Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Officer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

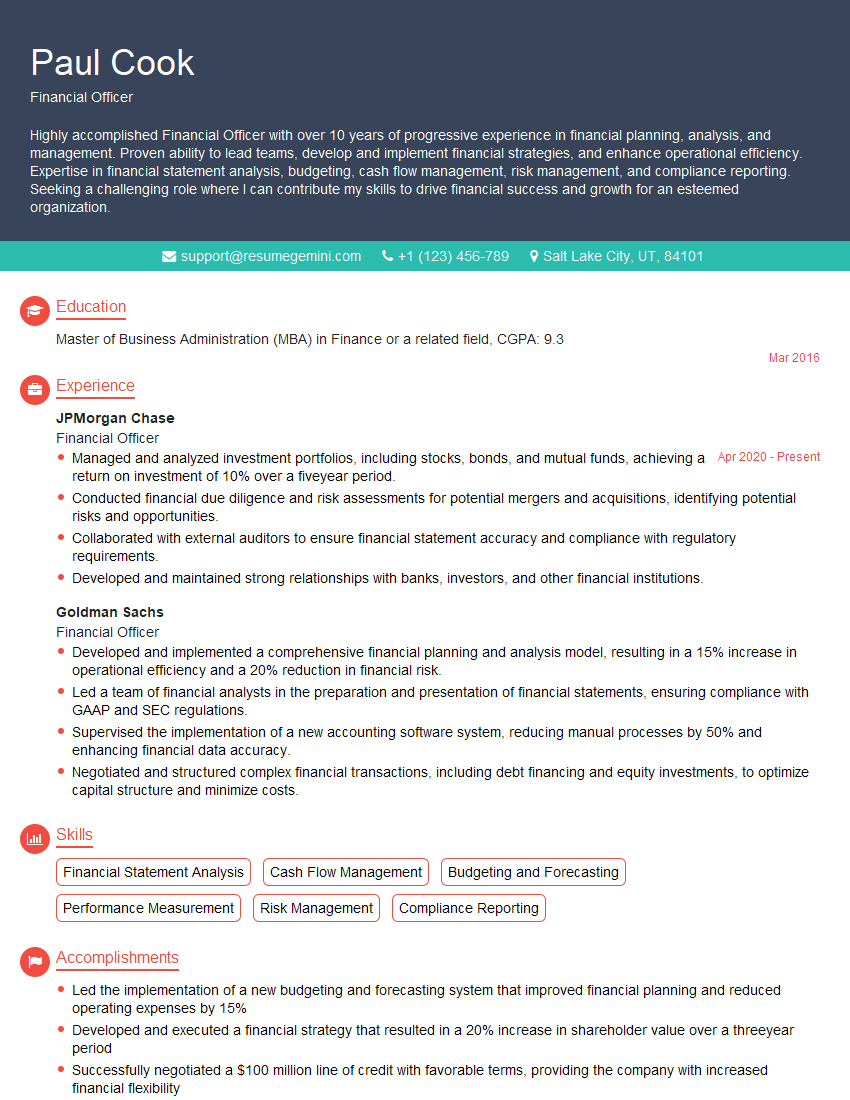

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Officer

1. Explain the concept of financial ratios and how you use them to assess a company’s financial health?

Financial ratios are mathematical calculations that compare different financial metrics to provide insights into a company’s financial performance, liquidity, solvency, and profitability. They help analysts and investors evaluate a company’s strengths and weaknesses and compare it to industry peers.

- Liquidity ratios: Measure a company’s ability to meet its short-term obligations, such as current ratio and quick ratio.

- Solvency ratios: Assess a company’s long-term debt-paying ability, such as debt-to-equity ratio and times interest earned ratio.

- Profitability ratios: Evaluate a company’s profitability and efficiency, such as gross profit margin, operating profit margin, and net income margin.

2. Walk me through the steps involved in preparing a consolidated financial statement?

Merging Financial Statements

- Combine the financial statements of all entities in the group.

- Eliminate inter-company transactions and balances.

Adjustments

- Record minority interest (for non-wholly owned subsidiaries).

- Adjust for differences in accounting policies.

Presentation

- Create consolidated balance sheet, income statement, and cash flow statement.

- Provide supporting disclosures.

3. How do you evaluate the cost of equity for a company?

- Capital Asset Pricing Model (CAPM): Uses market risk premium and beta to determine the required return on equity.

- Dividend Discount Model (DDM): Assumes that the value of an equity share is equal to the present value of its future dividends.

- Comparable Companies Analysis: Compares the company’s financial metrics to industry peers to estimate the cost of equity.

4. Describe the methods you use to forecast financial performance?

- Trend analysis: Examining historical financial data to identify trends and patterns.

- Budgeting and scenario analysis: Using budgets and assumptions to project future financial performance under different scenarios.

- Discounted cash flow analysis: Valuing future cash flows to determine the present value of a company’s assets or projects.

5. How do you manage cash flow effectively?

- Cash flow forecasting: Predicting cash inflows and outflows to ensure adequate liquidity.

- Accounts receivable management: Optimizing collection processes to accelerate cash receipts.

- Accounts payable management: Negotiating payment terms and leveraging discounts to extend cash flow.

- Cash flow budgeting: Allocating cash resources to meet operational and investment needs.

6. What are the key accounting principles that guide your financial reporting?

- Accrual accounting: Recognizing revenue and expenses when they occur, regardless of cash flow.

- Going concern: Assuming the company will continue operating in the foreseeable future.

- Matching principle: Matching expenses with the revenue they generate.

- Materiality: Disclosing information that could materially affect financial statements.

7. How do you stay up-to-date with changes in accounting standards and regulations?

- Continuing professional education: Attending conferences, workshops, and webinars.

- Subscribing to industry publications and newsletters: Staying informed about new regulations and best practices.

- Networking with other professionals: Sharing knowledge and insights with peers.

8. Describe your experience in managing financial audits?

Planning and Execution

- Developing audit plans and strategies.

- Performing risk assessments and internal control evaluations.

- Executing audit procedures to gather evidence.

Reporting and Follow-up

- Preparing audit reports and communicating findings.

- Following up on management’s responses and implementing recommendations.

9. How do you ensure the accuracy and integrity of financial data?

- Establishing robust accounting processes: Implementing clear policies and procedures.

- Regular reconciliation: Comparing financial records to supporting documentation.

- Internal audits: Conducting independent reviews to assess the reliability of financial data.

- External audits: Engaging independent auditors to provide objective assurance.

10. What are your key strengths and weaknesses as a Financial Officer?

Strengths

- Expertise in financial planning, forecasting, and reporting.

- Strong understanding of accounting principles and regulations.

- Ability to lead and motivate finance teams.

Weaknesses

- Limited experience in managing international operations.

- Working on improving my public speaking skills.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A financial officer holds a leadership position within an organization and is responsible for overseeing the financial health of the company. They are accountable for managing the organization’s financial resources effectively and efficiently.

1. Financial Planning and Analysis

The financial officer develops and implements the company’s financial plans and strategies. This involves forecasting financial performance, analyzing financial data, and identifying opportunities for growth and improvement.

- Prepare and analyze financial statements, including the balance sheet, income statement, and cash flow statement.

- Forecast future financial performance and develop strategies to achieve financial goals.

2. Financial Reporting and Compliance

The financial officer is responsible for ensuring that the company’s financial reporting is accurate, timely, and in compliance with all applicable laws and regulations.

- Prepare and file financial statements with the Securities and Exchange Commission (SEC) and other regulatory agencies.

- Ensure that the company complies with all applicable accounting principles, including Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

3. Capital Budgeting and Investment Analysis

The financial officer makes investment decisions for the company, including capital budgeting and portfolio management.

- Evaluate investment opportunities and make recommendations to senior management.

- Manage the company’s investment portfolio and ensure that it aligns with the company’s financial goals.

4. Risk Management

The financial officer is responsible for identifying, assessing, and mitigating financial risks that could impact the company.

- Identify and assess financial risks, including credit risk, market risk, and liquidity risk.

- Develop and implement strategies to mitigate financial risks and protect the company’s financial health.

Interview Tips

Preparing for your financial officer interview is crucial to making a strong impression and increasing your chances of success. Here are some essential tips to help you ace the interview:

1. Research the Company and the Position

Researching the company and the specific financial officer position you’re applying for is a must. This demonstrates your interest in the role and the organization and helps you ask informed questions during the interview.

- Visit the company’s website and read about their products, services, and financial performance.

- Review the job description and identify the key qualifications and responsibilities.

2. Practice Your Pitch

Prepare a brief but impactful introduction that highlights your key skills and experience. This is an opportunity to sell yourself and explain why you’re the best candidate for the job.

- Focus on your most relevant experiences and accomplishments.

- Quantify your achievements with specific metrics and data points.

3. Be Ready to Discuss Your Financial Acumen

Financial officers need to have a deep understanding of financial concepts and principles. Be prepared to discuss your knowledge of financial analysis, accounting, and financial management.

- Review your financial education and any professional certifications you hold.

- Practice solving financial problems and case studies.

4. Showcase Your Communication Skills

Financial officers must be able to communicate effectively with a wide range of stakeholders, including senior management, investors, and regulators.

- Be confident and articulate in your responses.

- Use clear and concise language, avoiding technical jargon.

5. Ask Thoughtful Questions

Asking insightful questions at the end of the interview demonstrates your engagement and interest in the role. It also gives you an opportunity to gather more information about the company and the position.

- Prepare questions that are specific to the company and the financial officer role.

- Don’t be afraid to ask about the company’s financial goals and challenges.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Financial Officer, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Financial Officer positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.