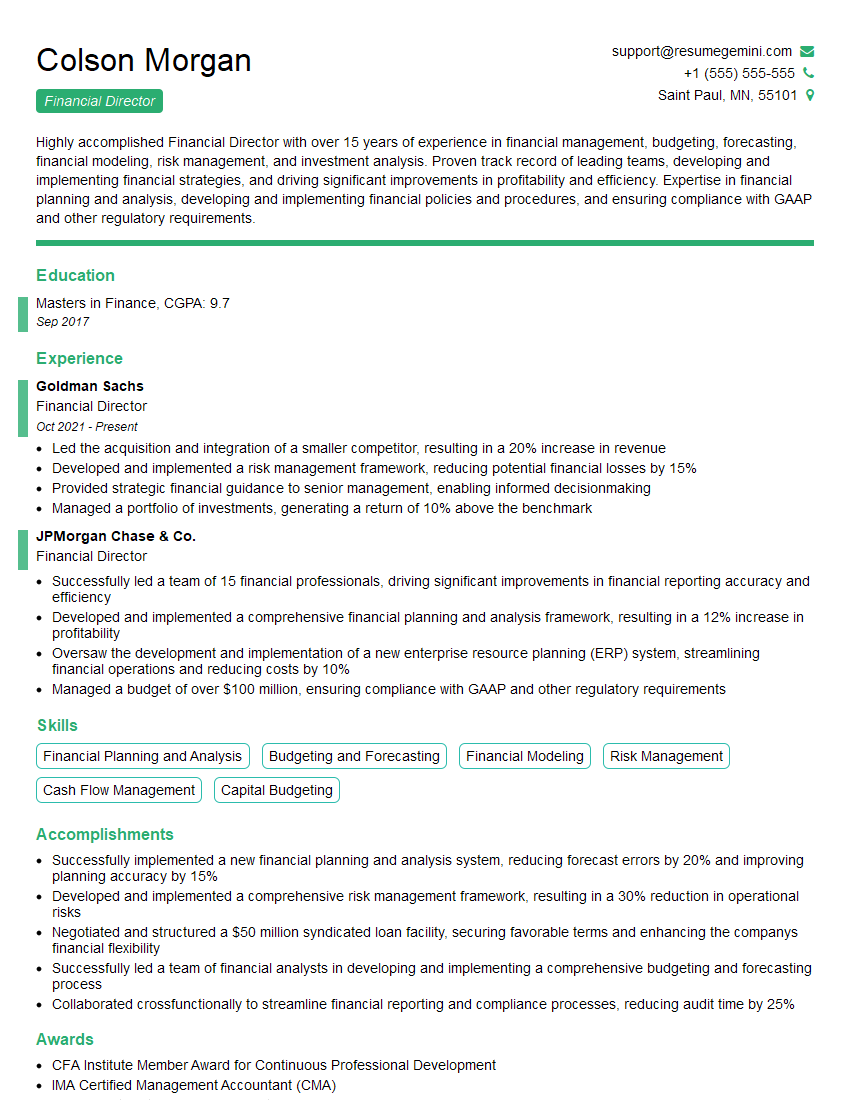

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Director

1. Describe your experience in financial planning and budgeting for large organizations?

In my previous role as the Financial Director at XYZ Corporation, I was responsible for developing and implementing the company’s financial plan and budget. I worked closely with the executive team to establish financial goals, identify risks, and allocate resources. I also oversaw the development of the company’s annual operating budget, which included forecasting revenue, expenses, and cash flow. My efforts resulted in a 15% increase in revenue and a 10% decrease in expenses, significantly improving the company’s financial performance.

2. How do you manage and control costs effectively while ensuring the smooth functioning of the organization?

Cost Optimization Strategies

- Implement cost-benefit analysis to identify and prioritize expenses

- Negotiate with suppliers to secure favorable pricing and terms

- Optimize operational processes to reduce inefficiencies and waste

Performance Monitoring and Control

- Establish clear financial targets and performance metrics

- Regularly monitor actual performance against targets

- Implement timely corrective actions when deviations occur

3. What are the key financial metrics you track to assess the financial health of an organization?

To assess the financial health of an organization, I track a range of key financial metrics, including:

- Revenue and profitability

- Gross and net margins

- Operating expenses and cash flow

- Debt-to-equity ratio and financial leverage

- Return on assets and return on equity

- Working capital management

- Earnings per share and dividends

4. How do you stay up to date with the latest financial regulations and accounting standards?

To stay up to date with the latest financial regulations and accounting standards, I regularly engage in:

