Are you gearing up for a career in Financing Analyst? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Financing Analyst and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

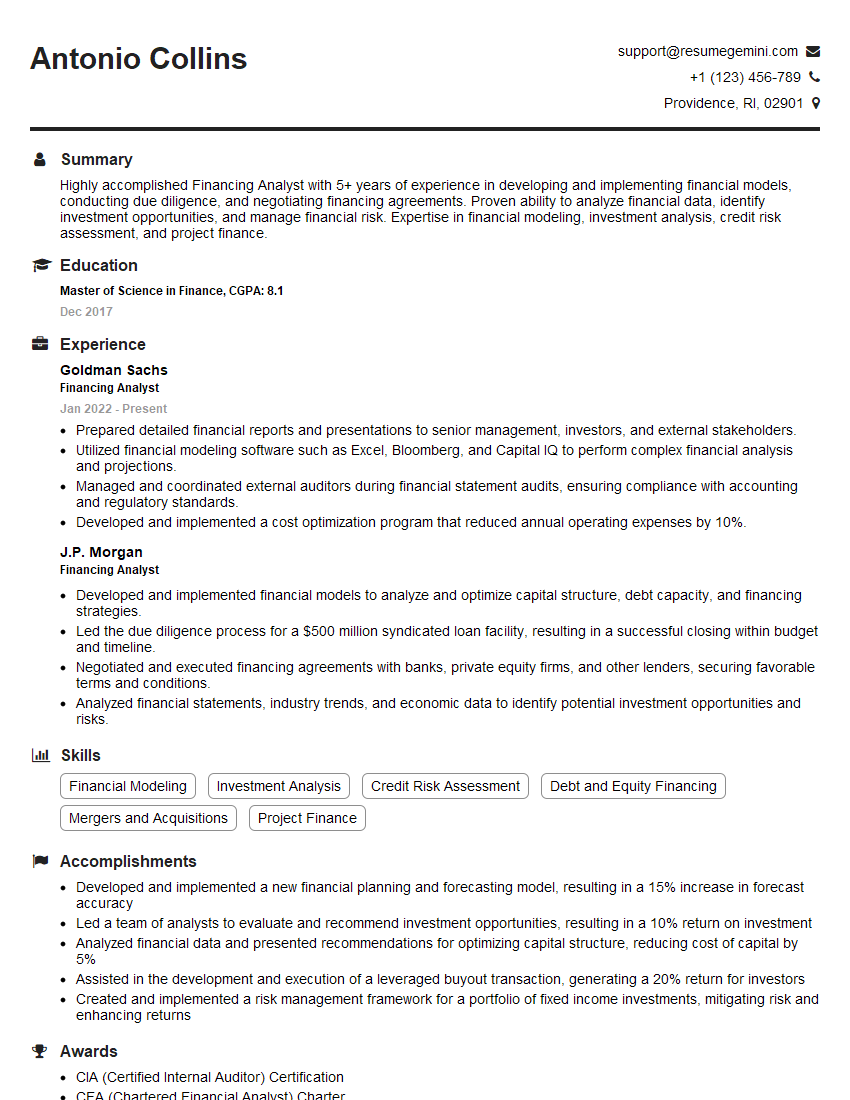

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financing Analyst

1. Walk me through the process of building a financial model?

- Define the project’s objectives and scope.

- Gather and analyze relevant data.

- Develop assumptions and scenarios.

- Build the financial model.

- Validate and refine the model.

2. Describe the key metrics and ratios used in financial analysis?

Profitability:

- Gross profit margin

- Operating profit margin

- Net profit margin

Liquidity:

- Current ratio

- Quick ratio

- Cash ratio

Solvency:

- Debt-to-equity ratio

- Interest coverage ratio

- Debt-to-asset ratio

Efficiency:

- Inventory turnover ratio

- Accounts receivable turnover ratio

- Days sales outstanding (DSO)

3. How would you assess the financial health of a company using financial ratios?

Step 1: Collect financial statements.

Step 2: Calculate financial ratios.

Step 3: Compare ratios to industry benchmarks.

Step 4: Identify trends and anomalies.

Step 5: Develop insights and recommendations.

4. What are the different types of financial models and when would you use each one?

Static models:

- Used for simple analysis, such as budgeting or forecasting.

Dynamic models:

- Used for more complex analysis, such as scenario planning or risk analysis.

