Are you gearing up for a career in Financial Responsibility Division Director? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Financial Responsibility Division Director and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

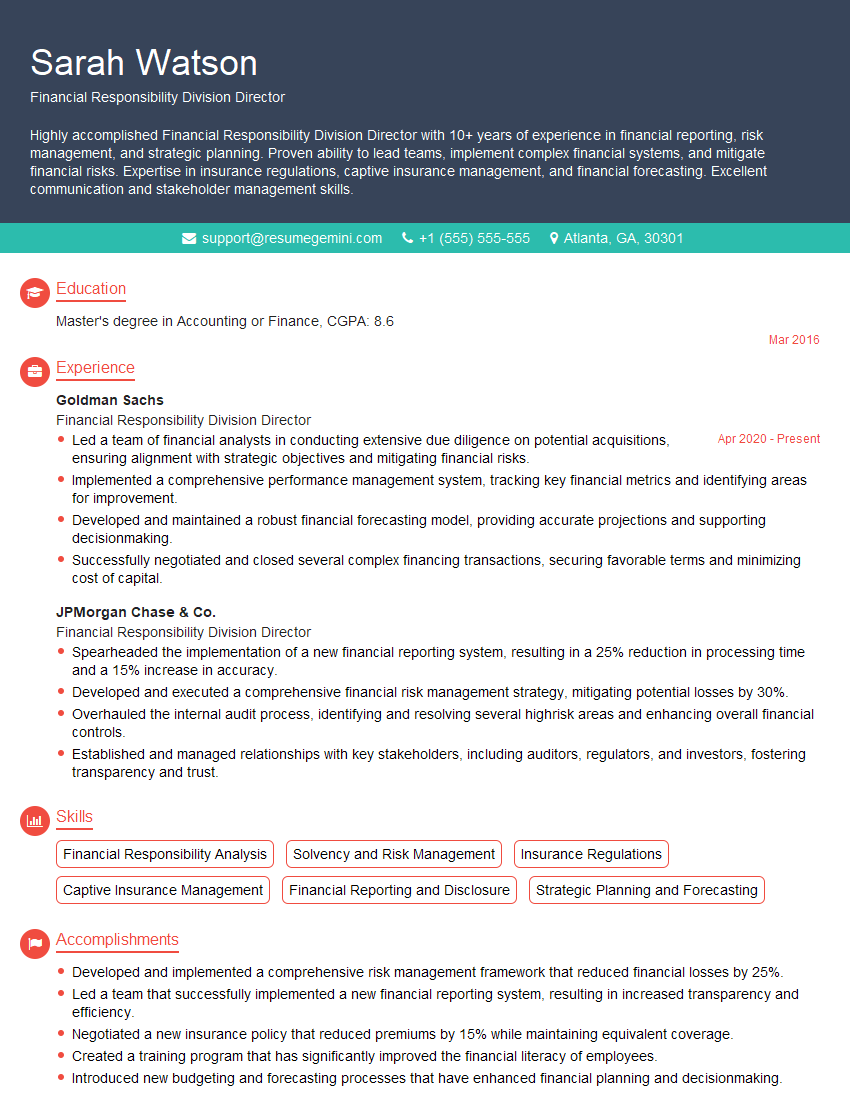

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Responsibility Division Director

1. How would you assess the financial health of an organization and determine its ability to meet its financial obligations?

Sample Answer:

- Analyze financial statements (balance sheet, income statement, cash flow statement) to evaluate profitability, liquidity, solvency, and overall financial performance.

- Review key financial ratios (e.g., debt-to-equity ratio, current ratio, inventory turnover) to assess financial stability and efficiency.

- Conduct a comprehensive review of the organization’s capital structure, sources of financing, and debt covenants.

- Assess the organization’s management team and their financial acumen, as well as the effectiveness of internal controls and risk management practices.

2. What are the key considerations when developing a financial responsibility strategy for an organization?

Sample Answer:

a. Establishing Financial Goals and Objectives

- Define clear financial targets, such as profit margins, debt ratios, and cash flow projections.

- Align financial goals with the organization’s strategic objectives and risk appetite.

b. Risk Assessment and Management

- Identify and assess financial risks (e.g., market volatility, credit risk, operational risk).

- Develop strategies to mitigate and manage identified risks.

3. How do you prioritize financial responsibilities within an organization and allocate resources effectively?

Sample Answer:

- Establish clear financial priorities based on organizational goals and risk tolerance.

- Conduct cost-benefit analyses to evaluate potential investments and allocate resources accordingly.

- Monitor and track financial performance regularly to ensure that resources are utilized efficiently.

4. How do you ensure compliance with financial regulations and reporting requirements?

Sample Answer:

- Establish robust internal controls and compliance procedures.

