Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Services Officer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

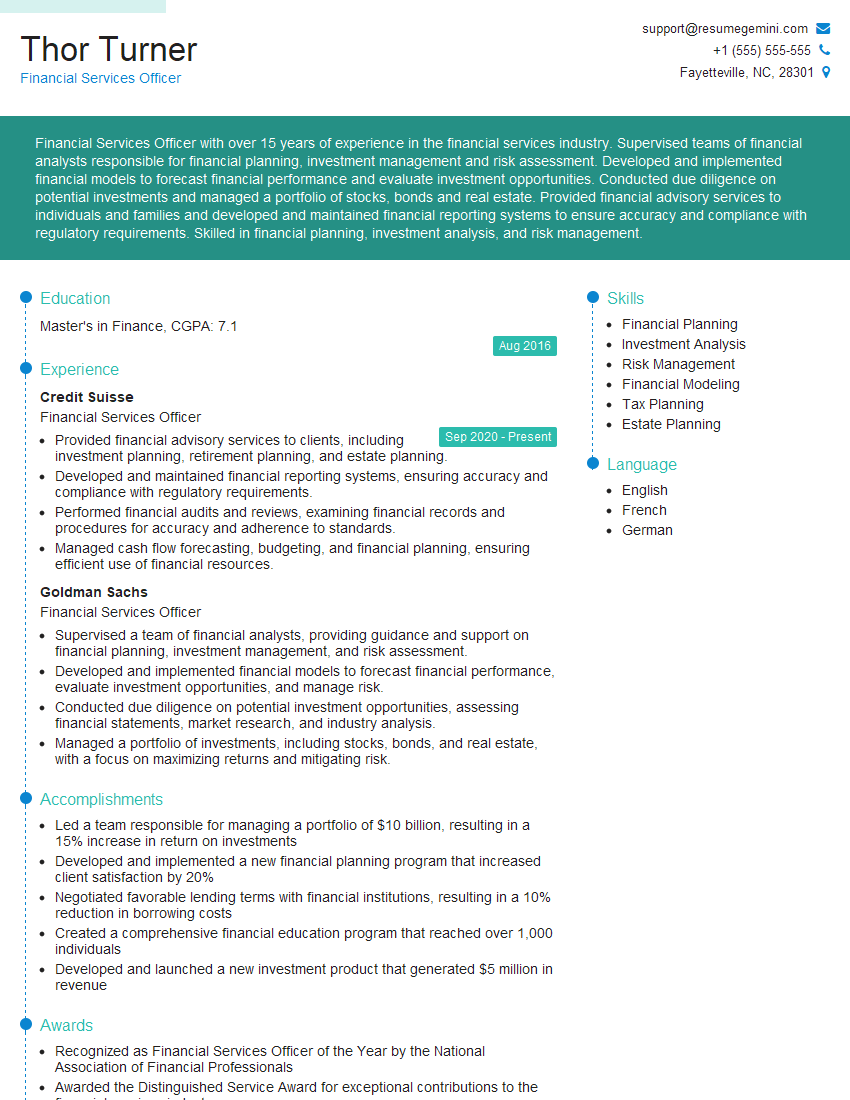

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Services Officer

1. Can you explain the different types of financial services that are offered by your company?

- In my previous role at [Company Name], I was responsible for managing a diverse portfolio of financial services, including:

- Providing financial advice and planning.

- Managing investment portfolios.

- Offering insurance products.

- Providing retirement planning services.

2. What are the key regulatory requirements that financial services officers must comply with?

Financial Industry Regulatory Authority (FINRA)

- FINRA is a self-regulatory organization that oversees all broker-dealers in the United States.

- FINRA members must comply with FINRA’s rules and regulations, which are designed to protect investors.

Securities and Exchange Commission (SEC)

- The SEC is the federal agency responsible for regulating the securities industry.

- The SEC’s rules and regulations are designed to protect investors and ensure the fair and orderly operation of the securities markets.

3. What are the most common challenges faced by financial services officers?

- Meeting the needs of increasingly sophisticated clients.

