Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Institution Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

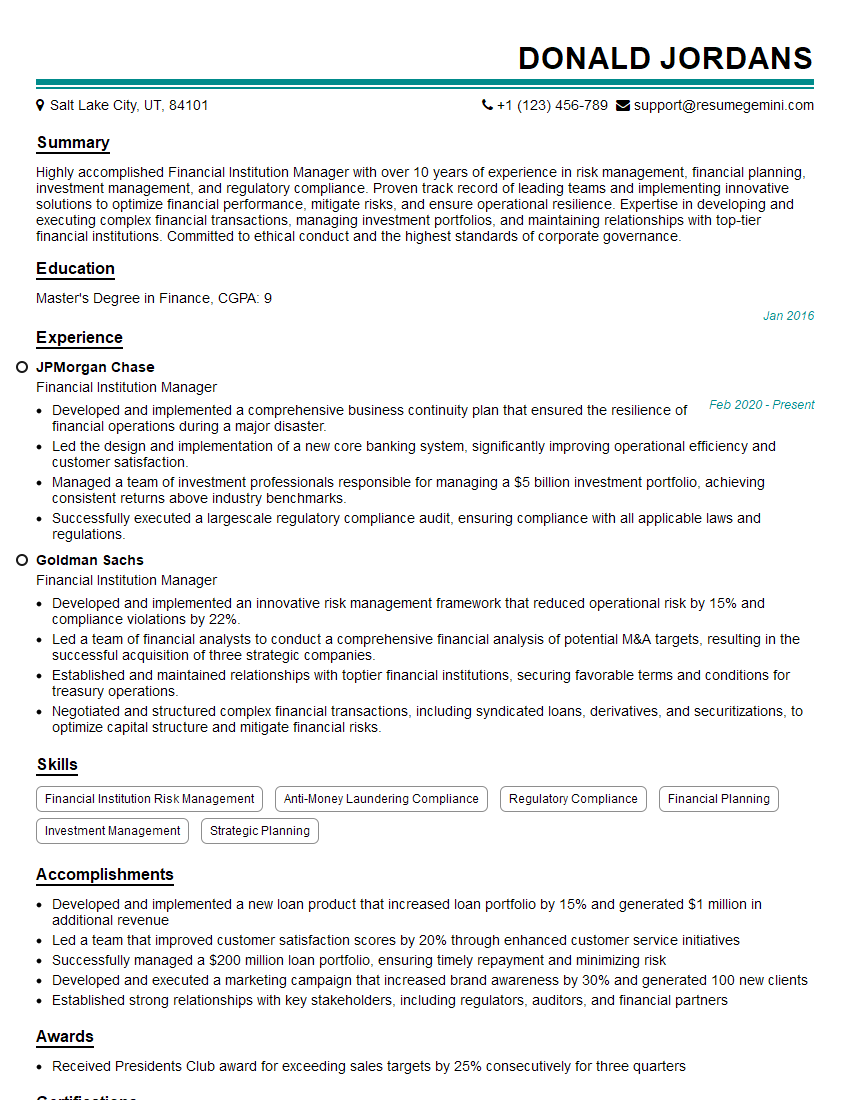

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Institution Manager

1. What are the key financial ratios that you monitor to assess the financial health of a financial institution?

As a Financial Institution Manager, it is crucial to monitor various key financial ratios to assess the financial health of the institution. These ratios provide insights into the institution’s liquidity, solvency, profitability, and overall risk profile. Here are some critical financial ratios that I closely monitor:

- Liquidity ratios: Current ratio, quick ratio, and cash ratio evaluate the institution’s ability to meet its short-term obligations.

- Solvency ratios: Debt-to-equity ratio, debt-to-asset ratio, and equity-to-asset ratio measure the institution’s financial leverage and ability to withstand financial shocks.

- Profitability ratios: Net profit margin, return on assets (ROA), and return on equity (ROE) assess the institution’s profitability and efficiency.

- Risk ratios: Capital adequacy ratio (CAR), credit-to-deposit ratio, and non-performing loan ratio provide insights into the institution’s risk exposure and ability to absorb losses.

2. How do you manage risk within a financial institution?

Risk Identification and Assessment

- Regularly conduct risk assessments to identify potential risks facing the institution.

- Analyze market trends, economic conditions, and regulatory changes to anticipate emerging risks.

Risk Mitigation

- Develop and implement risk mitigation strategies to reduce the likelihood and impact of identified risks.

- Diversify investments and maintain adequate capital reserves to absorb potential losses.

Risk Monitoring and Control

- Establish robust risk monitoring systems to track and assess the effectiveness of risk mitigation strategies.

- Implement internal controls to prevent and detect fraudulent activities and ensure compliance with regulations.

3. What are the key principles of sound lending practices?

- Creditworthiness assessment: Thoroughly evaluate the creditworthiness of borrowers before approving loans.

- Collateral management: Require appropriate collateral to mitigate the risk of loan default.

- Loan diversification: Spread lending across various sectors and industries to reduce portfolio risk.

- Loan monitoring: Regularly monitor loan performance and take prompt action in case of delinquencies.

- Prudent underwriting standards: Establish and adhere to strict underwriting guidelines to ensure responsible lending.

4. How do you manage and optimize the funding sources for a financial institution?

Managing and optimizing funding sources is crucial for the stability and growth of a financial institution. Here are some key steps involved:

- Diversification of funding sources: Rely on a mix of sources such as deposits, borrowings, and equity to reduce funding risk.

- Cost optimization: Negotiate favorable terms with lenders and ensure efficient use of internal funds to minimize funding costs.