- Train staff on applicable financial regulations and reporting requirements.

- Conduct regular audits and reviews to ensure compliance and identify potential risks.

5. What are your strategies for managing financial emergencies and minimizing financial losses?

Sample Answer:

- Develop contingency plans and emergency response protocols.

- Maintain a cash reserve or access to credit facilities to mitigate financial shocks.

- Implement measures to reduce operational costs and optimize expenses.

6. How do you communicate financial information effectively to stakeholders, including the board of directors, management, and employees?

Sample Answer:

- Prepare clear and concise financial reports tailored to the audience.

- Use a variety of communication channels (e.g., presentations, workshops, written reports) to engage stakeholders.

- Explain financial concepts and results in a manner that is easily understandable.

7. What are the key trends and best practices in financial responsibility?

Sample Answer:

- Increased adoption of technology for financial planning, forecasting, and risk management.

- Growing emphasis on sustainability and environmental, social, and governance (ESG) considerations.

- Shift towards data-driven decision-making and analytics to optimize financial performance.

8. How do you stay updated on the latest financial regulations and accounting standards?

Sample Answer:

- Attend industry conferences and workshops.

- Read industry publications and subscribe to financial news sources.

- Participate in professional development opportunities (e.g., certifications, online courses).

9. What are your strengths and weaknesses as a Financial Responsibility Division Director?

Sample Answer:

Strengths:

- Strong financial acumen and understanding of financial principles.

- Proven track record of developing and implementing successful financial strategies.

- Exceptional communication and stakeholder management skills.

Weaknesses:

- Limited experience in international financial markets.

- Not yet certified as a Chartered Financial Analyst (CFA).

10. How do you handle situations where there are competing financial priorities or limited resources?

Sample Answer:

- Analyze the potential impact of different courses of action.

- Consult with stakeholders to gather input and explore potential solutions.

- Make informed decisions based on financial analysis and risk assessment.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Responsibility Division Director.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Responsibility Division Director‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Financial Responsibility Division Director is a senior leadership position within the financial sector, responsible for driving the strategic direction and performance of the division.

1. Strategic Planning and Execution

Develop and execute long-term financial plans and strategies to achieve organizational goals, ensuring financial stability and growth.

- Conduct thorough financial analysis and market research to identify growth opportunities and risks.

- Set financial targets and performance metrics, establishing clear guidelines for the division.

2. Financial Risk Management

Establish and implement robust risk management practices to mitigate financial risks and ensure compliance with regulatory requirements.

- Develop and implement risk assessment models to identify and manage potential financial risks.

- Monitor financial performance and implement corrective actions to address any deviations from set objectives.

3. Budget and Financial Management

Oversee the development and execution of the division’s budget, ensuring efficient use of financial resources.

- Allocate funds across various departments and projects, prioritizing investments based on strategic objectives.

- Prepare and analyze financial statements, providing insights into financial performance and areas for improvement.

4. Team Leadership and Collaboration

Lead a team of financial professionals, fostering a collaborative and results-oriented work environment.

- Guide and mentor team members, providing ongoing support and professional development opportunities.

- Build strong relationships with internal and external stakeholders, including investors, regulators, and business partners.

Interview Tips

Preparing for an interview for a Financial Responsibility Division Director position requires thorough research, self-reflection, and practice.

1. Research the Company and Industry

Gather information about the company’s financial performance, industry trends, and competition. This knowledge will help you understand the context of the role and demonstrate your interest in the organization.

- Visit the company’s website, read industry publications, and attend industry events to gain insights.

- Identify the company’s key financial metrics, such as revenue, profit margin, and debt-to-equity ratio.

2. Practice Your Answers

Prepare responses to common interview questions to showcase your skills and experience. Consider using the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples of your accomplishments.

- Practice your answers out loud or with a friend to gain confidence and fluency.

- Focus on highlighting your technical expertise, leadership abilities, and experience in financial risk management.

3. Be Prepared for Technical Questions

Expect to encounter questions that assess your financial acumen and understanding of complex financial concepts. These questions may cover topics such as financial modeling, investment analysis, and risk management.

- Review basic financial formulas and concepts to ensure you can answer questions accurately.

- Familiarize yourself with the company’s financial performance and industry trends.

4. Showcase Your Leadership and Communication Skills

Highlight your ability to lead and motivate a team of financial professionals. Describe your experience in developing and implementing strategies, managing budgets, and fostering a collaborative work environment.

- Provide examples of how you have successfully led teams to achieve financial goals.

- Demonstrate your strong communication and interpersonal skills by describing how you build relationships and influence stakeholders.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Responsibility Division Director interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.