Are you gearing up for a career in Financial Examiner? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Financial Examiner and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

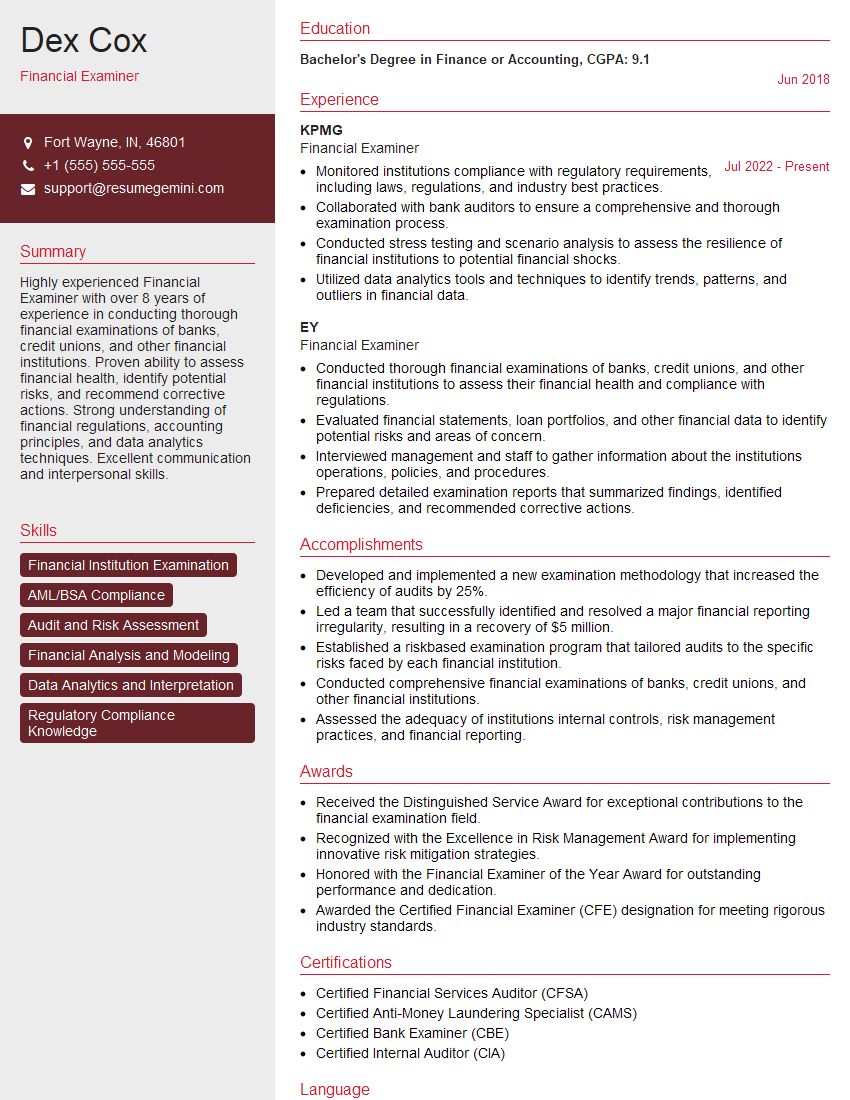

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Examiner

1. How do you assess the financial health of a company?

To assess the financial health of a company, I perform a comprehensive analysis of its financial statements, including the balance sheet, income statement, and cash flow statement. I look at key financial ratios, such as the debt-to-equity ratio, return on assets, and profit margin, to evaluate the company’s solvency, profitability, and overall financial performance. Additionally, I examine the company’s financial trends over time, as well as its industry and competitive landscape, to gain a deeper understanding of its financial position.

2. What are the common red flags that you look for when reviewing financial statements?

Some common red flags that I look for when reviewing financial statements include:

- Unusual or unexplained fluctuations in financial ratios

- Significant differences between the company’s financial statements and its public disclosures

- Large amounts of off-balance sheet financing

- Rapid growth in accounts receivable or inventory

- Consistent underperformance relative to industry peers

3. How do you determine whether a company is overvalued or undervalued?

To determine whether a company is overvalued or undervalued, I use a variety of valuation techniques, including:

- Discounted cash flow analysis

- Comparable company analysis

- Asset-based valuation

I consider a range of factors, such as the company’s financial performance, growth prospects, and industry dynamics, to arrive at a fair value estimate.

4. What are the key risks that you consider when evaluating a company’s financial performance?

The key risks that I consider when evaluating a company’s financial performance include:

- Credit risk

- Market risk

- Liquidity risk

- Operational risk

- Regulatory risk

I assess the company’s exposure to these risks and evaluate the adequacy of its risk management strategies.