Deterministic models:

- Assumes that the future is certain, and only one outcome is possible.

Stochastic models:

- Assumes that the future is uncertain, and multiple outcomes are possible.

5. How do you handle uncertainty in financial modeling?

- Use sensitivity analysis to test the impact of different assumptions.

- Develop multiple scenarios to account for different possible outcomes.

- Use Monte Carlo simulation to generate a range of possible outcomes.

6. What are the ethical considerations involved in financial modeling?

- Objectivity and independence

- Accuracy and transparency

- Disclosure of assumptions and limitations

- Avoidance of conflicts of interest

7. How do you stay up-to-date on the latest financial modeling techniques?

- Attend conferences and workshops.

- Read industry publications and white papers.

- Network with other financial professionals.

- Take online courses or certification programs.

8. What are some of the challenges you have faced in financial modeling and how did you overcome them?

Challenge: Building a model that is both accurate and transparent.

Solution: Using a structured approach to model development, including thorough documentation and peer review.

Challenge: Dealing with uncertainty in the financial markets.

Solution: Using sensitivity analysis and scenario planning to test the impact of different assumptions.

9. What are your strengths and weaknesses as a financial analyst?

Strengths:

- Strong technical skills in financial modeling and analysis.

- Excellent communication and presentation skills.

- Ability to work independently and as part of a team.

Weaknesses:

- Limited experience in certain specialized areas of finance.

- Sometimes struggles to meet tight deadlines.

10. Why are you interested in this position?

I am interested in this position because it offers the opportunity to:

- Use my financial modeling skills to make a real impact on the business.

- Work with a team of experienced professionals.

- Contribute to the success of a highly respected company.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financing Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financing Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Financing Analyst is accountable for evaluating and structuring financing alternatives, conducting feasibility studies, and recommending financing options to clients. Their primary duties include:

1. Financial Analysis

Assess a company’s financial health by analyzing its balance sheet, income statement, and cash flow statement.

- Conduct due diligence on potential investments and acquisitions.

- Develop and implement financial models to forecast future performance and assess risk.

2. Financing Options

Research and identify suitable financing options, such as equity, debt, or a combination thereof.

- Negotiate with lenders and investors to secure favorable terms.

- Structure financing packages that meet the client’s specific needs and objectives.

3. Feasibility Studies

Conduct feasibility studies to assess the viability of proposed projects or investments.

- Analyze market conditions, regulatory requirements, and competitive landscapes.

- Develop financial projections and sensitivity analyses to evaluate potential risks and rewards.

4. Presentation and Reporting

Present analysis and recommendations clearly and effectively to clients and stakeholders.

- Prepare written reports, financial models, and presentations.

- Monitor and evaluate financing performance and communicate updates to clients.

Interview Tips

To enhance your chances of success in a Financing Analyst interview, consider these tips:

1. Research the Company and Industry

Demonstrate your knowledge of the company’s business, financial performance, and industry trends. This shows that you are genuinely interested in the role and have taken the time to prepare.

- Review the company’s website, annual reports, and press releases.

- Research industry publications and news articles to gain insights into market dynamics.

2. Highlight Your Analytical Skills

Emphasize your ability to analyze financial data, identify patterns, and draw meaningful conclusions. Provide specific examples of projects where you successfully applied these skills.

- Discuss your experience using financial models to forecast performance and assess risk.

- Explain how you have used data visualization tools to present your analysis in a clear and compelling manner.

3. Showcase Your Communication and Presentation Skills

Financing Analysts frequently present their findings to clients and stakeholders. Demonstrate your ability to communicate effectively, both verbally and in writing.

- Prepare examples of presentations you have delivered or written reports that you are proud of.

- Practice answering interview questions clearly and concisely, using specific data and examples to support your responses.

4. Be Prepared to Discuss Your Knowledge of Financing Options

Be ready to discuss your knowledge of various financing options, including equity, debt, and hybrid instruments. Explain the advantages and disadvantages of each option and demonstrate your ability to structure financing packages that meet the needs of different clients.

- Provide examples of specific transactions where you have successfully negotiated with lenders or investors.

- Discuss your understanding of the latest trends in financing and how they are impacting clients’ decision-making.

Next Step:

Now that you’re armed with the knowledge of Financing Analyst interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Financing Analyst positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini