Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Risk Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

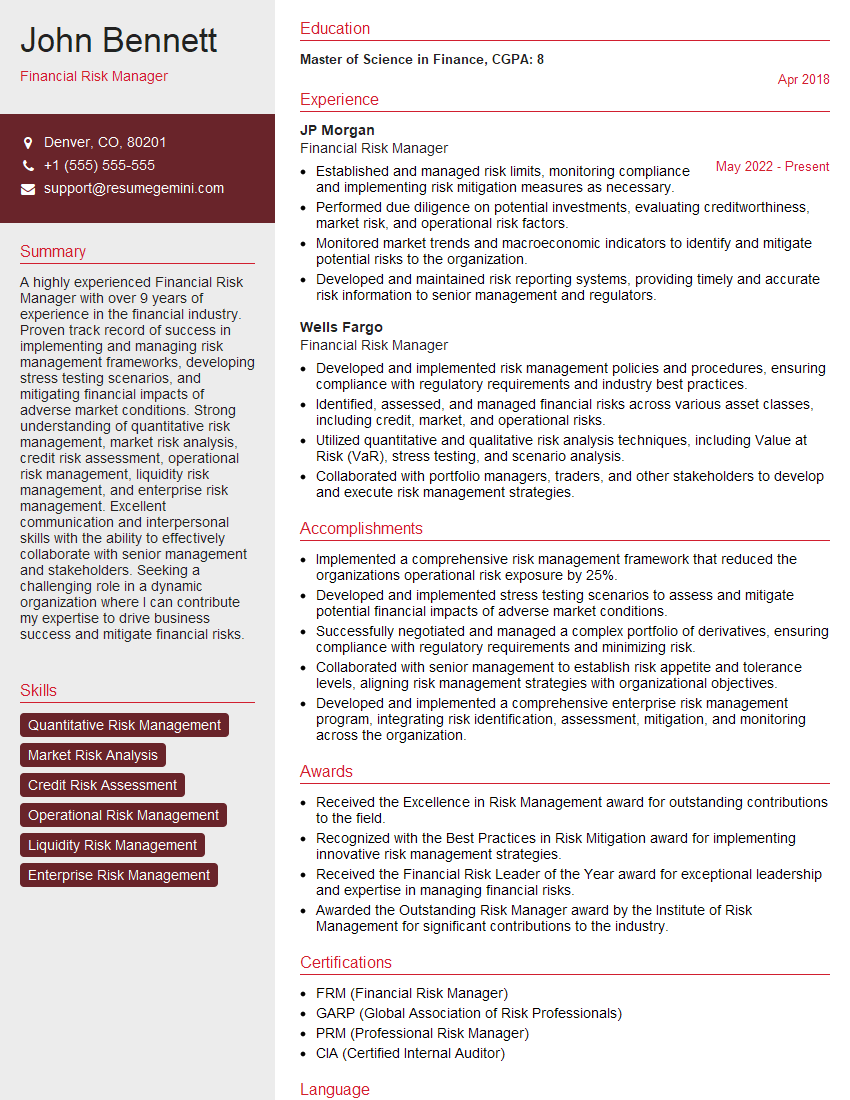

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Risk Manager

1. What is your understanding of Value at Risk (VaR) and how do you calculate it?

Value at Risk (VaR) is a statistical measure that quantifies the potential loss in value of a portfolio of assets over a given time horizon and under a specified confidence level. It is calculated by simulating the performance of the portfolio under various adverse market conditions and measuring the maximum potential loss incurred. The confidence level represents the probability that the actual loss will not exceed the VaR estimate.

2. Explain the difference between market risk and credit risk and how you would manage each type of risk?

Market risk

- Risk that arises from changes in market conditions, such as interest rates, exchange rates, and commodity prices.

- Managed by diversifying the portfolio, using hedging strategies, and setting risk limits.

Credit risk

- Risk that arises from the possibility that a counterparty will default on its financial obligations.

- Managed by assessing the creditworthiness of counterparties, setting credit limits, and using credit derivatives.

