Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Operations Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

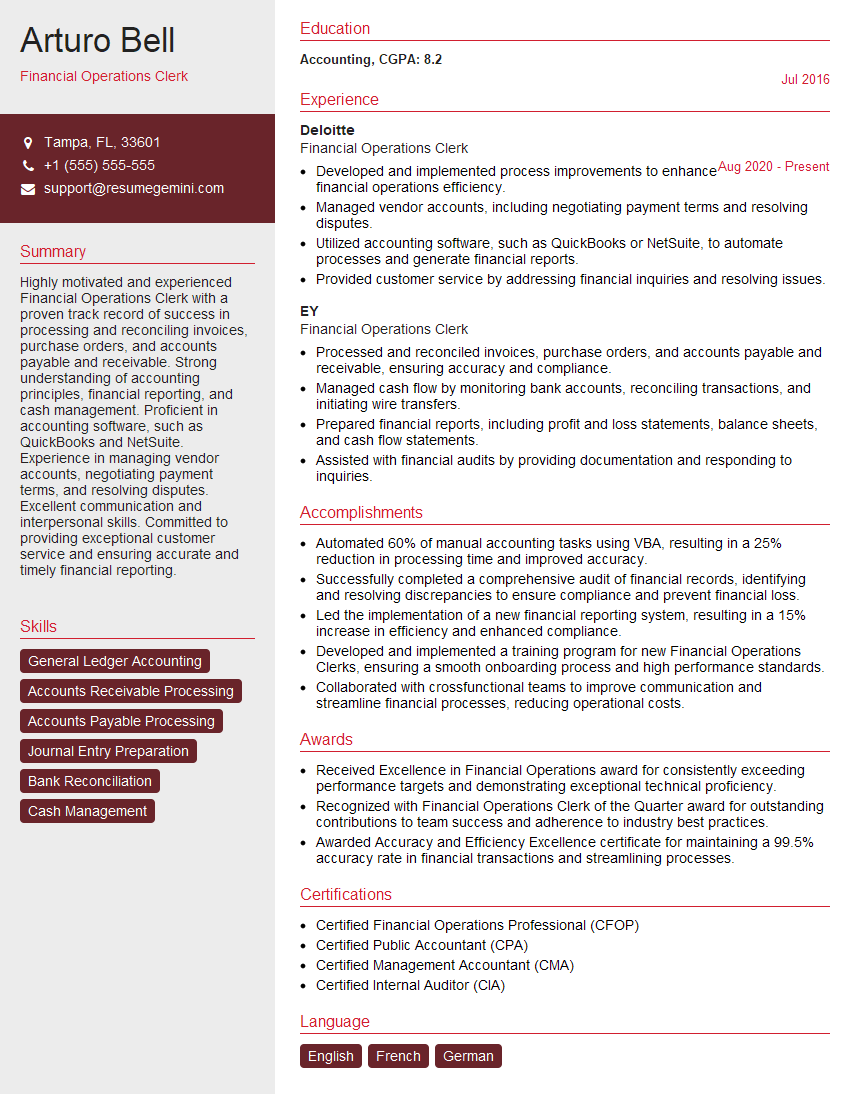

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Operations Clerk

1. What are the key responsibilities of a Financial Operations Clerk?

- Performing data entry and processing financial transactions accurately and efficiently

- Processing invoices, payments, and other financial documents

- Maintaining and reconciling accounts receivable and accounts payable

- Preparing reports and analyzing financial data

- Providing customer service and resolving queries

2. How do you ensure the accuracy of your financial transactions?

Using a meticulous approach

- Double-checking data entries

- Verifying calculations

- Following established procedures

Leveraging technology

- Utilizing accounting software with built-in error checks

- Automating repetitive tasks to reduce human error

3. Describe your experience in reconciling accounts receivable and accounts payable.

In my previous role, I was responsible for reconciling accounts receivable and accounts payable for a large manufacturing company.

- I used a systematic approach to match transactions and identify discrepancies

- I analyzed supporting documentation to resolve any outstanding issues

- I worked closely with the accounts receivable and accounts payable teams to ensure accuracy and timely completion

4. How do you handle discrepancies in financial records?

When I encounter discrepancies in financial records, I follow a structured approach:

- Identify the source of the discrepancy

- Review supporting documentation

- Consult with relevant departments or individuals

- Record and document the resolution

5. What accounting software are you familiar with?

I am proficient in using QuickBooks, NetSuite, and Oracle NetSuite.

- I have experience in setting up and maintaining accounting systems

- I am comfortable with generating reports, managing invoices, and processing payments

6. Describe your experience in preparing financial reports.

In my previous role, I was responsible for preparing monthly financial reports for senior management.

- I analyzed financial data and identified key trends

- I created clear and concise reports that presented the company’s financial performance

- I presented the reports to management and answered questions

7. How do you stay up-to-date with changes in financial regulations?

- Attend industry conferences and webinars

- Read professional publications and online resources

- Participate in training programs

- Network with other professionals in the field

8. What are your strengths and weaknesses as a Financial Operations Clerk?

Strengths

- Strong attention to detail

- Excellent communication and interpersonal skills

- Proficient in accounting software

Weaknesses

- I am relatively new to the financial industry

- I am not yet familiar with all aspects of GAAP

9. Why are you interested in this role?

I am eager to join your company because I am passionate about financial operations and I believe my skills and experience would make me a valuable asset to your team.

- I am confident in my ability to perform the duties of a Financial Operations Clerk efficiently and accurately

- I am excited about the opportunity to contribute to your company’s success

10. What are your salary expectations?

My salary expectations are in line with the industry average for this role in my location.

- I am open to discussing a compensation package that is commensurate with my experience and skills

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Operations Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Operations Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Financial Operations Clerk plays a pivotal role in the organization’s financial function, carrying out a diverse range of tasks. These responsibilities encompass assisting with the management of accounts payable, accounts receivable, and other financial transactions.

1. Accounts Payable Management

Process and review invoices, ensuring their accuracy and completeness

- Confirm receipt of goods or services before approving payments

- Maintain vendor relationships and resolve discrepancies

2. Accounts Receivable Management

Generate and send invoices to customers

- Track customer payments and manage collections

- Respond to customer inquiries and resolve billing issues

3. Financial Reporting and Analysis

Assist with the preparation of financial statements and reports

- Analyze financial data and identify trends or anomalies

- Provide support to external auditors during financial reviews

4. General Administrative Support

Maintain financial records and files

- Assist with bank reconciliations and cash flow management

- Perform data entry and other clerical tasks

Interview Tips

Preparing for a Financial Operations Clerk interview requires careful preparation and a thorough understanding of the role. Here are some tips to help you ace your interview:

1. Research the Company and Industry

Gain insights into the company’s financial operations, industry trends, and any recent developments

- Review the company’s website, financial reports, and news articles

- Learn about the specific industry and its financial practices

2. Highlight Your Skills and Experience

Emphasize your proficiency in key areas, such as accounts payable, accounts receivable, and financial reporting

- Provide specific examples of your work and how you contributed to the company’s financial success

- Quantify your accomplishments with metrics and results

3. Be Prepared to Answer Common Questions

Familiarize yourself with typical interview questions and practice your responses

- Research questions about your qualifications, experience, and understanding of financial operations

- Prepare thoughtful and concise answers that highlight your strengths and suitability for the role

4. Ask Informed Questions

Asking insightful questions demonstrates your interest and engagement in the role and the company

- Inquire about the company’s financial goals and challenges

- Ask about opportunities for professional development and growth

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Operations Clerk interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.