Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Reporting Accountant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

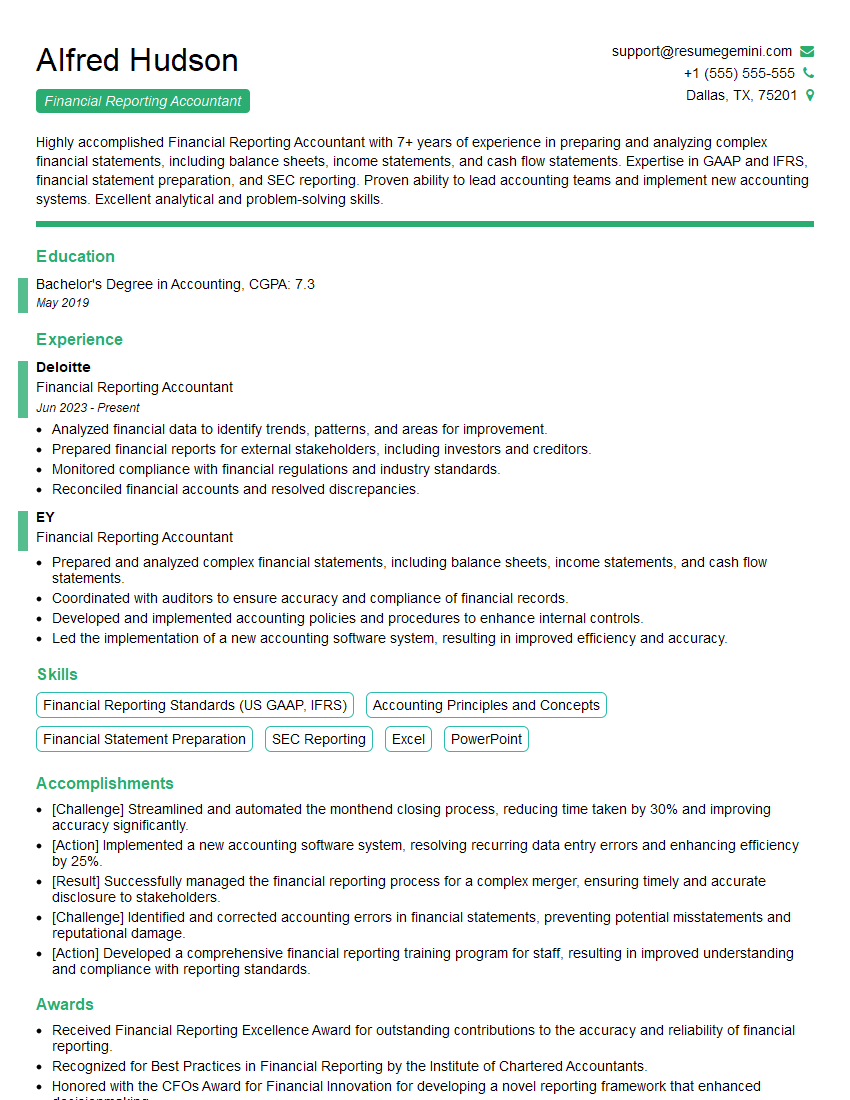

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Reporting Accountant

1. Explain the key elements of a Statement of Financial Position and how they are interrelated?

The Statement of Financial Position (Balance Sheet) presents a snapshot of a company’s financial health at a specific point in time. It comprises three main elements:

- Assets: Resources owned and controlled by the company, such as cash, accounts receivable, and property.

- Liabilities: Obligations the company owes, including accounts payable, loans, and taxes.

- Equity (Net Assets): The residual value of the company’s assets after deducting liabilities, representing the interest of owners.

These elements are interrelated by the accounting equation: Assets = Liabilities + Equity.

2. How do you ensure the accuracy and reliability of financial reporting?

Ensuring financial reporting accuracy and reliability is crucial. Key practices include:

- Following GAAP/IFRS: Adhering to established accounting principles and standards.

- Internal controls: Implementing robust processes to prevent and detect errors or fraud.

- Documentation: Maintaining thorough documentation of accounting transactions and decisions.

- Audits: Engaging in regular internal and external audits to verify financial statements.

- Disclosure and transparency: Providing clear and comprehensive financial information to stakeholders.

3. Describe the key differences between fair value accounting and historical cost accounting?

- Fair value accounting: Records assets and liabilities at their current market value.

- Historical cost accounting: Records assets and liabilities at their original purchase cost.

Fair value is more relevant for decision-making, while historical cost is more objective. The choice between methods depends on the specific asset or liability and the purpose of the financial reporting.

4. How do you handle the recognition and measurement of revenue in accordance with revenue recognition standards?

Revenue recognition involves recognizing revenue when it is earned and measurable. Key criteria include:

- Realized or realizable: Cash received or services performed.

- Measurable: Revenue can be quantified with reasonable accuracy.

- Probable: The transaction is likely to result in cash inflow.

The appropriate revenue recognition standard (e.g., IFRS 15) must be applied to ensure proper timing and measurement of revenue.

5. Explain the concepts of materiality and significance in financial reporting?

- Materiality: Determines whether an item or error is important enough to affect the economic decisions of users.

- Significance: An item is significant if its misstatement or omission would change the portrayal of the company’s financial position or results.

Materiality and significance are subjective judgments based on specific circumstances, industry norms, and auditor expectations.

