Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Institution Treasurer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

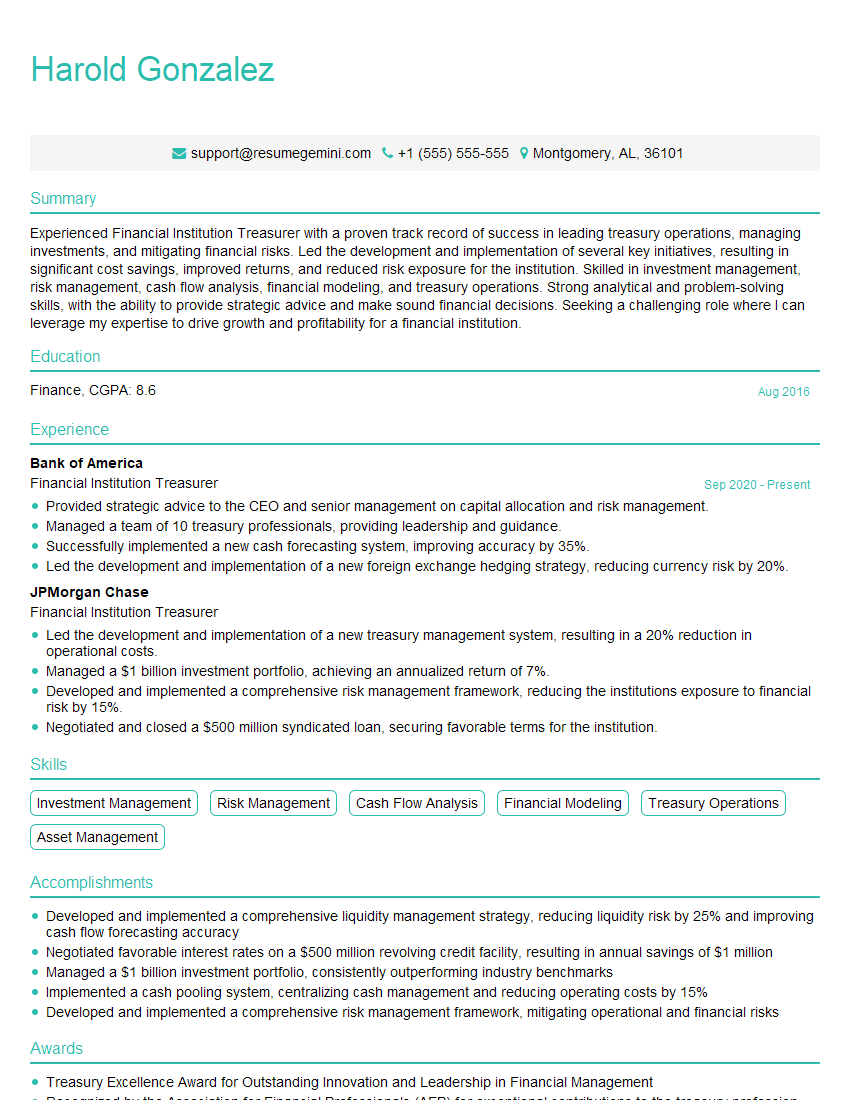

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Institution Treasurer

1. What are the key responsibilities of a financial institution treasurer?

The primary responsibilities of a financial institution treasurer include:

- Managing the institution’s liquidity and cash flow

- Developing and implementing investment strategies

- Managing financial risk

- Overseeing the institution’s capital structure

- Providing financial advice to the institution’s senior management and board of directors

2. What are the most important qualities and skills for a financial institution treasurer?

Technical skills

- Strong understanding of financial markets and instruments

- Experience in managing financial risk

- Excellent analytical and problem-solving skills

- Proficient in financial modeling and forecasting

Soft skills

- Excellent communication and interpersonal skills

- Strong leadership and management skills

- Ability to work effectively in a team environment

- Proven ability to make sound financial decisions under pressure

3. What are the key challenges facing financial institution treasurers today?

- The changing regulatory landscape

- The increasing complexity of financial markets

- The need to manage risk in a low-interest rate environment

- The growing importance of sustainability

- The rise of fintech

4. How do you stay up-to-date on the latest developments in financial markets and regulations?

- Reading industry publications and attending conferences

- Networking with other financial professionals

- Taking continuing education courses

- Following financial news and analysis on a regular basis

- Getting involved in professional organizations

5. What are your thoughts on the future of financial institutions?

The future of financial institutions is uncertain, but there are a number of trends that are likely to shape the industry in the years to come. These trends include:

- The continued growth of fintech

- The increasing importance of data and analytics

- The need for financial institutions to become more agile and innovative

- The growing focus on sustainability

6. What is your experience in managing financial risk?

I have extensive experience in managing financial risk, including:

- Developing and implementing risk management policies and procedures

- Identifying, assessing, and mitigating financial risks

- Stress testing the institution’s financial portfolio

- Reporting on financial risks to the institution’s senior management and board of directors

7. What are your thoughts on the current state of the financial markets?

The current state of the financial markets is characterized by a number of factors, including:

- Low interest rates

- High levels of volatility

- Uncertain economic outlook

- geopolitical risks

8. What is your investment philosophy?

My investment philosophy is based on the following principles:

- Long-term investment horizon

- Diversification

- Risk management

- Value investing

9. What are your thoughts on the role of sustainability in financial institutions?

Sustainability is becoming increasingly important for financial institutions for a number of reasons:

- Investors are increasingly demanding that financial institutions invest in sustainable companies

- Regulators are beginning to require financial institutions to consider sustainability risks in their operations

- Financial institutions themselves are recognizing that sustainability can be a source of competitive advantage

10. What are your career goals?

My career goal is to become a financial institution treasurer. I believe that my skills and experience in financial risk management, investment management, and financial analysis make me a strong candidate for this role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Institution Treasurer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Institution Treasurer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Institution Treasurers are responsible for the overall financial health and stability of their organization. They play a vital role in managing the institution’s financial resources, developing and implementing investment strategies, and ensuring compliance with regulatory requirements.

1. Financial Management

Treasurers are responsible for managing the institution’s cash flow, liquidity, and investments. They develop and implement investment strategies to maximize returns while minimizing risk.

- Develop and implement investment strategies

- Manage the institution’s cash flow and liquidity

- Monitor financial markets and economic conditions

2. Risk Management

Treasurers are responsible for identifying, assessing, and mitigating financial risks. They develop and implement risk management strategies to protect the institution from financial losses.

- Identify and assess financial risks

- Develop and implement risk management strategies

- Monitor and report on financial risks

3. Regulatory Compliance

Treasurers are responsible for ensuring that the institution complies with all applicable regulatory requirements. They work closely with regulators to ensure that the institution is operating in a safe and sound manner.

- Ensure compliance with all applicable regulatory requirements

- Work closely with regulators to ensure the institution is operating in a safe and sound manner

- Develop and implement compliance programs

4. Leadership and Management

Treasurers are responsible for leading and managing the treasury department. They develop and implement policies and procedures, and oversee the day-to-day operations of the department.

- Lead and manage the treasury department

- Develop and implement policies and procedures

- Oversee the day-to-day operations of the department

Interview Tips

There are several ways to prepare for a job interview, including researching the company and the position, practicing your answers to common interview questions, and dressing appropriately. Here are some tips for preparing for an interview for a Financial Institution Treasurer position:

1. Research the Company and the Position

Before you go on an interview, it’s important to do your research on the company and the position. This will help you understand the company’s culture, values, and goals, and it will also help you tailor your answers to the specific requirements of the position.

- Visit the company’s website

- Read the company’s annual report

- Talk to people who work at the company

- Review the job description

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you’re likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It’s a good idea to practice your answers to these questions in advance so that you can deliver them confidently and concisely.

- Use the STAR method to answer questions

- Be specific and provide examples

- Tailor your answers to the specific requirements of the position

3. Dress Appropriately

First impressions matter, so it’s important to dress appropriately for your interview. For a Financial Institution Treasurer position, you should wear a conservative business suit.

- Wear a suit that is clean and pressed

- Choose neutral colors like black, navy, or gray

- Make sure your shoes are clean and polished

4. Be Yourself

It’s important to be yourself during your interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not.

- Be confident and authentic

- Show your personality

- Be honest and transparent

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Financial Institution Treasurer, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Financial Institution Treasurer positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.