Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Financial Specialist interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Financial Specialist so you can tailor your answers to impress potential employers.

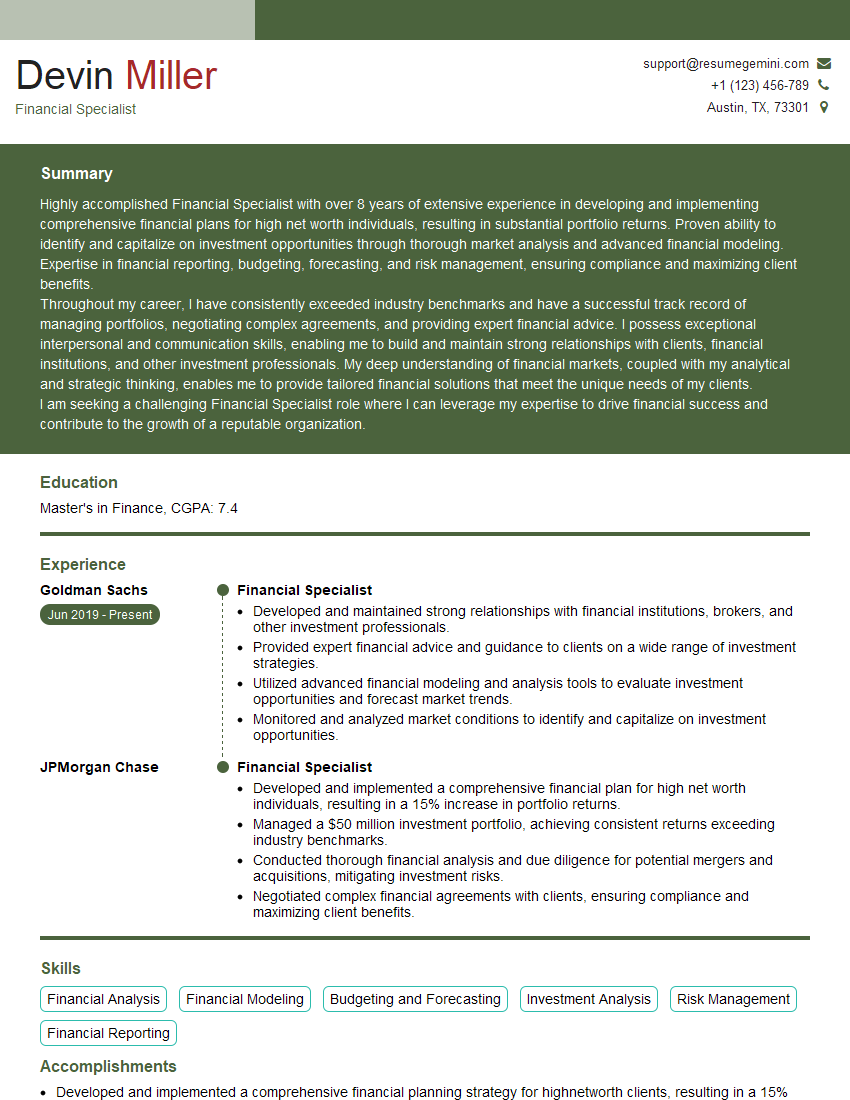

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Specialist

1. What are the key financial ratios used to evaluate a company’s financial health?

Financial ratios are important indicators used to evaluate a company’s financial health and performance. Key ratios include:

- Liquidity ratios: Current ratio, quick ratio, cash ratio

- Solvency ratios: Debt-to-equity ratio, debt-to-asset ratio, interest coverage ratio

- Profitability ratios: Gross profit margin, operating profit margin, net profit margin

- Efficiency ratios: Inventory turnover, accounts receivable turnover, days sales outstanding

- Return ratios: Return on equity, return on assets, return on investment

2. How do you use financial modeling to forecast a company’s future financial performance?

Steps in Financial Modeling:

- Gather financial data and assumptions

- Build financial models using tools like Excel, MATLAB, Python

- Create projections for income statement, balance sheet, and cash flow statement

- Analyze and interpret the results

Benefits of Financial Modeling:

- Identify financial trends and risks

- Evaluate investment opportunities

- Develop financial strategies and plans

3. What is the difference between a stock and a bond?

- Stocks: Represent ownership in a company, with potential for capital gains and dividends but also subject to price fluctuations.

- Bonds: Debt obligations that pay fixed interest payments and have a maturity date, offering lower risk and potential for return than stocks.

4. How do you manage risk in a financial portfolio?

- Diversification: Spreading investments across different asset classes, sectors, and geographies to reduce overall risk.

- Asset Allocation: Determining the appropriate mix of stocks, bonds, and other assets based on risk tolerance and financial goals.

- Hedging: Using financial instruments such as options and futures to offset or reduce potential losses.

- Risk Management Tools: Employing tools like stop-loss orders and volatility indicators to monitor and manage risk.

5. What are the different types of investment products available to clients?

- Stocks: Equities representing ownership in publicly traded companies.

- Bonds: Fixed-income securities that pay regular interest payments.

