Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Financial Institution Vice President interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Financial Institution Vice President so you can tailor your answers to impress potential employers.

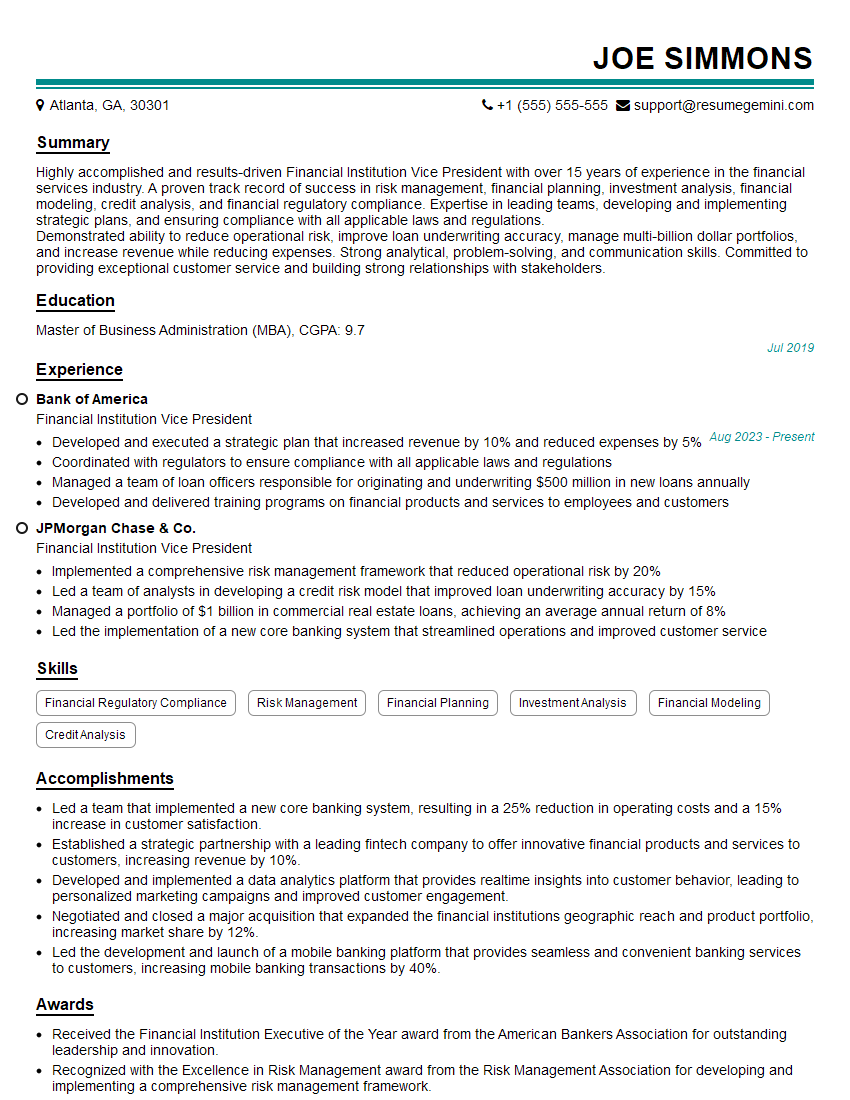

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Institution Vice President

1. What strategies have you implemented in the past to improve the profitability of a financial institution?

- Enhanced credit underwriting to reduce loan defaults.

- Optimized asset allocation and investment strategies to increase yield.

- Implemented cost-cutting measures while maintaining customer service levels.

- Expanded into new markets or product lines to diversify revenue streams.

- Leveraged technology to streamline operations and improve efficiency.

2. How would you evaluate the risk appetite of a new client applying for a loan?

Qualitative Assessment

- Examine the client’s financial history and creditworthiness.

- Review the client’s business plan and industry outlook.

- Assess the client’s management team and their experience.

Quantitative Analysis

- Calculate financial ratios and metrics to assess financial health.

- Review credit scores and payment history.

- Analyze cash flow projections and debt-to-income ratios.

3. How do you stay abreast of regulatory changes and their impact on the financial industry?

- Attend industry conferences and webinars.

- Monitor regulatory agency websites and publications.

- Collaborate with legal counsel and compliance officers.

- Stay informed through industry news sources and journals.

- Engage in professional development and training programs.

4. What is your approach to managing liquidity risk in a financial institution?

- Maintain a diversified funding portfolio with multiple sources of liquidity.

- Implement stress testing scenarios to assess liquidity under various conditions.

- Manage asset-liability mismatches to avoid maturity gaps.

- Establish contingency plans and emergency liquidity facilities.

- Monitor liquidity indicators and key ratios closely.

5. How would you handle a situation where a key member of your team is performing poorly?

- Schedule a meeting to discuss the issue privately and confidentially.

- Provide specific examples of the underperformance and set clear expectations.

- Offer opportunities for improvement and support, such as training or mentoring.

- Monitor progress closely and provide regular feedback.

- If necessary, develop a performance improvement plan with timelines and goals.

6. What strategies would you recommend to increase customer acquisition and retention for a financial institution?

- Develop a customer-centric approach with personalized products and services.

- Leverage digital channels and social media for outreach and engagement.

- Offer competitive rates and rewards programs.

- Implement referral programs and loyalty initiatives.

- Provide excellent customer service and support.

7. How would you approach the development and implementation of a new financial product or service?

- Conduct market research and identify customer needs.

- Assemble a cross-functional team to design and develop the product.

- Test and iterate the product based on customer feedback.

- Develop a comprehensive launch strategy and marketing plan.

- Monitor performance and make adjustments as needed.

8. How do you ensure compliance with anti-money laundering (AML) regulations in a financial institution?

- Develop and implement a robust AML compliance program.

- Train employees on AML policies and procedures.

- Monitor transactions and customer accounts for suspicious activities.

- Collaborate with law enforcement and regulatory authorities.

- Stay updated on the latest AML regulations and best practices.

9. How would you manage a merger or acquisition between two financial institutions?

- Conduct due diligence and assess the strategic fit of the two entities.

- Develop an integration plan that addresses operational, legal, and cultural aspects.

- Communicate with all stakeholders throughout the process.

- Ensure smooth transition and minimize disruption to customers and employees.

- Monitor post-merger performance and make adjustments as necessary.

10. What do you believe are the key trends shaping the future of the financial services industry?

- Digital transformation and the rise of fintech.

- Increased focus on sustainability and environmental, social, and governance (ESG) investing.

- Growing importance of data analytics and machine learning.

- Increased regulatory scrutiny and compliance requirements.

- Changing demographics and consumer preferences.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Institution Vice President.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Institution Vice President‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Financial Institution Vice President is a senior-level executive responsible for overseeing the financial operations of a financial institution, such as a bank, credit union, or insurance company. They play a vital role in ensuring the financial health and stability of the organization and are accountable for driving growth and profitability. The key job responsibilities of a Financial Institution Vice President typically include:

1. Strategic Planning and Execution

Develops and executes strategic plans to achieve the financial goals of the organization. Conducts market research, analyzes industry trends, and identifies opportunities for growth.

2. Risk Management

Oversees the development and implementation of risk management policies and procedures. Assesses and mitigates financial, operational, and compliance risks to protect the institution from losses.

3. Financial Management

Manages the financial resources of the organization, including cash flow, investments, and capital. Ensures compliance with regulatory requirements and financial reporting standards.

4. Leadership and Management

Provides leadership and direction to a team of financial professionals. Supervises and develops staff, creating a high-performing and motivated work environment.

5. Stakeholder Relations

Builds and maintains relationships with key stakeholders, including customers, investors, regulatory agencies, and the community. Represents the organization at industry events and conferences.

Interview Tips

To ace an interview for a Financial Institution Vice President position, it is essential to prepare thoroughly. Here are some tips:

1. Research the Organization

Familiarize yourself with the financial institution, its products and services, and its financial performance. This demonstrates your interest in the position and shows that you have taken the time to understand the organization’s business.

2. Practice Your Answers

Prepare for common interview questions by practicing your answers out loud. This will help you articulate your thoughts clearly and confidently during the interview.

3. Highlight Your Experience

Emphasize your relevant experience and skills in the financial services industry. Provide specific examples of how you have contributed to the success of previous organizations.

4. Be Prepared to Discuss Your Leadership Style

Financial Institution Vice Presidents are expected to be effective leaders. Be prepared to discuss your leadership style, how you motivate your team, and how you handle conflict.

5. Ask Thoughtful Questions

Asking insightful questions at the end of the interview shows that you are engaged and interested in the position. It also provides an opportunity for you to learn more about the organization and the role.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Financial Institution Vice President, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Financial Institution Vice President positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.