Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Retirement Plan Specialist position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

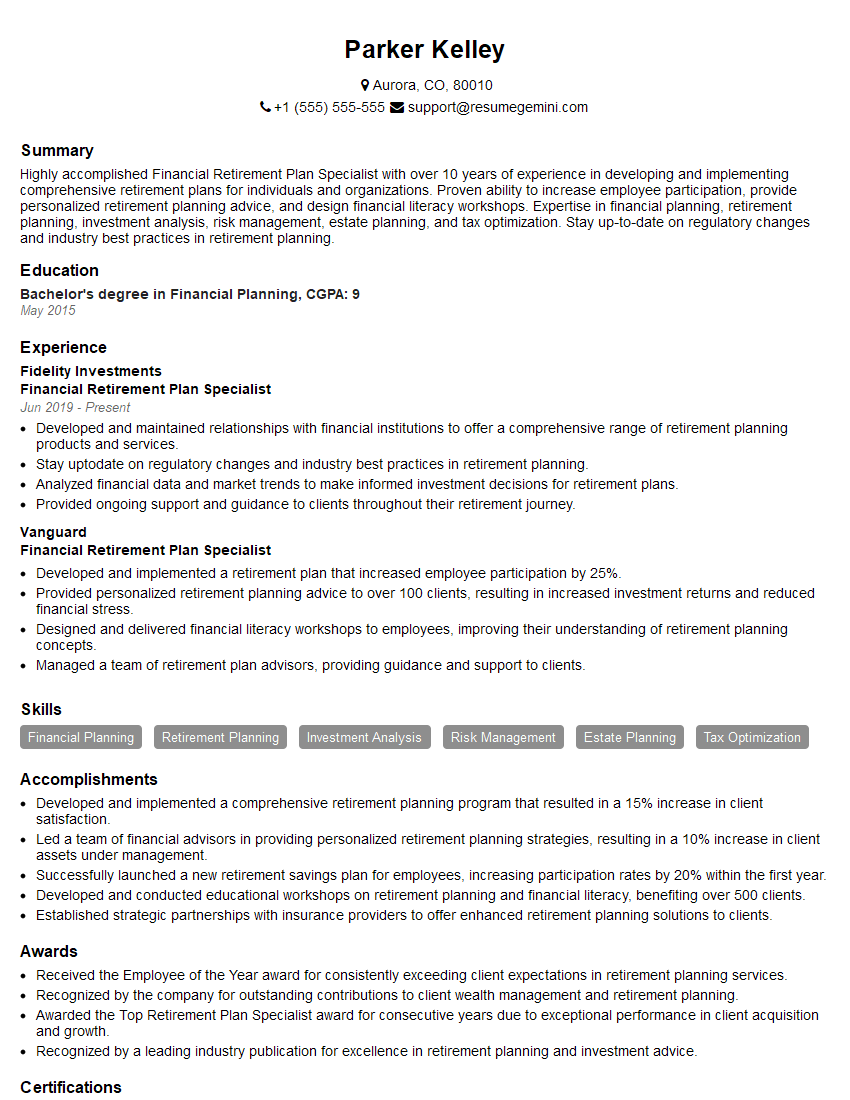

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Retirement Plan Specialist

1. Explain the key components of a comprehensive retirement plan?

A comprehensive retirement plan should include the following key components:

- Investment strategy: This outlines the asset allocation, diversification, and risk tolerance of the plan.

- Income plan: This details how the individual will generate income in retirement, including sources such as Social Security, pensions, and investments.

- Estate plan: This ensures that the individual’s assets are distributed according to their wishes after their death.

- Healthcare plan: This addresses the individual’s healthcare expenses in retirement, including long-term care.

2. Describe the different types of retirement accounts and their tax implications?

Tax-advantaged accounts

- 401(k): Employer-sponsored retirement plan with tax-deferred contributions.

- 403(b): Similar to 401(k), but for employees of public schools and certain other non-profit organizations.

- IRA: Individual retirement account with tax-advantaged savings.

Non-tax-advantaged accounts

- Brokerage account: Investment account where contributions are not tax-deferred and investment gains are taxed.

- Certificate of deposit (CD): Savings account with a fixed term and interest rate.

3. How do you evaluate the risk tolerance of a potential client?

I use a combination of qualitative and quantitative methods to evaluate a client’s risk tolerance:

- Qualitative assessment: This involves asking the client questions about their investment experience, financial goals, and time horizon.

- Quantitative assessment: This involves using a risk tolerance questionnaire to assess the client’s comfort level with different levels of investment risk.

4. Explain the importance of diversification in a retirement portfolio?

Diversification is crucial in a retirement portfolio because it helps to reduce risk and improve returns:

- Reducing risk: By investing in a variety of asset classes, such as stocks, bonds, and real estate, the portfolio becomes less vulnerable to fluctuations in any one asset class.

- Improving returns: Over time, different asset classes tend to perform differently, so a diversified portfolio can capture the returns from each asset class and smooth out overall performance.

5. How do you stay up-to-date on the latest investment trends and regulatory changes?

I stay up-to-date on the latest investment trends and regulatory changes through a combination of continuing education, industry publications, and networking with other financial professionals:

- Continuing education: I attend industry conferences, webinars, and workshops to learn about new investment strategies and regulations.

- Industry publications: I subscribe to industry publications such as the Wall Street Journal, Financial Times, and Investment News to stay informed about current events and trends.

