Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Institution Assistant Branch Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

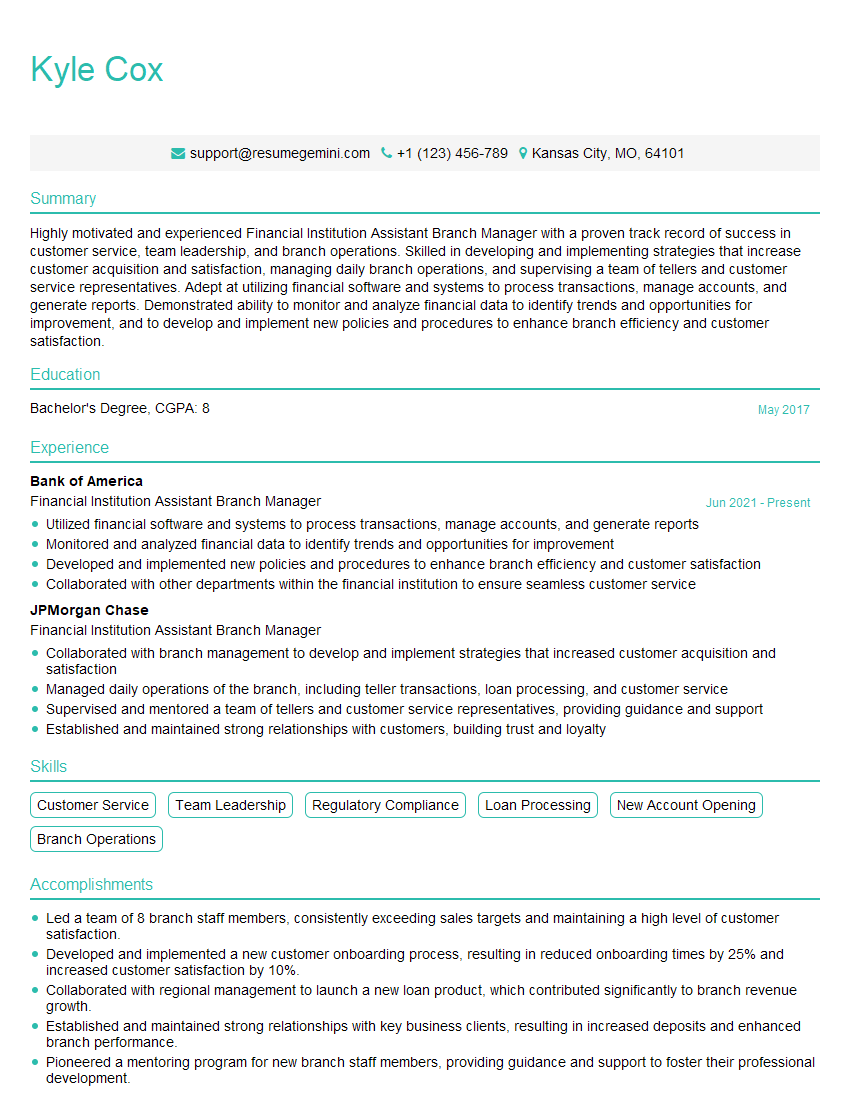

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Institution Assistant Branch Manager

1. What are the key responsibilities of a Financial Institution Assistant Branch Manager?

As a Financial Institution Assistant Branch Manager, my primary responsibilities would revolve around supporting the branch operations and providing exceptional customer service:

- Assist the Branch Manager in the daily operations of the branch, including managing staff, overseeing financial transactions, and ensuring compliance with regulations.

- Provide comprehensive customer service, resolving inquiries, opening accounts, processing transactions, and offering financial advice.

- Monitor and manage branch finances, including cash flow, deposits, and withdrawals.

- Identify and develop sales opportunities to enhance revenue generation.

- Maintain a safe and secure work environment, ensuring compliance with security protocols and risk management practices.

2. How would you approach developing and implementing a branch marketing plan?

Target Market Analysis

- Conduct thorough research to identify the demographics, financial needs, and banking preferences of the local community.

- Determine the target audience for the branch’s products and services.

Marketing Strategies

- Develop targeted marketing campaigns through various channels, such as online advertising, social media, and local partnerships.

- Highlight the branch’s unique offerings, exceptional customer service, and competitive rates.

- Host community events and workshops to build relationships and generate leads.

Performance Measurement

- Establish clear performance metrics to track the effectiveness of the marketing plan.

- Regularly monitor results and make adjustments as needed to optimize campaigns.

3. Describe your experience in managing and developing a high-performing team in a financial institution setting.

In my previous role as a Financial Institution Assistant Branch Manager, I was responsible for leading and developing a team of six employees:

- I established clear performance expectations, provided regular feedback, and recognized and rewarded achievements.

- I fostered a positive and collaborative work environment, encouraging teamwork and open communication.

- I provided training and development opportunities to enhance team members’ skills and knowledge.

- Through effective leadership and motivation, I consistently exceeded team performance targets and maintained a high level of customer satisfaction.

4. How do you stay up-to-date on regulatory changes and industry best practices?

To stay abreast of regulatory changes and industry best practices, I actively engage in the following activities:

- Attend industry conferences, workshops, and seminars.

- Subscribe to industry publications and newsletters.

- Network with other professionals in the field and participate in professional organizations.

- Regularly review and study regulatory updates and guidance from governing bodies.

- Complete continuing education courses and certifications to enhance my knowledge and skills.

