Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Planner position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

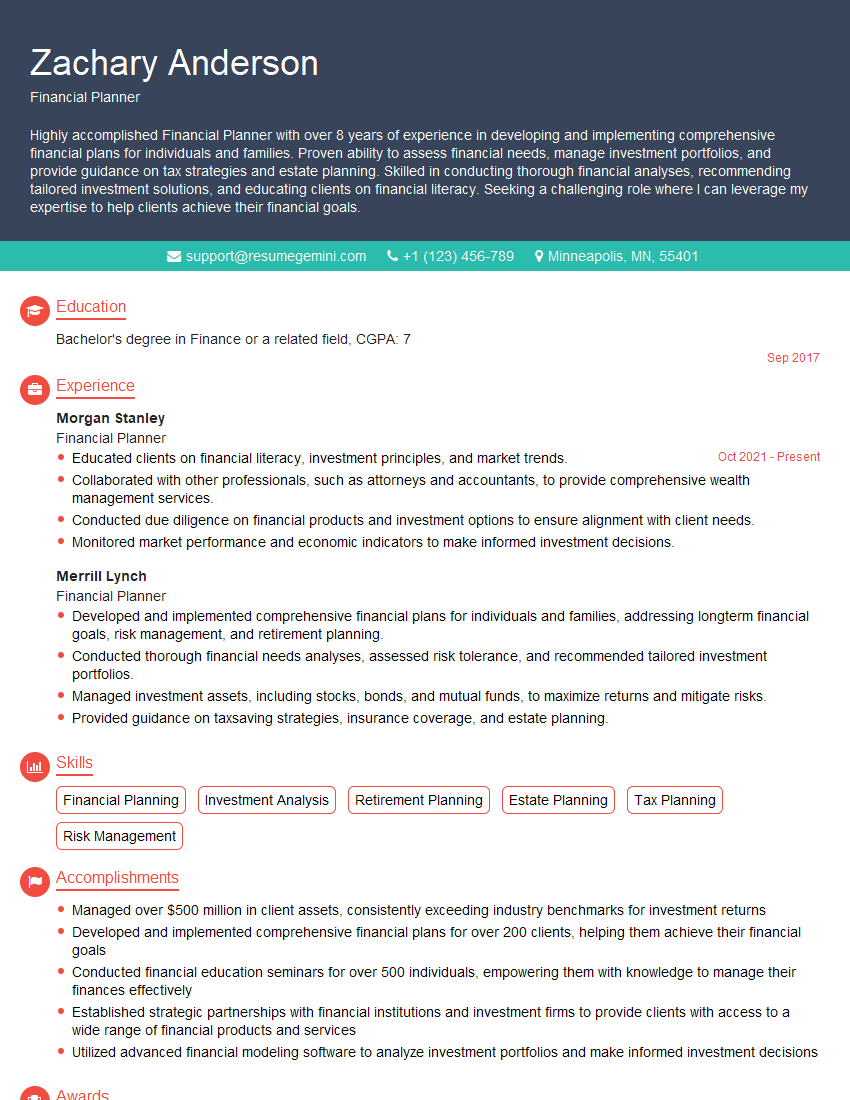

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Planner

1. What are the different types of financial planning services that you offer?

- Retirement planning

- Investment planning

- Tax planning

- Estate planning

- Education planning

2. What is your investment philosophy?

Investment Planning

- I believe in a long-term approach to investing.

- I believe in diversification.

- I believe in asset allocation.

Risk Management

- I believe in managing risk.

- I believe in protecting clients from downside risk.

- I believe in using stop-loss orders and other risk-management techniques.

3. What is your process for developing a financial plan?

- Gather client data.

- Analyze client data.

- Develop a financial plan.

- Implement the financial plan.

- Monitor the financial plan.

4. What are some of the most common challenges that you face in your work?

- Getting clients to understand their financial situation.

- Helping clients to make difficult financial decisions.

- Keeping up with the latest changes in the financial markets.

- Dealing with clients who have unrealistic expectations.

- Managing my own time and resources.

5. What are your strengths as a financial planner?

- I am a Certified Financial Planner™ professional.

- I have over 10 years of experience in the financial planning industry.

- I am passionate about helping people achieve their financial goals.

- I am able to communicate complex financial concepts in a clear and concise manner.

- I am a team player and I am always willing to go the extra mile.

6. What are your weaknesses as a financial planner?

- I am not a licensed investment advisor.

- I do not have any experience in managing large portfolios.

- I am not familiar with all of the latest financial planning software.

- I am not always able to keep up with the latest changes in the financial markets.

- I am not always able to manage my time and resources effectively.

7. Why are you interested in working for our company?

- I am impressed by your company’s commitment to providing quality financial planning services.

- I am excited about the opportunity to work with a team of experienced financial planners.

- I believe that my skills and experience would be a valuable asset to your company.

- I am confident that I can make a significant contribution to your company’s success.

