Feeling lost in a sea of interview questions? Landed that dream interview for Financial Services Sales Representative but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Financial Services Sales Representative interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

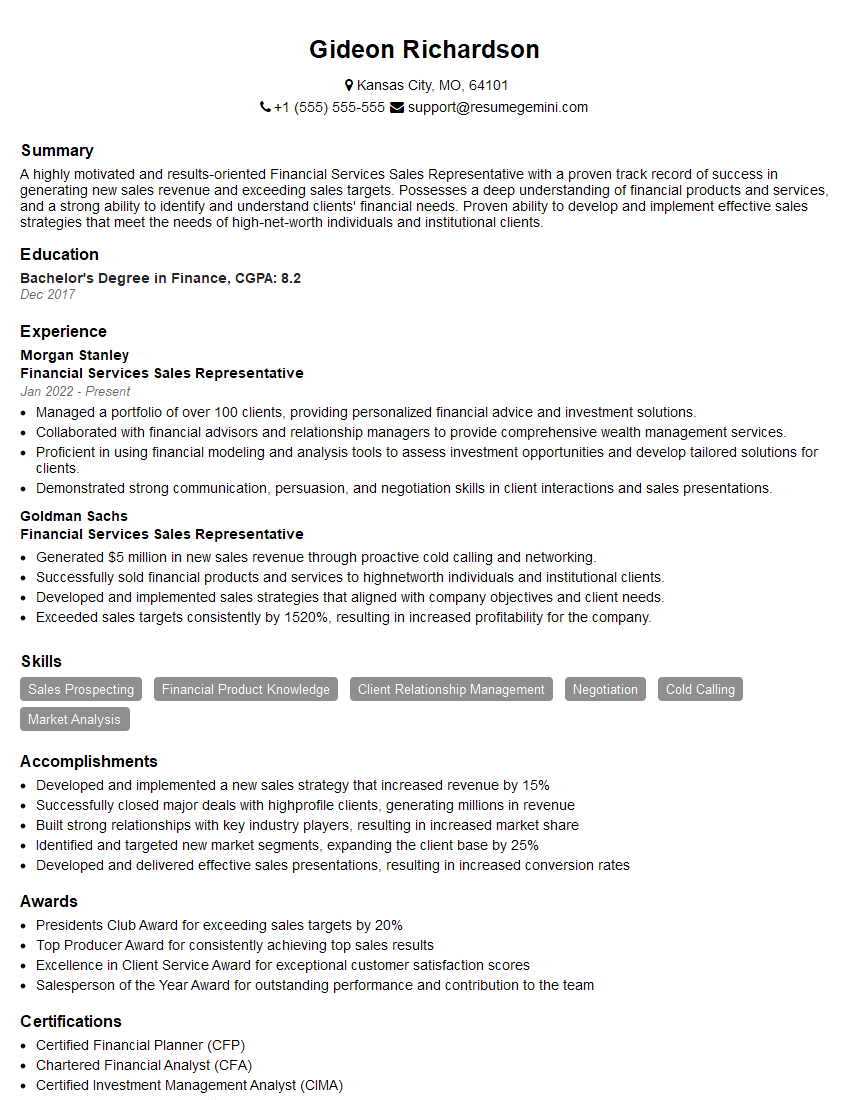

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Services Sales Representative

1. Tell us about your experience and skills relevant to this Financial Services Sales Representative position?

In my previous role as a Financial Services Sales Representative at [Company Name], I consistently exceeded sales targets and built a strong book of business. I have a deep understanding of financial products and services, including investment management, insurance, and retirement planning. I am skilled at identifying client needs and developing tailored solutions to meet their financial goals. Furthermore, I possess excellent communication, presentation, and negotiation skills, enabling me to effectively engage with and persuade clients.

2. How do you stay up-to-date on the latest financial products, regulations, and industry trends?

Continuing Education

- Regularly attend industry conferences, webinars, and training programs to expand my knowledge and stay abreast of the latest developments.

- Obtain industry certifications to demonstrate my proficiency in specific areas, such as investment management or financial planning.

Market Research

- Conduct market research to monitor emerging trends, identify potential opportunities, and understand the competitive landscape.

- Analyze industry reports, articles, and data to stay informed about market movements and economic indicators.

3. How do you build rapport and establish trust with clients?

Building rapport and establishing trust are crucial elements of my sales process. I achieve this by:

- Actively listening to understand client needs and concerns.

- Being transparent and honest in all my interactions.

- Providing personalized recommendations and solutions tailored to their unique circumstances.

- Communicating regularly and keeping clients informed throughout the process.

- Going the extra mile to ensure client satisfaction and exceed expectations.

4. How do you handle objections and negotiate with clients?

Handling objections and negotiating with clients are integral parts of the sales process:

- Actively listening to client concerns and objections without interrupting.

- Empathizing with the client’s perspective and acknowledging their concerns.

- Addressing objections with clear and concise explanations, supported by data and examples.

- Exploring alternative solutions or compromises to find mutually agreeable outcomes.

- Remaining professional and respectful throughout the negotiation process.

5. Describe your sales process from lead generation to closing the deal.

- Lead Generation: Identify and qualify potential clients through networking, referrals, and online lead generation channels.

- Needs Analysis: Conduct thorough needs analysis meetings to understand client goals, risk tolerance, and financial situation.

- Solution Presentation: Develop tailored proposals based on client needs, outlining recommended products and services.