5. How do you communicate your findings to stakeholders?

I communicate my findings to stakeholders in a clear and concise manner, tailored to their specific needs and understanding. I use a variety of communication methods, including written reports, presentations, and meetings, to ensure that my findings are effectively conveyed.

6. What are the ethical considerations that you take into account when conducting financial examinations?

I adhere to the highest ethical standards in all aspects of my work. I maintain confidentiality, objectivity, and integrity throughout the examination process. I avoid any conflicts of interest and disclose any potential conflicts to stakeholders.

7. How do you stay up-to-date with the latest developments in financial regulation and accounting standards?

I continually update my knowledge and skills by reading industry publications, attending conferences, and completing professional development courses. I am committed to staying abreast of the latest developments in financial regulation and accounting standards to ensure that my examinations are conducted in accordance with the most current requirements.

8. What are the challenges that you have faced in your previous role as a financial examiner?

In my previous role as a financial examiner, I faced several challenges, including:

- Evaluating the financial health of companies in complex and rapidly changing industries

- Uncovering financial irregularities and identifying potential risks

- Communicating complex financial information to stakeholders with diverse backgrounds and knowledge levels

I successfully overcame these challenges by leveraging my technical expertise, analytical skills, and communication abilities.

9. What are your strengths and weaknesses as a financial examiner?

My strengths as a financial examiner include:

- Strong technical expertise in financial analysis and accounting standards

- Exceptional analytical and problem-solving skills

- Excellent communication and interpersonal skills

My area for improvement is in developing my expertise in specific industry sectors.

10. Why are you interested in this financial examiner position?

I am highly interested in this financial examiner position because it aligns perfectly with my skills, experience, and career goals. I am eager to apply my expertise to contribute to the success of your organization and to further my professional development in the field of financial examination.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Examiners play a crucial role in the financial industry by ensuring compliance and safeguarding financial institutions. Their key responsibilities include:

1. Conduct Examinations and Investigations

Examining financial institutions, including banks, credit unions, and investment firms, to assess their compliance with regulations and internal policies.

- Reviewing financial records, performing interviews, and analyzing data to identify any irregularities or deviations from established standards.

- Investigating potential fraudulent activities, suspicious transactions, and other financial misconduct.

2. Evaluate Financial Condition and Risk Management

Assessing the financial health and risk management practices of financial institutions.

- Evaluating financial ratios, liquidity, profitability, and capital adequacy to determine financial stability.

- Reviewing risk management policies, internal controls, and stress testing scenarios to assess the institution’s ability to mitigate risks.

3. Issue Reports and Recommendations

Preparing and presenting examination reports that document the findings and provide recommendations for improvements.

- Communicating examination results to management, boards of directors, and regulatory agencies.

- Developing recommendations for corrective actions, regulatory enforcement, or other necessary measures to address identified deficiencies.

4. Collaborate and Coordinate

Working closely with other examiners, accountants, attorneys, and regulatory agencies to share information, coordinate investigations, and ensure a comprehensive approach to financial supervision.

- Maintaining open lines of communication with financial institutions to facilitate the examination process and address any concerns.

- Participating in industry conferences and training programs to stay up-to-date on financial regulations and best practices.

Interview Tips

To ace an interview for a Financial Examiner position, it is essential to prepare thoroughly and showcase your skills and qualifications.

1. Research the Industry and Institution

Familiarize yourself with the latest financial regulations, industry trends, and the specific institution you are applying for. This demonstrates your interest in the field and your ability to stay informed.

- Read industry publications, attend webinars, and follow regulatory agencies on social media.

- Visit the institution’s website to learn about its business model, financial performance, and regulatory history.

2. Highlight Your Technical Skills

Emphasize your proficiency in relevant software, analytical techniques, and regulatory knowledge. Provide specific examples of how you have applied these skills in previous roles.

- Discuss your experience using financial analysis software, such as Excel, SAS, or Tableau.

- Explain how you have used data analytics to identify trends, patterns, and anomalies in financial data.

3. Demonstrate Soft Skills

Financial Examiners need excellent communication, interpersonal, and problem-solving skills. Share experiences that showcase these abilities.

- Describe how you effectively communicated complex financial concepts to non-technical audiences.

- Provide examples of situations where you successfully resolved conflicts or addressed sensitive issues in a professional manner.

4. Prepare for Common Interview Questions

Review common interview questions for Financial Examiners and prepare thoughtful responses. These questions may include:

- Tell me about your experience in financial regulation and compliance.

- Describe your understanding of Basel III regulations.

- How do you approach financial risk assessment and mitigation?

- Can you provide an example of a successful financial investigation you conducted?

5. Practice and Seek Feedback

Conduct mock interviews with friends, family members, or a career counselor to practice your responses and receive feedback. This will help you improve your delivery and increase your confidence.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Examiner interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.