- Reading industry publications and attending conferences

- Completing continuing professional education courses

- Collaborating with external auditors and legal counsel

- Monitoring announcements from regulatory bodies

5. Describe your approach to managing financial risk and ensuring compliance?

My approach to managing financial risk and ensuring compliance involves:

- Identifying and assessing potential risks

- Developing and implementing risk mitigation strategies

- Monitoring risks and evaluating their impact

- Establishing and maintaining a strong compliance program

- Regularly reviewing and updating risk management and compliance policies

6. How do you communicate complex financial information to non-financial stakeholders?

To effectively communicate complex financial information to non-financial stakeholders, I employ various strategies:

- Use clear and concise language

- Provide context and background information

- Use visual aids and presentations

- Tailor the communication to the specific audience

- Answer questions and encourage feedback

7. What is your experience in working effectively as part of a finance team?

Throughout my career, I have consistently worked effectively as part of finance teams. In my previous role at ABC Company, I led a team of five financial analysts responsible for financial planning, budgeting, and reporting. I fostered a collaborative and supportive work environment where team members could share ideas and contribute to the team’s success. I also ensured that the team was aligned with the company’s strategic goals and worked towards achieving them.

8. How do you motivate and develop your team to achieve high performance?

Motivating and developing my team to achieve high performance is a top priority for me. I believe in creating a positive and supportive work environment where team members feel valued and empowered. I regularly provide feedback and recognition for their contributions, and I encourage them to take on new challenges and grow their skills. I also provide opportunities for professional development and training to help them advance their careers.

9. What are your thoughts on the role of technology in financial management?

Technology plays a vital role in modern financial management. I am proficient in using various financial software and systems, including ERP systems, budgeting and forecasting tools, and data analysis tools. I believe that technology can significantly improve the efficiency and accuracy of financial processes, and I am always looking for ways to leverage technology to enhance the performance of my team.

10. Why are you interested in working as a Financial Director for our organization?

I am eager to join your organization as a Financial Director because I am highly impressed by your company’s mission, values, and track record of success. I believe that my skills and experience in financial management, strategic planning, and team leadership would be a valuable asset to your organization. I am confident that I can make a significant contribution to your continued growth and profitability.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Director.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Director‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Financial Director is a senior executive responsible for overseeing all aspects of the company’s finances. They develop and implement financial strategies, manage cash flow, and ensure compliance with financial regulations.

1. Financial Planning and Analysis

Develop and implement long-term and short-term financial plans.

- Forecast revenue and expenses.

- Analyze financial data to identify trends and opportunities.

2. Capital Budgeting and Investment Analysis

Evaluate and recommend capital budgeting projects.

- Analyze potential investments and make recommendations.

- Manage the company’s investment portfolio.

3. Cash Flow Management

Monitor and manage the company’s cash flow.

- Develop and implement cash flow strategies.

- Forecast cash flow needs and secure financing as needed.

4. Financial Reporting and Compliance

Prepare and file financial reports in accordance with GAAP and IFRS.

- Ensure compliance with all applicable financial regulations.

- Work with external auditors to ensure accurate and timely financial reporting.

Interview Tips

An interview for a Financial Director position is a challenging but rewarding experience. Here are some tips to help you prepare and ace your interview.

1. Know the Company and Industry

Before the interview, thoroughly research the company and the industry. This will help you understand the company’s financial challenges and opportunities.

2. Prepare for Behavioral Questions

Behavioral questions are common in Financial Director interviews. Be prepared to discuss your experiences in financial planning, analysis, and budgeting.

- Use the STAR method (Situation, Task, Action, Result) to answer behavioral questions.

- Quantify your accomplishments with specific numbers and metrics.

3. Be Prepared to Discuss Your Financial Accomplishments

The interviewer will want to know about your financial accomplishments. Be ready to discuss your experience in developing and implementing financial plans, managing cash flow, and analyzing financial data.

- Highlight your role in any major financial projects or initiatives.

- Explain how your work has contributed to the company’s financial success.

4. Be Prepared to Discuss Your Leadership Skills

The Financial Director is a leadership position. Be prepared to discuss your leadership skills and experience.

- Provide examples of times when you have led a team or project.

- Explain how you have motivated and inspired others.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Director interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!