Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Secretary position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

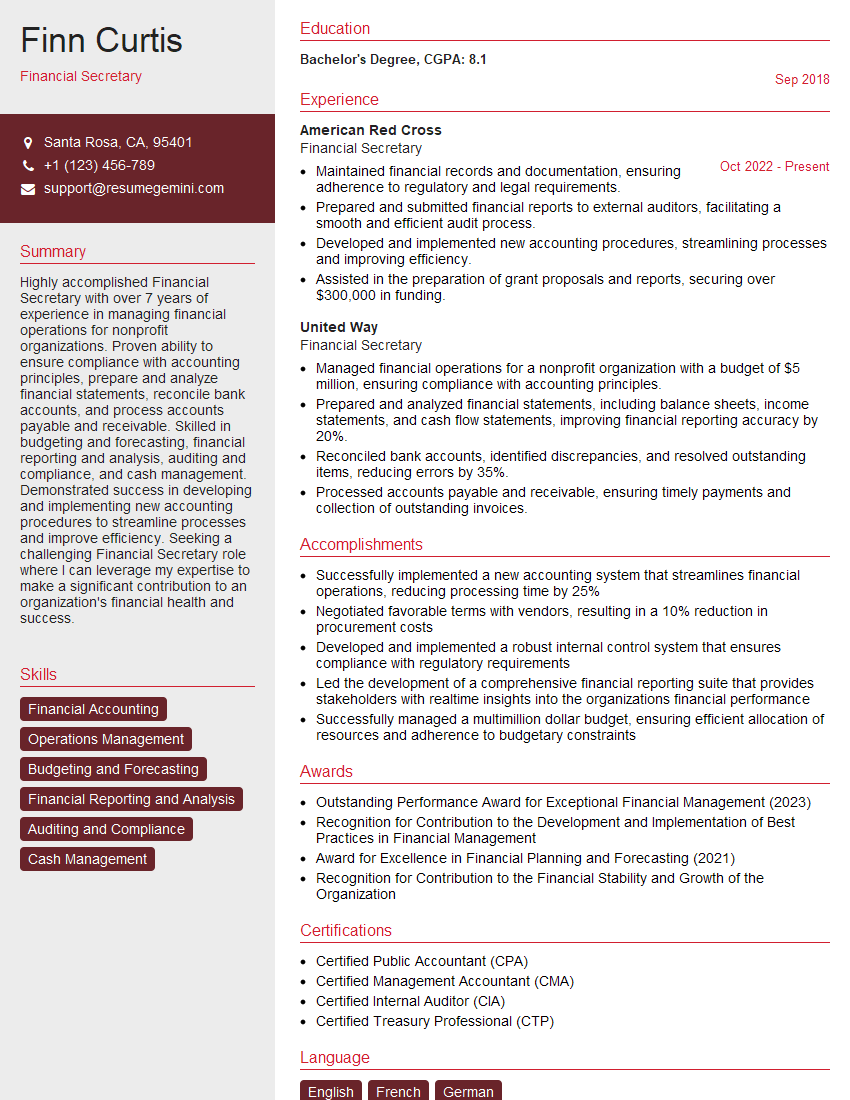

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Secretary

1. What are the key responsibilities of a Financial Secretary?

As a Financial Secretary, my primary responsibilities will encompass a comprehensive array of financial management duties, including:

- Overseeing the preparation, execution, and analysis of financial statements

- Managing treasury operations and cash flow forecasting

- Developing and implementing financial policies and procedures

- Advising senior management on financial matters

- Maintaining compliance with financial regulations and reporting requirements

2. How would you develop and implement a financial strategy for an organization?

Understanding the Organization’s Goals

- Conduct thorough research and analysis to gain insights into the organization’s mission, vision, and strategic objectives

- Identify key financial metrics and indicators to track performance

Developing the Strategy

- Formulate a financial plan that aligns with the organization’s strategic goals

- Establish clear financial targets and objectives

- Identify potential risks and develop mitigation strategies

Implementation and Monitoring

- Communicate the financial strategy to stakeholders

- Implement financial controls and reporting systems

- Monitor financial performance and make adjustments as needed

3. What are the best practices for managing cash flow?

To effectively manage cash flow, I would implement a multifaceted approach that includes:

- Forecasting cash flow to anticipate future cash needs

- Optimizing accounts receivable and accounts payable processes

- Exploring financing options to bridge cash flow gaps

- Identifying and implementing cost-saving measures

- Maintaining strong relationships with financial institutions

4. How would you analyze a company’s financial statements to assess its financial health?

To assess a company’s financial health, I would conduct a thorough analysis of its financial statements, focusing on:

- Income Statement: Reviewing revenue, expenses, and profitability

- Balance Sheet: Evaluating assets, liabilities, and equity

- Cash Flow Statement: Analyzing cash flow from operations, investing, and financing

- Key Financial Ratios: Calculating liquidity, solvency, profitability, and efficiency ratios

- Industry Benchmarks: Comparing the company’s financial performance to industry averages

5. What are the key principles of risk management in financial planning?

To ensure effective risk management in financial planning, I would adhere to the following principles:

- Identify and Assess Risks: Proactively identifying potential risks and evaluating their likelihood and impact

- Develop Mitigation Strategies: Formulating plans to minimize or eliminate the potential consequences of risks

- Monitor and Control Risks: Establishing systems to monitor risks and implementing controls to prevent or mitigate them

- Communicate Risks: Effectively communicating risks to stakeholders to ensure understanding and alignment

- Continuously Improve: Reviewing and updating risk management strategies on an ongoing basis to enhance their effectiveness

6. How would you prepare for and navigate an external audit?

Preparation

- Gather and organize financial records and documentation

- Review internal controls and ensure compliance

- Prepare a detailed audit plan

- Communicate with the audit team and establish clear expectations

Navigation

- Provide timely and accurate responses to auditor inquiries

- Maintain open and transparent communication

- Collaborate with the audit team to address any identified issues

- Review and provide feedback on the audit report

7. What are the ethical considerations involved in financial management?

As a Financial Secretary, ethical considerations would guide my decision-making and actions:

- Integrity: Maintaining honesty, fairness, and transparency in all financial dealings

- Confidentiality: Protecting sensitive financial information and adhering to confidentiality agreements

- Objectivity: Avoiding conflicts of interest and making decisions based solely on financial data

- Professionalism: Maintaining high standards of conduct and adhering to professional guidelines

- Sustainability: Considering the long-term financial impact of decisions and promoting sustainable practices

8. How would you stay up-to-date on the latest financial regulations and accounting standards?

- Regularly attend industry conferences and webinars

- Subscribe to professional publications and journals

- Participate in continuing professional education programs

- Network with other financial professionals

- Utilize online resources and databases for information updates

9. How would you manage a team of financial analysts?

Leadership and Communication

- Set clear goals and expectations for the team

- Foster open communication and provide regular feedback

- Delegate tasks effectively and provide support

Team Development and Collaboration

- Identify and develop team members’ strengths and skills

- Promote collaboration and knowledge sharing within the team

- Encourage teamwork and mutual support

10. What are your strengths and weaknesses as a Financial Secretary?

Strengths

- In-depth knowledge of financial management principles

- Strong analytical and problem-solving skills

- Proven ability to lead and motivate teams

- Excellent communication and interpersonal skills

- Commitment to ethical and professional standards

Weaknesses

- Limited experience in a specific industry (can be addressed through training and on-the-job learning)

- Can be detail-oriented and sometimes require additional time to ensure accuracy (mitigated by using technology and automation)

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Secretary.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Secretary‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Financial Management and Analysis

• Develop and implement financial policies and procedures to ensure sound financial management.

• Prepare and analyze financial statements, including balance sheets, income statements, and cash flow statements.

• Monitor financial performance and identify areas for improvement.

2. Budget Preparation and Execution

• Develop and manage the organization’s budget in collaboration with other departments.

• Control expenses and ensure compliance with budget guidelines.

• Prepare financial reports and present them to management for review and approval.

3. Treasury Management

• Manage cash flow, including forecasting, investing, and borrowing.

• Maintain relationships with banks and other financial institutions.

• Ensure compliance with regulatory requirements related to treasury operations.

4. Investor Relations

• Communicate with investors and analysts to provide information about the organization’s financial performance.

• Manage shareholder meetings and prepare shareholder reports.

• Assist with fundraising and other investor-related activities.

Interview Tips

1. Research the Company and Position

• Visit the company’s website to learn about their mission, values, and financial performance.

• Review the job description carefully to identify the key responsibilities and qualifications.

2. Prepare Answers to Common Interview Questions

• Practice answering common interview questions related to your financial skills, experience, and qualifications.

• Prepare examples of your work that demonstrate your abilities in financial management, analysis, and reporting.

3. Highlight Your Communication and Interpersonal Skills

• Emphasize your ability to clearly communicate financial information to both technical and non-technical audiences.

• Provide examples of how you have effectively collaborated with cross-functional teams.

4. Be Professional and Enthusiastic

• Dress professionally and arrive on time for the interview.

• Maintain a positive and enthusiastic demeanor throughout the interview.

• Ask thoughtful questions that demonstrate your interest in the position and the organization.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Financial Secretary role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.