3. What are the key components of a risk management framework?

A risk management framework typically includes the following components:

- Risk identification

- Risk assessment

- Risk mitigation

- Risk monitoring

- Risk reporting

4. How would you assess the risk appetite of a financial institution?

Assessing the risk appetite of a financial institution involves understanding the institution’s strategic objectives, financial position, and risk tolerance. It also involves considering the institution’s regulatory environment and its stakeholders’ expectations.

5. What are some of the challenges you have faced in your previous role as a Financial Risk Manager?

Some of the challenges I have faced in my previous role as a Financial Risk Manager include:

- Developing and implementing effective risk management strategies

- Communicating risk to senior management and the board of directors

- Staying up-to-date on regulatory changes and best practices

- Managing risk in a rapidly changing and uncertain market environment

6. What are your thoughts on the current state of the financial risk management industry?

The financial risk management industry is constantly evolving in response to changing market conditions and regulatory requirements. Some of the key trends in the industry include:

- The increasing use of technology and data analytics

- The growing importance of environmental, social, and governance (ESG) factors

- The increasing focus on risk culture and ethics

7. What are your career goals for the next 5 years?

My career goals for the next 5 years include:

- Continuing to develop my skills and knowledge in financial risk management

- Taking on more leadership responsibilities within my organization

- Making a significant contribution to the financial risk management profession

8. What are your strengths and weaknesses as a Financial Risk Manager?

Strengths

- Strong technical skills in financial risk management

- Excellent communication and interpersonal skills

- Ability to think critically and solve problems

- Proven track record of success in managing risk

Weaknesses

- Limited experience in managing operational risk

- Need to further develop my understanding of regulatory requirements in other jurisdictions

9. Why are you interested in working for our organization?

I am interested in working for your organization because of its strong reputation in the financial risk management industry. I am particularly impressed by your organization’s commitment to innovation and its focus on developing its employees.

10. Do you have any questions for me?

I would like to know more about your organization’s risk management framework and how it has been implemented.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Risk Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Risk Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Financial Risk Manager plays a pivotal role in any financial institution, shouldering the responsibility of identifying, assessing, and mitigating financial risks. Their core duties encompass:1. Risk Identification and Assessment

– Conducting comprehensive risk assessments to pinpoint potential sources of financial loss – Analyzing market trends, macroeconomic factors, and financial data to gauge risk exposure – Developing and implementing robust risk management frameworks to proactively address risks2. Risk Mitigation and Management

– Designing and executing risk mitigation strategies to minimize the impact of potential losses – Managing risk exposures through hedging, diversification, and insurance – Monitoring and evaluating risk management strategies to ensure their effectiveness3. Reporting and Communication

– Providing regular reports to senior management and stakeholders on risk assessments and mitigation plans – Communicating risk management policies and procedures to employees and external stakeholders – Advising management on risk-related decisions and the implications of financial risks4. Regulatory Compliance

– Ensuring compliance with financial regulations and industry best practices related to risk management – Working with regulators to ensure compliance and maintain the institution’s reputationInterview Tips

To ace an interview for a Financial Risk Manager position, meticulous preparation is paramount. Here are some invaluable tips to guide you:1. Research the Company and Role

– Thoroughly research the financial institution, its risk profile, and the specific industry it operates in – Understand the scope of the Financial Risk Manager role, its responsibilities, and the skills required2. Highlight Risk Management Expertise

– Showcase your deep understanding of financial risks, risk assessment techniques, and risk mitigation strategies – Quantify your accomplishments in identifying, assessing, and mitigating financial risks3. Quantify Your Results

– Quantify your contributions and the impact of your risk management efforts on the financial institution – Provide specific examples of how your interventions prevented financial losses or reduced risk exposure4. Demonstrate Communication Skills

– Highlight your ability to communicate complex risk information clearly and effectively to both technical and non-technical audiences – Showcase your proficiency in writing risk reports, presenting to stakeholders, and interacting with regulators5. Emphasize Compliance Knowledge

– Demonstrate your familiarity with relevant financial regulations and industry best practices related to risk management – Explain how you ensure compliance and mitigate regulatory risks in your previous rolesNext Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Financial Risk Manager, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Financial Risk Manager positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.