Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Reserve Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

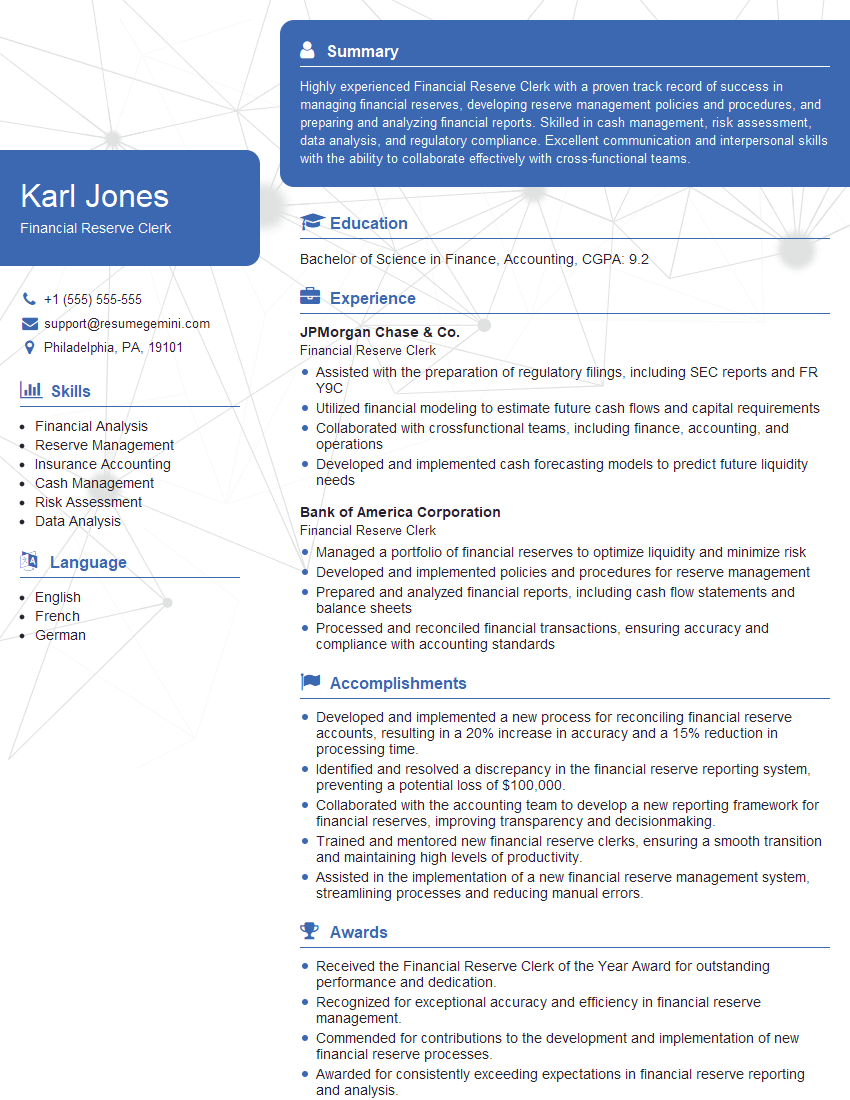

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Reserve Clerk

1. What are the primary responsibilities of a Financial Reserve Clerk?

As a Financial Reserve Clerk, I would be responsible for:

- Maintaining and reconciling cash and cash equivalents

- Processing financial transactions, including deposits, withdrawals, and transfers

- Issuing and tracking checks, money orders, and other financial instruments

- Operating and maintaining cash registers and other financial equipment

- Providing customer service and answering questions related to financial transactions

2. How do you ensure the accuracy of financial transactions?

Internal controls

- Following established policies and procedures

- Using dual controls for sensitive transactions

- Performing regular reconciliations

Attention to detail

- Checking and verifying all data before processing

- Balancing accounts daily and reviewing for any discrepancies

- Reporting any suspicious or unusual activity promptly

3. What is your experience with financial software and systems?

I have experience with a variety of financial software and systems, including:

- Microsoft Excel, Word, and PowerPoint

- Intacct

- NetSuite

- QuickBooks

- SAP

I am proficient in using these systems to perform a variety of tasks, including:

- Entering and processing financial data

- Generating financial reports

- Reconciling accounts

- Managing user accounts and permissions

4. How do you stay up-to-date on changes in financial regulations and best practices?

- Attending industry conferences and webinars

- Reading industry publications and articles

- Participating in online forums and discussion groups

- Completing continuing education courses

- Networking with other financial professionals

5. What are your strengths and weaknesses as a Financial Reserve Clerk?

Strengths

- Strong attention to detail and accuracy

- Excellent communication and interpersonal skills

- Proficient in Microsoft Office Suite and financial software

- Ability to work independently and as part of a team

- Commitment to providing excellent customer service

Weaknesses

- Limited experience with large-scale financial operations

- Not yet certified in financial accounting or auditing

6. Why are you interested in this Financial Reserve Clerk position?

I am interested in this Financial Reserve Clerk position because it aligns with my skills and experience, and I am eager to contribute to the success of your organization.

- Your company’s reputation for providing excellent customer service is something I admire.

- The opportunity to learn from experienced professionals and contribute to a team environment is exciting.

- I am confident that my skills and experience would make me a valuable asset to your team.

7. What are your salary expectations?

My salary expectations are in line with the industry average for Financial Reserve Clerks with my level of experience and qualifications. I am open to discussing this further during the negotiation process.

8. Are you willing to work overtime or on weekends?

Yes, I am willing to work overtime or on weekends if required. I understand that financial operations can be time-sensitive, and I am committed to meeting the needs of the business.

9. What is your availability to start work?

I am available to start work immediately. I am eager to get started and contribute to the success of your organization.

10. Do you have any questions for me?

Yes, I do have a few questions:

- Can you tell me more about the day-to-day responsibilities of this role?

- What is the company culture like?

- What opportunities for professional development are available?

Thank you for your time and consideration.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Reserve Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Reserve Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Financial Reserve Clerk is responsible for a variety of tasks related to the management of financial reserves. These responsibilities include:

1. Processing financial transactions

The Financial Reserve Clerk is responsible for processing financial transactions, such as deposits, withdrawals, and transfers. This may include verifying the accuracy of the transactions, ensuring that the funds are available, and updating the appropriate records.

2. Maintaining financial records

The Financial Reserve Clerk is responsible for maintaining financial records, such as ledgers, journals, and statements. This may include recording financial transactions, reconciling accounts, and preparing financial reports.

3. Monitoring financial activity

The Financial Reserve Clerk is responsible for monitoring financial activity, such as cash flow and investment performance. This may include identifying trends, analyzing data, and reporting on financial performance to management.

4. Preparing financial reports

The Financial Reserve Clerk is responsible for preparing financial reports, such as balance sheets, income statements, and cash flow statements. These reports may be used by management to make decisions about the financial future of the organization.

Interview Tips

Preparing for an interview for a Financial Reserve Clerk position can be a daunting task. However, by following these tips, you can increase your chances of success.

1. Research the company and the position

Before you go on an interview, it is important to research the company and the position you are applying for. This will help you understand the company’s culture, values, and goals, as well as the specific requirements of the position. You can research the company’s website, LinkedIn page, and other online resources.

2. Prepare your resume and cover letter

Your resume and cover letter are two of the most important documents you will submit during the interview process. Make sure your resume is up-to-date and highlights your relevant skills and experience. Your cover letter should be tailored to the specific position you are applying for and should explain why you are the best candidate for the job.

3. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. It is important to practice your answers to these questions so that you can deliver them confidently and concisely. You can practice with a friend or family member, or you can use online resources to find sample interview questions and answers.

4. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally for your interview. You should also arrive on time for your interview. This shows that you are respectful of the interviewer’s time and that you are serious about the position.

5. Be yourself and be confident

The most important thing is to be yourself and be confident. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Be confident in your abilities and your experience, and let the interviewer see why you are the best candidate for the job.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Reserve Clerk interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.