5. How would you approach risk management in a financial institution branch?

My approach to risk management in a financial institution branch would involve the following steps:

- Identify potential risks and vulnerabilities, including operational, financial, and compliance risks.

- Assess the likelihood and impact of identified risks.

- Develop and implement risk mitigation strategies, such as establishing internal controls, implementing security measures, and providing staff training.

- Monitor risks on an ongoing basis and make adjustments to risk management strategies as needed.

- Report risk-related incidents and concerns to the Branch Manager and compliance officers.

6. What are the key performance indicators (KPIs) you would use to measure the success of a branch?

The following KPIs would be instrumental in measuring the success of a branch:

- Customer satisfaction scores (CSAT)

- Sales revenue and account growth

- Branch profitability and operational costs

- Compliance with regulations and industry standards

- Employee turnover and staff development

- Market share and customer acquisition

7. How would you handle a difficult customer interaction involving a loan application denial?

When dealing with a difficult customer interaction regarding a loan application denial, I would approach the situation with empathy and professionalism:

- Acknowledge the customer’s disappointment and frustration.

- Explain the reasons for the denial clearly and concisely.

- Provide alternative solutions or resources to support the customer’s financial needs.

- Maintain a respectful and non-judgmental attitude throughout the interaction.

- Follow up with the customer to provide additional support and answer any further questions.

8. Describe your experience in implementing new technology or processes in a financial institution branch.

In my previous role, I played a key role in implementing a new customer relationship management (CRM) system in our branch:

- I worked with the IT team to configure and customize the system to meet our specific needs.

- I trained staff on the new system and provided ongoing support.

- I monitored the system’s usage and identified areas for improvement.

- Through effective implementation, the CRM system significantly enhanced our customer service capabilities and increased efficiency.

9. What are your strategies for identifying and mitigating fraud in financial transactions?

To identify and mitigate fraud in financial transactions, I employ the following strategies:

- Stay informed about common fraud schemes and industry trends.

- Review transactions for unusual patterns or inconsistencies.

- Utilize fraud detection software and tools.

- Educate customers about fraud prevention measures.

- Collaborate with law enforcement and regulatory bodies to report and investigate suspected fraud.

10. How would you approach the development and maintenance of relationships with commercial clients?

To develop and maintain relationships with commercial clients, I would:

- Proactively reach out to potential and existing clients to understand their financial needs.

- Provide personalized financial advice and solutions tailored to their specific requirements.

- Build trust and rapport through regular communication and follow-ups.

- Host client appreciation events and workshops to foster stronger relationships.

- Monitor client accounts and make proactive recommendations to optimize their financial performance.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Institution Assistant Branch Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Institution Assistant Branch Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of a Financial Institution Assistant Branch Manager

An Assistant Branch Manager plays a crucial role in the day-to-day operations of a financial institution branch. Their key responsibilities encompass a wide range of tasks, including:

1. Customer Service and Relationship Management

Providing exceptional customer service, addressing inquiries, resolving complaints, and building strong customer relationships.

- Handling cash transactions, opening accounts, and processing loan applications

- Maintaining a thorough understanding of financial products and services to provide informed advice to customers

2. Branch Operations Management

Supervising and coordinating branch activities, ensuring efficient operations and compliance with regulations.

- Managing staffing, scheduling, and training of branch personnel

- Implementing and maintaining operational policies and procedures

3. Sales and Marketing

Generating new business and promoting financial products and services to customers.

- Identifying and targeting potential customers for cross-selling opportunities

- Developing and implementing marketing strategies to enhance branch visibility and attract new accounts

4. Risk Management and Compliance

Ensuring compliance with regulatory guidelines, identifying and mitigating risks, and implementing internal controls.

- Monitoring branch activities for compliance with anti-money laundering and other financial regulations

- Developing and implementing policies and procedures to minimize operational risks

Interview Preparation Tips for a Financial Institution Assistant Branch Manager Position

To ace your interview for an Assistant Branch Manager position, it’s essential to prepare thoroughly and showcase your skills and experience. Here are some tips to help you succeed:

1. Research the Financial Institution and Industry

Familiarize yourself with the specific financial institution you’re applying to, including their products, services, and recent developments. Additionally, stay updated on industry trends and regulations to demonstrate your knowledge of the field.

2. Practice Your Answers to Common Interview Questions

Prepare for typical interview questions by practicing your responses and providing specific examples to illustrate your skills. Common questions may include:

- “Tell us about your experience in branch operations management.”

- “How do you build strong customer relationships and handle challenging situations?”

- “Explain your understanding of regulatory compliance in the financial services industry.”

3. Highlight Your Customer-Centric Mindset

Emphasize your passion for providing exceptional customer service and your ability to build lasting relationships. Share examples of how you’ve gone above and beyond to meet customer needs and resolve issues.

4. Quantify Your Accomplishments

When describing your past experiences, use specific numbers and metrics to quantify your accomplishments. For example, instead of saying “I increased sales,” say “I increased sales by 15% over a six-month period.”

5. Dress Professionally and Arrive on Time

First impressions matter, so dress professionally and arrive punctually for your interview. This demonstrates respect for the interviewer and the organization.

6. Ask Thoughtful Questions

Prepare thoughtful questions to ask the interviewer at the end of the interview. This shows your interest in the position and the institution and gives you an opportunity to clarify any remaining doubts.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Financial Institution Assistant Branch Manager role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.