- Staying up-to-date on the latest financial regulations.

- Maintaining a strong understanding of the financial markets.

- Dealing with the stress of working in a high-stakes environment.

4. What are the key skills that a successful financial services officer should possess?

- Excellent communication and interpersonal skills.

- Strong analytical and problem-solving skills.

- A deep understanding of the financial markets.

- A commitment to ethical and professional conduct.

- The ability to work independently and as part of a team.

5. What are the career advancement opportunities for financial services officers?

- Financial advisors can earn a variety of certifications, such as the Certified Financial Planner (CFP) or the Chartered Financial Analyst (CFA), which can lead to higher pay and more career opportunities.

- Financial advisors can also move into management roles, such as branch manager or regional director.

- With experience, financial advisors can also start their own financial planning firm.

6. What are the key trends that are shaping the financial services industry?

- The rise of digital financial services.

- The increasing importance of data and analytics.

- The growing demand for sustainable investing.

- The need for greater transparency and regulation.

7. What are the ethical considerations that financial services officers must be aware of?

- Financial services officers must always act in the best interests of their clients.

- Financial services officers must avoid conflicts of interest.

- Financial services officers must maintain confidentiality.

- Financial services officers must be honest and transparent in all their dealings.

8. What are the key risks that financial services officers must be aware of?

- Market risk is the risk that the value of a financial instrument will decline.

- Credit risk is the risk that a borrower will default on a loan.

- Operational risk is the risk of loss due to errors, fraud, or other internal factors.

9. How do you stay up-to-date on the latest financial regulations?

- I regularly read industry publications and attend conferences.

- I am a member of professional organizations, such as the Financial Planning Association, which provide access to continuing education opportunities.

- I consult with my compliance officer to ensure that I am aware of all relevant regulations.

10. Why are you interested in this position?

- I am passionate about helping people achieve their financial goals.

- I am confident that my skills and experience would be a valuable asset to your team.

- I am eager to learn and grow in this role and contribute to the success of your company.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Services Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Services Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Services Officers play a crucial role in financial institutions, managing a wide range of responsibilities related to financial operations and customer relations.

1. Transaction Processing and Accounting

Process financial transactions accurately and efficiently, including deposits, withdrawals, and transfers.

- Maintain accurate accounting records and prepare financial reports.

- Reconcile accounts and resolve discrepancies.

2. Customer Service and Relationship Management

Provide exceptional customer service, building strong relationships with clients.

- Open and maintain customer accounts.

- Process loan applications and manage loan accounts.

- Advise customers on financial products and services.

3. Risk Management and Compliance

Safeguard financial assets and ensure compliance with regulations.

- Identify and assess financial risks.

- Implement risk mitigation strategies.

- Adhere to anti-money laundering and other regulatory requirements.

4. Branch Operations

Manage day-to-day operations of a financial institution branch.

- Supervise and train staff.

- Maintain the branch environment and security.

- Collaborate with other departments to ensure smooth operations.

Interview Tips

Preparing thoroughly for your interview can boost your confidence and help you make a strong impression.

1. Research the Company and Position

Familiarize yourself with the financial institution and the specific role you’re applying for.

- Visit the company website and review their financial statements and annual reports.

- Read industry publications and news articles to gain insights into current trends.

2. Practice Your Communication Skills

Financial Services Officers require excellent verbal and written communication abilities.

- Practice answering common interview questions related to customer service, risk management, and financial analysis.

- Seek feedback from a friend, family member, or career counselor on your communication style.

3. Showcase Your Financial Knowledge

Demonstrate your understanding of financial concepts and principles.

- Review accounting principles, financial ratios, and investment strategies.

- Be prepared to discuss your experience in handling financial transactions and managing risk.

4. Highlight Your Customer Service Orientation

Financial Services Officers must be passionate about providing excellent customer experiences.

- Share examples of how you have resolved customer complaints and built strong relationships.

- Emphasize your ability to listen actively, communicate clearly, and go the extra mile.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Financial Services Officer, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Financial Services Officer positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.