6. How do you analyze and interpret financial ratios to assess a company’s financial performance and health?

Financial ratios are used to evaluate a company’s liquidity, profitability, efficiency, and solvency. Key ratios include:

- Liquidity ratios: Measure a company’s ability to meet short-term obligations.

- Profitability ratios: Assess a company’s ability to generate profits.

- Efficiency ratios: Evaluate a company’s use of assets and resources.

- Solvency ratios: Indicate a company’s ability to repay long-term debt.

By comparing ratios to industry benchmarks and historical data, we gain insights into a company’s financial performance and identify areas for improvement.

7. What is the role of professional judgment in financial reporting and how do you exercise it responsibly?

Professional judgment is crucial in financial reporting, where situations and transactions may not be explicitly covered by accounting standards. Responsible exercise of judgment involves:

- **Understanding the underlying principles and concepts of accounting.

- **Considering the facts and circumstances of the specific situation.

- **Applying relevant accounting standards and industry best practices.

- **Documenting the rationale for the judgment exercised.

- **Seeking guidance from colleagues or external experts when necessary.

8. Describe the process of preparing a cash flow statement and its importance in financial analysis?

The cash flow statement summarizes a company’s inflows and outflows of cash, classified into operating, investing, and financing activities. Its importance lies in:

- Provides insights into a company’s liquidity: Helps assess its ability to generate and manage cash.

- Shows how cash is used: Informs about investments, acquisitions, and debt repayment.

- Analyzes financial health: Can identify potential cash flow issues or surplus.

- Helps in forecasting: Provides a basis for predicting future cash flows and financial performance.

9. How do you stay up-to-date with the latest accounting standards and regulatory changes?

Staying current with accounting standards and regulatory changes is essential. I follow these practices:

- Attend industry conferences and workshops: Participate in events to gain insights and stay informed about industry best practices.

- Subscribe to professional journals and publications: Read industry-specific journals to monitor regulatory updates and accounting developments.

- Engage in continuing professional education (CPE): Attend courses and seminars to enhance knowledge and fulfill CPE requirements.

- Regularly review websites of standard-setting bodies and regulators: Monitor official sources for announcements and updates on accounting standards and regulations.

10. How do you prioritize and manage multiple tasks and deadlines in a fast-paced environment?

In fast-paced environments, effective task management is critical. I employ the following strategies:

- Create a prioritized task list: Identify the most important and urgent tasks based on their impact and deadlines.

- Break down large tasks: Divide complex tasks into smaller, more manageable steps to avoid feeling overwhelmed.

- Delegate responsibilities: If appropriate, assign tasks to colleagues or team members to distribute the workload.

- Use technology: Leverage tools and software to track tasks, set reminders, and collaborate with others.

- Communicate regularly: Keep stakeholders updated on task progress and any potential roadblocks.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Reporting Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Reporting Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Reporting Accountants hold a vital role in organizations, primarily responsible for ensuring accurate and timely financial reporting in accordance with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

1. Reporting and Consolidation

Prepare and consolidate financial statements including balance sheets, income statements, and cash flow statements.

- Adhere to established accounting policies and procedures

- Reconcile intercompany transactions and balances

2. Financial Analysis and Reporting

Analyze financial data, identify trends, and prepare financial reports for internal and external stakeholders.

- Conduct variance analysis and provide insights on financial performance

- Prepare management reports, SEC filings, and other required disclosures

3. Internal Controls and Compliance

Implement and maintain internal controls to ensure the accuracy and reliability of financial reporting.

- Review and assess internal controls over financial reporting

- Comply with regulatory requirements and reporting deadlines

4. Collaboration and Communication

Collaborate with other departments, auditors, and external stakeholders to gather information and provide financial insights.

- Communicate financial information clearly and effectively

- Build and maintain relationships with key stakeholders

Interview Tips

Preparing thoroughly for an interview can significantly increase your chances of success. Here are some tips and hacks to help you ace your Financial Reporting Accountant interview:

1. Research the Company and Industry

Demonstrate your interest and knowledge by researching the company’s financial performance, industry trends, and key competitors.

- Visit the company website, read industry publications, and analyze financial statements

- Identify the company’s strengths, weaknesses, opportunities, and threats (SWOT analysis)

2. Highlight Relevant Skills and Experience

Tailor your resume and cover letter to emphasize the skills and experience most relevant to the job. Quantify your accomplishments using specific metrics.

- Focus on your expertise in financial reporting, accounting standards, and internal controls

- Showcase your analytical abilities, attention to detail, and communication skills

3. Prepare for Common Interview Questions

Anticipate common interview questions and prepare thoughtful answers. Use the STAR method (Situation, Task, Action, Result) to structure your responses.

- Example Question: Tell me about a time you identified and resolved a discrepancy in financial reporting

- Example Answer: In my previous role, I discovered a variance between the balance sheet and income statement. I investigated the discrepancy, identified a coding error, and corrected the balance, resulting in accurate financial reporting.

4. Practice Mock Interviews

Practice mock interviews with a friend, family member, or career counselor. This will help you become comfortable with the interview process and improve your communication skills.

- Ask for feedback on your answers and identify areas for improvement

- Time yourself to ensure you can answer questions concisely and effectively

5. Follow Up and Thank You Note

Within 24 hours of the interview, send a thank-you note to the interviewer. Reiterate your interest in the position and highlight your key strengths.

- Express appreciation for the interviewer’s time

- Reiterate your qualifications and how you can contribute to the company

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Reporting Accountant interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.