Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Services Agent position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

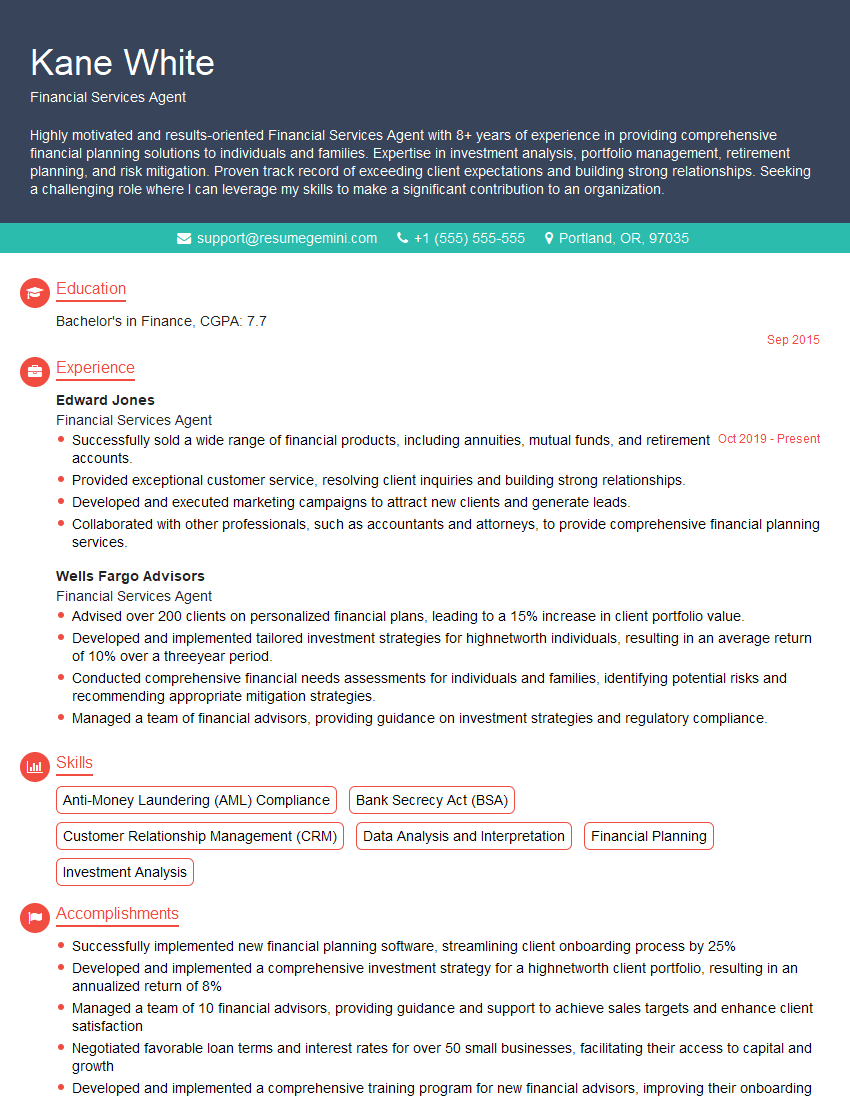

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Services Agent

1. Tell me about your experience in financial services?

- Having worked as a Financial Services Agent for the past 5 years, I have gained extensive experience in providing financial advice and solutions to individuals and businesses.

- My expertise lies in areas such as investment planning, retirement planning, estate planning, and risk management.

- I am proficient in conducting financial needs assessments, developing customized financial plans, and recommending suitable investment products.

2. What are the key responsibilities of a Financial Services Agent?

subheading of the answer

- Conducting financial needs assessments and developing customized financial plans.

- Recommending and selling investment products and services to meet client objectives.

- Providing ongoing financial advice and support to clients.

subheading of the answer

- Maintaining up-to-date knowledge of financial products and regulations.

- Building and maintaining strong client relationships.

- Adhering to ethical guidelines and regulatory requirements.

3. What are the different types of financial products and services you are familiar with?

- I am familiar with a wide range of financial products and services, including:

- Investment products such as stocks, bonds, mutual funds, and ETFs.

- Retirement planning products such as annuities, IRAs, and 401(k) plans.

