Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Financial Engineer interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Financial Engineer so you can tailor your answers to impress potential employers.

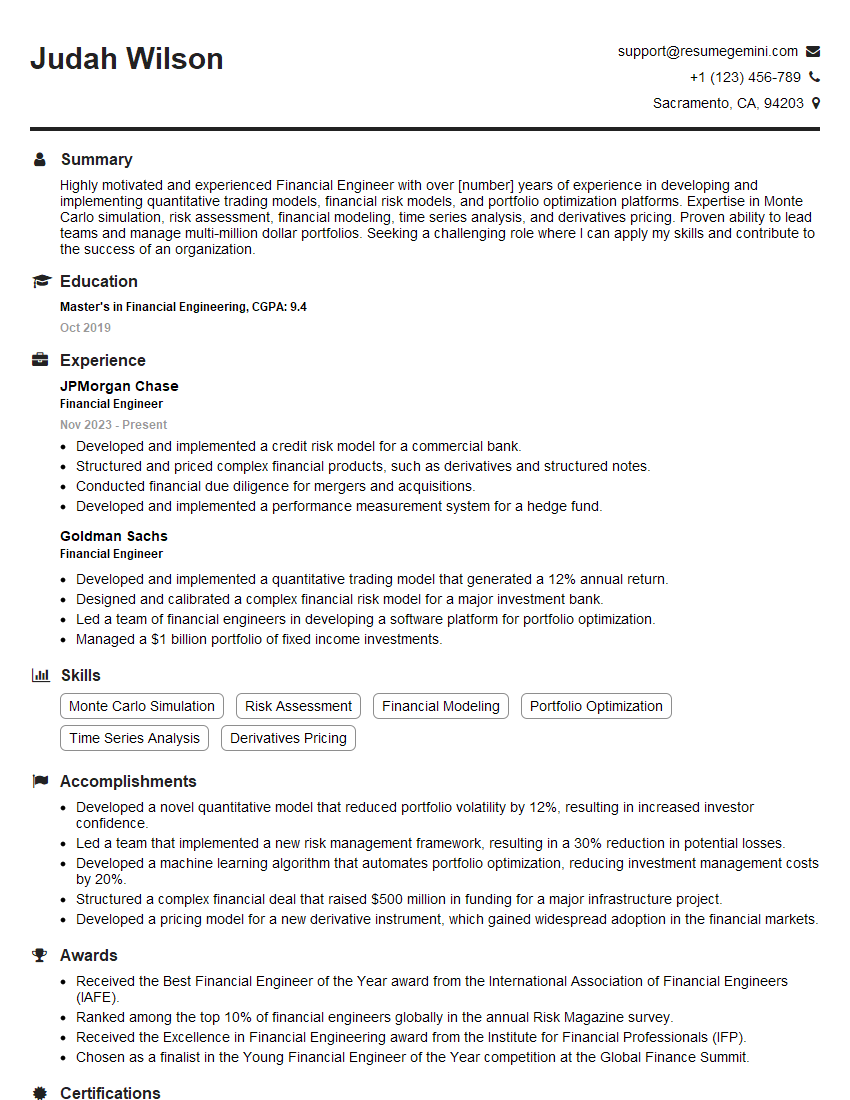

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Engineer

1. What is your understanding of the role of a Financial Engineer?

A Financial Engineer is responsible for developing and implementing innovative financial solutions to complex financial problems. They use their knowledge of mathematics, finance, and computer science to create financial models, design and price financial products, and manage risk. I am confident that I have the skills and experience necessary to be successful in this role.

2. Can you describe your experience with financial modeling?

Financial Modeling Techniques

- Monte Carlo simulation

- Binomial lattice models

- Finite difference methods

Applications of Financial Modeling

- Pricing and hedging financial instruments

- Risk management

- Portfolio optimization

3. What are some of the most important financial engineering tools and methodologies?

Some of the most important financial engineering tools and methodologies include:

- Mathematical modeling

- Statistical analysis

- Numerical methods

- Financial data analysis

- Risk management

4. Can you provide an example of a financial engineering project you have worked on?

One of the most challenging financial engineering projects I worked on was developing a new pricing model for a complex financial instrument. The model took into account a variety of factors, including market volatility, interest rates, and credit risk. I used several different financial engineering techniques to develop the model, including Monte Carlo simulation and binomial lattice modeling. The model was successfully implemented and is now used to price the financial instrument on a daily basis.