- I am excited about the opportunity to learn and grow within your company.

8. What are your salary expectations?

- My salary expectations are in line with the industry average for financial planners with my experience and qualifications.

- I am willing to negotiate my salary based on the benefits package and the company’s culture.

- I am confident that I can provide value to your company that will exceed my salary expectations.

9. What is your availability?

- I am available to start working immediately.

- I am available to work full-time or part-time.

- I am available to work flexible hours.

- I am available to travel for work.

10. Do you have any questions for me?

- What is the company’s culture like?

- What are the company’s growth plans?

- What are the company’s financial goals?

- What are the company’s investment strategies?

- What are the company’s risk management policies?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Planner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Planner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Planners play a vital role in assisting individuals and families in achieving their financial goals. They provide personalized financial advice and services to help clients plan for the future, manage risk, and make informed financial decisions.

1. Financial Planning

Financial Planners develop comprehensive financial plans for clients that outline strategies for achieving their financial objectives. These plans may include recommendations for investments, savings, retirement planning, tax optimization, and estate planning.

- Conduct in-depth financial assessments to understand clients’ needs and goals.

- Develop personalized financial plans tailored to specific client circumstances.

- Provide ongoing financial advice and guidance to help clients stay on track with their plans.

2. Investment Management

Financial Planners manage and invest client portfolios in accordance with their risk tolerance and financial objectives. They conduct thorough research and analysis to identify suitable investment opportunities and make informed decisions on behalf of their clients.

- Conduct investment research and due diligence to identify potential opportunities.

- Develop investment strategies that align with clients’ risk tolerance and financial goals.

- Monitor investment performance and make adjustments as needed.

3. Retirement Planning

Retirement planning is a crucial aspect of financial planning. Financial Planners assist clients in planning for a secure retirement by optimizing retirement savings, managing retirement accounts, and selecting appropriate retirement income strategies.

- Help clients understand their retirement goals and needs.

- Develop and implement retirement savings strategies, including contributions to 401(k)s and IRAs.

- Provide guidance on retirement income options, such as annuities and pensions.

4. Tax Planning

Financial Planners provide tax planning advice to help clients minimize their tax liability and optimize their financial returns. They stay updated on tax laws and regulations to provide informed recommendations and strategies.

- Analyze clients’ tax situations and identify potential tax-saving opportunities.

- Develop tax planning strategies to reduce tax liability and maximize after-tax income.

- Provide guidance on tax-efficient investment strategies and retirement savings vehicles.

5. Estate Planning

Financial Planners assist clients in preserving and distributing their assets upon death. They work with estate planning attorneys to create wills, trusts, and other legal documents to ensure their clients’ wishes are respected and their assets are distributed according to their intentions.

- Discuss estate planning goals with clients and their families.

- Collaborate with estate planning attorneys to draft wills, trusts, and other legal documents.

- Provide advice on estate tax minimization strategies and charitable giving.

Interview Tips

Preparing for a job interview is essential for any candidate. Here are some tips to help you ace the interview and land the Financial Planner position.

1. Research the Company and Position

Thoroughly research the financial planning firm and the specific position you’re applying for. Visit their website, read industry news, and connect with employees on LinkedIn to gain insights into the company culture and the role’s expectations.

- Familiarize yourself with the firm’s services, investment philosophy, and industry reputation.

- Understand the key responsibilities of the Financial Planner role and how they align with your skills and experience.

2. Practice Your Answers to Common Interview Questions

Prepare for common interview questions by practicing your answers in front of a mirror or with a friend or family member. Focus on highlighting your relevant skills and experience, and provide specific examples that demonstrate your abilities.

- Anticipate questions about your financial planning experience, investment knowledge, and client relationship management skills.

- Prepare examples of successful financial plans you’ve developed or investment strategies you’ve implemented.

3. Dress Professionally and Arrive on Time

First impressions matter, so make sure you dress professionally and arrive on time for your interview. Your appearance and punctuality convey respect for the interviewer and the company.

- Choose appropriate attire that aligns with the firm’s dress code, typically business professional or business casual.

- Plan your route in advance and allow ample time for travel and parking.

4. Be Enthusiastic and Confident

Enthusiasm and confidence can make a positive impact on the interviewer. Show your genuine interest in the position and the company, and demonstrate your self-assurance in your abilities.

- Express your excitement about the opportunity to work with the firm and contribute to their success.

- Convey your confidence in your financial planning knowledge and experience, while remaining humble and respectful.

5. Follow Up After the Interview

Within 24 hours of the interview, send a thank-you note to the interviewer. Express your appreciation for their time and consideration, and reiterate your interest in the position. You can also use this opportunity to address any points you may have missed during the interview or to provide additional information that supports your candidacy.

- Craft a personalized thank-you note that highlights specific aspects of the interview or your qualifications.

- Proofread your note carefully before sending it to ensure accuracy and professionalism.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Planner interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.