- Estate planning products such as trusts, wills, and life insurance.

- Risk management products such as health insurance, disability insurance, and property insurance.

4. How do you stay up-to-date on financial trends and regulations?

- I stay up-to-date on financial trends and regulations through a variety of channels, including:

- Attending industry conferences and workshops.

- Reading industry publications and news articles.

- Taking continuing education courses.

- Consulting with colleagues and other professionals.

5. What are some of the challenges you have faced as a Financial Services Agent?

- One of the challenges I have faced is staying up-to-date on the rapidly changing financial landscape.

- Another challenge is navigating the complex regulatory environment.

- Additionally, it can be challenging to build trust with clients and overcome their skepticism about financial advice.

6. What are your strengths and weaknesses as a Financial Services Agent?

- My strengths include my strong analytical skills, my ability to build rapport with clients, and my commitment to providing ethical and professional advice.

- One area where I am looking to improve is my knowledge of alternative investment products.

7. Why are you interested in working for our company?

- I am interested in working for your company because I am impressed by your commitment to providing personalized financial advice to clients.

- I believe that my skills and experience would be a valuable asset to your team.

- Additionally, I am eager to contribute to the growth and success of your company.

8. What are your salary expectations?

- My salary expectations are in line with the industry average for Financial Services Agents with my level of experience and qualifications.

- I am flexible and willing to negotiate a compensation package that is fair and mutually beneficial.

9. Do you have any questions for me?

- Here are a few questions that I have:

- What is the company’s culture like?

- What are the opportunities for professional development?

- What are the company’s goals for the future?

10. What is your investment philosophy?

- My investment philosophy is centered around the following principles:

- Diversification

- Long-term investing

- Risk management

- I believe that by adhering to these principles, I can help my clients achieve their financial goals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Services Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Services Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Services Agents play a crucial role in the financial industry, providing expert advice and guidance to clients on various financial products and services. Here are the key responsibilities:

1. Client Relationship Management

Establish and maintain strong relationships with clients, understanding their financial goals and needs.

- Actively listen to client concerns and provide personalized recommendations.

- Conduct thorough financial assessments to determine suitable products and services.

2. Financial Product Sales

Sell and promote a range of financial products, including investments, insurance, and loans.

- Present product features and benefits, highlighting potential returns and risks.

- Negotiate terms and conditions with clients, ensuring they fully understand the agreements.

3. Financial Planning and Advice

Provide financial planning advice based on clients’ individual circumstances.

- Develop and implement financial plans that align with client goals, such as retirement planning, education funding, and wealth management.

- Educate clients on financial concepts, making complex matters easy to understand.

4. Regulatory Compliance and Ethics

Uphold ethical standards and adhere to all relevant financial regulations.

- Stay abreast of industry regulations and best practices.

- Handle client information with confidentiality and integrity.

Interview Tips

Interview preparation is key to presenting yourself as the ideal candidate. Here are some tips to help you ace the interview:

1. Research the Company and Position

Thoroughly research the company’s background, values, and financial services offerings.

- Visit the company website, read industry news, and study the job description to gain insights into the role and responsibilities.

- This will help you tailor your answers and demonstrate your knowledge of the company and industry.

2. Practice Common Interview Questions

Anticipate common interview questions and prepare well-structured responses.

- Practice answering questions related to your financial knowledge, sales skills, and client relationship management abilities.

- Use the STAR method (Situation, Task, Action, Result) to provide clear and concise examples of your experience.

3. Highlight Relevant Experience and Skills

Emphasize your relevant experience in financial services or related fields.

- Quantify your accomplishments with specific metrics and results whenever possible.

- Relate your skills and experience to the core responsibilities of the Financial Services Agent position.

4. Showcase Your Communication and Interpersonal Skills

Financial Services Agents need strong communication and interpersonal skills.

- During the interview, demonstrate your active listening abilities, empathy, and ability to engage in meaningful conversations.

- Highlight your experience in building and maintaining client relationships.

5. Ask Thoughtful Questions

Asking insightful questions at the end of the interview shows your interest and engagement.

- Prepare questions about the company’s financial services offerings, growth plans, or industry trends.

- This indicates your eagerness to learn and contribute to the company’s success.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Services Agent interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!