- Networking: I network with other financial professionals through professional organizations and industry events to exchange ideas and discuss market developments.

6. Describe your process for developing a personalized retirement plan for a client?

My process for developing a personalized retirement plan for a client involves the following steps:

- Gather client information: I collect information about the client’s financial situation, investment goals, and risk tolerance.

- Analyze the client’s needs: I analyze the client’s information to identify their retirement goals and the challenges they may face in achieving them.

- Develop a plan: I develop a retirement plan that outlines the investment strategy, income plan, estate plan, and healthcare plan that is tailored to the client’s unique needs.

- Implement the plan: I help the client implement the plan by recommending specific investments and strategies.

- Monitor and review the plan: I regularly monitor and review the plan to ensure that it is still meeting the client’s needs and goals.

7. How do you handle clients who are experiencing market volatility?

When working with clients who are experiencing market volatility, I take the following steps:

- Provide reassurance: I reassure the client that market volatility is normal and that it is important to stay invested for the long term.

- Review the client’s portfolio: I review the client’s portfolio to ensure that it is still aligned with their risk tolerance and investment goals.

- Recommend adjustments: If necessary, I recommend adjustments to the client’s portfolio to help reduce risk and improve returns.

- Stay in touch: I stay in close contact with the client to provide updates on the market and answer any questions they may have.

8. How do you build trust with clients?

Building trust with clients is essential in this field. Here are some ways I do it:

- Honesty and transparency: I am honest and transparent with clients about their financial situation and the investment strategies I recommend.

- Putting the client’s interests first: I always put the client’s interests first and make recommendations that are in their best interest.

- Effective communication: I communicate with clients regularly and clearly, so they always understand their financial situation and the strategies we are using.

- Building a personal connection: I take the time to get to know my clients on a personal level, which helps build rapport and trust.

9. How do you stay motivated in this competitive industry?

I stay motivated in this competitive industry by:

- Focusing on my clients’ success: Seeing my clients achieve their financial goals is incredibly motivating.

- Continuous learning: I am always learning about new investment strategies and regulations to stay ahead of the curve.

- Networking with other professionals: Exchanging ideas and best practices with other financial professionals helps me stay motivated and up-to-date.

- Challenging myself: I set challenging goals for myself to constantly improve my skills and knowledge.

10. What is your favorite aspect of being a Financial Retirement Plan Specialist?

My favorite aspect of being a Financial Retirement Plan Specialist is helping people achieve their retirement goals. I enjoy working with clients to develop personalized plans that meet their unique needs. It is rewarding to see them retire comfortably and financially secure.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Retirement Plan Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Retirement Plan Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Retirement Plan Specialists are responsible for providing expert guidance and support to individuals and organizations in planning and managing their retirement savings. Key job responsibilities include:

1. Retirement Planning and Advice

Conducting comprehensive retirement planning sessions with clients to assess their financial needs, goals, and risk tolerance.

- Developing personalized retirement plans that include investment strategies, savings targets, and withdrawal strategies.

- Providing ongoing advice and guidance to clients throughout their retirement journey.

2. Investment Management

Managing client retirement portfolios to align with their investment objectives and risk tolerance.

- Conducting thorough market research and analysis to identify suitable investment opportunities.

- Implementing diversified investment strategies to maximize returns while mitigating risk.

3. Tax Planning

Developing tax-efficient retirement strategies to minimize tax burdens and maximize savings.

- Understanding and utilizing various tax-advantaged retirement accounts, such as 401(k)s, IRAs, and Roth accounts.

- Planning for potential tax implications during retirement.

4. Education and Outreach

Educating clients and the public about retirement planning and investment strategies.

- Conducting workshops, seminars, and presentations on retirement planning topics.

- Providing written materials and online resources to enhance financial literacy.

Interview Tips

Preparing for an interview for a Financial Retirement Plan Specialist position requires thorough research, self-reflection, and practice. Here are some essential tips:

1. Research the Company and Role

Gather information about the company’s culture, retirement planning services, and specific requirements for the role.

- Visit the company website and review their financial documents.

- Read industry publications and articles to stay informed about retirement planning trends and regulations.

2. Highlight Relevant Skills and Experience

Emphasize your expertise in retirement planning, investment management, and tax strategies.

- Quantify your accomplishments and provide specific examples of how you have helped clients achieve their retirement goals.

- Highlight any relevant certifications, such as the CERTIFIED FINANCIAL PLANNER™ (CFP®) designation.

3. Demonstrate Your Communication and Interpersonal Skills

Financial Retirement Plan Specialists must effectively communicate complex financial concepts to clients from diverse backgrounds.

- Prepare examples of how you have engaged with clients in a clear and empathetic manner.

- Emphasize your ability to build strong relationships and inspire trust.

4. Practice Your Answers

Anticipate common interview questions and prepare thoughtful responses that align with the job requirements.

- Practice using the STAR method (Situation, Task, Action, Result) to structure your answers.

- Seek feedback from a trusted mentor or career coach to enhance your presentation.

5. Be Enthusiastic and Professional

Convey your passion for retirement planning and your commitment to helping clients secure their financial futures.

- Dress professionally and maintain a positive attitude throughout the interview.

- Ask thoughtful questions to demonstrate your interest in the role and the company.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Retirement Plan Specialist interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!