- Mutual Funds: Baskets of stocks or bonds managed by portfolio managers.

- Exchange-Traded Funds (ETFs): Traded on stock exchanges, offering exposure to a specific market or sector.

- Certificates of Deposit (CDs): Time deposits with fixed interest rates and maturity dates.

6. How do you stay up-to-date on the latest financial market trends and developments?

- Industry Publications: Reading financial news outlets, journals, and reports.

- Financial Websites and Apps: Monitoring real-time market data, research, and analysis.

- Professional Development: Attending conferences, workshops, and webinars.

- Networking: Connecting with other financial professionals, including investors, analysts, and portfolio managers.

7. What is your experience in providing financial advice and recommendations to clients?

- Understanding Client Needs: Thoroughly assessing clients’ financial goals, risk tolerance, and time horizon.

- Investment Plan Development: Collaborating with clients to create customized investment portfolios that align with their objectives.

- Ongoing Portfolio Management: Monitoring portfolio performance, making adjustments as needed, and providing regular updates to clients.

- Financial Education: Providing clients with clear and understandable explanations of financial concepts and investment strategies.

8. How do you handle conflicts of interest when providing financial advice?

- Disclosure: Clearly disclosing any potential conflicts of interest to clients.

- Ethical Decision-Making: Prioritizing clients’ best interests and avoiding any actions that could compromise their financial well-being.

- External Oversight: Consulting with supervisors or compliance officers when necessary to ensure compliance with ethical guidelines.

- Continuing Education: Regularly reviewing ethical guidelines and attending training to stay up-to-date on best practices.

9. What are the challenges you have faced as a Financial Specialist, and how did you overcome them?

- Market Volatility: Adapting investment strategies to navigate volatile market conditions.

- Client Communication: Effectively communicating complex financial information and managing client expectations during market fluctuations.

- Regulatory Compliance: Staying abreast of and adhering to industry regulations and ethical guidelines.

- Time Management: Managing a demanding workload while providing personalized service to clients.

10. Why are you interested in working as a Financial Specialist for our firm?

I am drawn to your firm’s reputation for ethical and client-centric financial services. Your commitment to providing comprehensive financial advice and solutions aligns with my passion for helping clients achieve their financial goals. I am confident that my skills and experience in financial analysis, investment management, and client relationship management would enable me to make a significant contribution to your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Specialists are responsible for providing guidance and support to individuals and organizations on various financial matters. Their expertise encompasses a wide range of financial services, from investment planning and retirement strategies to tax preparation and budgeting.

1. Financial Planning

Assist clients in developing comprehensive financial plans that align with their long-term goals, risk tolerance, and investment objectives.

- Develop customized investment strategies based on client needs.

- Conduct financial risk assessments and provide tailored solutions.

2. Retirement Planning

Guide clients in planning for a secure financial future, including retirement income strategies and estate planning.

- Provide advice on retirement savings plans, such as 401(k)s and IRAs.

- Create strategies for maximizing retirement income.

3. Tax Preparation

Prepare accurate and timely tax returns for individuals and businesses, ensuring compliance with tax regulations.

- Review and analyze financial documents to determine tax deductions and credits.

- Stay updated on tax laws and regulations to provide effective tax planning.

4. Budgeting and Debt Management

Assist clients in creating realistic budgets, managing debt effectively, and achieving financial stability.

- Help clients track expenses and identify areas for savings.

- Develop strategies for reducing debt and improving credit scores.

Interview Preparation Tips

To ace an interview for a Financial Specialist role, it’s crucial to prepare thoroughly. Here are some tips to enhance your chances of success:

1. Research the Company and Industry

Demonstrate your interest in the company and the financial industry by researching their background, mission, and recent developments. This knowledge will help you understand their business and align your skills with their needs.

- Visit the company website and read press releases.

- Follow industry news and trends to stay informed.

2. Review Key Concepts and Industry Terminology

Ensure you have a strong understanding of core financial concepts, investment principles, and relevant industry terms. Refresh your knowledge in areas such as financial planning, retirement strategies, and tax regulations.

- Review textbooks or online resources.

- Attend industry seminars or workshops.

3. Prepare for Common Interview Questions

Prepare answers to common interview questions that assess your financial expertise, problem-solving abilities, and communication skills. Practice your responses to questions about financial planning, retirement strategies, and tax preparation.

- Create an “Example Outline” to structure your answers and provide specific examples.

- Use the STAR method (Situation, Task, Action, Result) to highlight your accomplishments.

4. Practice Active Listening

During the interview, pay close attention to the interviewer’s questions and demonstrate your active listening skills. Ask clarifying questions when needed to ensure a clear understanding of the requirements.

- Maintain eye contact and nod to indicate engagement.

- Summarize the interviewer’s questions before answering to show that you understand.

5. Showcase Your Enthusiasm and Confidence

Convey your passion for finance and your eagerness to contribute to the company’s success. Be confident in your abilities, but also be humble and open to learning and growing.

- Share examples of your success in previous roles.

- Express your interest in the industry and your desire to stay updated on the latest trends.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Specialist interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!