- Objection Handling: Address client concerns and objections through open and transparent communication.

- Closing the Deal: Secure client commitment, obtain necessary documentation, and finalize the sale.

- Post-Sales Follow-Up: Provide ongoing support, monitor client progress, and nurture long-term relationships.

6. How do you track and measure your sales performance?

Tracking and measuring my sales performance is essential for continuous improvement:

- Regularly review sales reports to monitor key metrics such as revenue generated, number of clients acquired, and client retention rates.

- Set clear sales goals and track progress towards achieving them.

- Use CRM systems to manage client interactions, track sales pipelines, and identify areas for improvement.

- Seek feedback from clients and colleagues to gather insights into strengths and areas for development.

7. Tell us about a time when you successfully resolved a challenging client situation.

In a previous role, I encountered a client who was dissatisfied with the performance of their investment portfolio. I actively listened to their concerns and conducted a thorough review of their account. I discovered that their asset allocation was not aligned with their risk tolerance, leading to underperformance. I worked closely with the client to adjust their portfolio, ensuring it was optimized for their goals. Through transparent communication and proactive management, I successfully resolved the issue, regained the client’s trust, and strengthened our ongoing relationship.

8. How do you stay motivated and focused on achieving sales targets?

- Set clear and achievable sales goals that provide a sense of purpose and direction.

- Break down large goals into smaller, more manageable milestones to maintain momentum.

- Track progress regularly and celebrate successes to stay motivated and on track.

- Seek support and mentorship from colleagues and managers when needed.

- Focus on the positive impact of my work on clients and their financial well-being.

9. What are your strengths and weaknesses as a Financial Services Sales Representative?

Strengths

- Strong understanding of financial products and services.

- Exceptional communication and presentation skills.

- Ability to build rapport and establish trust with clients.

- Proven track record of exceeding sales targets.

- Committed to providing exceptional client service.

Weaknesses

- Limited experience in certain niche financial products.

- Working on improving time management skills to optimize productivity.

10. Why are you interested in this Financial Services Sales Representative position at our company?

I am eager to join your esteemed organization because I am impressed by your reputation for providing exceptional financial services to clients. Your commitment to innovation and client-centricity aligns perfectly with my values and aspirations. I am confident that my skills and experience in financial sales and client relationship management would be a valuable asset to your team. I am particularly excited about the opportunity to contribute to the growth of your business and make a meaningful impact on the financial well-being of your clients.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Services Sales Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Services Sales Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Services Sales Representatives hold a crucial role within financial institutions. Their primary focus is lead generation and establishing strong client relationships. This role necessitates a comprehensive understanding of financial products and services, along with exceptional sales and communication skills.

1. Prospecting and Lead Generation

Identifying and qualifying potential clients is a cornerstone of their duties. They leverage various channels to connect with individuals and businesses that align with the organization’s target market.

- Conduct thorough market research to identify potential clients

- Utilize networking events, referrals, and cold calling to generate leads

2. Client Relationship Management

Building long-term relationships with clients is paramount. They serve as trusted advisors, providing financial guidance and tailored solutions to meet individual needs.

- Understand client objectives, risk tolerance, and investment horizon

- Develop and present customized financial plans and recommendations

3. Product and Service Sales

Financial Services Sales Representatives are responsible for selling a range of financial products and services. They must be well-versed in the features, benefits, and risks associated with each offering.

- Present and explain investment options, such as stocks, bonds, and mutual funds

- Offer insurance products, including life, health, and property insurance

4. Market Analysis and Reporting

Monitoring market trends and analyzing industry data is crucial. They provide insights to senior management and support the development of effective sales strategies.

- Stay updated on economic and financial market conditions

- Track sales performance and identify areas for improvement

Interview Tips

To ace the interview for a Financial Services Sales Representative role, candidates should be well-prepared and demonstrate their qualifications through compelling responses.

1. Research the Company and Role

Thoroughly research the financial institution and the specific role you are applying for. Familiarize yourself with their products, services, culture, and market position. This knowledge will allow you to tailor your answers and show that you are genuinely interested in the opportunity.

- Review the company website, annual reports, and LinkedIn profile

- Identify key financial products and services offered by the organization

2. Showcase Your Sales Skills

Highlight your sales achievements and provide concrete examples of successful client interactions. Quantify your accomplishments using metrics such as revenue generated, new accounts acquired, or client satisfaction ratings.

- Provide specific instances where you exceeded sales targets

- Describe how you built rapport with clients and gained their trust

3. Emphasize Financial Knowledge

Financial Services Sales Representatives must possess a solid understanding of financial products, markets, and principles. Demonstrate your mastery by providing examples of how you have applied this knowledge to provide value to clients.

- Explain how you analyze financial statements to assess a company’s financial health

- Describe various investment strategies and how you tailor them to clients’ needs

4. Prepare for Behavioral Questions

Behavioral questions focus on your past experiences and behaviors. Use the STAR method (Situation, Task, Action, Result) to structure your responses. Provide detailed examples that demonstrate your skills and abilities.

- For instance, if asked about a challenging sales situation, describe the situation, the task you had to perform, the actions you took, and the positive outcome.

5. Ask Thoughtful Questions

At the end of the interview, prepare insightful questions that demonstrate your genuine interest in the role and the organization. This is an opportunity to clarify any doubts and show your enthusiasm for the position.

- Inquire about the company’s growth plans and industry outlook

- Ask about the training and development opportunities provided to sales representatives

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Services Sales Representative interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.