Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Financial Institution Branch Manager interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Financial Institution Branch Manager so you can tailor your answers to impress potential employers.

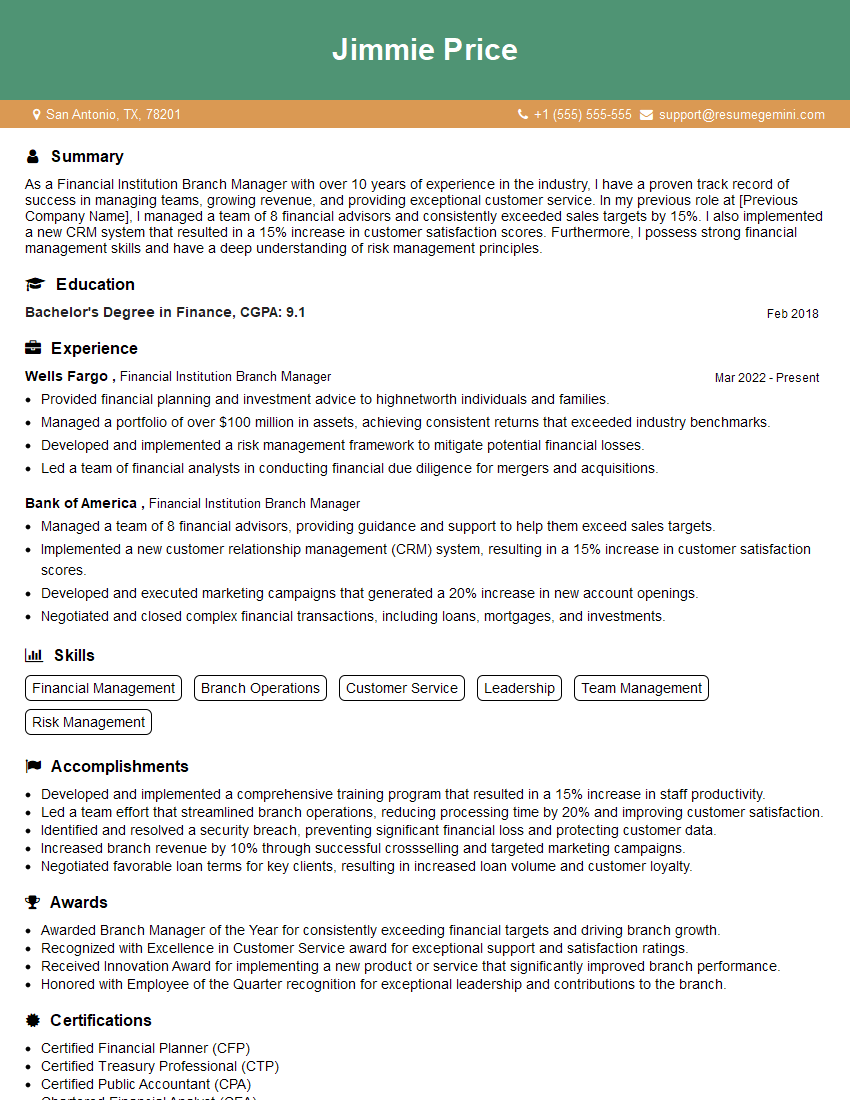

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Institution Branch Manager

1. Describe the key elements of a robust risk management framework for a financial institution branch.

A robust risk management framework should include the following key elements:

- Identification of risks

- Assessment of risks

- Mitigation of risks

- Monitoring of risks

- Reporting of risks

2. How would you approach managing credit risk in a loan portfolio?

of the answer

- I would start by assessing the creditworthiness of each borrower.

- I would then diversify the portfolio by lending to borrowers with different risk profiles.

Subheading of the answer

- I would also set limits on the amount of money that can be lent to any one borrower.

- Finally, I would monitor the performance of the portfolio on a regular basis and take corrective action if necessary.