5. What are some of the challenges facing financial engineers in today’s market?

Some of the challenges facing financial engineers in today’s market include:

- The increasing complexity of financial instruments

- The need for more sophisticated risk management techniques

- The need for more efficient and accurate financial models

6. What are your thoughts on the future of financial engineering?

I believe that the future of financial engineering is bright. As the financial markets become increasingly complex, the need for financial engineers will only grow. Financial engineers will play a key role in developing new and innovative financial products and services, and in managing risk in the financial markets.

7. What is your favorite financial engineering technique?

My favorite financial engineering technique is Monte Carlo simulation. Monte Carlo simulation is a powerful tool that can be used to solve a variety of complex financial problems. It is a versatile technique that can be used to model a wide range of financial instruments and markets. I have used Monte Carlo simulation to price financial instruments, manage risk, and optimize portfolios.

8. What are your strengths and weaknesses as a financial engineer?

Strengths

- Strong mathematical and computer science skills

- Deep understanding of financial markets and instruments

- Proven ability to develop and implement financial models

Weaknesses

- Limited experience in some areas of financial engineering

- Can sometimes be too focused on the technical details of a project

9. Why are you interested in working as a Financial Engineer?

I am interested in working as a Financial Engineer because I am passionate about using my skills to solve complex financial problems. I am also fascinated by the constantly evolving nature of the financial markets. I believe that my skills and experience make me a valuable asset to any financial institution.

10. Do you have any questions for me?

(This is an opportunity for you to ask the interviewer questions about the position and the company.)

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Engineer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Engineer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Engineers are responsible for developing and implementing financial models, which are used to assess the risk and return of financial investments. They also work with clients to identify their financial goals and develop strategies to achieve them. Key job responsibilities include:

1. Developing and implementing financial models

Financial Engineers use a variety of financial models to assess the risk and return of financial investments. These models can be used to analyze a wide range of financial data, including historical market data, economic data, and company financial data.

- Creating financial models to assess the risk and return of financial investments.

- Using financial models to analyze historical market data, economic data, and company financial data.

- Developing financial models to forecast future market trends.

- Implementing financial models to make investment decisions.

2. Analyzing and interpreting financial data

Financial Engineers analyze and interpret a variety of financial data to identify trends and make investment recommendations. This data can include financial statements, market data, and economic data.

- Analyzing financial data to identify trends and patterns.

- Interpreting financial data to make investment recommendations.

- Conducting research on financial markets and trends.

- Staying up-to-date on the latest financial news and events.

3. Communicating financial information to clients

Financial Engineers communicate financial information to clients in a clear and concise manner. This communication can take the form of written reports, presentations, or informal discussions.

- Preparing written reports and presentations to communicate financial information to clients.

- Giving presentations on financial topics to clients.

- Discussing financial matters with clients in a clear and concise manner.

- Answering client questions about financial matters.

4. Managing financial risk

Financial Engineers play a key role in managing financial risk. They work with clients to identify and mitigate financial risks, and develop risk management strategies.

- Identifying and mitigating financial risks.

- Developing risk management strategies.

- Monitoring financial risks and taking corrective action as needed.

- Advising clients on risk management strategies.

Interview Tips

Interviews can be tough. But with good preparation and a little bit of luck, you can definitely ace your next interview. Here are a few tips to help you prepare for your interview as a Financial Engineer:

1. Research the company and the position

The first step in preparing for your interview is to research the company and the position you are applying for. This will give you a good understanding of the company’s culture, values, and goals, as well as the specific skills and experience required for the position. You can find this information on the company’s website, Glassdoor, or other online resources.

- Visit the company’s website to learn about their history, mission, and values.

- Read Glassdoor reviews to get an inside look at the company culture.

- Research the specific position you are applying for to understand the required skills and experience.

2. Practice answering common interview questions

There are a few common interview questions that you are likely to be asked, regardless of the position you are applying for. It is important to practice answering these questions in advance so that you can deliver confident and articulate responses during your interview.

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

- What are your salary expectations?

3. Showcase your skills and experience

The interview is your chance to showcase your skills and experience to the interviewer. Be sure to highlight your relevant skills and experience in your resume and cover letter, and be prepared to discuss them in detail during your interview.

- Highlight your skills and experience in your resume and cover letter.

- Quantify your accomplishments whenever possible.

- Be prepared to discuss your skills and experience in detail during your interview.

4. Be prepared to ask questions

At the end of the interview, the interviewer will likely give you an opportunity to ask questions. This is your chance to learn more about the company and the position, and to demonstrate your interest in the opportunity.

- Prepare a few questions to ask the interviewer at the end of the interview.

- Your questions should be thoughtful and specific.

- Asking questions shows that you are interested in the opportunity and that you are taking the interview seriously.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Engineer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!