- Liquidity management: Maintain adequate liquidity to meet short-term obligations and absorb unexpected withdrawals.

- Capital planning: Regularly assess capital needs and raise capital through various means to support growth and maintain financial stability.

5. How do you ensure compliance with regulatory requirements in the financial industry?

- Regulatory monitoring: Stay updated with regulatory changes and developments to ensure compliance.

- Compliance framework: Establish a comprehensive compliance framework that includes policies, procedures, and training programs.

- Internal audits: Conduct regular internal audits to assess compliance performance and identify areas for improvement.

- External audits: Engage external auditors to provide independent assurance on the institution’s compliance.

- Employee training: Provide ongoing training to employees on regulatory requirements and ethical conduct.

6. How do you stay abreast of the latest trends and developments in the financial industry?

- Industry conferences and events: Attend industry conferences and events to network with peers and learn about emerging trends.

- Professional development: Pursue continuing education and professional development opportunities to enhance knowledge and skills.

- Trade publications and news: Read industry trade publications and follow financial news to stay informed about market developments.

- Research and analysis: Conduct research and analysis on industry trends to identify opportunities and risks.

- Collaboration with experts: Collaborate with industry experts and consultants to gain insights into best practices and emerging technologies.

7. What are the biggest challenges facing financial institutions in today’s market?

- Regulatory complexity: Increasing regulatory complexity and compliance requirements pose challenges to institutions.

- Fintech disruption: The rise of fintech and digital banking is disrupting traditional financial services models.

- Cybersecurity threats: Financial institutions face ongoing cybersecurity threats that require robust risk management strategies.

- Economic volatility: Economic and market volatility can impact the performance and stability of financial institutions.

- Competition: Intense competition from both traditional and non-traditional financial providers.

8. What are your strategies for driving growth and profitability in a financial institution?

- Product innovation: Develop innovative financial products and services to meet evolving customer needs.

- Market expansion: Explore new market segments and geographical regions to diversify revenue streams.

- Customer-centric approach: Focus on providing exceptional customer service and building long-term relationships.

- Operational efficiency: Implement technology and process improvements to enhance efficiency and reduce costs.

- Strategic partnerships: Form strategic partnerships with fintech companies and other financial institutions to expand offerings and improve customer experience.

9. How do you build and maintain strong relationships with key stakeholders?

- Regular communication: Establish open and regular communication channels with stakeholders.

- Understanding stakeholder needs: Identify and understand the needs and expectations of key stakeholders.

- Transparency and trust: Build trust by being transparent in communication and fulfilling commitments.

- Active listening: Actively listen to feedback and concerns to address stakeholder concerns promptly.

- Stakeholder involvement: Involve stakeholders in decision-making processes to ensure their buy-in and support.

10. What are the key leadership qualities that you possess to excel as a Financial Institution Manager?

- Strategic vision: Ability to develop and execute a clear strategic vision for the institution.

- Financial acumen: Strong understanding of financial principles and ability to make sound financial decisions.

- Leadership and management skills: Ability to motivate and lead a team effectively.

- Regulatory knowledge: Deep understanding of regulatory requirements and compliance.

- Risk management expertise: Ability to identify, assess, and mitigate risks effectively.

- Customer focus: Passion for providing exceptional customer service and meeting customer needs.

- Innovation mindset: Embrace innovation and explore new opportunities to drive growth.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Institution Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Institution Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Institution Managers oversee the operations of financial institutions such as banks, credit unions, and investment firms.

1. Strategic Planning and Financial Management

Develop and implement strategic plans to achieve organizational goals.

- Create and analyze financial models to forecast revenue, expenses, and profits.

- Manage financial resources to ensure optimal allocation and utilization.

2. Risk Management

Identify, assess, and mitigate financial and operational risks.

- Establish policies and procedures to minimize losses and protect assets.

- Oversee compliance with regulatory requirements and industry best practices.

3. Business Development and Relationship Management

Acquire and retain customers by developing and managing relationships with key stakeholders.

- Identify and target new markets and customer segments.

- Establish and nurture relationships with clients, investors, and regulators.

4. Human Capital Management

Attract, develop, and retain a high-performing team.

- Recruit and hire qualified staff members.

- Provide training and development opportunities for employees.

Interview Tips

To prepare for an interview for a Financial Institution Manager position, consider the following tips:

1. Research the Company and Industry

Demonstrate your knowledge of the financial institution and its industry. Research the company’s financial performance, strategic objectives, and regulatory environment.

- Study industry reports and publications to stay updated on current trends.

- Network with professionals in the industry to gain insights and build relationships.

2. Quantify Your Experience and Accomplishments

Provide specific examples of your contributions and the impact you have had in previous roles. Use data and metrics to quantify your accomplishments whenever possible.

- “Increased revenue by 15% through the implementation of a new business development strategy.”

- “Reduced operational costs by 10% through process optimization and efficiency improvements.”

3. Be Prepared to Discuss Your Leadership Style

Highlight your leadership qualities and how you motivate and inspire your team. Explain your approach to managing risk, fostering collaboration, and driving performance.

- Use the STAR method (Situation, Task, Action, Result) to describe specific examples of your leadership in action.

- Emphasize your ability to build and maintain strong relationships with colleagues, clients, and regulators.

4. Prepare Questions for the Interviewers

Asking thoughtful questions shows that you are engaged and interested in the position. Prepare questions that demonstrate your understanding of the industry and the company’s strategic direction.

- “What are the key challenges and opportunities facing the financial institution industry?”

- “How does the company plan to achieve its strategic goals in the next 5 years?”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Institution Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!