3. How would you implement a successful sales strategy for a financial institution branch?

I would implement a successful sales strategy for a financial institution branch by:

- Identifying the target market

- Developing a value proposition

- Creating a sales plan

- Training the sales team

- Monitoring the results

4. What are the key elements of a successful customer service strategy for a financial institution branch?

The key elements of a successful customer service strategy for a financial institution branch include:

- Understanding customer needs

- Providing excellent customer service

- Building relationships with customers

- Resolving customer complaints

- Measuring customer satisfaction

5. How would you motivate and lead a team of financial service professionals?

I would motivate and lead a team of financial service professionals by:

- Creating a positive and empowering work environment

- Setting clear goals and expectations

- Providing feedback and recognition

- Delegating responsibilities

- Building a team culture of trust and respect

6. What are the key trends in the financial services industry and how are you preparing for them?

The key trends in the financial services industry include:

- The rise of digital banking

- The increasing demand for personalized financial advice

- The growing importance of data and analytics

- The need for financial institutions to be more agile and innovative

I am preparing for these trends by:

- Investing in digital banking capabilities

- Developing personalized financial advice services

- Investing in data and analytics

- Creating a more agile and innovative culture

7. What are your strengths and weaknesses as a financial institution branch manager?

Strengths

- I have a strong understanding of the financial services industry.

- I have a proven track record of success in managing a financial institution branch.

- I am a motivated and results-oriented leader.

- I am an excellent communicator and have strong interpersonal skills.

Weaknesses

- I can sometimes be too detail-oriented.

- I can sometimes be too demanding of myself and others.

8. Why are you interested in working for our financial institution?

I am interested in working for your financial institution because:

- I am impressed by your commitment to customer service.

- I believe that your financial institution is a leader in the industry.

- I am excited about the opportunity to contribute to your financial institution’s continued success.

9. What are your salary expectations?

My salary expectations are commensurate with my experience and qualifications.

I am confident that I can add value to your financial institution and I am looking for a salary that reflects my contributions.

10. Do you have any questions for me?

- What are the biggest challenges facing your financial institution?

- What are your financial institution’s goals for the next year?

- What is the culture of your financial institution like?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Institution Branch Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Institution Branch Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Financial Institution Branch Manager is responsible for the overall operation of a bank or credit union branch, ensuring compliance with regulations and providing excellent customer service.

1. Lead and Manage

The Branch Manager is responsible for leading and managing a team of employees, motivating them to achieve goals and provide exceptional customer service.

- Set clear expectations and provide regular feedback to employees.

- Foster a positive and productive work environment.

2. Financial Management

The Branch Manager is responsible for managing the financial performance of the branch, including revenue generation and expense control.

- Develop and implement strategies to increase revenue and profitability.

- Monitor expenses and identify areas for cost savings.

3. Compliance and Risk Management

The Branch Manager is responsible for ensuring that the branch complies with all applicable laws and regulations, including anti-money laundering and fraud prevention.

- Establish and maintain a compliance program.

- Identify and mitigate risks to the branch.

4. Customer Service

The Branch Manager is responsible for providing excellent customer service, building relationships with customers, and resolving any issues or concerns.

- Greet and assist customers in a friendly and professional manner.

- Handle customer inquiries and complaints promptly and efficiently.

Interview Tips

Preparing for an interview for a Financial Institution Branch Manager position requires careful preparation and research. Here are some tips to help you ace the interview:

1. Research the company and position

Take the time to learn about the financial institution and the specific branch you are applying to. Understand their mission, values, and products and services.

- Visit the financial institution’s website and social media pages.

- Read industry news and articles to stay up-to-date on the current financial landscape.

2. Practice your answers to common interview questions

There are several common questions that you are likely to be asked in an interview for a Financial Institution Branch Manager position. Practice your answers to these questions in advance so that you can deliver them confidently and succinctly.

- Tell me about your experience in managing a team of employees.

- How would you handle a difficult customer situation?

- What are your strengths and weaknesses as a leader?

3. Be prepared to discuss your knowledge of the financial industry

The interviewer will want to assess your knowledge of the financial industry and your ability to apply that knowledge to the role of Branch Manager. Be prepared to discuss your understanding of financial products and services, banking regulations, and risk management.

- Review the latest financial news and trends.

- Consider taking online courses or attending industry events to expand your knowledge.

4. Dress professionally and arrive on time

First impressions matter. Dress professionally and arrive on time for your interview. This will show the interviewer that you are serious about the position and that you respect their time.

- Choose conservative colors and avoid wearing too much jewelry or makeup.

- Plan your route to the interview location in advance so that you can avoid any delays.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Institution Branch Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!